Market Overview

The US Airport Passenger Screening Systems market is projected to reach a significant value based on a recent historical assessment, driven by the increasing focus on airport security and advancements in screening technologies. The market size for 2024 is estimated to be USD ~ billion, with a strong push towards automated and biometric screening solutions. The demand is also fueled by the increasing number of air travelers, government regulations on security standards, and the adoption of next-generation screening systems by airports across the country.

The US remains a dominant player in this market, with major cities such as New York, Los Angeles, and Chicago leading the demand. These regions are key due to their high traffic volumes, large international hubs, and advanced airport infrastructure. Federal support and regulations like those from the TSA further solidify the country’s leadership in this market. Additionally, the presence of numerous major manufacturers and technology providers in the US strengthens the country’s position as a global leader in passenger screening solutions.

Market Segmentation

By System Type

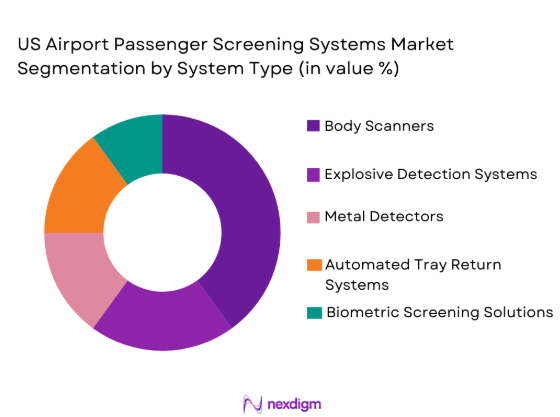

The US Airport Passenger Screening Systems market is segmented by system type into body scanners, explosive detection systems, metal detectors, automated tray return systems, and biometric screening solutions. Recently, biometric screening solutions have gained a dominant market share due to factors such as their increased adoption in line with the growing demand for contactless and efficient passenger processing systems. Airports are focusing on biometric solutions to streamline passenger experience and comply with stringent government security regulations. This trend is particularly prominent in major airports, where innovations in technology have enabled faster, safer, and more efficient passenger processing. Biometric solutions also benefit from reduced operational costs and enhanced security, which further fuels their dominance in the market.

By Platform Type

The market is segmented by platform type into airport terminals, check-in counters, security checkpoints, airline lounges, and cargo and baggage handling areas. Recently, airport terminals have a dominant market share due to their crucial role in overall airport operations. They serve as the primary point for passenger screening, making them a focal point for the deployment of cutting-edge security systems. Major airports are increasingly investing in terminal infrastructure to enhance security, improve passenger flow, and streamline the screening process. This has led to high demand for screening technologies within terminals. Furthermore, the trend toward integrating advanced technologies in terminals for real-time data processing and faster passenger handling continues to boost market growth in this sub-segment.

Competitive Landscape

The competitive landscape of the US Airport Passenger Screening Systems market is highly fragmented, with multiple players competing across various technological innovations and product offerings. Major players are consolidating their positions by acquiring smaller firms, diversifying their portfolios, and enhancing their technological capabilities. These strategic moves are designed to address growing concerns over security and operational efficiency, which are becoming increasingly important for airports across the country. The influence of these large players is significant in driving market standards, regulatory compliance, and cutting-edge advancements in screening technology.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Smiths Detection | 1940 | London, UK | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | New York, USA | ~ | ~ | ~ | ~ | ~ |

| Rapiscan Systems | 1997 | California, USA | ~ | ~ | ~ | ~ | ~ |

| Leidos | 1969 | Virginia, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

US Airport Passenger Screening Systems Market Analysis

Growth Drivers

Increasing Security Concerns

The rising concerns regarding terrorist threats and other security risks continue to drive the growth of the US Airport Passenger Screening Systems market. As airports are critical points of infrastructure, they face increased scrutiny from governments and international bodies to implement the most advanced security measures. The development of new screening technologies such as biometric solutions, machine learning integration, and advanced X-ray machines provides airports with the tools needed to enhance security and passenger safety. This heightened sense of security, compounded by evolving terrorism tactics, has made security screening a top priority. Additionally, the rising number of air travelers has contributed to the growing need for efficient screening solutions that can manage large volumes of passengers while maintaining the highest security standards. Therefore, the continuous innovation and deployment of security screening systems remain key drivers in expanding the market.

Technological Advancements in Screening Systems

The US market is also driven by the rapid advancement of security screening technologies. With growing demands for more efficient, non-intrusive, and accurate screening methods, companies are integrating next-gen technologies such as artificial intelligence (AI), biometric recognition, and 3D imaging into their solutions. AI-driven systems allow for faster decision-making and enhanced accuracy, significantly reducing false alarms and improving overall operational efficiency. Biometric screening solutions, in particular, have become a game-changer in passenger identification, offering faster processing times and better accuracy. These technologies not only enhance security but also improve the passenger experience, a critical factor for airports aiming to balance security with customer satisfaction. Furthermore, continuous improvements in machine learning algorithms are paving the way for self-learning systems that adapt to new security threats, thus offering long-term market growth potential.

Market Challenges

High Capital Investment Requirements

One of the primary challenges facing the US Airport Passenger Screening Systems market is the high capital investment required for the installation and maintenance of advanced security systems. Implementing cutting-edge screening technologies such as biometric systems, body scanners, and AI-driven solutions can be cost-prohibitive, particularly for smaller airports or those operating on tight budgets. This barrier is compounded by the ongoing maintenance costs of these systems, which require regular upgrades to keep up with the latest advancements in security and technology. Airports that already face financial constraints may hesitate to make such significant capital expenditures, which slows down the widespread adoption of these technologies. As a result, achieving a balance between investing in the latest technology and staying within budget remains a major challenge for the market.

Regulatory and Compliance Hurdles

Another significant challenge for the market is the complex regulatory environment governing airport security systems. The US government, particularly agencies like the TSA, enforces strict compliance requirements for screening systems used in airports. These regulations are constantly evolving to address emerging threats, requiring airport operators and manufacturers to continuously adapt their systems to remain compliant. For example, any new advancements in biometric or AI technology must meet rigorous privacy and data protection standards. Furthermore, the adoption of new systems often faces lengthy approval processes and rigorous testing before they can be deployed in operational settings. These regulatory and compliance hurdles can delay the rollout of innovative security solutions, hindering market growth.

Opportunities

Expansion of Biometric Screening Solutions

One of the most significant opportunities for the US Airport Passenger Screening Systems market is the expansion of biometric screening solutions. With increasing pressure on airports to streamline passenger processing while maintaining high-security standards, biometric solutions offer a compelling value proposition. These systems enable faster, more efficient passenger identification using fingerprint, facial recognition, and iris scanning technology. Biometric screening is expected to reduce long wait times and improve overall passenger satisfaction. Moreover, these solutions help airports achieve contactless operations, which is becoming increasingly critical in a post-pandemic world. As such, biometric systems are poised to capture a larger market share, particularly in high-traffic airports, and expand further in both domestic and international markets.

Integration with AI and Machine Learning

Another opportunity lies in the integration of artificial intelligence (AI) and machine learning (ML) technologies into airport security screening systems. These technologies enhance the accuracy, speed, and efficiency of screening processes by analyzing large amounts of data in real-time. AI algorithms can quickly identify potential threats based on patterns learned from historical data, enabling faster decision-making and improving detection rates. Furthermore, AI-powered systems can be integrated with existing security infrastructures, providing airports with a cost-effective way to enhance their security operations without the need for a complete overhaul. The growing interest in AI for airport security, driven by both operational efficiency and enhanced security, presents a significant opportunity for companies in the market.

Future Outlook

The US Airport Passenger Screening Systems market is poised for substantial growth in the coming years, with a focus on technological advancements and regulatory support. With increasing air traffic and a growing emphasis on improving security measures, demand for more sophisticated screening solutions is expected to rise. The adoption of AI, biometric technologies, and automated systems will continue to drive innovation in the sector. Regulatory bodies will likely continue to implement new guidelines to enhance passenger safety, providing a favorable environment for growth. As airport infrastructure expands and evolves, the demand for more efficient, seamless security systems will create new opportunities for market players.

Major Players

- Smiths Detection

- L3 Technologies

- Rapiscan Systems

- Leidos

- Thales Group

- Analogic Corporation

- Cognitec Systems

- Homeland Security Solutions

- Adani Systems

- Nuctech Company

- Kromek Group

- Scanna MSC

- Aventura Technologies

- Vanderlande Industries

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities

- Airlines

- Security technology manufacturers

- System integrators

- Airport contractors

- Security service providers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market size, growth trends, technology adoption rates, and regulatory influences are identified to lay the foundation for the research.

Step 2: Market Analysis and Construction

Data from credible industry reports, financial records, and expert interviews are collected to build a detailed market profile and forecast model.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and stakeholders are consulted to validate the hypotheses, ensuring accuracy and relevance to the current market environment.

Step 4: Research Synthesis and Final Output

The data and insights gathered are synthesized into a cohesive report, with a clear narrative on market dynamics, trends, and forecasts for the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Security Concerns and Terrorism Threats

Technological Advancements in Screening Technology

Rising Air Traffic and Passenger Numbers

Government Regulations and Security Compliance

Growing Investment in Airport Infrastructure - Market Challenges

High Installation and Maintenance Costs

Privacy and Data Security Concerns

Integration with Existing Systems

Regulatory Barriers and Compliance Issues

Operational Delays and Inconvenience for Passengers - Market Opportunities

Expansion of Biometric Screening Solutions

Development of AI and Machine Learning-based Screening Systems

Partnerships for Smart Security Infrastructure - Trends

Adoption of Contactless Screening Solutions

Integration of AI and Big Data for Predictive Screening

Shift Toward Automated Security Checkpoints

Increase in Cloud-based Security Management Solutions

Growth of Mobile Screening and Remote Technologies - Government Regulations & Defense Policy

Increased Focus on Cybersecurity in Airport Systems

Strict Data Protection and Privacy Regulations

Compliance with TSA and International Aviation Security Guidelines - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Body Scanners

Explosive Detection Systems

Metal Detectors

Automated Tray Return Systems

Biometric Screening Solutions - By Platform Type (In Value%)

Airport Terminals

Check-in Counters

Security Checkpoints

Airline Lounges

Cargo and Baggage Handling Areas - By Fitment Type (In Value%)

Fixed Systems

Portable Systems

Integrated Systems

Modular Systems

Hybrid Systems - By EndUser Segment (In Value%)

Commercial Airports

Private Airports

Cargo Airlines

Government and Military Airports

Security Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tendering

Airport Operator Partnerships

Third-Party Distributors

Online Procurement Platforms - By Material / Technology (in Value%)

X-ray Technology

Millimeter Wave Scanning

Infrared Detection

Chemical Detection

Artificial Intelligence Integration

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Market Value, Installed Units, Average System Price)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Smiths Detection

L3 Technologies

Rapiscan Systems

Leidos

Thales Group

Analogic Corporation

Cognitec Systems

Homeland Security Solutions

Adani Systems

Nuctech Company

Kromek Group

Scanna MSC

Aventura Technologies

Vanderlande Industries

Boeing

- Increasing Demand for Efficient Screening Systems

- Government and Regulatory Agencies’ Role in Airport Security

- Airlines’ Push for Faster Passenger Processing

- Private Sector Interest in Security-as-a-Service

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035