Market Overview

The US Aircraft Lighting Market is valued at approximately USD ~ billion, driven by increasing demand for efficient and advanced lighting systems in both commercial and military aircraft. Key growth factors include the rise in air traffic, advancements in LED technologies, and stringent regulatory standards for safety. Additionally, the push for energy-efficient systems and the need for improved cabin comfort are further propelling market demand, with aircraft operators seeking advanced lighting solutions for operational efficiency and passenger experience enhancement.

The US remains a dominant player in the aircraft lighting market, supported by a well-established aerospace industry, leading aircraft manufacturers, and a strong government defense presence. The market is particularly concentrated in states like California and Texas, which host major aircraft manufacturers and aerospace facilities. Additionally, global competition from countries such as Germany, the UK, and France, along with technological advancements, helps maintain the US’s leadership position in this sector, ensuring a steady demand for next-generation lighting solutions.

Market Segmentation

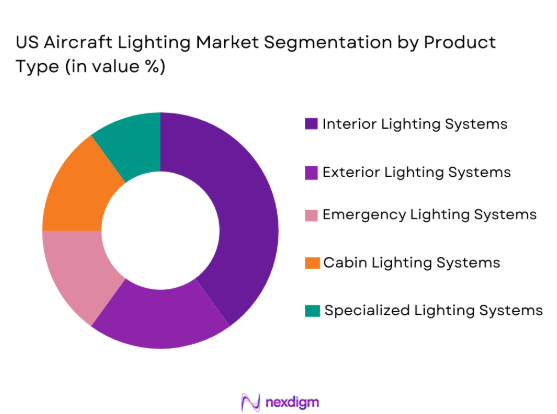

By Product Type

The US Aircraft Lighting Market is segmented by product type into interior lighting systems, exterior lighting systems, emergency lighting systems, cabin lighting systems, and specialized lighting systems. Recently, interior lighting systems have gained a dominant market share due to increased demand for aesthetically appealing and energy-efficient solutions. Factors such as higher passenger expectations for in-flight comfort and the growing emphasis on LED technology in reducing energy consumption have contributed to the widespread adoption of interior lighting systems. This trend is especially prevalent in commercial aircraft, where customer experience plays a crucial role.

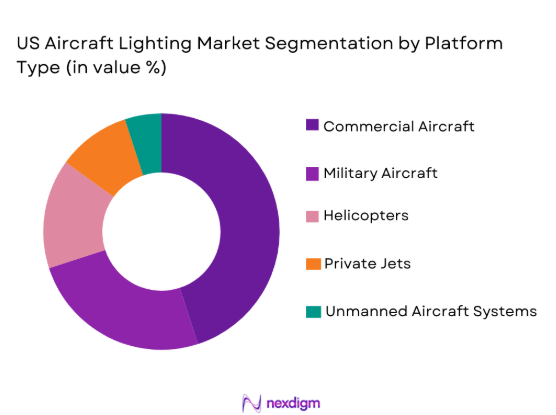

By Platform Type

The US Aircraft Lighting Market is segmented by platform type into commercial aircraft, military aircraft, helicopters, private jets, and unmanned aircraft systems. Recently, commercial aircraft have dominated the market share due to the consistent increase in air travel and fleet expansions. With the demand for energy-efficient and durable lighting solutions, commercial airlines have been adopting advanced lighting systems for both aesthetics and functionality. Furthermore, military and private jet segments also show steady growth driven by advancements in technology and high operational standards for safety and comfort.

Competitive Landscape

The US Aircraft Lighting Market is highly competitive, with several key players at the forefront driving innovation and technological advancements. Major players have been consolidating their positions through strategic partnerships, acquisitions, and product development initiatives to address the growing demand for energy-efficient and customizable lighting solutions. These players have a significant impact on market trends, with several introducing new technologies such as smart lighting systems and OLED solutions to cater to evolving customer needs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Product Innovation Focus |

| Honeywell International | 1906 | Morris Plains, NJ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, NC | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Astronics Corporation | 1968 | East Aurora, NY | ~ | ~ | ~ | ~ | ~ |

| Luminator Technology Group | 1984 | Plano, TX | ~ | ~ | ~ | ~ | ~ |

US Aircraft Lighting Market Analysis

Growth Drivers

Increased Demand for Energy-Efficient Lighting

The increasing demand for energy-efficient lighting solutions in the aircraft lighting market is one of the primary drivers. As airlines and operators seek to reduce operational costs, the shift toward LED and OLED technologies has accelerated. These technologies offer longer lifespans, lower energy consumption, and reduced heat emission compared to traditional lighting systems, making them an attractive choice for the aviation sector. The rising need to meet environmental sustainability goals further promotes the adoption of energy-efficient solutions. Moreover, regulatory standards and airline commitments to lower carbon footprints have led to an increase in the deployment of such systems. Additionally, aircraft manufacturers are focusing on integrating energy-efficient lighting to comply with stringent environmental norms, which encourages airlines to adopt these lighting solutions. Airlines are also prioritizing fuel savings and operational efficiency, all of which contribute to a robust demand for energy-efficient lighting in the market.

Technological Advancements in Aircraft Lighting Systems

Technological advancements have become a significant driver for the aircraft lighting market. Innovations in smart lighting systems, which provide enhanced flexibility and control, have contributed to increased demand. Aircraft operators and manufacturers now prioritize integrating advanced lighting systems that not only improve energy efficiency but also enhance passenger comfort and safety. Intelligent lighting solutions, which adapt to flight conditions and passenger preferences, have gained popularity. The incorporation of sensors, dimming capabilities, and color-changing features improves the overall flight experience, making aircraft lighting systems more sophisticated. As the aviation industry embraces automation and digitization, there is a rising demand for lighting solutions that can seamlessly integrate into the aircraft’s broader intelligent systems. Furthermore, the development of OLED and interactive lighting solutions offers new possibilities for the in-flight environment. These advancements improve operational performance while enhancing the aesthetic appeal of the aircraft.

Market Challenges

High Cost of Advanced Lighting Systems

The high cost associated with advanced lighting systems remains a significant challenge in the US Aircraft Lighting Market. Advanced lighting solutions, particularly those involving LED and OLED technologies, require significant upfront investment, making them financially challenging for smaller airlines and operators. While these systems offer long-term cost savings in terms of energy efficiency and maintenance, the initial installation costs can be prohibitive for many players in the market. Additionally, the integration of such advanced lighting systems into existing aircraft fleets, particularly legacy aircraft, involves high retrofitting costs. These high initial costs can deter potential customers from adopting newer lighting technologies, especially in a competitive market where reducing operational costs is a priority. This challenge is especially relevant in the current market environment, where airlines and aircraft operators are increasingly focused on maintaining profitability amidst rising fuel costs and other economic pressures.

Regulatory Compliance and Certification Issues

Regulatory challenges are another major obstacle for the US Aircraft Lighting Market. The aviation industry is highly regulated, and any changes or updates to aircraft lighting systems must comply with stringent regulations and certification standards set by bodies such as the FAA and EASA. These regulations cover aspects such as safety, performance, and electromagnetic compatibility, which can slow the development and adoption of new lighting technologies. Meeting these compliance requirements adds to the overall cost and complexity of implementing new lighting systems. The lengthy approval processes and the need for extensive testing also delay the widespread adoption of the latest technologies, further hampering growth in the market. Additionally, international regulatory differences and the requirement to obtain multiple certifications for global markets make it challenging for manufacturers to standardize their lighting products across regions. This regulatory burden can significantly increase the time and cost associated with bringing new lighting solutions to market.

Opportunities

Expansion of Smart Lighting Solutions in Aircraft

The growing trend of smart lighting systems presents a significant opportunity in the US Aircraft Lighting Market. Smart lighting systems, which are capable of adjusting to environmental conditions, passenger needs, and flight parameters, offer greater flexibility and functionality compared to traditional lighting systems. These solutions can be integrated with other in-flight systems, such as entertainment and climate control, creating a more seamless and customizable passenger experience. Airlines are increasingly seeking to differentiate themselves by providing unique and premium services, and advanced lighting is a key part of this offering. As a result, the demand for smart lighting systems is expected to grow, with airlines willing to invest in these solutions to improve passenger satisfaction and operational efficiency. Moreover, the integration of sensors and automated controls allows for optimized energy consumption, offering both environmental and financial benefits. This growing interest in smart technologies in the aviation sector represents a lucrative opportunity for manufacturers to innovate and cater to these evolving demands.

Increasing Focus on Safety and Emergency Lighting Systems

The increasing focus on safety regulations presents a substantial opportunity for the US Aircraft Lighting Market, particularly in the area of emergency lighting systems. As airlines and manufacturers place greater emphasis on passenger safety, the demand for enhanced emergency lighting systems has risen. These systems are crucial in ensuring safe evacuation during emergencies, and technological advancements are improving their reliability and effectiveness. Regulatory bodies, including the FAA, have strict safety standards that mandate the installation of advanced emergency lighting systems, which is driving market growth in this segment. Furthermore, as new aircraft models are introduced and older models are retrofitted, there is an increasing need for up-to-date, reliable, and efficient emergency lighting solutions. The integration of LED and smart technologies into emergency lighting systems offers new growth avenues, ensuring that these systems not only meet safety standards but also provide long-term operational benefits. The evolving focus on enhanced safety measures is a critical driver for this market segment.

Future Outlook

The US Aircraft Lighting Market is expected to see continued growth over the next five years, driven by technological advancements and a rising demand for energy-efficient and customized lighting systems. The industry is likely to benefit from regulatory support aimed at reducing environmental impact and improving passenger comfort. Additionally, the growing emphasis on smart technologies and automation in aircraft systems will spur innovations in lighting solutions. Aircraft manufacturers and operators will prioritize integrating next-generation lighting technologies to meet evolving consumer demands and stay ahead in a competitive market.

Major Players

- Honeywell International

- Collins Aerospace

- Safran

- Astronics Corporation

- Luminator Technology Group

- Diehl Aerospace

- Zodiac Aerospace

- Raytheon Technologies

- Hella GmbH

- STG Aerospace

- LPS Aerostructures

- Rockwell Collins

- Astronics Advanced Electronic Systems

- Ametek Inc.

- Meggitt PLC

Key Target Audience

- Aircraftmanufacturers

- Airlines and commercial aircraft operators

- Military and defense contractors

- Aviation technology developers

- Aviation maintenance providers

- OEMs for aircraft lighting systems

- Aviation industry regulators

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and defining the key variables that influence the aircraft lighting market, including product types, technologies, and regulatory factors.

Step 2: Market Analysis and Construction

In this step, detailed market research is conducted to assess current trends, competition, and growth drivers, followed by segmentation based on product types, platforms, and applications.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with key industry stakeholders and technical experts to validate market assumptions and refine hypotheses.

Step 4: Research Synthesis and Final Output

This step synthesizes all collected data into comprehensive reports, providing actionable insights for stakeholders, including market forecasts, competitive analysis, and trend identification.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Demand for Energy-Efficient Lighting Solutions

Technological Advancements in Lighting Systems

Rising Air Traffic and Aircraft Fleet Expansion

Growing Emphasis on Passenger Comfort and Safety

Development of Smart Lighting Systems - Market Challenges

High Initial Investment Costs

Strict Regulatory Standards and Compliance Requirements

Integration with Legacy Aircraft Systems

Limited Availability of Skilled Labor for Installation

Competition from Alternative Lighting Technologies - Market Opportunities

Advancements in Sustainable and Eco-friendly Lighting

Growth in Military and Defense Aircraft Lighting

Opportunities in Unmanned Aircraft Systems Lighting - Trends

Integration of Smart Lighting Technologies

Customization of Aircraft Interiors with Advanced Lighting

Use of Dynamic and Adaptive Lighting for Safety and Comfort

Adoption of Automated Lighting Systems

Focus on Energy Efficiency in Aircraft Lighting Solutions - Government Regulations & Defense Policy

FAA Regulations on Aircraft Lighting

Defense Procurement Standards for Lighting Systems

Environmental Regulations Impacting Lighting Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Interior Lighting Systems

Exterior Lighting Systems

Emergency Lighting Systems

Cabin Lighting Systems

Specialized Lighting Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Helicopters

Private Jets

Unmanned Aircraft Systems - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Upgrades and Modifications

Retrofit

Maintenance and Repairs - By EndUser Segment (In Value%)

Aircraft Manufacturers

Aircraft Operators

Government and Defense Agencies

Private Jet Owners

Maintenance and Repair Organizations - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Distributors

Online Procurement Platforms

Government Tendering

Maintenance Service Providers - By Material / Technology (in Value%)

LED Lighting Systems

Halogen Lighting Systems

Fluorescent Lighting Systems

OLED Lighting Systems

Laser-based Lighting Systems

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Honeywell International

Collins Aerospace

Safran

Eaton Corporation

LEDtronics

Luminator Technology Group

Astronics Corporation

Ametek Inc.

Diehl Aerospace

Zodiac Aerospace

Thales Group

LPS Aerostructures

Soderberg Aviation

Optical Display Systems

Elbit Systems

- Aircraft Operators Seeking Enhanced Lighting Solutions

- Aircraft Manufacturers Focusing on Cost-effective Lighting

- Private Jet Owners Investing in Custom Lighting

- Military and Defense Agencies Upgrading Lighting for Safety

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035