Market Overview

The US Aircraft Engines market has witnessed significant growth based on a recent historical assessment, with a market size valued in USD ~ billion. The market is driven by the expansion of both commercial and military aviation sectors, alongside advancements in engine technology. Moreover, the increasing demand for fuel-efficient and environmentally friendly engines further accelerates market growth. Key factors such as technological innovations, government regulations, and a surge in air traffic contribute to the demand for more sophisticated and high-performance engines in the aviation industry.

The US, being a global hub for aviation, holds a dominant position in the aircraft engines market. Major cities like Seattle, Wichita, and Indianapolis are central to this dominance, supported by the presence of industry giants such as Boeing and General Electric. The US government’s defense spending and strong demand for commercial aircraft engines further bolster the market’s growth. Additionally, the US benefits from its well-established infrastructure, research facilities, and skilled workforce, enabling technological innovations in aircraft engines.

Market Segmentation

By Product Type

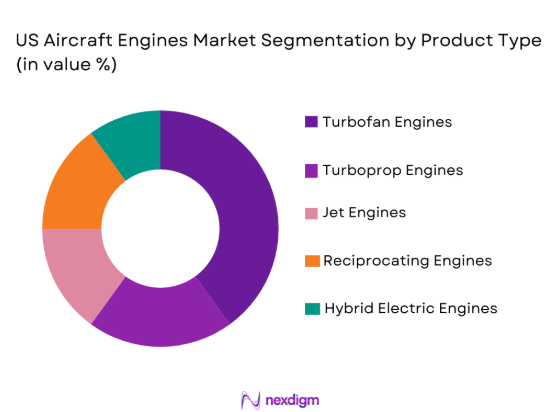

The US Aircraft Engines market is segmented by product type into turbofan, turboprop, jet, reciprocating, and hybrid electric engines. The turbofan engine has emerged as the dominant product type, owing to its high efficiency and extensive use in commercial aviation. As airlines focus on reducing fuel consumption and increasing operational range, turbofan engines have become the preferred choice due to their superior fuel efficiency and reliability. Moreover, ongoing innovations and advancements in materials and technology continue to enhance the performance of turbofan engines, solidifying their market dominance.

By Platform Type

The US Aircraft Engines market is segmented by platform type into commercial aircraft, military aircraft, business jets, helicopters, and unmanned aerial vehicles (UAVs). The commercial aircraft segment holds the dominant market share due to the increasing global demand for air travel and fleet expansion by major airlines. Aircraft engine manufacturers are focusing on providing more fuel-efficient engines for commercial jets to meet the growing demand for low-cost, high-performance engines. Additionally, continuous advancements in jet engine technologies, coupled with government incentives and commercial airline investments, contribute to the strong growth of this segment.

Competitive Landscape

The US Aircraft Engines market is highly competitive, with several key players shaping the market’s direction. Major companies like General Electric, Rolls-Royce, and Pratt & Whitney lead the market with their extensive product portfolios and technological advancements. Consolidation in the market has also been notable, with many players opting for strategic mergers and acquisitions to enhance their research and development capabilities. The influence of these major players continues to drive innovations, from fuel-efficient engines to the development of electric propulsion technologies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Product Innovations |

| General Electric | 1892 | Boston, MA | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | East Hartford, CT | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

US Aircraft Engines Market Analysis

Growth Drivers

Increased Global Air Traffic

As global air traffic continues to grow, particularly in emerging markets, the demand for commercial aircraft engines is expected to rise significantly. Airlines are expanding their fleets to accommodate the increasing number of passengers, prompting the need for more engines. Moreover, the aviation industry is focusing on reducing operational costs, especially fuel consumption, leading to a greater emphasis on fuel-efficient engines. Aircraft engine manufacturers are responding by developing advanced engines that not only meet these efficiency requirements but also adhere to stricter environmental regulations. This continued growth in air travel coupled with the demand for high-performance engines is driving the market’s expansion.

Advancements in Engine Technology

Technological innovations in aircraft engines are another key growth driver for the market. Manufacturers are increasingly focusing on enhancing the efficiency and performance of aircraft engines by using advanced materials and incorporating new technologies. For instance, advancements in hybrid-electric propulsion and lightweight composite materials are expected to reduce fuel consumption and carbon emissions, appealing to both commercial and military sectors. Moreover, the shift towards digitalized engine management systems that leverage AI and IoT to improve operational performance has further boosted the demand for high-tech engine systems. This technological evolution in aircraft engines is expected to fuel market growth and keep the US at the forefront of innovation in aviation propulsion.

Market Challenges

High Cost of Aircraft Engines:

One of the primary challenges in the US Aircraft Engines market is the high initial cost of aircraft engines, which can be prohibitive for smaller airlines and private operators. These engines require significant capital investment, which can strain financial resources, especially in an industry that is also faced with fluctuating fuel prices and economic uncertainty. The production costs of these engines, particularly when using advanced materials and manufacturing techniques, can further drive up prices. While the market is seeing long-term operational cost savings due to fuel efficiency, the upfront costs remain a significant barrier to entry for many potential customers.

Regulatory Compliance and Environmental Standards

The US Aircraft Engines market is also faced with increasing pressure to meet stringent environmental regulations and compliance standards. The aviation industry is under constant scrutiny for its carbon emissions, and manufacturers are required to meet these standards by developing more environmentally friendly engines. Complying with these regulations often involves costly modifications and long-term R&D investments. While innovations in sustainable aviation fuel (SAF) and hybrid-electric propulsion are promising, regulatory compliance remains a challenge that manufacturers must navigate in order to remain competitive in the global market.

Opportunities

Sustainable Aviation Technologies

The growing emphasis on reducing the environmental impact of aviation presents a significant opportunity for manufacturers in the aircraft engines market. Innovations in sustainable aviation fuel (SAF) and electric propulsion technologies are increasingly becoming viable solutions. Companies focusing on developing environmentally friendly engines that offer reduced carbon emissions are poised to capitalize on this trend. Government incentives, regulatory support, and growing consumer demand for sustainable solutions are likely to create new avenues for growth, with a focus on carbon-neutral and low-emission aircraft engines being a key differentiator in the market.

Growing Military and Defense Sector

The military and defense sector represents a promising opportunity for the aircraft engines market. Increased defense budgets, along with modernization programs and the push for next-generation fighter jets and unmanned aerial vehicles (UAVs), are driving the demand for advanced propulsion systems. Military forces are also focusing on upgrading their fleets with more efficient and powerful engines to enhance their capabilities. As a result, defense contracts and partnerships with aerospace companies will be a key growth opportunity for manufacturers, helping them expand their product offerings and increase their market share in the defense sector.

Future Outlook

The future outlook for the US Aircraft Engines market indicates continued growth driven by advancements in technology, increasing demand for air travel, and governmental support for sustainable solutions. Over the next five years, the market is expected to experience continued innovation in fuel-efficient and hybrid-electric engines. As airlines and military sectors increasingly adopt new technologies to reduce operational costs and environmental impact, aircraft engine manufacturers will focus on developing next-generation propulsion systems that align with sustainability goals. Additionally, regulatory changes and government incentives for green technologies will further drive market expansion, particularly for engines that comply with stricter emissions standards. The market will also see a rise in demand for aftermarket services, as more airlines and defense sectors focus on engine maintenance and repair.

Major Players

- General Electric

- Rolls-Royce

- Pratt & Whitney

- Safran Aircraft Engines

- MTU Aero Engines

- Honeywell Aerospace

- IHI Corporation

- Leonardo

- Boeing

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- L3 Technologies

- Rockwell Collins

- BAE Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Airlines and private operators

- Aerospace component suppliers

- Military and defense contractors

- Maintenance, repair, and overhaul (MRO) providers

- OEM (Original Equipment Manufacturers)

Research Methodology

Step 1: Identification of Key Variables

We identify the critical factors driving the US Aircraft Engines market, including technological trends, regulatory requirements, and market demands.

Step 2: Market Analysis and Construction

We conduct a thorough market analysis, segment the market, and forecast future trends based on historical data and industry insights.

Step 3: Hypothesis Validation and Expert Consultation

We validate our hypotheses with industry experts, stakeholders, and through primary and secondary data collection from credible sources.

Step 4: Research Synthesis and Final Output

We synthesize the research findings into actionable insights, presenting a comprehensive report on the market dynamics and future outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Air Travel and Commercial Fleet Expansion

Rising Military Budgets and Modernization Programs

Technological Innovations in Fuel Efficiency

Demand for Environmentally Friendly Aircraft Engines

Growth in UAV and Electric Aircraft Market - Market Challenges

High Initial Cost of Aircraft Engines

Stricter Environmental Regulations

Supply Chain Disruptions

Limited Availability of Skilled Workforce

Technological Barriers to Advancing Engine Performance - Market Opportunities

Expansion in Electric and Hybrid Aircraft Development

Rising Demand for Lightweight and Fuel-Efficient Engines

Government Contracts and Defense Sector Investments - Trends

Integration of AI and IoT in Engine Management Systems

Advancements in Engine Materials for High Efficiency

Adoption of Sustainable Aviation Fuel (SAF)

Increase in Engine Health Monitoring Technologies

Emergence of Urban Air Mobility (UAM) Engines - Government Regulations & Defense Policy

FAA Regulations for Emission Standards

Defense Procurement and Modernization Programs

Government Support for Sustainable Aviation Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Turbofan Engines

Turboprop Engines

Jet Engines

Reciprocating Engines

Hybrid Electric Engines - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM Engines

Aftermarket Engines

Upgrades & Refurbishment

Replacement Engines

Custom Engines - By EndUser Segment (In Value%)

Airlines

Military & Defense

OEMs (Original Equipment Manufacturers)

Maintenance, Repair, and Overhaul (MRO) Providers

Private Operators - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Commercial Aviation Contracts

Third-party Suppliers

Online Marketplaces - By Material / Technology (in Value%)

Titanium Alloys

Composites

Ceramic Matrix Composites

Superalloys

Advanced Manufacturing Techniques

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Price, Engine Size, Aftermarket Support, Sustainability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

General Electric

Pratt & Whitney

Rolls-Royce

CFM International

Honeywell Aerospace

MTU Aero Engines

Safran Aircraft Engines

L3Harris Technologies

GE Aviation

Snecma

IHI Corporation

Aero Vodochody

United Technologies

Boeing

Lockheed Martin

- Commercial Airlines’ Adoption of Next-Gen Engines

- Military Focus on Advanced Propulsion Systems

- OEMs’ Collaboration with Engine Manufacturers

- MRO Providers’ Role in Maintaining Aircraft Fleet

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035