Market Overview

The US Aircraft Engine MRO market is valued at approximately USD ~ billion, driven by a steady increase in commercial air traffic, along with the growing number of aircraft in service. The market continues to expand due to the high demand for maintenance, repair, and overhaul services for both commercial and military aircraft engines. Rising fuel costs and regulatory requirements also fuel the demand for regular engine servicing to ensure optimal performance and regulatory compliance, thus contributing to market growth.

The US dominates the Aircraft Engine MRO market due to its large number of aircraft operators, including the world’s leading airlines and defense contractors. The region benefits from a robust infrastructure, a well-established aerospace industry, and a high volume of aircraft fleet operations. Moreover, the increasing trend toward outsourcing engine maintenance to specialized MRO providers in the US further consolidates its position as a leader in the global market.

Market Segmentation

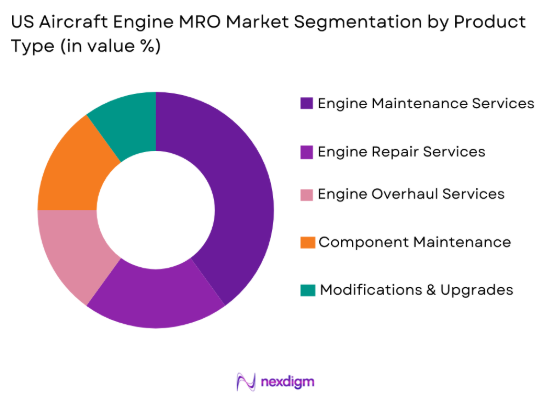

By Product Type

The US Aircraft Engine MRO market is segmented by product type into engine maintenance services, engine repair services, engine overhaul services, component maintenance services, and modifications & upgrades. Recently, engine maintenance services dominate the market share due to the increasing fleet size of commercial and military aircraft requiring regular maintenance. The high volume of air travel and aging fleet significantly drives the need for routine maintenance, ensuring engine performance and minimizing downtime.

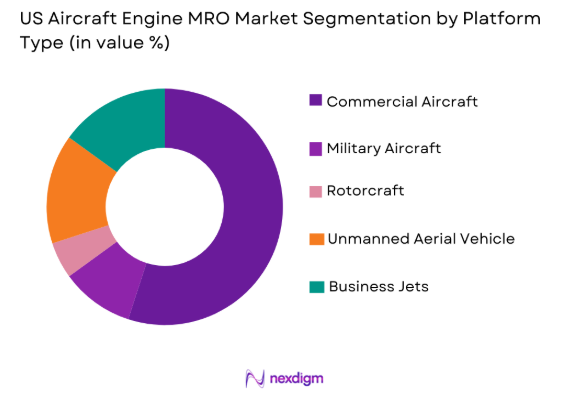

By Platform Type

The US Aircraft Engine MRO market is segmented by platform type into commercial aircraft, military aircraft, business jets, rotorcraft, and unmanned aerial vehicles (UAVs). Recently, commercial aircraft have a dominant market share due to the rapid growth in air travel demand. The large volume of aircraft in service, especially post-pandemic recovery, has increased the demand for MRO services, with a particular focus on engine repairs and overhauls to ensure flight safety and reliability.

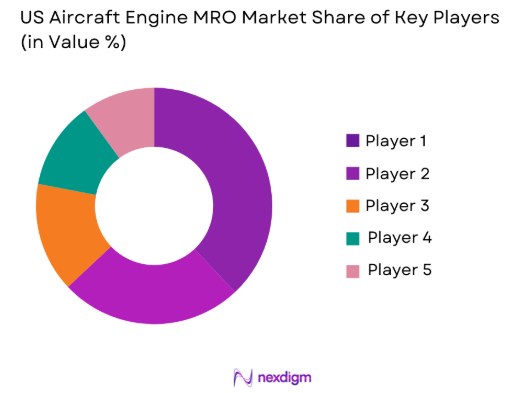

Competitive Landscape

The US Aircraft Engine MRO market is highly competitive, with several key players offering comprehensive services across different sectors, such as commercial, military, and private aircraft. Major players in the market include established aerospace firms and specialized MRO providers, contributing to market consolidation. These players are focusing on technological advancements such as predictive maintenance and integration of digital solutions to streamline MRO operations and reduce operational costs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| General Electric | 1892 | Boston, MA | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | East Hartford, CT | ~ | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

US Aircraft Engine MRO Market Analysis

Growth Drivers

Technological Advancements

Technological advancements in predictive maintenance, including AI and machine learning, are significantly driving growth in the US Aircraft Engine MRO market. Predictive maintenance allows MRO service providers to forecast engine failures before they occur, which helps airlines minimize unplanned downtimes and reduce maintenance costs. These technologies are now embedded into the maintenance processes of both commercial and military aircraft, providing operational efficiency and boosting demand for MRO services. Another technological trend contributing to market growth is the increasing integration of digital twins in engine monitoring, which provides real-time data on engine performance and helps in optimizing maintenance schedules. As more airlines and defense operators adopt these technologies, the need for specialized MRO services to handle complex systems will continue to rise, fostering growth in the market.

Regulatory Compliance

Increasing regulatory demands related to aviation safety, environmental protection, and engine emissions are pushing the US Aircraft Engine MRO market forward. With authorities like the Federal Aviation Administration (FAA) setting stricter safety and emission standards, airlines and military operators must adhere to regular engine overhauls and maintenance to stay compliant. These regulations drive the constant need for MRO services to ensure that engines meet both operational safety standards and environmental regulations. The enforcement of sustainable practices and the continuous evolution of engine emission standards have resulted in a growing demand for maintenance services that comply with these new regulatory frameworks. Therefore, the stringency of regulatory compliance is expected to keep the US Aircraft Engine MRO market growing steadily over the forecast period.

Market Challenges

High Maintenance Costs

High maintenance costs are a significant challenge for the US Aircraft Engine MRO market. The cost of engine repair and overhaul services has been increasing, driven by the complexity of modern engines and the high cost of replacement parts. For many airlines and military operators, these costs can be prohibitive, especially with the increasing number of engine overhauls required due to aging fleets. While some companies try to mitigate these costs by outsourcing MRO services, the rising costs of materials, labor, and advanced diagnostic technologies still pose a significant financial burden. As operators seek to control costs, they may delay or extend maintenance schedules, leading to operational risks and reduced engine performance. This rising cost pressure is expected to remain a major obstacle for the market, especially for smaller operators.

Skilled Labor Shortage

The shortage of skilled technicians in the aircraft engine maintenance sector is another challenge impacting the US Aircraft Engine MRO market. As the demand for MRO services grows, there is an increasing need for qualified personnel capable of servicing advanced engine systems. The workforce in this sector is aging, and there is a lack of younger professionals entering the field. Moreover, the skills required for new, advanced technologies such as AI-driven diagnostics, 3D printing for components, and new materials are highly specialized, creating a further gap in available talent. This shortage of skilled labor has the potential to delay maintenance schedules, increase costs, and affect the overall operational efficiency of both commercial and military fleets. Addressing this labor gap remains a pressing issue for the market.

Opportunities

Retrofit and Upgrades

The increasing demand for engine retrofitting and upgrades presents a significant opportunity in the US Aircraft Engine MRO market. Airlines and military operators are increasingly opting for retrofit solutions to improve engine performance, enhance fuel efficiency, and meet stricter environmental regulations. As older aircraft engines age, retrofitting becomes a cost-effective solution compared to replacing them with new models. This growing preference for engine retrofits creates a substantial market for MRO service providers, offering both performance and compliance-driven opportunities. Additionally, retrofitting allows aircraft operators to extend the life of their existing fleets, leading to a continuous need for MRO services. This presents a long-term opportunity for companies specializing in engine upgrades, modifications, and performance enhancement.

Adoption of Sustainable Aviation Technologies

The adoption of sustainable aviation technologies, including fuel-efficient and low-emission engines, is another promising opportunity in the US Aircraft Engine MRO market. With increasing pressure from regulatory bodies to reduce carbon emissions, the aviation sector is shifting toward greener technologies. This shift presents a growing demand for MRO services focused on maintaining and servicing eco-friendly engines, such as electric or hybrid systems. The MRO providers who can offer specialized services to handle these innovative and environmentally-friendly technologies will have a competitive advantage. As governments and airlines alike focus on sustainability goals, the demand for maintenance services supporting these greener technologies will increase, creating significant opportunities for market players. This trend aligns with global efforts to promote environmental sustainability in aviation.

Future Outlook

The US Aircraft Engine MRO market is expected to see steady growth in the coming years, driven by increasing air traffic, technological advancements, and regulatory demands for engine performance and safety. The market will benefit from the continued adoption of predictive maintenance technologies, which will reduce downtime and enhance operational efficiency. Moreover, the shift towards sustainable aviation and eco-friendly engine technologies will further shape the future of the market, with MRO providers expanding their capabilities to service newer, greener engines.

Major Players

- General Electric

- Rolls-Royce

- Pratt & Whitney

- MTU Aero Engines

- Safran Aircraft Engines

- Honeywell Aerospace

- Lufthansa Technik

- AAR Corp.

- Air France-KLM Engineering & Maintenance

- ST Engineering Aerospace

- Delta TechOps

- International Aero Engines

- United Technologies

- Singapore Technologies Aerospace

- OEM Services

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Military contractors

- Airline operators

- Aircraft leasing companies

- Maintenance, Repair, and Overhaul service providers

- Aircraft parts suppliers

Research Methodology

Step 1: Identification of Key Variables

In this step, we identify the key variables that influence the US Aircraft Engine MRO market, such as demand drivers, technological innovations, regulatory changes, and market growth patterns.

Step 2: Market Analysis and Construction

In this step, we analyze historical data, market trends, and economic factors to construct a comprehensive view of the US Aircraft Engine MRO market. This includes identifying the key sectors and segments driving growth.

Step 3: Hypothesis Validation and Expert Consultation

We validate our hypotheses through consultations with industry experts, including MRO providers, airline operators, and regulatory bodies, to ensure the accuracy and relevance of our findings.

Step 4: Research Synthesis and Final Output

In the final step, we synthesize the gathered data and insights to produce a detailed market report that offers actionable insights and recommendations for stakeholders in the US Aircraft Engine MRO market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in air travel demand

Increasing aircraft fleet size

Technological advancements in engine performance

Government regulations mandating maintenance schedules

Increasing adoption of predictive maintenance technology - Market Challenges

High maintenance costs

Shortage of skilled labor in MRO sector

Stringent regulatory compliance and certification requirements

Supply chain disruptions for parts and materials

Technological integration challenges with new engine models - Market Opportunities

Expanding market for retrofit and upgrades

Adoption of AI and IoT in engine monitoring

Growth of military aircraft maintenance - Trends

Rise in digitalization and automation in MRO services

Emerging use of drones for aircraft inspections

Sustainability initiatives driving eco-friendly engine technologies

Increase in MRO outsourcing

Advancements in 3D printing for engine components - Government Regulations & Defense Policy

Tighter regulations for engine emissions

FAA certifications and compliance requirements

Defense contracts driving military MRO demand

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Engine Maintenance Services

Engine Repair Services

Engine Overhaul Services

Component Maintenance Services

Modifications & Upgrades - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Rotorcraft

Unmanned Aerial Vehicles - By Fitment Type (In Value%)

OEM Parts Fitment

Aftermarket Parts Fitment

Engine Overhaul Fitment

On-site Maintenance Fitment

Off-site Maintenance Fitment - By End User Segment (In Value%)

Commercial Airlines

Private Aircraft Operators

Military Operators

Aircraft Leasing Companies

Maintenance, Repair & Overhaul Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Online Bidding Platforms

OEM-Contracted Procurement

Private Procurement - By Material / Technology (In Value%)

Advanced Composite Materials

Titanium Alloys

High-performance Steel

Additive Manufacturing Components

Electric and Hybrid Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Market Share, Technology Adoption, Service Capabilities, Geographic Reach, Customer Relationships, Maintenance Infrastructure, Price Competitiveness, MRO Specialization, Innovation, and Reputation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

General Electric

Rolls-Royce

Pratt & Whitney

Honeywell International

MTU Aero Engines

Safran Aircraft Engines

CFM International

Airbus

Boeing

Lufthansa Technik

United Technologies

AerCap

SIA Engineering Company

Air New Zealand Engineering

ST Engineering Aerospace

- Airlines adopting engine health management systems

- Increased military procurement driving MRO demand

- Private operators requiring efficient maintenance services

- Leasing companies focusing on cost-effective maintenance solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035