Market Overview

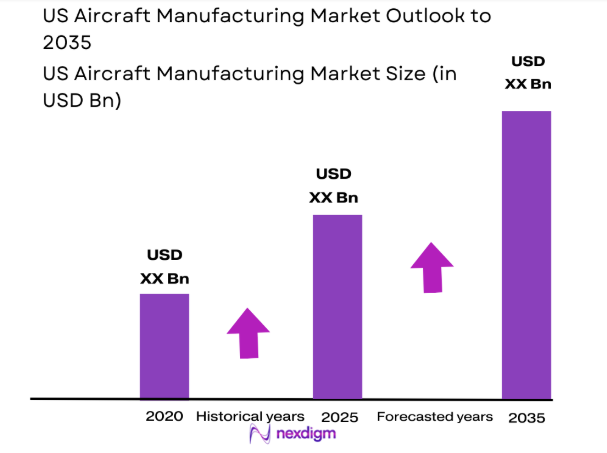

The US aircraft manufacturing market has reached a substantial size, driven by ongoing advancements in technology, strong demand from defense and commercial sectors, and government spending on aerospace infrastructure. As of a recent historical assessment, the market is valued at USD ~ billion, with growth fueled by increased military investments, growing global air traffic, and the shift towards electric aircraft solutions. The market’s robust performance is supported by a strong manufacturing base and continuous product innovation.

The US remains the dominant player in the global aircraft manufacturing market due to its advanced aerospace industry, skilled workforce, and leading technological innovations. Major aerospace hubs such as Washington, California, and Texas drive the sector’s growth with their established ecosystems and extensive research facilities. The strong presence of key manufacturers like Boeing and Lockheed Martin, combined with significant government contracts, contributes to the US’s leadership position in both the commercial and military aviation sectors.

Market Segmentation

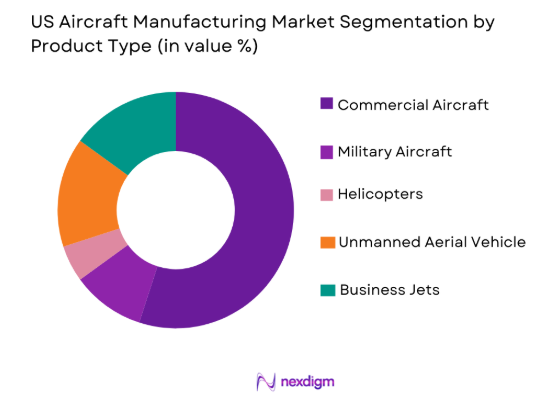

By Product Type

The US aircraft manufacturing market is segmented by product type into commercial aircraft, military aircraft, business jets, helicopters, and unmanned aerial vehicles (UAVs). Recently, the commercial aircraft segment has a dominant market share due to the growing demand for air travel, the increasing fleet sizes of airlines, and the expansion of low-cost carriers. As global travel demand surges, major airlines in the US are prioritizing fleet modernization, boosting commercial aircraft production.

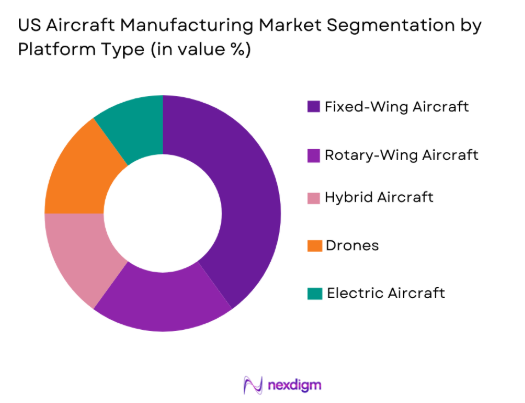

By Platform Type

The US aircraft manufacturing market is segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, hybrid aircraft, drones, and electric aircraft. Fixed-wing aircraft dominate the market share due to their wide application in both commercial and military sectors. These aircraft are extensively used in commercial flights, cargo transport, and defense operations, with airlines and military forces prioritizing large fleets of fixed-wing models due to their efficiency, range, and payload capacity.

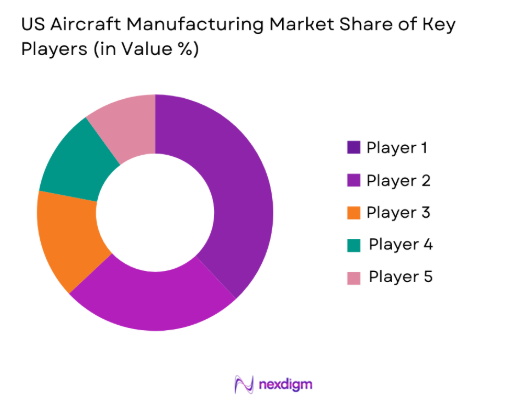

Competitive Landscape

The competitive landscape in the US aircraft manufacturing market is dominated by large multinational corporations and established aerospace firms. There has been significant consolidation in the industry, with key players forming strategic partnerships and alliances to expand their market reach and technological capabilities. The influence of major players such as Boeing and Lockheed Martin is strong, with these companies leading the way in innovation, defense contracts, and production capacity. Their established reputations and market reach make them formidable competitors in both the military and commercial sectors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Technology Innovation |

| Boeing | 1916 | Chicago, IL | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, MA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

US Aircraft Manufacturing Market Analysis

Growth Drivers

Government Defense Spending

A significant growth driver for the US aircraft manufacturing market is the continuous investment in defense by the federal government. As global security concerns grow, the US government has steadily increased its defense budget, which has been directed toward the procurement and modernization of military aircraft. These investments support a strong demand for advanced, next-generation aircraft, including fighter jets, bombers, and unmanned aerial systems, stimulating growth in the aerospace manufacturing sector. The US military’s focus on maintaining technological superiority through cutting-edge defense systems directly impacts the aircraft manufacturing market, ensuring steady demand for these specialized products. Additionally, the growing trend of international military contracts with allied nations has provided further momentum, resulting in sustained business opportunities for major defense contractors like Lockheed Martin and Boeing.

Technological Advancements in Aircraft Design

The rapid evolution of aircraft technology is another key driver of growth in the US aircraft manufacturing market. Innovations such as electric and hybrid propulsion systems, autonomous flight technology, and advanced avionics are revolutionizing the aviation industry. As airlines and defense organizations seek to enhance fuel efficiency, reduce emissions, and improve operational capabilities, the demand for technologically advanced aircraft continues to rise. Additionally, the integration of artificial intelligence in flight control systems, predictive maintenance, and real-time data analytics is transforming aircraft design and production, allowing manufacturers to create more efficient, sustainable, and safer aircraft. These technological advancements are expected to continue driving the market’s growth as manufacturers prioritize research and development in these areas to meet future aviation needs.

Market Challenges

High Manufacturing and R&D Costs

One of the significant challenges faced by the US aircraft manufacturing market is the high cost of manufacturing and research and development. The production of advanced aircraft, particularly military models and commercial jets, requires significant capital investment in both manufacturing facilities and R&D. Moreover, stringent regulatory requirements and quality control measures further increase the costs involved in aircraft production. These high operational costs can limit the ability of smaller manufacturers to compete with industry giants like Boeing and Lockheed Martin, thus leading to market consolidation. While the demand for new aircraft remains strong, these financial barriers present a considerable challenge to profitability and market access, especially for firms attempting to innovate or enter the market with new product offerings.

Supply Chain Disruptions

Another significant challenge is the ongoing supply chain disruptions impacting the US aircraft manufacturing industry. The COVID-19 pandemic and geopolitical tensions have led to delays in the supply of key materials, parts, and components required for aircraft production. This disruption has created bottlenecks, extending lead times and impacting production schedules. Additionally, the reliance on global suppliers for critical components, such as engines and avionics systems, makes the industry vulnerable to international trade policies, tariff changes, and political instability. These factors collectively increase the risks associated with maintaining efficient production timelines, causing further financial and operational strains on manufacturers.

Opportunities

Sustainability and Electric Aircraft

One significant opportunity in the US aircraft manufacturing market is the increasing shift toward sustainability, particularly the development and deployment of electric aircraft. With growing environmental concerns and rising fuel costs, both commercial and military sectors are exploring electric propulsion systems as a means to reduce carbon emissions and operational costs. Several companies, including Boeing and job-specific manufacturers, are investing in electric aircraft technology, which is expected to become a pivotal market segment. The US government’s focus on reducing carbon footprints and promoting green aviation solutions further boosts opportunities for manufacturers specializing in electric or hybrid-powered aircraft. This growing demand for environmentally friendly solutions presents a lucrative opportunity for players in the aircraft manufacturing space to capture emerging market share in electric flight technology.

Urban Air Mobility (UAM)

The rise of urban air mobility (UAM) is another key opportunity for the US aircraft manufacturing market. With advancements in autonomous technology and electric aircraft, UAM is poised to revolutionize urban transportation. The US government and private companies are investing heavily in UAM research, with the aim of reducing traffic congestion, improving transportation efficiency, and providing faster urban mobility solutions. Companies like Joby Aviation and Lilium are developing electric vertical takeoff and landing (eVTOL) aircraft designed for short-range urban flights. The growth of this segment presents manufacturers with the opportunity to diversify their product offerings and tap into the emerging market for personal air vehicles, cargo drones, and urban transportation systems.

Future Outlook

The future outlook for the US aircraft manufacturing market over the next five years shows promising growth driven by technological innovation, strong government defense spending, and the push for sustainable aviation. With the continued development of electric and hybrid aircraft, alongside advancements in autonomous flight technology, the market is set to experience a transformation. Regulatory support for green aviation initiatives and rising demand from the commercial and defense sectors will further enhance market prospects. Manufacturers are expected to focus on reducing operational costs, improving fuel efficiency, and integrating new technologies to maintain competitive advantage, ensuring continued growth in the US aerospace industry.

Major Players

- Boeing

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- General Dynamics

- Airbus

- Textron Aviation

- Honeywell Aerospace

- Bell Helicopter

- Gulfstream Aerospace

- Sikorsky Aircraft

- Pratt & Whitney

- Spirit AeroSystems

- Rockwell Collins

- Embraer

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Business jet manufacturers

- Aircraft leasing companies

- Commercial airlines

- Aerospace contractors

- Military defense forces

- Aviation technology developers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market size, growth rate, technological trends, and regional demands are identified through extensive market surveys, industry reports, and interviews with stakeholders.

Step 2: Market Analysis and Construction

Market analysis is performed using historical data, industry trends, and future projections, while construction involves segmenting the market based on product types, platforms, and other relevant parameters.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and companies are conducted to validate hypotheses regarding market trends, product developments, and challenges faced by manufacturers in the market.

Step 4: Research Synthesis and Final Output

The final report synthesizes collected data, market analysis, expert insights, and other relevant research to create a comprehensive overview of the market, highlighting key drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Government Defense Budgets

Technological Advancements in Aircraft Design

Growing Demand for Business Jets

Expansion of Commercial Air Travel

Rising Demand for UAVs in Defense and Civil Applications - Market Challenges

High Manufacturing and R&D Costs

Supply Chain Disruptions

Labor Shortages in Skilled Aircraft Manufacturing

Stringent Regulatory and Certification Processes

Environmental Impact and Sustainability Concerns - Market Opportunities

Shift Towards Sustainable Aviation Technologies

Growth in the Urban Air Mobility (UAM) Sector

Partnerships Between Government and Private Firms for Aircraft Innovation - Trends

Adoption of Electric and Hybrid Aircraft

Increasing Integration of AI and Automation in Aircraft Manufacturing

Development of Next-Generation UAVs for Military and Civil Applications

Increase in Commercial Aircraft Orders Due to Travel Resurgence

Focus on Reducing Aircraft Emissions and Enhancing Fuel Efficiency - Government Regulations & Defense Policy

FAA Regulations on Aircraft Safety and Certification

DOD Procurement Policies for Military Aircraft

Environmental Regulations for Aircraft Emissions

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Hybrid Aircraft

Drones

Electric Aircraft - By Fitment Type (In Value%)

OEM Systems

Aftermarket Systems

Integrated Systems

Modular Systems

Retrofit Systems - By End User Segment (In Value%)

Government & Military

Commercial Airlines

Private Jet Operators

Cargo & Freight Companies

Aerospace Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Private Sector Procurement

Online Bidding Platforms

Third-Party Distributors - By Material / Technology (in Value%)

Composite Materials

Advanced Alloys

Hybrid Materials

Electric Propulsion Systems

Avionics & Control Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Production Capacity, Innovation, Price Point, Sustainability Practices)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Boeing

Lockheed Martin

Northrop Grumman

Raytheon Technologies

General Dynamics

Airbus

Textron Aviation

Honeywell Aerospace

Bell Helicopter

Gulfstream Aerospace

Sikorsky Aircraft

Pratt & Whitney

Spirit AeroSystems

Rockwell Collins

Embraer

- Government Agencies’ Demand for Advanced Aircraft

- Commercial Airlines Expanding Fleets

- Private Jet Market Growth Among Wealthy Individuals

- Military Forces’ Focus on Modernizing Aircraft for Defense

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035