Market Overview

The US Air Defense Systems Market is projected to reach USD ~ billion, driven by a surge in military spending and advancements in defense technologies. The market’s growth is fueled by increasing geopolitical tensions and the demand for robust air defense systems to safeguard critical infrastructure and national security. The shift towards integrated multi-layered defense systems and the adoption of advanced radar and missile technologies further contribute to the market’s expansion. In addition, governments worldwide are investing heavily in modernizing their defense capabilities, with air defense systems being a focal point of these efforts.

Dominant players in the US Air Defense Systems Market are concentrated in cities with strong military and aerospace industries, such as Washington, D.C., and Los Angeles. These areas benefit from proximity to defense contractors, military bases, and government agencies. Furthermore, the US government’s strategic initiatives in defense spending and the expansion of military operations globally have solidified the country’s dominance. The market is characterized by continuous technological advancements, which enhance system reliability and capabilities in complex and multi-threat environments.

Market Segmentation

By Product Type

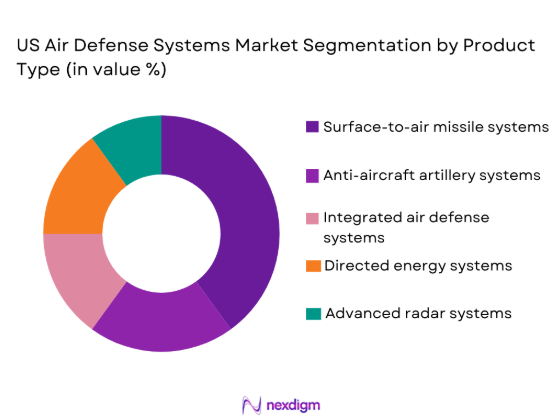

The US Air Defense Systems market is segmented by product type into surface-to-air missile systems, anti-aircraft artillery systems, integrated air defense systems, directed energy systems, and advanced radar systems. Recently, surface-to-air missile systems have dominated the market share due to increasing demand for long-range, high-precision defense solutions. Surface-to-air missile systems offer high effectiveness against a wide range of aerial threats, from enemy aircraft to unmanned aerial vehicles (UAVs), thus making them essential in modern air defense strategies. Their widespread adoption across military forces and defense contractors, supported by substantial investments in advanced missile technologies, has driven their market dominance.

By Platform Type

The US Air Defense Systems market is segmented by platform type into land-based platforms, naval-based platforms, airborne platforms, space-based platforms, and mobile systems. Recently, land-based platforms have dominated the market share due to their adaptability in various geographical and combat scenarios. These platforms provide defense forces with versatile, high-performance systems that can be deployed rapidly in strategic locations. Their integration with mobile and fixed defense systems further enhances operational capabilities, making land-based platforms the primary choice for modern air defense solutions. Their widespread deployment by both government and defense contractors solidifies their market-leading position.

Competitive Landscape

The US Air Defense Systems market is highly competitive, with a blend of well-established companies and innovative startups pushing the technological boundaries of air defense systems. Major defense contractors are increasingly focusing on consolidating their market presence through mergers and acquisitions to integrate next-gen technologies such as AI, machine learning, and directed energy. The influence of these players is profound as they drive product innovations, operational efficiency, and strategic initiatives, setting the stage for continued growth. Companies are also keen on expanding their geographic reach to cater to international markets, leveraging their advanced technological capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | |

| Raytheon Technologies | 1922 | Waltham, MA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 2002 | New York, NY | ~ | ~ | ~ | ~ | ~ |

US Air Defense Systems Market Analysis

Growth Drivers

Increased Military Spending:

The increase in military expenditure, particularly in defense budgets, serves as a primary driver for the air defense systems market. Government funding for defense-related projects, including air defense systems, has significantly risen in recent years, driven by the need to modernize military capabilities and address emerging threats. The US, in particular, has ramped up its spending on air defense as part of broader efforts to safeguard its borders and critical infrastructure from evolving military threats. Additionally, many countries are following suit, boosting global demand for air defense systems. The prioritization of defense expenditure has also led to substantial investments in advanced technologies such as AI, radar systems, and missile defense systems. This trend is expected to continue, contributing to the overall growth of the market.

Technological Advancements in Defense Systems

Technological innovations in air defense systems are propelling market growth, with significant advancements in radar, missile defense, and electronic warfare systems. These advancements have made air defense systems more capable, reliable, and effective against a broader range of threats. The integration of AI, machine learning, and advanced sensors has enhanced the ability of air defense systems to detect, track, and neutralize enemy threats at greater ranges with higher accuracy. Additionally, developments in directed energy weapons and hypersonic defense solutions promise to revolutionize the defense landscape further. As these technologies continue to evolve, air defense systems are becoming more adaptable and capable of addressing diverse security challenges. This technological shift is driving demand, particularly for next-gen defense systems capable of countering modern aerial threats like UAVs and hypersonic missiles.

Market Challenges

High Capital Investment

The high capital expenditure required for developing and deploying advanced air defense systems poses a significant challenge to the market. The initial investment for acquiring these systems, along with ongoing maintenance and training costs, can be prohibitive for some governments and defense contractors, particularly in developing regions. While the long-term benefits of enhanced security and defense capabilities are undeniable, the upfront cost remains a major hurdle for widespread adoption, especially for smaller nations or entities with limited defense budgets. This high capital requirement often results in slower adoption rates and limited procurement, particularly for countries with constrained resources. The challenge also extends to the cost of system integration and ensuring that existing infrastructure can support new, high-tech defense systems. Despite this challenge, the growing recognition of the importance of air defense is helping to mitigate some of these financial barriers.

Regulatory and Compliance Issues

Regulatory challenges are another key obstacle for the US Air Defense Systems market. Compliance with national and international defense regulations, including arms control treaties, export control laws, and military protocols, can complicate the development, procurement, and deployment of air defense systems. Strict regulations surrounding the sale and distribution of advanced technologies, particularly missile systems, often hinder the ability of defense contractors to expand into new markets. These regulatory hurdles not only delay the delivery of essential defense systems but also add to the complexity of the market, as firms must navigate a web of rules and restrictions across multiple jurisdictions. In addition, evolving political climates and changing defense policies can further complicate regulatory compliance, adding layers of uncertainty to defense projects.

Opportunities

Partnerships with Private Sector Tech Firms

There is a growing opportunity for defense contractors to form partnerships with private sector technology firms, particularly those specializing in AI, machine learning, and cybersecurity, to develop next-gen air defense solutions. These collaborations can help address the evolving threat landscape, particularly in areas such as cyber warfare, unmanned aerial vehicles (UAVs), and hypersonic missile defense. By leveraging the technological expertise of private firms, defense contractors can enhance the capabilities of air defense systems, making them more effective and adaptable in countering new threats. Additionally, the integration of commercial technologies can help reduce costs and accelerate the development of advanced defense solutions. This opportunity is particularly relevant as both defense contractors and technology firms are keen to expand their footprint in the growing market for advanced defense technologies.

Emerging Demand for Hypersonic Missile Defense

The rising threat of hypersonic missiles presents a significant opportunity for the US Air Defense Systems market. Hypersonic weapons, capable of traveling at speeds greater than Mach 5, pose a challenge to existing missile defense systems. As countries continue to develop and test these advanced weapons, the demand for effective hypersonic missile defense systems is expected to surge. This presents an opportunity for air defense system providers to innovate and develop systems specifically designed to detect, intercept, and neutralize hypersonic threats. The need for such technologies is expected to grow rapidly, with the US leading the charge in developing and deploying countermeasures. As hypersonic missile technology becomes more widespread, the market for systems capable of countering them is expected to expand, providing a lucrative opportunity for companies involved in air defense.

Future Outlook

The US Air Defense Systems market is poised for continued growth over the next five years, driven by increasing geopolitical tensions and advancements in defense technologies. With a focus on missile defense, radar systems, and integrated defense solutions, the market is set to benefit from both government spending and technological innovations. Key trends, such as the rise of directed energy systems and the increasing integration of AI, will shape the market, while regulatory support will continue to foster growth in defense sectors. As global security concerns intensify, the demand for advanced air defense systems is expected to accelerate, making the market a critical focus for both military and defense contractors.

Major Players

- Raytheon Technologies

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- L3 Technologies

- Thales Group

- Rafael Advanced Defense Systems

- MBDA

- General Dynamics

- Elbit Systems

- Saab Group

- Leonardo

- Kongsberg Gruppen

- Leonardo DRS

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

- Military and defense contractors

- Defense system integrators

- Private security companies

- National security agencies

- International defense procurement offices

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables impacting the market, including technological advancements, economic factors, government policies, and geopolitical dynamics. These variables provide the foundation for further analysis.

Step 2: Market Analysis and Construction

In this step, comprehensive data collection methods are employed, including both primary and secondary research, to build a robust market model. Detailed analysis is performed on market trends, historical performance, and future projections.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and hypothesis validation are conducted with industry professionals and stakeholders to ensure the accuracy and relevance of the market model. This phase helps refine the analysis and aligns it with real-world conditions.

Step 4: Research Synthesis and Final Output

The final output synthesizes all research findings, consolidating data, expert insights, and market projections into a comprehensive market report. This final analysis is presented with actionable insights and recommendations for industry stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions and defense spending

Technological advancements in missile defense systems

Increasing focus on cybersecurity for air defense systems

Growing demand for integrated multi-layered defense solutions

Expansion of military modernization programs - Market Challenges

High capital expenditure in defense projects

Interoperability challenges with legacy systems

Regulatory and compliance barriers for defense contracts

High maintenance and operational costs

Cybersecurity vulnerabilities - Market Opportunities

Expansion of autonomous air defense systems

Growing partnerships with private tech firms for enhanced defense capabilities

Emerging demand for hypersonic missile defense solutions - Trends

Integration of AI and machine learning in air defense systems

Increase in use of directed energy systems

Surge in cross-platform integration for holistic defense solutions

Advancements in radar and sensor technologies

Adoption of space-based defense systems - Government Regulations & Defense Policy

Compliance with international arms control regulations

Government funding and grants for advanced air defense technologies

Export control regulations affecting system sales - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surface-to-Air Missile Systems

Anti-Aircraft Artillery Systems

Integrated Air Defense Systems

Directed Energy Systems

Advanced Radar Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval-Based Platforms

Airborne Platforms

Space-Based Platforms

Mobile Systems - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Security Firms

Aerospace & Defense Industry - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Radar and Sensor Technology

Missile Technology

Command & Control Technology

Electronic Warfare Systems

Artificial Intelligence & Machine Learning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Technology, Geography, Key Capabilities, Product Differentiation, Price)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Raytheon Technologies

Lockheed Martin

Northrop Grumman

BAE Systems

L3 Technologies

General Dynamics

Thales Group

Rheinmetall

Saab Group

Leonardo

Elbit Systems

Harris Corporation

MBDA

BAE Systems

Kongsberg Gruppen

- Military Forces’ growing demand for multi-layered air defense systems

- Government agencies’ increasing investment in defense technologies

- Defense contractors’ focus on innovation and integration

- Aerospace & defense firms’ interest in next-gen defense systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035