Market Overview

The US Airport Ground Handling Systems market is valued at approximately USD ~ billion, driven by the growing demand for efficient and automated ground handling solutions. The expansion of airport infrastructure, increasing air traffic, and the rising need for operational efficiency in ground handling processes are some of the primary factors fueling market growth. This demand is also supported by advancements in technology such as automated baggage handling and electric ground support equipment, aimed at improving operational efficiency while reducing environmental impact.

The market is dominated by major airports in cities such as New York, Los Angeles, and Chicago. These regions exhibit high demand due to their large volumes of air traffic and substantial investment in modern airport infrastructure. As key hubs for international and domestic travel, these airports are continuously upgrading ground handling systems to enhance operational efficiency, reduce turnaround times, and ensure smoother passenger experiences. Additionally, government regulations and initiatives are further propelling infrastructure investments in these cities.

Market Segmentation

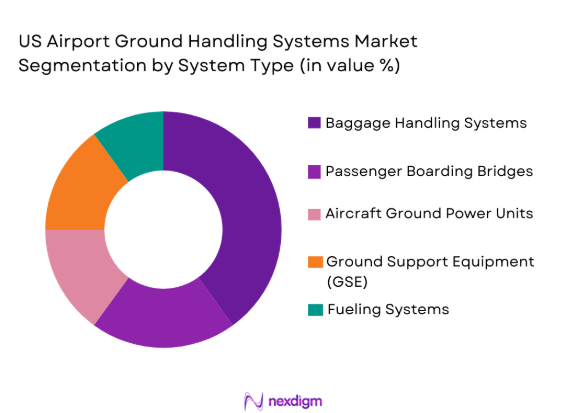

By System Type

The US Airport Ground Handling Systems market is segmented by system type into baggage handling systems, passenger boarding bridges, aircraft ground power units, ground support equipment (GSE), and fueling systems. Recently, baggage handling systems have a dominant market share due to factors such as demand patterns, brand presence, and infrastructure availability. Baggage handling systems are increasingly prioritized for automation, improving efficiency in high-volume airports. The demand is also growing for more sophisticated systems that integrate with broader airport management systems for real-time tracking and management, reducing wait times and enhancing the overall passenger experience.

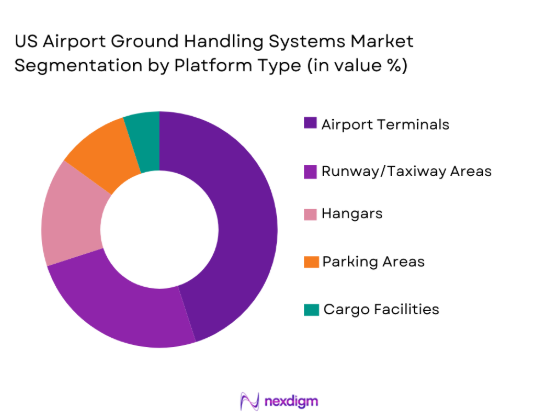

By Platform Type

The market is segmented by platform type into airport terminals, runway/taxiway areas, hangars, parking areas, and cargo facilities. Recently, airport terminals have a dominant market share due to demand patterns and the need for streamlined passenger movement. As passenger volumes increase, the demand for efficient terminal systems that handle baggage, check-in, and boarding processes has surged. Additionally, the integration of automated systems to manage passenger flow, baggage handling, and check-in counters has become critical in major airports, driving growth in this segment.

Competitive Landscape

The competitive landscape of the US Airport Ground Handling Systems market is characterized by high consolidation, with large players dominating the supply of advanced systems. These companies focus on technology innovation, strategic partnerships, and acquisitions to strengthen their position. Major players are investing in automation, electric ground support equipment, and AI-based solutions to meet the growing demand for operational efficiency and sustainability in airport operations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Vanderlande Industries | 1949 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| JBT Corporation | 1961 | US | ~ | ~ | ~ | ~ | ~ |

| Swissport International | 1996 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| ITW GSE | 1997 | US | ~ | ~ | ~ | ~ | ~ |

| Menzies Aviation | 1833 | UK | ~ | ~ | ~ | ~ | ~ |

US Airport Ground Handling Systems Market Analysis

Growth Drivers

Increased Air Traffic

The US Airport Ground Handling Systems market is experiencing significant growth due to the surge in air traffic. The rising number of flights and passengers necessitates the adoption of advanced ground handling systems that can streamline airport operations. Airports are faced with the challenge of handling larger volumes of travelers efficiently and with minimal delays. This has led to increased investments in systems like automated baggage handling and AI-based solutions to improve operational speed and reliability. These systems also reduce human error, making them crucial as air traffic increases year after year. As passenger numbers grow, airports need to upgrade their infrastructure to meet this demand, pushing the need for advanced, efficient ground handling technologies. Thus, the growth of air traffic has a direct impact on the demand for high-tech airport ground handling solutions.

Government Infrastructure Investments

The expansion and modernization of airport infrastructure, supported by government investments, serve as another key growth driver. Significant funding is being channeled into improving and expanding the nation’s airports, with an emphasis on upgrading ground handling systems to meet the growing demands of air travel. In recent years, several major airports have undertaken large-scale modernization projects to accommodate the increasing flow of passengers and aircraft. As part of these projects, airports are investing in advanced technologies like automated baggage systems, self-service check-ins, and electric ground support equipment. These upgrades not only improve operational efficiency but also ensure sustainability, addressing environmental concerns. The government’s backing of these projects through funding and regulations has driven significant growth in the US Airport Ground Handling Systems market, creating new opportunities for suppliers and manufacturers in the sector.

Market Challenges

High Capital Expenditure

One of the primary challenges faced by the US Airport Ground Handling Systems market is the high capital expenditure required for upgrading and installing advanced systems. Large-scale investments in new ground handling systems, such as automated baggage handling or electric ground support equipment, can be prohibitively expensive, especially for smaller regional airports. These systems require not only substantial initial investment but also ongoing maintenance and operational costs. As a result, many airports are hesitant to adopt the latest technologies, especially when they are faced with budget constraints. While large airports with greater budgets can absorb these costs, smaller airports often struggle to keep up, leading to disparities in the adoption of advanced systems across the country. The high capital expenditure involved is a significant barrier to rapid market adoption and is hindering the growth of the sector.

Technological Integration with Legacy Systems

Another major challenge in the US Airport Ground Handling Systems market is the integration of new technologies with existing legacy systems. Many airports still rely on older, outdated infrastructure, and upgrading these systems to accommodate the latest technologies can be complex and costly. Airports face difficulties in making new systems work seamlessly with legacy technologies, such as outdated baggage handling systems or non-automated check-in counters. These integration challenges not only cause delays but also lead to inefficiencies in airport operations. The lack of standardization among systems and equipment from various manufacturers makes integration even more difficult, and airports may face issues with compatibility and interoperability. As airports aim to modernize, they must carefully navigate the complexities of upgrading legacy systems while ensuring smooth operations, further compounding the challenges faced by the market.

Opportunities

Expansion of Electric Ground Support Equipment

One of the key opportunities in the US Airport Ground Handling Systems market is the shift towards electric ground support equipment (GSE). As part of broader sustainability initiatives, airports are increasingly adopting electric versions of traditional ground support equipment, such as tugs, baggage carts, and loaders. Electric GSE offers numerous benefits, including lower operational costs, reduced carbon emissions, and lower noise levels. With growing environmental concerns and the push for greener airports, the demand for electric GSE is expected to rise. Additionally, government regulations are increasingly mandating sustainability goals for airports, further accelerating the adoption of electric vehicles and equipment. As a result, manufacturers and suppliers of electric GSE are well-positioned to capitalize on the growing demand, creating a lucrative opportunity in the US Airport Ground Handling Systems market.

Adoption of Autonomous Ground Handling Systems

The increasing adoption of autonomous ground handling systems presents another significant opportunity in the market. Autonomous systems, such as self-driving baggage carts, robotic loaders, and automated pushback tractors, are becoming more prevalent in major airports across the US. These systems offer numerous advantages, including reduced labor costs, increased efficiency, and enhanced safety. Airports are particularly drawn to the potential for autonomous systems to optimize operational efficiency, reduce delays, and streamline ground handling procedures. As air travel volumes rise, the need for faster, more efficient operations is pushing the demand for automation. This trend is expected to grow as technology evolves and becomes more cost-effective, providing a substantial opportunity for companies operating in the US Airport Ground Handling Systems market to innovate and expand their product offerings.

Future Outlook

The US Airport Ground Handling Systems market is expected to experience substantial growth in the coming years, driven by advancements in automation and sustainability initiatives. Technological developments, particularly in autonomous ground support systems, will be a key factor shaping the market, enabling airports to streamline operations and reduce labor costs. Regulatory support for environmentally friendly solutions, including electric ground support equipment, will further boost growth. Additionally, demand for faster, more efficient ground handling services will continue to rise as air traffic increases, offering opportunities for innovation and expansion in the sector.

Major Players

- Vanderlande Industries

- JBT Corporation

- Swissport International

- ITW GSE

- Menzies Aviation

- Lödige Industries

- TLD Group

- Konecranes

- Cavotec SA

- Bharat Heavy Electricals Limited (BHEL)

- Boeing

- Textron Ground Support Equipment

- Liebherr Aerospace

- Power Stow

- ST Engineering

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities

- Airport contractors

- Airlines and airline operators

- Ground handling service providers

- Equipment manufacturers

- Large airport operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables influencing the market, such as air traffic growth, technological advancements, regulatory frameworks, and capital investment patterns.

Step 2: Market Analysis and Construction

In this phase, market analysis is conducted, using primary and secondary data sources to construct market models, including segmentation, growth drivers, and challenges.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and industry surveys are conducted to validate hypotheses, ensuring accuracy and relevance in the findings and providing insights into market dynamics.

Step 4: Research Synthesis and Final Output

Finally, research findings are synthesized into a comprehensive report, consolidating data into actionable insights and providing a forecast based on the validated market model.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air traffic

Advancements in automation technology

Government investment in airport infrastructure

Focus on operational efficiency

Demand for sustainability and eco-friendly solutions - Market Challenges

High capital investment requirements

Complex regulatory environment

Integration of new technologies with legacy systems

Operational disruptions from technological transitions

Limited skilled labor for advanced systems - Market Opportunities

Expansion of automated ground handling solutions

Adoption of green technologies for airport ground handling

Rising demand for advanced cargo handling systems - Trends

Increasing use of electric ground support equipment

Growth in data-driven airport management

Adoption of AI and machine learning in operations

Technological upgrades in baggage handling

Emerging importance of cybersecurity in ground operations - Government Regulations & Defense Policy

Government funding for airport infrastructure projects

Compliance with environmental regulations

Regulations promoting sustainability in aviation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Baggage Handling Systems

Passenger Boarding Bridges

Aircraft Ground Power Units

Ground Support Equipment (GSE)

Fueling Systems - By Platform Type (In Value%)

Airport Terminals

Runway/Taxiway Areas

Hangars

Parking Areas

Cargo Facilities - By Fitment Type (In Value%)

Standalone Solutions

Integrated Solutions

Modular Solutions

Customized Solutions

Automated Systems - By EndUser Segment (In Value%)

Airports

Ground Handling Service Providers

Airlines

Cargo Handlers

Airport Authorities - By Procurement Channel (In Value%)

Direct Procurement

Tenders and Bidding

OEM Partnerships

Third-party Distributors

Online Bidding Platforms - By Material / Technology (In Value%)

Electric/Hybrid Systems

Automated Systems

Telematics and IoT Solutions

Hydraulic and Pneumatic Systems

Fuel-efficient Systems

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Region, Price, Performance, Customization)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lödige Industries

Vanderlande Industries

Swissport International

JBT Corporation

Menzies Aviation

ITW GSE

Cavotec SA

Bharat Heavy Electricals Limited (BHEL)

Jumbo Group

TLD Group

Delta Ground Support Equipment

Konecranes

Boeing

Textron Ground Support Equipment

DHL Express

- Airports focusing on capacity expansion

- Airlines increasing efficiency and cost-effectiveness

- Ground handling companies adopting automation

- Cargo handlers optimizing storage and transport systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035