Market Overview

The US Border Security market current size stands at around USD ~ million, reflecting sustained federal prioritization of border surveillance, inspection, and command infrastructure across land, maritime, and aerial domains. Capital allocation remains directed toward integrated sensing platforms, data fusion environments, and persistent monitoring assets. Procurement emphasizes modernization of legacy detection systems, scalable deployment kits, and lifecycle services. Ongoing upgrades to inspection corridors and identity verification infrastructure reinforce system continuity, while multi-year programmatic commitments support phased capability expansion across operational theaters.

Deployment intensity concentrates around high-traffic land corridors in the Southwest, major maritime gateways along the Gulf and Pacific coasts, and high-throughput ports of entry in metropolitan logistics hubs. Concentration aligns with infrastructure maturity, operational demand density, and the presence of established integrator ecosystems. Border states exhibit deeper maintenance and integration capacity, while federal command nodes anchor data fusion and response coordination. Policy emphasis on technology-driven enforcement and interagency interoperability further shapes regional prioritization and sustained adoption momentum.

Market Segmentation

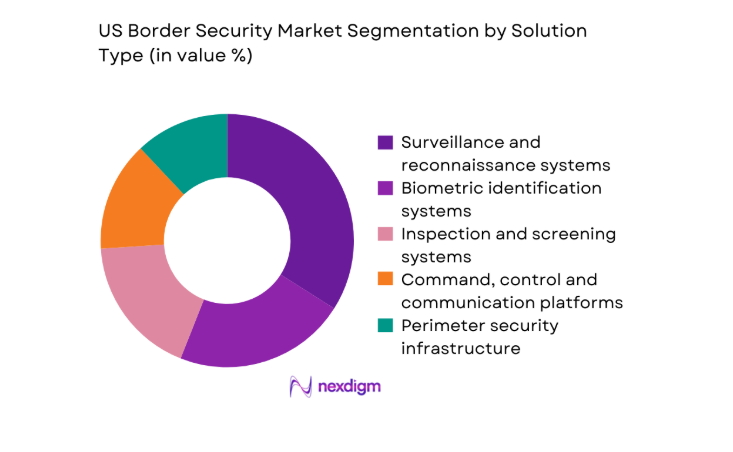

By Solution Type

Integrated surveillance and reconnaissance systems dominate procurement due to their role in persistent situational awareness across rugged terrain and maritime approaches. Biometric identification and inspection platforms follow closely, driven by modernization of ports of entry and the need for faster throughput without compromising enforcement rigor. Command, control, and communication platforms are increasingly bundled with analytics modules to support multi-agency coordination and operational continuity. Perimeter infrastructure remains essential for fixed-site protection, while cybersecurity and data analytics platforms gain traction as digital attack surfaces expand. The convergence of hardware, software, and services into interoperable solution stacks favors vendors capable of end-to-end delivery and lifecycle support.

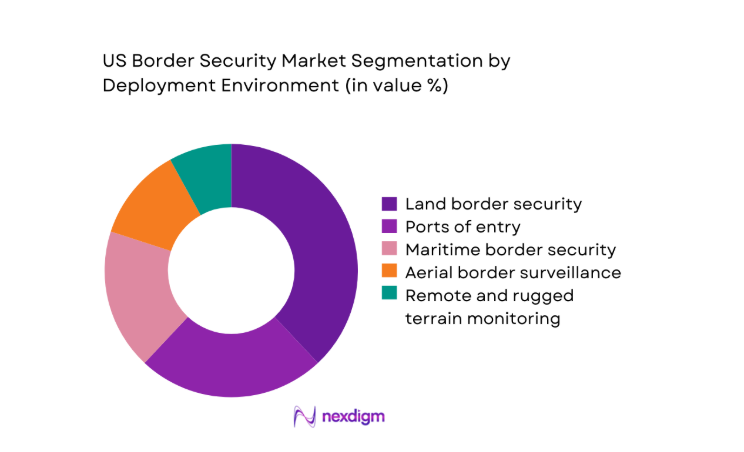

By Deployment Environment

Land border deployments account for the highest share due to extended terrain coverage requirements and persistent monitoring needs across remote corridors. Ports of entry form the second-largest environment, driven by throughput optimization and identity verification mandates. Maritime surveillance is prioritized along high-traffic coastal approaches and commercial shipping lanes, while aerial surveillance augments coverage gaps and rapid response. Remote and rugged terrain monitoring remains specialized but strategically significant, requiring resilient platforms and autonomous systems. The operational mix increasingly favors multi-domain integration, enabling shared situational awareness across land, maritime, and aerial environments through unified command platforms and interoperable data pipelines.

Competitive Landscape

The competitive environment features diversified defense technology providers and specialized security integrators offering integrated hardware, software, and services. Differentiation centers on system interoperability, deployment scalability, compliance readiness, and lifecycle support capabilities aligned with federal procurement frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Leidos | 1969 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

US Border Security Market Analysis

Growth Drivers

Rising illegal crossings and trafficking activity along land and maritime borders

Apprehensions recorded across Southwest corridors reached 2240000 in 2024, sustaining operational pressure on detection, screening, and response capabilities. Seizures of synthetic opioids exceeded 11000 kilograms in 2025, reinforcing the need for advanced inspection systems at ports of entry and maritime approaches. Maritime interdictions increased across 17 coastal sectors, while unmanned aerial surveillance hours expanded by 42000 operational flight hours in 2024. Federal staffing levels supporting frontline screening surpassed 62000 personnel in 2025, indicating institutional scale. Cross-border incident reports filed through interagency platforms exceeded 980000 in 2024, driving continued investment in persistent surveillance and integrated command environments.

Increased federal budget allocations for border surveillance modernization

Congressional appropriations enacted in 2024 authorized multi-year modernization programs spanning sensor replacement cycles, data fusion upgrades, and mobile inspection deployments. Capital authorizations supported 148 technology refresh initiatives across ports of entry and remote corridors during 2025. Fleet modernization included procurement of 320 surveillance towers and 680 mobile sensor kits, improving coverage density across 9 border states. Network upgrades expanded secure data nodes to 214 operational sites in 2024, enabling cross-agency interoperability. Training allocations supported 18000 personnel certifications for advanced surveillance platforms in 2025, reflecting institutional readiness to absorb modernized capabilities and sustain operational continuity across multiple deployment environments.

Challenges

Procurement delays and lengthy federal contracting cycles

Average procurement lead times extended to 14 months in 2024 due to multi-stage compliance reviews and audit requirements. Contract award protests increased by 63 cases in 2025, delaying deployment schedules across 11 high-priority corridors. Vendor onboarding required completion of 27 security compliance checkpoints, lengthening pre-award validation cycles. Field deployment schedules slipped by 9 months for 42 projects during 2024 because of contracting bottlenecks and logistics sequencing. Interagency approvals across 6 federal entities added coordination overhead, constraining rapid adoption of modular platforms and limiting responsiveness to emergent operational requirements along land and maritime borders.

Interoperability gaps across legacy and modern systems

Field assessments identified 312 legacy platforms still operating on incompatible data standards in 2024, limiting cross-domain data fusion. Integration backlogs affected 84 operational sites where command platforms could not ingest real-time sensor feeds. Firmware mismatches across 19 vendor ecosystems required manual data mediation, reducing response timeliness during 2025 operations. Cyber accreditation cycles for interface upgrades extended to 180 days, delaying interoperability remediation. Training gaps impacted 7600 operators unfamiliar with unified interfaces, constraining utilization of integrated capabilities. These constraints elevate operational risk during peak activity periods and complicate multi-agency coordination across distributed surveillance assets.

Opportunities

Expansion of autonomous surveillance platforms

Autonomous ground and aerial platforms logged 96000 operational hours in 2024, demonstrating reliability across rugged terrain and maritime corridors. Endurance improvements enabled 24-hour continuous coverage across 61 monitored sectors during 2025. Sensor payload miniaturization reduced platform weight by 18 kilograms, expanding deployability in remote areas. Fleet utilization rates reached 0.72 across deployed assets, indicating operational readiness. Institutional pilots across 7 border states validated autonomous perimeter patrol integration with command platforms. Scaling deployments can reduce manpower exposure across 340 high-risk corridors while enhancing persistent monitoring and rapid response capabilities under constrained staffing environments.

Integration of AI-driven threat detection and predictive analytics

AI-enabled video analytics processed 4100000 frames per hour across deployed sites in 2024, improving anomaly detection in cluttered environments. False-positive alerts declined by 38 incidents per 1000 events following model retraining in 2025. Predictive models incorporated 126 variables from terrain, weather, and historical incident logs to optimize patrol routing. Data fusion nodes supported real-time correlation across 204 sensor feeds, reducing response latency by 17 minutes during pilot operations. Institutional adoption of accredited AI modules across 23 command centers establishes a scalable foundation for anticipatory enforcement and resource optimization across multi-domain deployments.

Future Outlook

The outlook through 2035 reflects sustained modernization cycles across sensing, analytics, and command platforms, with continued emphasis on interoperability and privacy-aligned deployment. Multi-domain integration across land, maritime, and aerial environments will shape procurement priorities. Policy continuity and interagency coordination are expected to reinforce long-term technology adoption and lifecycle service models.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Leidos

- L3Harris Technologies

- BAE Systems

- General Dynamics Mission Systems

- Thales Group

- Elbit Systems of America

- Motorola Solutions

- Palantir Technologies

- Anduril Industries

- Teledyne FLIR

- OSI Systems

- Booz Allen Hamilton

Key Target Audience

- US Department of Homeland Security procurement offices

- US Customs and Border Protection operational commands

- US Immigration and Customs Enforcement program units

- State and local border security task forces

- Port authorities and transportation security agencies

- Systems integrators and prime contractors

- Infrastructure operators at ports of entry

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Operational variables were mapped across surveillance coverage density, inspection throughput, platform uptime, and interoperability readiness. Regulatory constraints and compliance checkpoints were defined to bound deployment feasibility. Institutional capacity indicators informed variable prioritization.

Step 2: Market Analysis and Construction

Deployment environments were structured across land, maritime, and aerial domains. Technology stacks were decomposed into sensing, analytics, command, and lifecycle services. Adoption pathways were constructed around procurement workflows and operational readiness indicators.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured consultations with operational leaders, integrators, and program managers. Scenario testing examined deployment constraints, integration risk, and training absorption. Feedback loops refined opportunity framing and risk exposure.

Step 4: Research Synthesis and Final Output

Findings were synthesized into actionable insights aligned to procurement realities and deployment constraints. Cross-domain linkages were consolidated to reflect ecosystem dynamics. Outputs were structured for decision support across planning, sourcing, and implementation phases.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of US border security systems, Primary interviews with DHS, CBP, ICE and border state law enforcement agencies, Procurement database analysis of federal and state border security contracts, Import-export and shipment tracking of surveillance and screening equipment, Technology benchmarking across detection and surveillance platforms, Regulatory and budget analysis of DHS appropriations and border security programs)

- Definition and Scope

- Market evolution

- Usage and operational deployment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising illegal crossings and trafficking activity along land and maritime borders

Increased federal budget allocations for border surveillance modernization

Adoption of AI-enabled surveillance and biometric screening

Expansion of unmanned aerial systems for persistent monitoring

Modernization of ports of entry and inspection infrastructure

Cross-agency data integration initiatives - Challenges

Procurement delays and lengthy federal contracting cycles

Interoperability gaps across legacy and modern systems

Civil liberties and privacy concerns limiting technology deployment

Operational challenges in remote and harsh terrains

Workforce training and system adoption barriers

Supply chain dependencies for advanced sensors and components - Opportunities

Expansion of autonomous surveillance platforms

Integration of AI-driven threat detection and predictive analytics

Upgrades to smart ports of entry and biometric corridors

Public-private partnerships for technology deployment

Cross-border data sharing and joint surveillance initiatives

Lifecycle services and managed security offerings - Trends

Shift toward integrated command-and-control platforms

Increased deployment of persistent surveillance aerostats and drones

Growing use of AI and computer vision in border monitoring

Adoption of mobile and rapid-deploy inspection systems

Cloud-based data fusion and analytics platforms

Emphasis on privacy-by-design and compliance frameworks - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Unit Economics, 2020–2025

- By Solution Type (in Value %)

Surveillance and reconnaissance systems

Biometric identification systems

Inspection and screening systems

Command, control and communication platforms

Perimeter security infrastructure

Cybersecurity and data analytics platforms - By Technology (in Value %)

Radar and RF sensing

Electro-optical and infrared imaging

AI-enabled video analytics

Biometric modalities

Unmanned aerial and ground systems

Satellite and aerostat surveillance - By Deployment Environment (in Value %)

Land border security

Maritime border security

Aerial border surveillance

Ports of entry

Remote and rugged terrain monitoring - By Component (in Value %)

Hardware systems

Software platforms

Integration and installation services

Maintenance and lifecycle support

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology portfolio depth, system interoperability, federal contract footprint, deployment scalability, lifecycle service capabilities, cybersecurity compliance, AI and analytics maturity, pricing competitiveness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Lockheed Martin

Raytheon Technologies

Northrop Grumman

Booz Allen Hamilton

Palantir Technologies

Leidos

L3Harris Technologies

BAE Systems

General Dynamics Mission Systems

Elbit Systems of America

Thales Group

Anduril Industries

FLIR Systems (Teledyne FLIR)

OSI Systems

Motorola Solutions

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Unit Economics, 2026–2035