Market Overview

The US aircraft brakes market, valued at approximately USD ~ billion, is primarily driven by the increasing demand for commercial and military aircraft. The sector is propelled by factors such as the growth of the aviation industry, technological advancements in braking systems, and the need for more efficient, durable, and lighter braking solutions. In addition, the shift toward electric and hybrid aircraft is stimulating demand for advanced braking systems. Based on a recent historical assessment, the market is expected to continue expanding in response to evolving industry needs and the continuous innovation of braking technologies.

The dominance of the US aircraft brakes market is concentrated in key regions, including major metropolitan areas and industrial hubs such as Seattle, Wichita, and Los Angeles. These cities are home to prominent aerospace manufacturers and defense contractors, contributing significantly to the market’s development. The proximity of suppliers, OEMs, and aviation-related infrastructure in these regions further strengthens their dominance. Additionally, government defense contracts and commercial aviation activities in these cities foster a strong competitive environment, driving continuous innovation and demand in the sector.

Market Segmentation

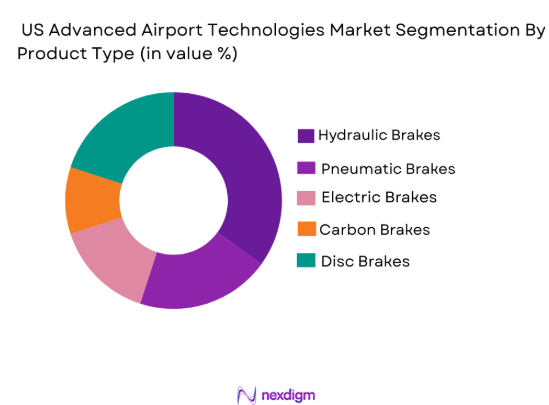

By Product Type

The US aircraft brakes market is segmented by product type into hydraulic brakes, pneumatic brakes, electric brakes, carbon brakes, and disc brakes. Recently, hydraulic brakes have dominated the market share due to their reliability, efficiency, and ability to withstand high temperatures. Hydraulic systems are widely adopted across commercial and military aircraft, where performance and durability are crucial. The advancement of hydraulic braking technology, along with the established infrastructure, further boosts its demand across various aviation sectors.

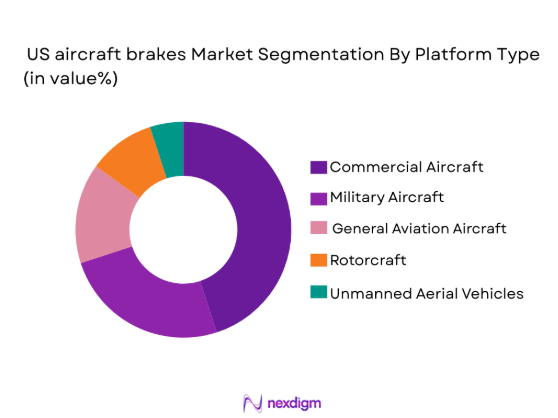

By Platform Type

The market is segmented by platform type into commercial aircraft, military aircraft, general aviation aircraft, rotorcraft, and unmanned aerial vehicles. The commercial aircraft segment holds the largest share due to the continuous expansion of global air travel. The growth in passenger demand and the increase in fleet size drive the need for reliable braking systems in commercial aircraft. Advances in technology and the adoption of more fuel-efficient, lightweight systems have further fueled this segment’s growth.

Competitive Landscape

The US aircraft brakes market is highly competitive, characterized by both global and regional players offering a range of braking solutions. Major companies are focusing on mergers, acquisitions, and partnerships to enhance their product portfolios and expand their geographical reach. Companies also invest heavily in R&D to develop advanced braking technologies, such as carbon composite and electric brake systems, to meet the evolving needs of the aviation industry. Market consolidation is evident as companies aim to strengthen their position in the growing aerospace sector.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Boeing | 1916 | Chicago, USA | ~ | ~

|

~

|

~

|

~

|

| Safran | 2005 | Paris, France | ~

|

~

|

~

|

~

|

~

|

| Honeywell International | 1906 | Charlotte, USA | ~

|

~

|

~

|

~

|

~

|

| Collins Aerospace | 2018 | Charlotte, USA | ~

|

~

|

~

|

~

|

~

|

| GE Aviation | 1892 | Cincinnati, USA | ~

|

~

|

~

|

~

|

~

|

US Aircraft Brakes Market Analysis

Growth Drivers

Increased Air Traffic

The rising demand for air travel has driven the growth of the aircraft brakes market. With more passengers flying globally, airlines are expanding their fleets to accommodate the increased air traffic. As the number of aircraft grows, so does the need for high-performance braking systems. Aircraft brakes play a vital role in ensuring safe and efficient landings, especially under challenging conditions such as high-speed landings or adverse weather. Additionally, advancements in braking technology are allowing for lighter and more efficient systems, which are essential for modern aircraft’s performance. These factors collectively drive the market, as new aircraft models are developed with advanced braking technologies that contribute to increased performance and safety.

Technological Advancements in Brake Materials

The development of advanced brake materials is another key driver of growth in the aircraft brakes market. Breakthroughs such as the introduction of carbon-carbon composite materials have significantly enhanced brake performance. These materials are lighter and offer better heat resistance than traditional metal brakes, resulting in improved overall aircraft efficiency. The use of such materials also enables longer lifespan and reduced wear and tear, further reducing operational costs for airlines. As the industry continues to prioritize performance and safety, innovations in brake materials are expected to remain a driving force for market growth.

Market Challenges

High Maintenance Costs

A major challenge for the US aircraft brakes market is the high cost of maintaining advanced braking systems. While technological advancements have made brakes more efficient and durable, they have also raised maintenance costs. Hydraulic and carbon-based brake systems, for example, require regular inspection and replacement of parts, which can be costly for airlines and military operators. Additionally, as aircraft fleets age, retrofitting older planes with new braking systems or upgrading existing components can involve significant investment. The high operational costs associated with maintaining these systems could hinder the adoption of advanced braking technologies, especially among smaller airlines or operators with limited budgets.

Regulatory and Certification Barriers

Another challenge is navigating the complex regulatory environment and certification processes that aircraft braking systems must undergo before being approved for use. Given the high safety standards and requirements set by aviation authorities like the FAA and EASA, manufacturers often face long approval timelines and significant regulatory hurdles. This adds to the time and cost involved in bringing new braking technologies to market, which can slow down innovation and increase the risk of delays in system deployments. For manufacturers, the need to meet stringent safety and compliance regulations further complicates the path to market entry and expansion.

Opportunities

Sustainability Initiatives in Aviation

As the aviation industry faces increasing pressure to reduce its carbon footprint, there is a growing opportunity for manufacturers to focus on eco-friendly aircraft braking solutions. Carbon brakes are becoming more widely adopted due to their lighter weight, improved fuel efficiency, and reduced energy consumption compared to traditional metallic systems. The demand for sustainable technology is being fueled by regulatory frameworks and green initiatives from governments, airlines, and international bodies. Manufacturers who develop and introduce environmentally conscious braking solutions stand to benefit from increased demand, positioning themselves as leaders in a market increasingly focused on sustainability.

Shift Toward Electric and Hybrid Aircraft

Another significant opportunity lies in the growing trend of electric and hybrid aircraft development. As the aviation sector explores alternative powertrains to reduce emissions, the need for specialized braking systems for these aircraft arises. Electric and hybrid aircraft have different performance and safety requirements compared to traditional jet-powered aircraft, which could necessitate the development of new braking technologies tailored to these platforms. This creates an opportunity for the aircraft brakes market to innovate and adapt to the evolving needs of the aerospace sector, particularly as new regulatory standards for these aircraft types are introduced.

Future Outlook

The US aircraft brakes market is expected to see continued growth in the coming years, driven by advancements in brake technology and increasing demand for safer and more efficient braking systems. Innovations such as electric and hybrid braking systems are poised to become a major focus, spurred by both regulatory support and technological advancements. Additionally, the trend toward sustainability and the demand for reduced environmental impact will continue to shape the market, with manufacturers looking to develop eco-friendly solutions. This, coupled with growing air traffic and a stronger push for modernization within military and commercial aircraft fleets, ensures a growth trajectory for the market.

Major Players

- Boeing

- Safran

- Honeywell International

- Collins Aerospace

- GE Aviation

- UTC Aerospace Systems

- Liebherr-Aerospace

- Meggitt

- Parker Hannifin

- AAR Corporation

- Goodrich Corporation

- Rockwell Collins

- Thales Group

- BAE Systems

- Raytheon Technologies

Key Target Audience

- Airlines

- Military Forces

- Aircraft Manufacturers

- Aircraft Maintenance and Repair Providers

- Government Agencies

- Aircraft Leasing Companies

- Aerospace Engineers and Designers

- Aircraft Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the main drivers, trends, and potential barriers impacting the aircraft brakes market. Key variables are examined through industry reports, regulatory guidelines, and market forecasts.

Step 2: Market Analysis and Construction

In this stage, data is compiled from primary and secondary research sources to build an accurate picture of the market size, segmentation, and dynamics. Historical data is analyzed to identify emerging trends and growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with industry professionals, suppliers, and regulatory bodies to validate initial hypotheses and assumptions. Feedback from key stakeholders is integrated to refine market analysis and projections.

Step 4: Research Synthesis and Final Output

The final market report is synthesized, incorporating all findings from previous steps. The result is a comprehensive analysis that includes validated market sizes, trends, growth drivers, and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Traffic

Advancements in Aircraft Design

Growing Demand for High-Performance Braking Systems

Technological Innovations in Braking Materials

Rising Investments in Military Aviation - Market Challenges

High Initial Cost of Advanced Systems

Maintenance and Repair Complexities

Regulatory Compliance and Certification Issues

Supply Chain Disruptions

Technological Adaptation in Older Aircraft - Market Opportunities

Emerging Markets for Aircraft Brakes

Sustainability Initiatives in Aircraft Manufacturing

Rising Demand for Hybrid and Electric Aircraft - Trends

Shift Towards Eco-friendly Braking Solutions

Increased Focus on Lightweight Materials

Integration of Smart Braking Systems

Customization and Tailored Aircraft Solutions

Advances in Noise and Vibration Reduction - Government Regulations & Defense Policy

Tighter Emissions Regulations

Aviation Safety Regulations

Defense Budget Allocations Impacting Procurement - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hydraulic Brakes

Pneumatic Brakes

Electric Brakes

Carbon Brakes

Disc Brakes - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Rotorcraft

Unmanned Aerial Vehicles - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Replacement

Upgrades

Customization - By End User Segment (In Value%)

Airlines

Military Forces

Private Operators

Government Agencies

Aircraft Manufacturers - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Sales

Third-Party Procurement

Contractual Agreements - By Material / Technology (In Value%)

Carbon-Carbon Composite

Ceramic Matrix Composites

Metallic Alloys

Hybrid Materials

Standard Steel

- Market structure and competitive positioning

- Cross Comparison Parameters (Price, Technology, Innovation, Brand Reputation, Product Portfolio, Market Share, Service Capabilities, Customer Support, Delivery Lead Time

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing

Safran

Honeywell International

Collins Aerospace

Goodrich Corporation

GE Aviation

Messier-Bugatti-Dowty

Magellan Aerospace

Daimler AG

UTAS

AeroBraking Systems

Heroux Devtek

Raytheon Technologies

Lufthansa Technik

MTU Aero Engines

- Technological Advancements and Their Impact on Operators

- Shift Towards Sustainability in Aircraft Maintenance

- Growing Influence of OEMs in Design and Procurement

- Cost Management in Aircraft Braking Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035