Market Overview

The US attack helicopter market is valued at approximately USD ~ billion based on recent assessments, with key drivers including military modernization, evolving security threats, and government defense budgets. Technological advancements, particularly in avionics, weapon systems, and autonomous capabilities, are driving innovation in this sector. Increased demand for versatile, multi-role platforms capable of performing various combat and reconnaissance tasks is further contributing to the growth. The market is expanding due to continuous upgrades and the introduction of next-generation models such as the AH-64 Apache and Bell AH-1Z Viper.

The US market is dominated by cities and military hubs such as Arlington, Virginia, and Fort Rucker, Alabama, due to the presence of leading manufacturers like Boeing, Lockheed Martin, and Bell Helicopter. The concentration of defense contractors, military bases, and government contracts in these regions fosters a competitive environment. Furthermore, the US government’s strategic defense initiatives, including modernization programs and military expansions, reinforce the country’s leadership in the attack helicopter market. These factors ensure that the US remains at the forefront of technological advancements and military capabilities.

Market Segmentation

By Product Type

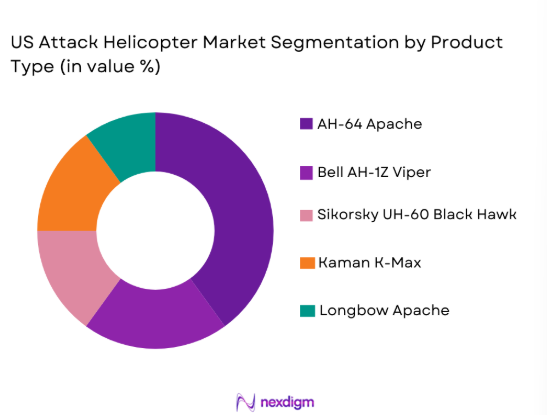

The US attack helicopter market is segmented by product type into models such as Longbow Apache, AH-64 Apache, Bell AH-1Z Viper, Sikorsky UH-60 Black Hawk, and Kaman K-Max. Recently, the AH-64 Apache has held a dominant market share due to its multi-role versatility, technological advancements, and global deployment. Its adaptability for various missions such as close combat, reconnaissance, and armed escort positions it as the preferred choice for the US military. The Apache’s integration of advanced avionics and weapon systems allows it to outperform competitors in both modernized and future combat scenarios, making it essential in defense strategies.

By Platform Type

The US attack helicopter market is segmented by platform type into airborne, land, naval, space, and hybrid platforms. The airborne platform has a dominant market share due to its unmatched agility, capability to operate in complex environments, and support in tactical operations. The ability of airborne platforms to perform various missions, including troop support, reconnaissance, and precision strikes, solidifies their position. Modern technological improvements, such as GPS navigation and radar systems, continue to enhance their operational capabilities, leading to sustained market dominance.

Competitive Landscape

The competitive landscape of the US attack helicopter market is characterized by significant consolidation, with major defense contractors dominating the sector. Boeing, Lockheed Martin, and Bell Helicopter are key players, heavily influencing market dynamics. These companies benefit from substantial government contracts, military alliances, and technological leadership in rotorcraft and avionics systems. As the market continues to evolve, collaboration between private defense contractors and government agencies is expected to further drive innovation in attack helicopter technology.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Boeing | 1916 | Chicago, US | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, US | ~ | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | Fort Worth, US | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, US | ~ | ~ | ~ | ~ | ~ |

| Textron | 1923 | Providence, US | ~ | ~ | ~ | ~ | ~ |

US Attack Helicopter Market Analysis

Growth Drivers

Technological Advancements

Technological advancements are a major driver of the US attack helicopter market, with continuous improvements in avionics, weapon systems, and rotorcraft design. The introduction of modern technologies such as AI-powered targeting systems, improved infrared targeting systems, and enhanced autopilot features significantly enhances operational efficiency and combat capabilities. These advancements make attack helicopters more effective in multi-domain operations, capable of performing precise strikes and reconnaissance tasks. The integration of commercial technologies into military platforms has further enhanced performance and reliability, leading to broader adoption and increased demand. Additionally, the trend toward greater automation, including semi-autonomous flight control systems, is expected to reduce pilot workload and enhance mission success rates. As these technologies become more integrated, they contribute to a greater overall value of military operations, particularly in fast-evolving combat environments. The continuous upgrades of these platforms ensure their relevance in future defense strategies, fueling growth in the market.

Increased Defense Spending

Increased government defense spending is another key driver of market growth. With global geopolitical tensions rising and the need for advanced military capabilities growing, the US government has significantly raised its defense budget, resulting in greater investments in new technologies and military platforms. As a result, manufacturers of attack helicopters are benefiting from a more stable pipeline of defense contracts and production orders. This growing demand for next-generation systems to address complex battlefield conditions and enhance national security is also spurring innovation in attack helicopter technology. Furthermore, rising investment in military modernization programs and the desire to replace aging fleet systems contribute to long-term growth in the sector. As the global arms race intensifies, the demand for versatile, agile, and technologically advanced helicopters will likely see sustained growth.

Market Challenges

High Development and Maintenance Costs

A significant challenge facing the US attack helicopter market is the high development and maintenance costs associated with these systems. The cost of designing, testing, and manufacturing advanced helicopters is considerable, and this has led to higher production costs that are often passed on to the customer. Additionally, ongoing maintenance, parts replacement, and system upgrades further drive costs, making these systems expensive to operate over their lifecycle. While military budgets may cover some of these expenses, the economic burden placed on both defense contractors and governments is substantial. This financial challenge limits the pace at which new platforms can be developed and impacts the affordability of upgrading or replacing older models. Furthermore, long-term service and repair requirements contribute to challenges in fleet management, particularly for government agencies with constrained budgets. The high costs involved in ensuring attack helicopter readiness also hamper efforts to expand fleets rapidly.

Regulatory and Compliance Barriers

Regulatory and compliance barriers represent another challenge for manufacturers and stakeholders in the US attack helicopter market. Adhering to stringent government regulations and international treaties is crucial for the development and export of attack helicopters. Compliance with export control laws, environmental regulations, and aviation safety standards often slows down the development cycle and increases costs for manufacturers. In addition, different countries have specific certification requirements for the deployment of military aviation systems, adding complexity to international contracts. The need for extensive testing and validation, particularly in high-stakes military applications, can delay production timelines. International military procurement programs are often subject to changes in government policies, further complicating the export of attack helicopters to foreign buyers. These regulatory hurdles can restrict market growth, especially as companies strive to meet both domestic and international standards simultaneously.

Opportunities

Integration of Autonomous Technology

One significant opportunity in the US attack helicopter market is the integration of autonomous and semi-autonomous technologies into existing platforms. The US military has been exploring unmanned and semi-autonomous aerial systems for several years, and there is growing interest in applying these technologies to attack helicopters. Autonomous systems can enhance mission effectiveness by allowing attack helicopters to perform tasks such as reconnaissance, target acquisition, and surveillance with minimal human intervention. Additionally, autonomous systems reduce the cognitive load on pilots, increase mission duration, and enhance overall operational efficiency. These innovations are expected to drive market demand for attack helicopters equipped with autonomous capabilities, as the military seeks to reduce the risk to human life while maximizing performance. As technological advances in AI and automation continue, this trend will play a key role in shaping the future direction of the attack helicopter market.

Emerging Markets

Another promising opportunity for the US attack helicopter market lies in the growth of emerging markets, particularly in regions with increasing defense spending and modernization programs. Countries in the Asia-Pacific and the Middle East are investing heavily in military infrastructure and technology, and they are turning to the US for advanced defense systems. This represents a significant opportunity for US manufacturers of attack helicopters to expand their market reach and establish partnerships with foreign governments. Moreover, as geopolitical tensions in regions like the South China Sea and Eastern Europe continue to rise, demand for advanced military equipment, including attack helicopters, will increase. The US can leverage its strong defense portfolio and technological leadership to tap into these expanding markets. Additionally, emerging markets are often more receptive to upgrading their military fleets, which could present opportunities for the export of next-generation helicopters.

Future Outlook

The future of the US attack helicopter market is poised for significant growth, driven by increasing defense budgets and technological advancements. The shift towards more versatile and advanced multi-role helicopters, alongside the adoption of autonomous and AI-driven systems, will dominate the landscape. As geopolitical tensions rise, the demand for sophisticated, high-performance helicopters will only grow. Technological advancements will also lead to cost reductions in both production and maintenance, creating more opportunities for global sales. Additionally, the increasing integration of commercial technologies and innovations in rotorcraft design will further expand the market’s scope.

Major Players

- Boeing

- Lockheed Martin

- Bell Helicopter

- Northrop Grumman

- Textron

- Airbus

- Sikorsky Aircraft

- Kaman Corporation

- General Dynamics

- Raytheon Technologies

- Thales Group

- Leonardo

- Elbit Systems

- Saab Group

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace manufacturers

- Procurement and logistics firms

- Defense technology developers

- Private security firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables that influence the US attack helicopter market. These include technological innovations, defense spending trends, geopolitical factors, and demand for military modernization. These variables are analyzed to understand their impact on market dynamics and growth patterns.

Step 2: Market Analysis and Construction

Comprehensive market analysis is conducted by collecting and analyzing both primary and secondary data. This includes insights from industry reports, government publications, and data from defense contractors. Market construction is based on these insights to estimate market size, growth rates, and segmentation, ensuring the accuracy and reliability of the data.

Step 3: Hypothesis Validation and Expert Consultation

In this step, the hypotheses developed from the market analysis are validated through consultations with subject-matter experts, defense contractors, and government defense agencies. These consultations provide additional insights and ensure that the data is aligned with real-world trends and expectations.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered information and research findings into a comprehensive market report. This output incorporates data from the previous steps, presenting a clear and detailed analysis of the market, including key growth drivers, challenges, opportunities, and future outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Helicopter Systems

Increased Military Spending

Demand for Advanced Defense Systems

Rising Geopolitical Tensions

Integration of AI and Automation in Aircraft - Market Challenges

High Development and Maintenance Costs

Technological Integration Barriers

Regulatory Compliance and Certification Challenges

Complexity of Upgrades and Modifications

Cybersecurity Vulnerabilities in Aircraft Systems - Market Opportunities

Emerging Demand for Autonomous Attack Helicopters

Rising Demand from Emerging Markets

Technological Integration with Commercial Aviation - Trends

Integration of Autonomous Systems

Advancements in AI-driven Combat Systems

Increasing Focus on Cybersecurity

Adoption of Advanced Rotorcraft Technologies

Shift Towards Multi-role and Versatile Platforms - Government Regulations & Defense Policy

Export Control and Compliance Policies

Government Funding for Military Aviation

Data Protection and Privacy Regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Longbow Apache

Bell AH-1Z Viper

AH-64 Apache

Kaman K-Max

Sikorsky UH-60 Black Hawk - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Modular Solutions

Integrated Solutions

Cloud-based Solutions

Hybrid Solutions

On-premise Solutions - By EndUser Segment (In Value%)

US Army

Defense Contractors

Government Agencies

Private Sector

Security Services - By Procurement Channel (In Value%)

Government Tenders

Direct Procurement

Private Sector Procurement

Third-party Distributors

Online Bidding Platforms - By Material / Technology (in Value%)

Composite Materials

Lightweight Alloys

Advanced Avionics

Flight Control Systems

Rotor Systems

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material, Technology, Price Tier, Complexity, Region)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Lockheed Martin

Bell Helicopter

Northrop Grumman

General Dynamics

Sikorsky Aircraft

Textron

Airbus

Kaman Corporation

Raytheon Technologies

Thales Group

Leonardo

Elbit Systems

Saab Group

Harris Corporation

- Military Forces’ Increasing Demand for Advanced Aircraft

- Private Sector’s Growing Interest in Multi-role Platforms

- Government Agencies’ Focus on Modernization Programs

- Defense Contractors’ Investment in Research and Development

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035