Market Overview

The US Aircraft MRO market is valued at USD ~ billion, driven by increasing aircraft fleet sizes and the need for regular maintenance services. The market is propelled by technological advancements, including predictive maintenance and automation, which optimize costs and enhance efficiency. Additionally, rising air travel and an aging fleet fuel demand for maintenance, repair, and overhaul services across commercial and military sectors. Key players in the market focus on developing advanced maintenance technologies, ensuring high-quality service delivery, and meeting regulatory standards.

The market is dominated by key regions such as California, Texas, and Florida due to the high density of airports and military installations. These areas have substantial aviation infrastructure, including numerous commercial and military airports, as well as defense contractors. The dominance is driven by high air traffic, military spending, and established aviation hubs, which require constant maintenance and support. Factors like strategic location, strong industry presence, and government contracts further bolster their position as dominant regions.

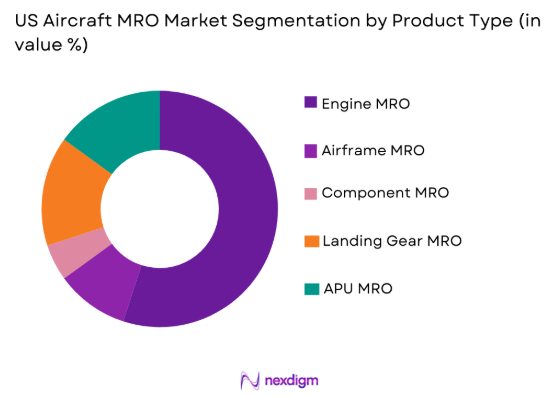

Market Segmentation

By Product Type

The US Aircraft MRO market is segmented by product type into engine MRO, airframe MRO, component MRO, landing gear MRO, and auxiliary power unit (APU) MRO. Recently, engine MRO has a dominant market share due to factors such as increasing aircraft fleet sizes, longer operational hours, and advancements in engine technology that require frequent servicing. Engine manufacturers have increased their focus on providing specialized and durable engines, enhancing operational efficiency and flight safety, further boosting the demand for engine MRO services.

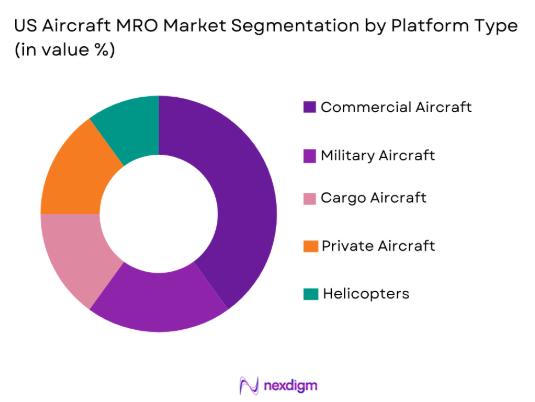

By Platform Type

The US Aircraft MRO market is segmented by platform type into commercial aircraft, military aircraft, cargo aircraft, private aircraft, and helicopters. Commercial aircraft MRO dominates the market due to the high demand for passenger flights and the large number of commercial aircraft operating within the region. As the commercial aviation sector grows, the need for maintenance, repair, and overhaul services increases to ensure safety, compliance with regulations, and to maximize operational uptime. The expansion of global aviation networks and the rapid increase in passenger numbers support the dominance of commercial aircraft MRO.

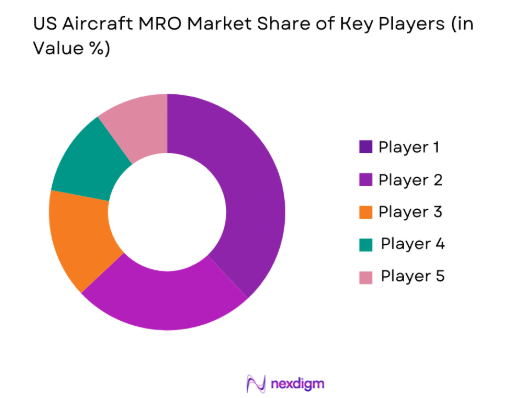

Competitive Landscape

The US Aircraft MRO market is highly competitive, with major players consolidating and focusing on technological advancements to maintain a competitive edge. The influence of leading MRO service providers is significant, as they dominate through strong brand presence and strategic partnerships. The presence of OEMs also adds to the competitive landscape, offering both repair services and original parts to customers. The industry continues to evolve with technological developments such as predictive analytics and AI, improving efficiency and turnaround times.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | MRO Specialization |

| AAR Corp | 1955 | Wood Dale, IL | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | Cincinnati, OH | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | Phoenix, AZ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

US Aircraft MRO Market Analysis

Growth Drivers

Increased Fleet Size

The growth in the US Aircraft MRO market is primarily driven by the increasing number of commercial and military aircraft. Airlines continue to expand their fleets to meet growing passenger demand, while defense contractors are upgrading their fleets with modern aircraft. Additionally, longer aircraft lifespans and aging fleets necessitate frequent maintenance and repair to ensure airworthiness, which directly boosts the demand for MRO services. The need for effective fleet management and maximization of aircraft uptime requires extensive MRO services. Aircraft owners and operators are investing in advanced MRO solutions to address these requirements. Furthermore, the expansion of low-cost carriers has led to a greater demand for maintenance services to keep costs competitive while maintaining safety and reliability. Aircraft OEMs are also contributing to the growth by providing robust engines and airframes that need specialized MRO services throughout their lifecycle.

Technological Advancements

Technological advancements are playing a key role in the growth of the US Aircraft MRO market. Predictive maintenance technologies using AI and machine learning have revolutionized the industry by identifying potential issues before they occur. This helps reduce unexpected failures and downtime, allowing operators to perform repairs more efficiently and cost-effectively. Additionally, the use of drones and robotics for inspections has improved the speed and accuracy of maintenance procedures. These advancements reduce labor costs, increase the lifespan of aircraft components, and enhance overall maintenance efficiency. With the integration of automation and the Internet of Things (IoT), MRO services can now leverage real-time data from aircraft systems to monitor and predict maintenance needs, thereby streamlining operations. The transition to digital platforms for managing parts inventory and service schedules also ensures that MRO services are optimized for performance and reliability.

Market Challenges

High Labor Costs

One of the major challenges facing the US Aircraft MRO market is the high labor costs associated with skilled technicians and mechanics. Aircraft maintenance is a labor-intensive service, requiring specialized skills and experience. As the demand for MRO services increases, the shortage of skilled labor puts pressure on service providers to meet the growing demand. Training programs are costly and time-consuming, making it difficult for companies to quickly fill the labor gaps. High labor costs directly impact the profitability of MRO service providers, forcing them to pass on the cost to airlines and other clients. Moreover, maintaining a skilled workforce is challenging as workers retire or leave the industry, creating further demand for skilled labor. This issue is exacerbated by competition from other industries that also require highly skilled workers, making it difficult for MRO providers to retain employees.

Regulatory Compliance

Another challenge faced by the US Aircraft MRO market is the constantly evolving regulatory environment. Regulatory bodies such as the Federal Aviation Administration (FAA) set strict safety standards and guidelines that MRO providers must adhere to. Compliance with these regulations requires substantial investments in training, equipment, and processes. Changes in regulatory requirements can also lead to delays in certification, increasing the costs and complexity of operations. Additionally, meeting international regulatory standards for global MRO services can be challenging for companies seeking to expand their reach. Failure to comply with regulations can result in fines, penalties, or a loss of certification, further hindering growth prospects in the market. The cost of ensuring compliance can also discourage smaller providers from entering the market, thus limiting competition and innovation.

Opportunities

Emerging Markets

The US Aircraft MRO market has significant growth opportunities in emerging markets. As developing nations continue to expand their aviation sectors, the demand for MRO services will increase. Countries in Asia-Pacific, the Middle East, and Latin America are investing heavily in expanding their air travel networks and modernizing their fleets. These regions have a growing need for MRO services to maintain and repair new aircraft. MRO service providers in the US can tap into these emerging markets by offering their expertise in maintaining modern fleets. Furthermore, collaborations and joint ventures with local companies in these regions present opportunities for market expansion. The ability to leverage existing US-based technological advancements and expertise in these new markets is a key driver of future growth.

Sustainability and Green Aviation

Sustainability is an increasing focus in the aviation industry, presenting an opportunity for the US Aircraft MRO market to cater to the rising demand for eco-friendly services. As airlines and manufacturers focus on reducing their carbon footprint, the need for green aviation technologies will drive the demand for sustainable MRO solutions. Aircraft engines and parts are becoming more energy-efficient, and the market for MRO services that support green aviation technologies is expanding. Providers who specialize in environmentally friendly materials, parts recycling, and reducing emissions will be well-positioned to meet the needs of eco-conscious airlines. This trend is expected to gain momentum as stricter environmental regulations are introduced globally.

Future Outlook

The US Aircraft MRO market is expected to witness steady growth in the next five years, driven by increasing demand for both commercial and military aircraft services. Technological developments such as predictive maintenance, automation, and digital platforms will continue to optimize MRO processes, making them more efficient and cost-effective. Regulatory support and increasing government defense spending are expected to drive the demand for military aircraft MRO services, while the growing air passenger numbers will fuel commercial aircraft MRO services. Overall, the market will experience growth with an increasing shift toward sustainable and technology-driven solutions.

Major Players

- AAR Corp

- GE Aviation

- Rolls-Royce

- Honeywell Aerospace

- Lockheed Martin

- Safran

- Lufthansa Technik

- ST Aerospace

- United Technologies

- Boeing

- Delta TechOps

- Jet Aviation

- Airbus

- Pratt & Whitney

- Collins Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- MRO service providers

- Airlines and air operators

- Defense contractors

- Fleet operators

- Airport infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

In this step, key market variables such as product types, platform types, and technological developments are identified to establish the scope of the study.

Step 2: Market Analysis and Construction

A comprehensive analysis of market size, trends, and segments is performed using primary and secondary data sources.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics are validated through interviews with industry experts and MRO service providers.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a detailed report, presenting the market’s potential, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Air Travel and Fleet Growth

Technological Advancements in MRO Processes

Rise in Aircraft Fleet Age

Demand for Enhanced Aircraft Safety

Government Investments in Defense MRO - Market Challenges

High Labor Costs in MRO Services

Challenges in Meeting Regulatory Standards

Dependency on OEMs for Parts and Services

Increasing Complexity of Aircraft Systems

Shortage of Skilled MRO Technicians - Market Opportunities

Expansion of Digital MRO Solutions

Growth of Regional Aircraft Fleets

Adoption of Sustainable Aviation Technologies - Trends

Use of Predictive Maintenance Technologies

Shift Toward Sustainable MRO Practices

Integration of AI and Automation in MRO

Consolidation of MRO Service Providers

Rising Demand for Engine MRO Services - Government Regulations & Defense Policy

FAA Regulations and Standards for MRO Services

Defense Budget Allocations for Aircraft Maintenance

Export Control Regulations Impacting MRO

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Engine MRO

Airframe MRO

Component MRO

Landing Gear MRO

Auxiliary Power Unit MRO - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Cargo Aircraft

Private Aircraft

Helicopters - By Fitment Type (In Value%)

On-site MRO

Outsourced MRO

OEM-Authorized MRO

Independent MRO

Integrated MRO - By End User Segment (In Value%)

Airlines

Defense Contractors

Private Operators

Cargo and Freight Operators

MRO Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

OEM Procurement

Online Procurement

Government Tendering - By Material / Technology (In Value%)

Composite Materials

Metals and Alloys

Advanced Coatings

Additive Manufacturing

Automation and Robotics

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

AAR Corp

GE Aviation

Rolls-Royce

Honeywell Aerospace

United Technologies

Lockheed Martin

Northrop Grumman

Boeing Global Services

Safran

Airbus

Delta TechOps

Lufthansa Technik

ST Aerospace

Jet Aviation

Hawaiian Airlines MRO Services

- Airlines Seeking Cost-effective Maintenance Solutions

- Military Forces Increasing MRO Spending

- Private Operators’ Demand for Quick Turnaround Times

- MRO Providers Focusing on Service Diversification

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035