Market Overview

The USA Air Traffic Management (ATM) market is valued at approximately USD ~ billion, driven by rapid advancements in air traffic control technologies, regulatory policies, and growing air traffic. The increase in flight volumes, the implementation of NextGen technologies by the FAA, and the integration of Unmanned Aerial Systems (UAS) into national airspace are key growth drivers. As air traffic continues to expand, the need for modernized air traffic control systems, automation tools, and data analytics solutions grows, providing new avenues for market growth.

The United States leads the global Air Traffic Management market, with key hubs like New York, Los Angeles, and Chicago dominating due to their high volume of air traffic. Cities like Washington D.C. are central for policy making and regulatory development through the Federal Aviation Administration (FAA). Furthermore, the growth in unmanned traffic management, as well as NextGen implementation, positions these cities as critical centers for both technological innovation and policy leadership, fueling market dominance.

Market Segmentation

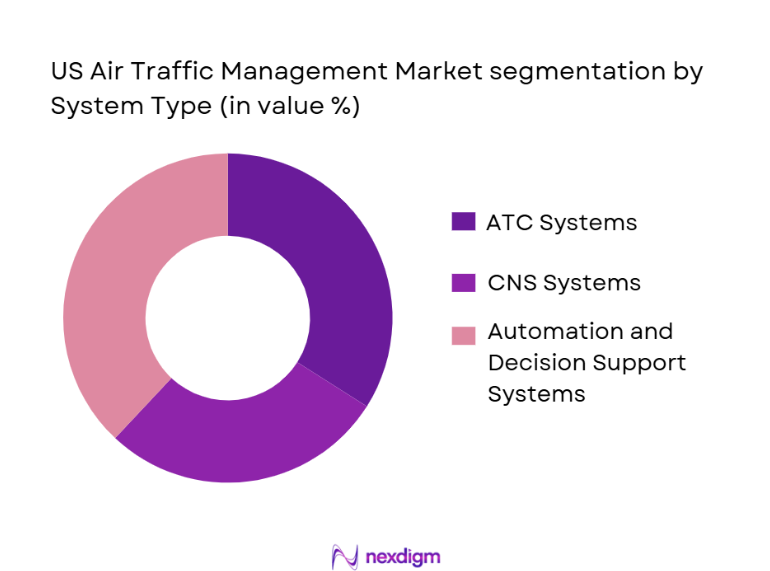

By System Type:

The USA Air Traffic Management market is segmented into several key system types, with significant market share held by Automation & Decision Support Platforms, CNS Systems (Communication, Navigation, and Surveillance), and Air Traffic Control (ATC) systems.

Automation & Decision Support Platforms have seen the most dominance in recent years, as there has been a shift toward AI-driven decision-making processes to manage the increasing air traffic and complexity of modern flight patterns. These systems reduce the burden on air traffic controllers, increase operational efficiency, and enhance safety measures, making them crucial in the modernization of air traffic management.

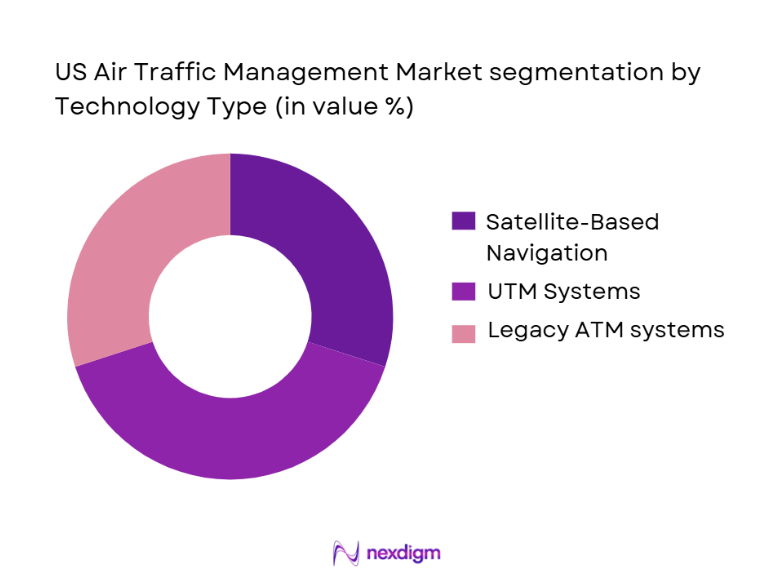

By Technology Type:

The market is also segmented based on technology types, where the focus is on legacy systems, satellite-based navigation, and UTM (Unmanned Traffic Management) systems.

UTM Systems are gaining a dominant share in the market due to the increasing integration of drones and unmanned vehicles into national airspace. These systems provide real-time tracking, communication, and coordination among drones, ensuring safety and minimizing collision risks. UTM’s capabilities are crucial for managing increasingly crowded skies, especially with new airspace entrants such as eVTOLs and commercial drones.

Competitive Landscape

The USA Air Traffic Management market is dominated by major global players such as Raytheon Technologies, Lockheed Martin, and Thales Group, which offer cutting-edge ATM systems, radar solutions, and automation platforms. The competition is driven by technological innovation, government contracts, and large-scale infrastructure projects. The market consolidation showcases the significant influence of these key companies, who lead in NextGen ATM technologies, satellite-based communication, and data-driven air traffic management systems.

| Company Name | Establishment Year | Headquarters | Technological Innovation | Product Portfolio | Strategic Partnerships | R&D Investment |

| Raytheon Technologies | 1922 | Waltham, Massachusetts | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, Maryland | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | Melbourne, Florida | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Charlotte, North Carolina | ~ | ~ | ~ | ~ |

US Air Traffic Management Market Analysis

Growth Drivers

Technological Advancements in Automation and AI

The increasing adoption of AI and machine learning technologies in air traffic management systems is enhancing operational efficiency, reducing human error, and improving safety. Automation in areas like flight sequencing, predictive traffic management, and real-time decision support systems is driving the market forward.

Rising Air Traffic and Congestion

As global air traffic continues to grow, the need for efficient air traffic management becomes more critical. The expansion of airport infrastructure, along with the FAA’s NextGen program, is aimed at handling the increasing flight volume and ensuring seamless management of airspace and air traffic.

Market Challenges

High Capital Investment and Implementation Costs

The installation and modernization of air traffic management systems involve significant upfront capital investment. Legacy systems often require expensive upgrades to integrate new technologies like radar, automation, and UTM systems, presenting a financial challenge for stakeholders.

Regulatory Hurdles and Compliance

The complex regulatory environment, particularly with respect to airspace safety, privacy, and drone/UAS integration, creates a challenge. Ensuring compliance with both national and international standards, such as those set by the FAA and ICAO, adds an additional layer of complexity to market growth.

Opportunities

Integration of Unmanned Aircraft Systems (UAS) and Urban Air Mobility (UAM)

The rise of drones and UAM technologies presents a significant opportunity for growth in air traffic management. Integrating UAS into existing air traffic management systems with innovative solutions like UTM is critical for managing this new airspace and expanding the market.

Government Investments in Air Traffic Modernization

Government initiatives, particularly the FAA’s NextGen program, continue to prioritize modernization of air traffic control systems. This commitment to infrastructure upgrades, along with ongoing investments in satellite-based navigation and data management systems, creates a ripe opportunity for market expansion.

Future Outlook

Over the next 5 years, the USA Air Traffic Management market is expected to exhibit significant growth due to the continuous modernization efforts by the FAA, the adoption of AI-powered decision-making tools, and the incorporation of unmanned vehicles and drones into the national airspace. Key drivers for this growth include government-backed projects like NextGen, technological advancements in communication and surveillance systems, and growing demand for airspace efficiency as flight volumes rise.

Major Players in the USA Air Traffic Management Market

- Raytheon Technologies

- Lockheed Martin

- Thales Group

- L3Harris Technologies

- Honeywell International

- Indra Sistemas

- Northrop Grumman

- Frequentis

- SITA

- Saab

- Leonardo

- Adacel Technologies

- Harris Corporation

- Rockwell Collins (Collins Aerospace)

- Fujitsu Limited

Key Target Audience

- Air Navigation Service Providers (ANSPs)

- Commercial Airlines

- Airport Authorities

- Government Regulatory Bodies (FAA, DOT)

- Military Aviation

- Unmanned Aircraft System (UAS) Companies

- Investments and Venture Capitalist Firms

- Original Equipment Manufacturers (OEMs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive map of the USA Air Traffic Management ecosystem. Extensive desk research is conducted, drawing on secondary databases such as government reports, industry publications, and proprietary databases to identify key stakeholders like ANSPs, airlines, and regulatory bodies. This helps define the critical variables affecting the market dynamics, such as technological trends, regulations, and air traffic growth.

Step 2: Market Analysis and Construction

This phase focuses on gathering historical data on market size, growth trajectories, and trends in air traffic volumes. The analysis will assess the ratio of air traffic controllers to automated systems, examining how advancements in technology, such as AI and satellite navigation, have impacted operational efficiencies. Service quality data and revenue generation models will be evaluated to ensure accuracy in forecasting market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested and validated through consultations with industry experts, including executives from major aerospace firms, FAA officials, and senior engineers from ANSPs. These expert insights will help refine market projections, providing a clearer picture of technological adoption, policy implementation, and investment patterns.

Step 4: Research Synthesis and Final Output

The final phase includes deep consultations with UTM system providers, satellite communication firms, and air traffic control technology manufacturers. Insights from these interactions will be integrated with quantitative market data to offer an accurate and comprehensive analysis of the USA ATM market, ensuring alignment with the latest technological innovations and regulatory frameworks.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions [ATM/ATC/ATFM/AIS], Abbreviations, Data Triangulation Framework, BottomUp & TopDown Market Sizing Approach [Value/Volume/Installations], Primary & Secondary Research Approach [FAA, ANSPs, OEMs], Forecasting Methodology [Statistical Trend Analysis], Research Limitations & Bias Controls)

- Market Definition and Scope

- USA National Airspace System Architecture

- Evolution of ATM in the USA

- ATM Value Chain Analysis

- ATM Policy & Regulatory Landscape

- Technology Ecosystem Overview

- Market Drivers

National Modernization Mandates

Rising Flight Volume & Congestion Metrics

Safety & Reliability Imperatives

UTM & eVTOL Integration Requirements - Market Restraints

High CapEx & Integration Complexity

Legacy System Reliance & Technical Debt

Talent & Controller Workforce Constraints - Market Opportunities

AIDriven Predictive Traffic Management

SatelliteBased CNS Adoption & 4D Trajectory Optimization

CyberSecurity for Critical ATM Networks - Market Trends

Digital Tower & Remote-Control Center Adoption

Interoperable ATM Platforms

Data Analytics & Decision Support - Regulation & Policy Framework

FAA Reauthorization & Funding Allocations

ICAO Compliance Requirements

UAS/UTM Operational Rules - Value Chain Mapping & Ecosystem

- Porter’s Five Forces

- By Revenue 2020-2025

- By Unit Deployments 2020-2025

- By Operational Metrics 2020-2025

- Average Selling Price 2020-2025

- By System/Component Type (In Value%)

Air Traffic Services (ATC, ATFM, AIS)

Communication, Navigation & Surveillance (CNS) Systems

Automation & Decision Support Platforms

Remote & Digital Towers

Unmanned Traffic Management (UTM) & UAS Integration - By Offering (In Value%)

Hardware (Radars, Telecom Networks, ADSB Stations)

Software (ATM Platforms, Sequencing/Flow Management, AI/ML Tools)

Services (Maintenance, Integration, Managed Services, Training) - By Airspace Operation Mode (In Value%)

Enroute & Center

Terminal/Radar Approach

Tower & Remote Tower Operation

Surface Movement Management - By EndUser (In Value%)

Federal Aviation Administration (FAA)

Commercial Airlines & Operators

Airports & Airport Authorities

Defense & Government Aviation

ANSPs & Regional Service Providers - By Deployment Model (In Value%)

Greenfield Installations

Brownfield Upgrades / Modernization

Hybrid/CloudEnabled Solutions

- Market Share by Revenue & Units

- CrossComparison Parameters (Company Overview / Geographic Footprint, Product & Solution Portfolio Breadth, Innovation Index / R&D Intensity, Strategic Partnerships & Alliances, Contract Wins & Government Programs, Integration Capabilities & Lifecycle Services, Certification & Regulatory Compliance Credentials, Installed Base & Customer References, Pricing Strategy & Revenue Models, Support & Training Infrastructure)

- SWOT Analysis of Top Competitors

- Pricing & Contract Structuring Analysis

- Key Competitors:

RTX Corporation (Raytheon Technologies)

Lockheed Martin Corporation

Thales Group

L3Harris Technologies, Inc.

Indra Sistemas, S.A.

Northrop Grumman Corporation

Frequentis AG

Honeywell International Inc.

Collins Aerospace

BAE Systems plc

Saab AB

SITA (ATC Solutions)

ADB SAFEGATE

Leidos Holdings, Inc.

Adacel Technologies Limited

- ANSP Requirements & Procurement Dynamics

- Airport Authority Technology Adoption Pathways

- Airline Network Operational Needs

- Defense ATM Requirements & Sovereignty Constraints

- UTM Infrastructure Integration Challenges

- DecisionMaker Priorities & Pain Points

- Forecast by Revenue 2026-2035

- Forecast by Deployment Units 2026-2035

- Forecast by Operational Metrics 2026-2035

- Forecast by Technology Trends 2026-2035