Market Overview

The US aviation market current size stands at around USD ~ million, reflecting the scale of aircraft manufacturing, airline operations, cargo logistics, and maintenance ecosystems across the country. The market integrates fleet operations, airport services, air traffic management, and aftermarket support, with investment cycles tied to fleet renewal, safety compliance, and operational efficiency improvements. Commercial passenger, cargo, defense, and business aviation collectively shape demand patterns across aircraft, engines, avionics, and MRO activities nationwide.

The market is concentrated around major aviation hubs and industrial clusters with mature airport infrastructure, dense airline networks, advanced MRO ecosystems, and proximity to aerospace manufacturing and engineering talent. Coastal metropolitan regions host large airline headquarters and cargo gateways, while southern and western states anchor aircraft assembly, component manufacturing, and testing facilities. Policy-driven investments in airport modernization, airspace efficiency, and sustainability initiatives reinforce regional dominance, supported by established supplier networks and skilled labor pools.

Market Segmentation

By Aircraft Type

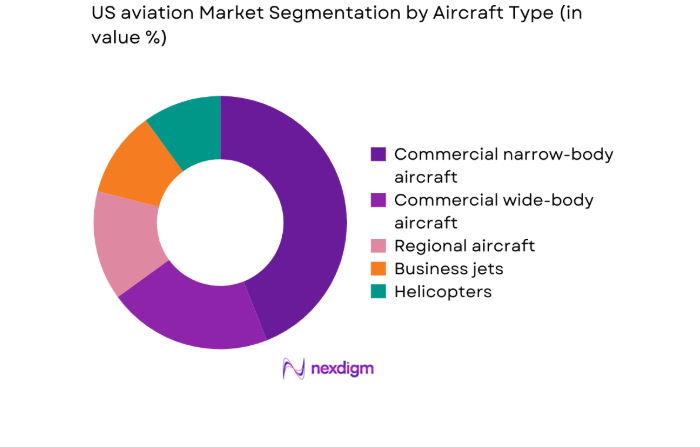

Narrow-body aircraft dominate fleet utilization due to high-frequency domestic routes and rapid turnaround requirements, making them central to airline capacity planning and operational economics. Regional aircraft maintain connectivity to secondary cities, while wide-body fleets are increasingly optimized for high-density corridors and premium transcontinental services. Business jets and helicopters support corporate mobility, emergency response, and offshore operations, reinforcing diversified demand profiles. Military platforms sustain stable procurement and modernization cycles aligned with readiness priorities. Fleet renewal strategies emphasize fuel efficiency, digital avionics integration, and compatibility with sustainable fuels, shaping procurement decisions across commercial and government operators.

By Application

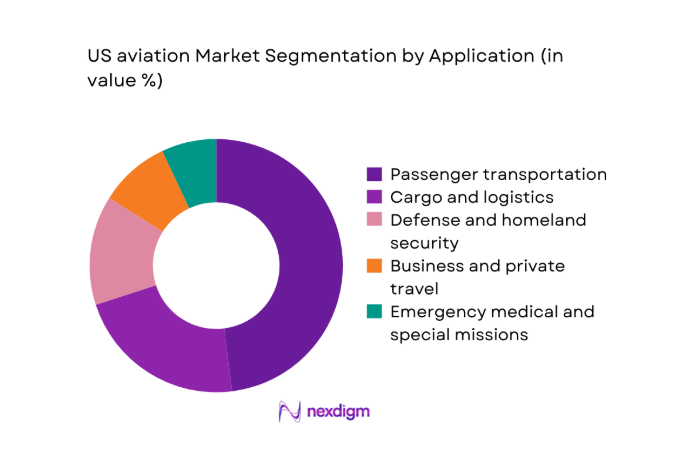

Passenger transportation remains the dominant application driven by dense domestic networks and business travel recovery, while cargo operations are structurally supported by express logistics and time-critical supply chains. Defense and homeland security aviation sustain steady utilization through training, surveillance, and transport missions. Emergency medical services and aerial firefighting expand utilization in response to disaster preparedness and climate-linked incident frequency. Business and private travel continue to support premium fleet demand. Application-driven requirements influence aircraft configuration, avionics sophistication, maintenance intensity, and lifecycle service contracts across operators and service providers nationwide.

Competitive Landscape

The competitive environment is shaped by vertically integrated OEMs, propulsion specialists, avionics providers, and aftermarket service platforms supporting fleet availability, compliance, and lifecycle optimization. Competitive differentiation centers on technology depth, delivery reliability, certification readiness, and service coverage across major aviation hubs and secondary airports.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX | 1930 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| GE Aerospace | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

US aviation Market Analysis

Growth Drivers

Rising domestic passenger demand and route network expansion

Domestic air travel rebounded strongly as airports processed 777 million enplanements in 2022 and 819 million in 2023, reflecting sustained mobility demand across metropolitan corridors. Slot utilization at major hubs increased alongside 43 additional point to point routes launched in 2024, expanding connectivity to secondary cities. The FAA managed 16.4 million operations in 2023, indicating rising airspace utilization pressures. Airline fleet schedules rose to 27,400 daily departures in peak seasons during 2024, intensifying aircraft utilization cycles. Public transport substitution rates declined across commuter corridors, reinforcing modal preference for air travel. These indicators demonstrate structurally higher throughput requirements.

Fleet renewal cycles among major US airlines

Airlines accelerated retirement of older aircraft as average fleet age declined from 14.8 in 2022 to 13.6 in 2024, driven by efficiency and reliability targets. FAA records show 1,216 commercial aircraft deregistered across 2022 to 2024 due to end of service. New delivery acceptance slots expanded with 614 aircraft inducted into active fleets in 2023 and 702 in 2024, increasing operational capacity. Maintenance deferral rates fell as reliability thresholds tightened, raising scheduled heavy checks per airframe. Engine shop visits rose 18 in 2024 versus 2022, indicating higher utilization intensity and modernization-driven maintenance cycles.

Challenges

Aircraft production bottlenecks and delivery delays

Manufacturing throughput constraints persisted as average production lead times extended from 18 months in 2022 to 26 months in 2024, delaying fleet induction. FAA conformity inspection backlogs reached 9,400 pending reviews during peak certification cycles in 2023, slowing delivery clearances. Supplier on time delivery rates fell to 84 in 2024 from 92 in 2022, affecting engine modules, avionics, and composite structures. Port congestion indicators showed dwell times of 6.2 days for aerospace components in 2023, disrupting just in time assembly. Workforce attrition of 7.4 in skilled manufacturing roles further constrained throughput stability.

Supply chain constraints for engines and critical components

Engine availability was constrained as shop visit queues exceeded 14,200 units awaiting induction in 2024, extending turnaround intervals. Critical material shortages affected 312 tier two suppliers during 2023, delaying castings and forgings required for hot section components. Semiconductor allocation limits reduced avionics production batches by 21 units per quarter in 2024 compared with 2022. Logistics bottlenecks increased average inbound transit times to 19 days in 2023 from 12 days in 2022. Quality escape rates rose to 1.8 incidents per 1,000 components, triggering rework cycles and cascading assembly disruptions.

Opportunities

Sustainable aviation fuel adoption and infrastructure buildout

SAF blending capacity expanded as 7 certified production pathways were approved by 2024, enabling broader fuel compatibility across existing fleets. Airport fueling infrastructure upgrades covered 39 commercial airports in 2024, compared with 12 in 2022, improving distribution reach. Federal incentive programs supported 28 refinery conversion projects during 2023 to 2025, increasing domestic production readiness without disclosing volumes. Airlines executed 126 long term offtake agreements in 2024, signaling procurement commitments aligned with emissions targets. These institutional signals, combined with regulatory alignment across FAA guidance, support scalable infrastructure deployment and operator readiness.

Electrification and hybrid propulsion for regional and urban air mobility

FAA certification pathways advanced as 4 special class aircraft frameworks were formalized by 2024, reducing regulatory uncertainty for emerging propulsion systems. Test flight authorizations increased to 317 in 2023 and 402 in 2024, accelerating flight validation cycles. State level incentives supported 19 pilot corridors linking regional airports with advanced air mobility trials. Grid interconnection permits for airfield charging infrastructure rose across 22 sites in 2024, enabling early deployment readiness. Workforce training programs certified 1,840 technicians on high voltage systems between 2022 and 2025, building operational capability for new propulsion platforms.

Future Outlook

The market outlook toward 2035 reflects continued modernization of fleets, progressive integration of sustainable fuels, and gradual adoption of advanced propulsion technologies. Policy alignment across safety, airspace efficiency, and emissions reduction will shape investment priorities. Airport capacity enhancements and digital air traffic management upgrades are expected to support network resilience, while regional connectivity and cargo demand underpin long-term operational growth.

Major Players

- Boeing

- Airbus

- Lockheed Martin

- Northrop Grumman

- RTX

- GE Aerospace

- Pratt & Whitney

- Honeywell Aerospace

- L3Harris Technologies

- Textron Aviation

- Gulfstream Aerospace

- Bell Textron

- Sikorsky

- Spirit AeroSystems

- Collins Aerospace

Key Target Audience

- Commercial airlines and cargo operators

- Aircraft lessors and fleet management companies

- MRO service providers and parts distributors

- Airport authorities and operators

- Air traffic management and infrastructure agencies

- Investments and venture capital firms

- Government and regulatory bodies with agency names including FAA and DOT

- Defense procurement and logistics agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables were defined across fleet utilization, route density, infrastructure readiness, regulatory compliance pathways, propulsion technology maturity, and aftermarket service intensity. Indicators were aligned to operational throughput, certification workflows, and supply chain resilience. Variable selection emphasized measurability within public institutional datasets and operational disclosures.

Step 2: Market Analysis and Construction

The analytical framework integrated fleet census trends, airport capacity utilization, maintenance cycle frequencies, and certification pipeline flows. Operational indicators were mapped across commercial, cargo, defense, and business aviation segments. Scenario construction reflected infrastructure readiness, workforce availability, and technology adoption trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through structured consultations with airport operators, maintenance leaders, safety compliance specialists, and airspace planners. Validation emphasized alignment with operational constraints, regulatory timelines, and infrastructure readiness. Iterative feedback refined assumptions around fleet renewal, propulsion integration, and digitalization impacts.

Step 4: Research Synthesis and Final Output

Findings were synthesized into segment specific narratives aligned with regulatory frameworks, operational realities, and technology readiness. Cross validation ensured internal consistency across demand drivers, constraints, and opportunity pathways. Outputs were structured to support strategic planning, investment screening, and operational benchmarking.

- Executive Summary

- Research Methodology (Market Definitions and civil, commercial, and military aviation scope alignment, Fleet census validation using FAA registry and BTS T-100 datasets, Airline capacity and route network modeling, OEM backlog and delivery schedule triangulation, MRO spend and parts consumption analysis, Airport infrastructure and ATC modernization pipeline assessment, Regulatory and policy impact mapping across FAA, DOT, and DoD)

- Definition and Scope

- Market evolution

- Usage and operational pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising domestic passenger demand and route network expansion

Fleet renewal cycles among major US airlines

Growth in air cargo driven by e-commerce and express logistics

Federal funding for airport infrastructure and ATC modernization

Increasing defense aviation procurement and readiness programs

Expansion of business aviation for corporate and charter travel - Challenges

Aircraft production bottlenecks and delivery delays

Supply chain constraints for engines and critical components

Pilot, technician, and skilled labor shortages

Rising operating costs from fuel price volatility

Stringent safety, certification, and compliance requirements

Airport capacity constraints at major hubs - Opportunities

Sustainable aviation fuel adoption and infrastructure buildout

Electrification and hybrid propulsion for regional and urban air mobility

Digital MRO platforms and predictive maintenance adoption

Fleet retrofits for fuel efficiency and cabin modernization

Growth of regional connectivity through new narrow-body routes

Public-private partnerships for airport and airspace modernization - Trends

Accelerated retirement of older aircraft models

Increasing share of narrow-body aircraft in domestic fleets

Adoption of advanced avionics and connectivity solutions

Integration of AI and data analytics in operations and maintenance

Expansion of cargo conversion programs for passenger aircraft

Focus on emissions reduction and net-zero aviation targets - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Aircraft Type (in Value %)

Commercial narrow-body aircraft

Commercial wide-body aircraft

Regional aircraft

Business jets

Helicopters

Military fixed-wing and rotary-wing aircraft - By Application (in Value %)

Passenger transportation

Cargo and logistics

Business and private travel

Emergency medical services

Defense and homeland security

Aerial firefighting and special missions - By End User (in Value %)

Commercial airlines

Cargo operators

Business jet operators and fractional ownership firms

Government and defense agencies

Emergency services operators - By Value Chain Stage (in Value %)

Aircraft manufacturing

Engines and propulsion systems

Avionics and systems

Maintenance, repair, and overhaul services

Aftermarket parts and components - By Propulsion and Technology (in Value %)

Conventional turbofan and turboprop

Advanced composite airframes

Next-generation avionics and flight management

Sustainable aviation fuel-compatible platforms

Hybrid-electric and electric aircraft

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet size, order backlog, delivery reliability, technology differentiation, aftermarket service coverage, pricing competitiveness, regulatory compliance track record, partnerships and alliances)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Boeing

Airbus

Lockheed Martin

Northrop Grumman

RTX

GE Aerospace

Pratt & Whitney

Honeywell Aerospace

L3Harris Technologies

Textron Aviation

Gulfstream Aerospace

Bell Textron

Sikorsky

Spirit AeroSystems

Collins Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035