Market Overview

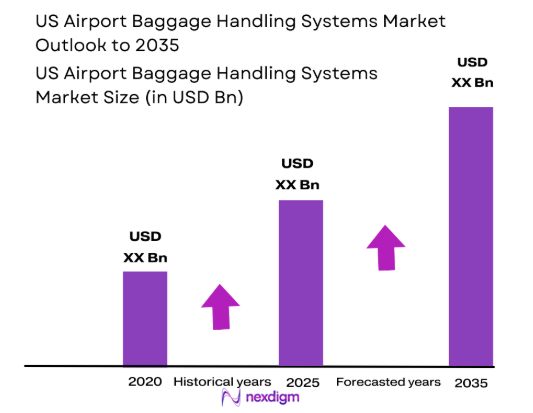

The US Airport Baggage Handling Systems market is driven by the growing demand for automation, as well as the continuous improvement in operational efficiency at airports. Based on a recent historical assessment, the market size is valued at over USD ~ billion, fueled by significant investments in airport infrastructure and technology upgrades. The market is supported by key technological advancements in baggage handling solutions, including the adoption of robotics and smart systems. The integration of these systems into airports allows for enhanced baggage tracking, efficiency, and security.

The dominant countries in the market include the United States, with major international airports like those in New York, Los Angeles, and Chicago. These airports lead the way due to their large passenger volumes and ongoing investment in modernization projects. The continuous demand for better passenger experience and operational efficiency is driving the adoption of advanced baggage handling systems. The US remains a hub for innovation, hosting the headquarters of many technology providers in the baggage handling industry.

Market Segmentation

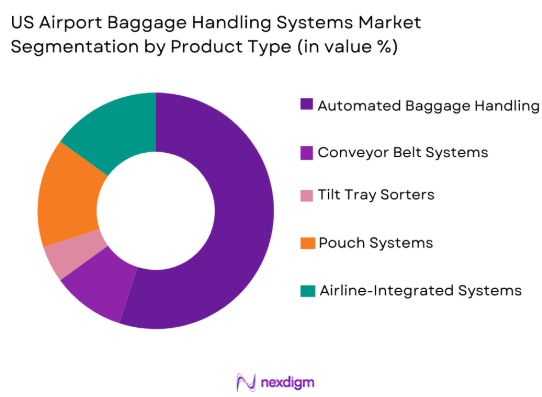

By Product Type

The US Airport Baggage Handling Systems market is segmented by product type into automated baggage handling systems, conveyor belt systems, tilt tray sorters, pouch systems, and airline-integrated systems. Recently, automated baggage handling systems have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, and consumer preference. The rise in air travel, especially at large airports, has significantly driven the demand for automation, offering more efficiency and reducing operational costs.

By Platform Type

The US Airport Baggage Handling Systems market is segmented by platform type into airport terminals, cargo facilities, airlines, consolidation areas, and maintenance platforms. Recently, airport terminals have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, and consumer preference. The consistent growth of air travel and the need to optimize baggage handling in busy terminals is contributing to the high demand for advanced systems that ensure smoother operations.

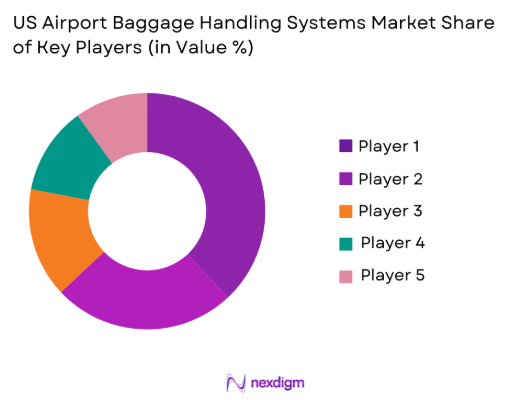

Competitive Landscape

The competitive landscape of the US Airport Baggage Handling Systems market is characterized by consolidation among key players offering comprehensive, innovative solutions. Major players, including Siemens, Vanderlande, and Daifuku, continue to dominate the market, driving advancements in automation and system integration. The market also sees increasing investments in research and development for smarter and more energy-efficient baggage handling systems. Several large-scale acquisitions and partnerships are occurring as companies seek to expand their market share and capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | System Complexity Tier |

| Siemens | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Vanderlande | 1950 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| Daifuku | 1937 | Japan | ~ | ~ | ~ | ~ | ~ |

| BEUMER Group | 1978 | Germany | ~ | ~ | ~ | ~ | ~ |

| G&S Airport Conveyor | 1967 | USA | ~ | ~ | ~ | ~ | ~ |

US Airport Baggage Handling Systems Market Analysis

Growth Drivers

Technological Advancements

Technological advancements have been one of the key growth drivers in the US Airport Baggage Handling Systems market. The development of automated baggage handling systems, including robotics, AI, and machine learning, has enabled airports to improve efficiency, reduce errors, and streamline baggage operations. These advancements have become increasingly important in the face of rising air traffic and passenger demands for seamless travel experiences. Additionally, smart baggage systems with RFID tracking have improved operational performance and the security of baggage handling. Automation also helps airports minimize labor costs and enhance overall productivity, which is a significant factor behind the growing adoption of these systems across major airports. Airports are increasingly investing in new technologies to ensure smooth baggage handling, reduce wait times, and enhance customer satisfaction. This technological evolution continues to shape the future of baggage handling in the industry.

Regulatory Support and Infrastructure Investment

The growing focus on improving airport infrastructure, supported by regulatory initiatives, is another significant growth driver. Government initiatives, including funding for modernization projects and compliance with safety regulations, have facilitated substantial investments in baggage handling systems. Airports in the US are receiving substantial support through federal grants to upgrade their infrastructure. Such support has created a favorable environment for the adoption of advanced baggage handling technologies. Federal agencies, including the Federal Aviation Administration (FAA), provide guidelines and financial assistance to ensure that airports meet safety standards while incorporating modern technologies. Moreover, regulations ensuring smoother baggage handling and reducing delays have pushed airports to adopt more efficient systems. The combination of regulatory support and infrastructure investment ensures that airport authorities prioritize upgrading their baggage handling capabilities to meet global standards.

Market Challenges

High Initial Capital Investment

The substantial initial capital investment required for installing automated baggage handling systems remains one of the key challenges in the market. Although these systems offer long-term operational savings, the upfront cost for procurement and installation can be a significant barrier for many airports, especially smaller ones or those in developing regions. The expense is not limited to just equipment but also includes the integration of advanced technologies such as RFID tracking, robotics, and conveyor systems, which further increase the financial burden. Some airports may struggle to balance the costs with other essential infrastructure projects, making it challenging to implement cutting-edge baggage handling solutions. This financial constraint can cause delays in system upgrades and may restrict the widespread adoption of newer, more efficient technologies across all airports.

System Integration and Interoperability

Another significant challenge in the market is the complexity involved in integrating new baggage handling systems with existing airport infrastructure. Older airports with legacy systems often find it difficult to seamlessly integrate new automated technologies without causing disruptions. The lack of standardization across different baggage handling systems further complicates the process, leading to compatibility issues. Moreover, interoperability challenges arise as different suppliers and system components might not be fully compatible with each other, leading to operational inefficiencies. Airports must invest considerable time and resources to ensure smooth system integration, which can delay the implementation of new technologies and increase costs. Overcoming these integration challenges is essential for the effective deployment of baggage handling systems across the sector.

Opportunities

Integration of AI and Robotics

One of the key opportunities in the US Airport Baggage Handling Systems market is the increased integration of artificial intelligence (AI) and robotics. The rise of AI-driven baggage handling solutions is transforming the way airports process luggage. These advanced systems are capable of automating tasks such as sorting, scanning, and tracking, reducing human intervention, and speeding up operations. Robotics also plays a critical role in enhancing the efficiency of baggage systems by automating the lifting, sorting, and transportation of luggage. The opportunity lies in further improving these AI and robotics systems, allowing for faster, more accurate baggage handling while reducing the likelihood of errors. Additionally, AI can be leveraged to predict demand, analyze operational patterns, and optimize baggage handling operations, creating significant efficiencies for airport operators. This technological evolution offers promising growth potential for both existing players and new entrants in the market.

Sustainability in Baggage Handling

As sustainability becomes a critical consideration in global industries, the demand for eco-friendly baggage handling systems is expected to grow. Airport authorities and operators are increasingly focusing on adopting greener technologies that reduce energy consumption and minimize waste. The use of energy-efficient conveyor belts, solar-powered systems, and recyclable materials in baggage handling systems is an emerging trend that offers long-term environmental benefits. This shift toward sustainability presents an opportunity for companies to innovate and offer systems that not only enhance operational efficiency but also contribute to environmental conservation. As regulations surrounding sustainability tighten and consumer expectations rise, the market for green baggage handling systems will likely expand, creating new growth avenues for companies that prioritize environmentally friendly solutions.

Future Outlook

The US Airport Baggage Handling Systems market is set to experience significant growth over the next five years, driven by technological advancements, regulatory support, and increasing passenger volumes. Expected developments in automation and AI will likely revolutionize baggage handling operations, enhancing efficiency, reducing delays, and improving security. Airport authorities are expected to continue investing in infrastructure upgrades, with a focus on sustainability and eco-friendly technologies. Increased demand for seamless travel experiences and operational efficiencies will support the adoption of advanced baggage handling systems across major airports in the US. Regulatory initiatives and government funding will further accelerate the implementation of cutting-edge solutions.

Major Players

- Siemens

- Vanderlande

- Daifuku

- BEUMER Group

- G&S Airport Conveyor

- Amadeus

- Swisslog

- Fives

- Toshiba

- Logplan

- Baggage Systems International

- Honeywell

- Thales

- International Conveyor & Baggage Systems

- Rockwell Automation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators

- Airlines

- Ground service providers

- System integrators

- Technology providers

- Infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

The initial step involved identifying and defining the key variables and parameters that influence the market, including technological advancements, market demand, and regional dynamics.

Step 2: Market Analysis and Construction

We conducted an extensive market analysis, reviewing historical data and trends, to develop a robust model that captures the growth drivers, challenges, and opportunities in the market.

Step 3: Hypothesis Validation and Expert Consultation

We validated the hypotheses using primary research, including expert consultations, surveys, and interviews with industry professionals, ensuring the accuracy of the market trends and insights.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the collected data and insights, formulating the market outlook, and presenting a comprehensive, data-backed report on the US Airport Baggage Handling Systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Air Travel Demand

Technological Advancements in Automation

Focus on Efficiency and Safety in Airports

Government Investments in Airport Infrastructure

Rising Demand for Seamless Baggage Handling Solutions - Market Challenges

High Initial Capital Investment

Complex Integration with Existing Infrastructure

Maintenance and Operational Costs

Regulatory Compliance Requirements

Cybersecurity and Data Privacy Concerns - Market Opportunities

Integration of AI and Robotics for Baggage Handling

Growing Demand for Green and Sustainable Solutions

Opportunities in Emerging and Expanding Airports - Trends

Shift Toward Automated Baggage Handling Systems

Growth in Cloud-based and Hybrid Baggage Solutions

Rising Demand for Self-service Baggage Check-ins

Focus on Sustainable and Energy-efficient Systems

Integration of IoT and Smart Technologies in Baggage Handling - Government Regulations & Defense Policy

Airline Security and Compliance Regulations

International Baggage Handling Standards

Government Funding for Smart Infrastructure Projects

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automated Baggage Handling Systems

Conveyor Belt Systems

Tilt Tray Sorters

Pouch Systems

Airline-Integrated Systems - By Platform Type (In Value%)

Airport Terminals

Cargo Facilities

Airlines

Consolidation Areas

Maintenance Platforms - By Fitment Type (In Value%)

Integrated Systems

Modular Systems

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions - By End User Segment (In Value%)

Airport Operators

Airlines

Cargo Handling Services

Ground Services Providers

Technology Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Platforms

Third-party Distributors - By Material / Technology (in Value%)

Steel

Aluminum

Robotic Systems

Smart Technologies

Sustainable Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material / Technology, Average System Price, Installed Units, System Complexity Tier)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Siemens

Vanderlande

BEUMER Group

Schiaparelli

Daifuku

G&S Airport Conveyor

Toshiba

Logplan

Fives

Aeroporti di Roma

Amadeus

Swisslog

Harris

Thales

Honeywell

- Airport Operators’ Increasing Demand for Automation

- Airlines’ Focus on Cost Efficiency and Reliability

- Cargo Handlers’ Need for Speed and Accuracy

- Technology Providers’ Role in Advancing System Innovation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035