Market Overview

The US ammunition market current size stands at around USD ~ million, reflecting steady demand across civilian recreation, personal protection, institutional training, and defense readiness use cases. Supply normalization and improved primer availability have stabilized production planning, while compliance requirements continue to shape manufacturing practices and channel access. The market structure is defined by vertically integrated producers, contract manufacturing arrangements, and diversified distributor networks, with ongoing investments in automation and quality assurance to ensure consistent throughput and reliability.

Demand concentration is strongest in states with established shooting sports infrastructure, dense law enforcement training ecosystems, and significant defense procurement footprints, including Texas, Florida, Arizona, Virginia, and California. Urban corridors with extensive indoor range networks and training academies drive recurring consumption, while rural regions with hunting traditions sustain seasonal demand. Logistics hubs near the Midwest and Southeast enable efficient national distribution, supported by favorable industrial zoning and manufacturing heritage.

Market Segmentation

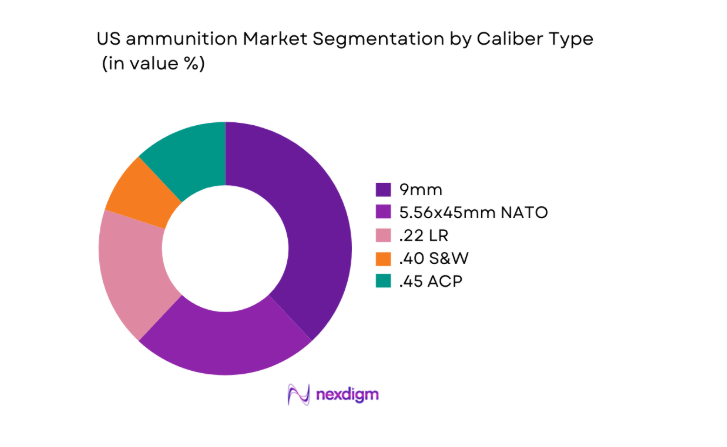

By Caliber Type

Dominance within the market is shaped by versatile handgun and rifle calibers that align with civilian practice, law enforcement qualification cycles, and standardized defense training protocols. The 9mm segment remains the most widely utilized due to platform compatibility, manageable recoil, and consistent availability across training and duty applications. 5.56x45mm NATO maintains relevance through sustained institutional procurement and range programs, while .22 LR anchors entry-level training and high-frequency recreational shooting. Specialty calibers retain niche demand tied to hunting seasons and competitive disciplines, with periodic demand spikes linked to regulatory sentiment and inventory rebuilding behavior across distributor channels.

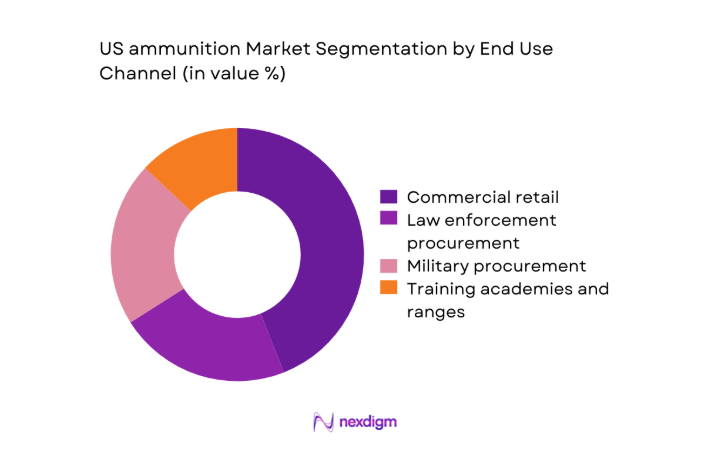

By End Use Channel

End use dynamics are anchored by commercial retail, institutional procurement, and defense contracting, each with distinct replenishment cycles and compliance requirements. Commercial retail dominates unit throughput due to high-frequency consumer practice and range-based consumption, supported by omnichannel distribution and reservation models. Law enforcement procurement remains structurally stable through mandated qualification cycles and standardized training loads. Military procurement is programmatic, tied to training cadence and readiness mandates, creating predictable baseload demand. Training academies and private ranges add recurring volumes, particularly for reduced recoil and frangible rounds used in indoor environments with stringent safety requirements.

Competitive Landscape

The competitive environment is characterized by vertically integrated manufacturers with national distribution footprints and diversified product portfolios serving civilian, institutional, and defense channels. Competitive positioning is shaped by production scalability, regulatory readiness, component sourcing resilience, and channel access across distributors and retail networks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Vista Outdoor | 1916 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Winchester Ammunition | 1866 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Hornady Manufacturing | 1949 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| SIG SAUER Ammunition | 1853 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| CBC Global Ammunition | 1926 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

US ammunition Market Analysis

Growth Drivers

Rising civilian firearm ownership and training frequency

Civilian training demand is reinforced by infrastructure growth and participation intensity across metropolitan corridors. In 2024, more than 1200 indoor and outdoor ranges operated nationwide, with over 380 new range permits approved by municipal authorities since 2022. State wildlife agencies issued 165000 hunting licenses in 2025 across three high-adoption states, sustaining seasonal practice cycles. The National Shooting Sports Foundation reported 1800 sanctioned competitive events in 2024, while background check volumes surpassed 1600000 in several months of 2025, indicating sustained participation intensity supporting recurring training consumption.

Increased law enforcement training rounds consumption

Institutional training intensity has risen with updated qualification standards and expanded academy intakes. In 2024, more than 18000 recruits graduated from state and municipal academies, while annual in-service qualification cycles required 1200 rounds per officer across multiple jurisdictions. Federal grant programs funded 240 new training facilities since 2022, expanding live-fire capacity. DOJ equipment modernization guidelines issued in 2023 reinforced quarterly qualification schedules. These indicators point to structurally higher training cadence and recurring ammunition utilization across agencies during 2024 and 2025.

Challenges

Regulatory uncertainty and compliance burdens

Compliance complexity continues to disrupt production planning and channel access. In 2024, 47 states updated storage, transport, or sales compliance requirements affecting hazardous materials handling, while 19 jurisdictions revised range safety standards tied to indoor air quality. ATF processing times for manufacturing amendments averaged 92 days in 2025, constraining capacity changes. Environmental permitting cycles extended to 14 months in several counties, delaying facility upgrades. These administrative frictions increase lead times for compliance-driven investments and complicate distribution routing, particularly for interstate shipments to high-regulation urban markets.

Volatility in raw material prices for brass, lead, and copper

Upstream material volatility creates procurement uncertainty for casings and projectiles. In 2024, refined copper output from domestic smelters fluctuated across 11 monthly production cycles due to maintenance outages, while primary lead production experienced 9 unplanned curtailments reported to state regulators. Rail congestion events reached 34 incidents in 2025 across Midwest logistics corridors, delaying component deliveries to assembly plants. EPA remediation actions at 6 legacy smelting sites constrained regional supply. These disruptions elevate inventory risk and complicate just-in-time production scheduling.

Opportunities

Expansion of non-lead and environmentally compliant ammunition

Policy-driven demand for non-toxic projectiles is expanding across indoor ranges and wildlife-managed lands. By 2024, 22 states enforced non-lead requirements on select public lands, and 310 indoor ranges adopted lead-free mandates aligned with OSHA guidance. EPA guidance updates in 2025 accelerated remediation compliance across 140 municipal range facilities, favoring frangible and copper alternatives. Public health departments reported 420 remediation projects initiated since 2022, indicating sustained institutional preference shifts. These indicators support scalable opportunities for compliant product lines aligned with environmental and occupational standards.

Private-label manufacturing for large retailers

Retail consolidation enables private-label programs anchored in predictable offtake. In 2024, national sporting goods chains expanded to 680 superstores, while 215 regional chains standardized house-brand programs across 2025 assortments. Retail distribution centers increased cross-dock capacity by 28 facilities since 2023, improving private-label replenishment cadence. Omnichannel reservation systems processed 4.2 million orders in 2024, enabling demand visibility for contract manufacturing planning. These structural shifts support long-run private-label partnerships with stable volumes and improved forecasting accuracy.

Future Outlook

The outlook through 2035 reflects steady normalization of supply chains alongside structurally higher training cadence across civilian and institutional users. Environmental compliance will accelerate product mix shifts, while automation and capacity investments improve throughput reliability. Regional manufacturing clusters and omnichannel distribution will continue to shape access and availability, with policy clarity influencing expansion timing across states.

Major Players

- Vista Outdoor

- Winchester Ammunition

- Hornady Manufacturing

- Olin Corporation

- CBC Global Ammunition

- SIG SAUER Ammunition

- Nosler

- Black Hills Ammunition

- Norma Precision

- Fiocchi of America

- RUAG Ammotec

- Aguila Ammmunition

- PMC Ammunition

- Barnes Bullets

- Underwood Ammunition

Key Target Audience

- Investments and venture capital firms

- U.S. Department of Defense procurement offices

- Bureau of Alcohol, Tobacco, Firearms and Explosives

- State and municipal law enforcement agencies

- National and regional sporting goods retailers

- Ammunition distributors and wholesalers

- Indoor and outdoor shooting range operators

- Component suppliers and contract manufacturers

Research Methodology

Step 1: Identification of Key Variables

Key variables included caliber mix, channel throughput, training cadence, compliance requirements, and component sourcing resilience. Data points were framed around operational indicators, regulatory timelines, and infrastructure density. Emphasis was placed on repeat consumption drivers and procurement cycles.

Step 2: Market Analysis and Construction

Analytical construction integrated range infrastructure counts, agency training schedules, and manufacturing capacity utilization. Institutional indicators and permitting cycles were mapped to operational constraints. Demand patterns were triangulated across civilian, law enforcement, and defense use cases.

Step 3: Hypothesis Validation and Expert Consultation

Working hypotheses were validated through structured consultations with manufacturing operations leaders, compliance specialists, and procurement officers. Scenario testing examined supply normalization, regulatory shifts, and channel consolidation impacts. Assumptions were stress-tested against recent institutional indicators.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a cohesive narrative linking infrastructure growth, compliance dynamics, and channel evolution. Insights were structured to inform strategic planning, capacity investments, and product mix decisions. The final output aligns operational indicators with forward-looking market direction.

- Executive Summary

- Research Methodology (Market Definitions and caliber classifications across civilian, law enforcement, and military use, Primary interviews with ammunition manufacturers, OEM component suppliers, and defense procurement officials, Analysis of ATF manufacturing and excise tax filings and import-export records, Demand modeling using shooting sports participation, law enforcement training cycles, and DoD procurement data, Pricing analysis from distributor price sheets and retail POS sell-through data)

- Definition and Scope

- Market evolution

- Usage pathways across civilian, law enforcement, and defense

- Ecosystem structure of manufacturers, component suppliers, distributors, and retailers

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising civilian firearm ownership and training frequency

Increased law enforcement training rounds consumption

Sustained military training and readiness requirements

Growth in shooting sports and competitive events

Supply chain normalization improving availability

Technological improvements in propellants and projectile design - Challenges

Regulatory uncertainty and compliance burdens

Volatility in raw material prices for brass, lead, and copper

Supply chain disruptions for primers and propellants

Capacity constraints and long lead times

Public policy and reputational risks impacting retail channels

Import restrictions and trade compliance complexity - Opportunities

Expansion of non-lead and environmentally compliant ammunition

Private-label manufacturing for large retailers

Advanced training ammunition for indoor ranges

Long-term government contracts and framework agreements

Capacity expansion through automation and new plants

Premium defensive and specialty rounds - Trends

Shift toward non-toxic and frangible rounds

Inventory normalization after demand spikes

Vertical integration of component supply

Growth of DTC and online reservation models

Increased adoption of training-specific reduced-recoil loads

Data-driven demand forecasting by distributors - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Caliber Type (in Value %)

9mm

5.56x45mm NATO

7.62x51mm NATO

.22 LR

.40 S&W

.45 ACP

Other calibers - By Application (in Value %)

Civilian sporting and hunting

Personal defense

Law enforcement training and duty use

Military training and operational use

Competitive shooting - By Product Type (in Value %)

Rimfire

Centerfire handgun

Centerfire rifle

Shotgun shells

Specialty and armor-piercing - By End Use Channel (in Value %)

Commercial retail

Law enforcement procurement

Military procurement

Institutional training academies - By Distribution Channel (in Value %)

Direct government contracts

Distributors and wholesalers

Sporting goods retailers

E-commerce and DTC

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (caliber portfolio breadth, production capacity utilization, government contract penetration, distribution footprint, cost per round competitiveness, quality and reliability metrics, ESG and non-lead product availability, supply lead time performance)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Vista Outdoor (Federal, CCI, Speer, Remington Ammunition)

Winchester Ammunition

Hornady Manufacturing

Olin Corporation

CBC Global Ammunition (Magtech)

SIG SAUER Ammunition

Nosler

Black Hills Ammunition

Norma Precision

Fiocchi of America

RUAG Ammotec (Swiss P)

Aguila Ammunition

PMC Ammunition

Barnes Bullets

Underwood Ammunition

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035