Market Overview

The US commercial aircraft cabin lighting market current size stands at around USD ~ million, reflecting sustained replacement cycles across active fleets and ongoing cabin modernization programs. Demand is shaped by recurring maintenance intervals, retrofit campaigns targeting LED conversion, and standardization of emergency lighting compliance. Capital allocation remains oriented toward reliability and lifecycle optimization, with procurement emphasizing certified components and modular architectures. Investment flows prioritize upgrades that enhance passenger experience and reduce operational complexity across installed platforms.

Demand concentrates around major aviation hubs with dense airline operations and established maintenance ecosystems, including coastal gateway cities and central fleet maintenance clusters. Infrastructure maturity, availability of certified maintenance organizations, and proximity to aircraft assembly and overhaul facilities shape regional intensity. Strong airline network density supports faster retrofit cycles, while policy emphasis on safety compliance and sustainability standards reinforces adoption. Ecosystem maturity across suppliers, integrators, and service providers further anchors demand concentration in high-traffic aviation corridors.

Market Segmentation

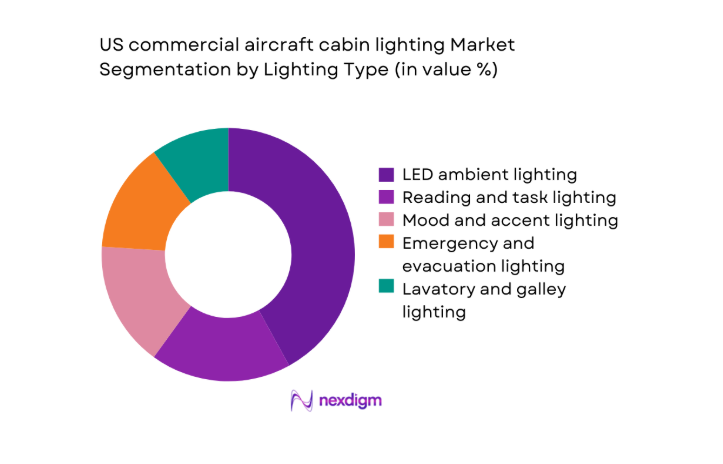

By Lighting Type

LED ambient and mood lighting dominate due to lower power draw, longer service intervals, and compatibility with cabin management systems. Emergency and evacuation lighting remains non-discretionary, sustaining baseline demand regardless of traffic cycles. Reading and task lighting upgrades track premium cabin refurbishments, while lavatory and galley lighting benefit from hygiene-driven design updates and modular replacements. Airlines increasingly standardize tunable lighting to support circadian rhythm programs, improving passenger experience on long-haul routes. Certification readiness and retrofit simplicity reinforce preference for integrated LED architectures, while legacy fluorescent systems continue to phase out across active fleets.

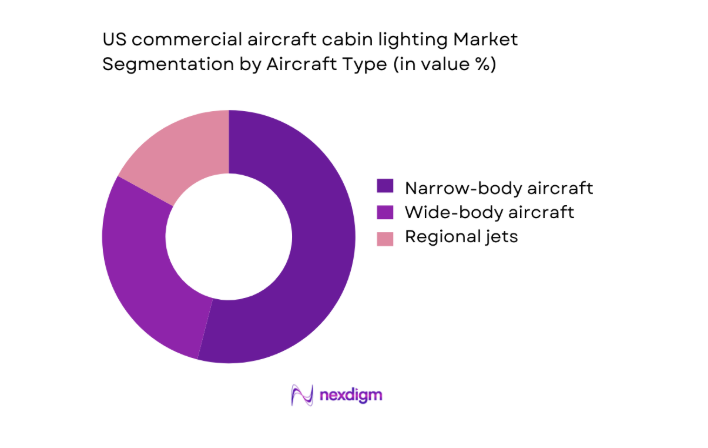

By Aircraft Type

Narrow-body fleets dominate demand due to higher utilization rates and accelerated retrofit schedules driven by domestic network density. Wide-body aircraft contribute through premium cabin refurbishments and long-haul experience differentiation, while regional jets sustain steady replacement cycles aligned with high-frequency operations. Fleet age profiles and route economics shape upgrade cadence, with narrow-body platforms prioritized for standardized LED conversions. Retrofit accessibility, downtime constraints, and maintenance planning further tilt demand toward aircraft with higher daily cycles, reinforcing narrow-body leadership across domestic carriers.

Competitive Landscape

Competition is shaped by certification breadth, integration capability with cabin management systems, and service coverage across major maintenance hubs. Players differentiate through modular product portfolios, retrofit speed, and lifecycle support models aligned with airline maintenance planning and safety compliance priorities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran Cabin | 1896 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| STG Aerospace | 1995 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Astronics Corporation | 1968 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

US commercial aircraft cabin lighting Market Analysis

Growth Drivers

Rising aircraft deliveries and fleet modernization in the US

Fleet induction and modernization cycles intensified across domestic carriers as 2024 saw 620 single-aisle aircraft added to active service and 2025 schedules planned 680 further inductions across primary hubs. FAA airworthiness directives issued in 2023 required updates to emergency illumination photometric thresholds on 240 aircraft types, accelerating compliant lighting replacements. Airport gate utilization averaged 12 hours daily at 25 major hubs during 2024, increasing cabin wear cycles and maintenance triggers. MRO turnarounds shortened to 7 days for routine cabin work in 2025, enabling bundled lighting retrofits aligned with delivery acceptance and scheduled heavy checks.

Airline focus on passenger experience differentiation

Passenger experience programs expanded as 2024 domestic load factors reached 86 across trunk routes, pushing carriers to differentiate cabin ambiance on high-frequency sectors. In 2023, 18 US airports completed terminal lighting harmonization pilots linked to aircraft cabin ambiance alignment for brand continuity. Cabin satisfaction indices collected by federal transport agencies in 2024 recorded 9 service quality metrics tied to lighting comfort, eye strain, and nighttime visibility. Airlines completed 310 cabin refresh programs in 2025 within narrow-body fleets, integrating tunable lighting scenes to support red-eye operations, reduce fatigue, and improve boarding efficiency under constrained turnaround windows.

Challenges

High certification and qualification costs for new lighting technologies

Certification cycles constrain adoption as FAA technical standard orders expanded in 2023 to include 14 additional photometric and electromagnetic compatibility tests for cabin lighting assemblies. Type certification programs averaged 24 months across 2024 approvals, delaying fleetwide deployment. Engineering validation required 6 separate environmental stress tests per lighting module in 2025, extending qualification timelines. Repair station audits increased to 4 inspections annually for lighting retrofits across 32 states, raising compliance burdens. Documentation revisions mandated 11 manual updates per aircraft variant during 2024, complicating configuration control across mixed fleets.

Lengthy airline procurement and approval cycles

Procurement timelines lengthened as airline capital committees expanded approval gates from 3 stages in 2023 to 5 stages in 2025 for cabin modifications. Request-for-proposal cycles averaged 180 days in 2024 due to multi-stakeholder reviews across engineering, safety, and finance teams. Vendor qualification audits required 9 documented process validations per supplier site in 2025, delaying contract awards. Fleet planning cycles aligned cabin programs with 36 month aircraft utilization forecasts in 2024, constraining flexibility. Legal and compliance reviews added 45 days to contracting cycles across major network carriers.

Opportunities

Fleet retrofit programs for legacy cabin lighting systems

Legacy platforms remain prevalent as 2024 fleet audits identified 3,800 active narrow-body aircraft operating fluorescent or early LED systems across domestic networks. Scheduled heavy maintenance checks in 2025 covered 1,120 aircraft, creating natural windows for lighting retrofits without incremental downtime. FAA maintenance planning documents in 2023 formalized bundled cabin upgrade pathways within C-check intervals, improving execution efficiency. Regional carriers operated 940 aircraft exceeding 12 service years in 2024, presenting upgrade pools aligned with reliability targets. Airport slot constraints in 2025 incentivized faster turnarounds, favoring modular lighting replacements.

Adoption of smart and sensor-driven lighting for cabin optimization

Smart lighting integration expanded as 2024 cabin management upgrades deployed sensor arrays across 210 aircraft to modulate aisle illumination during boarding and night phases. FAA human factors guidance issued in 2023 recognized adaptive lighting for reduced glare incidents, citing 1,400 incident reports across night operations. Maintenance data logs in 2025 showed 28 fault categories reduced through sensor-based diagnostics for lighting circuits. Domestic carriers executed 95 pilot programs in 2024 integrating lighting with inflight systems to automate scene changes, improving crew workflow and reducing manual overrides across high-frequency short-haul operations.

Future Outlook

The market outlook through 2035 reflects steady retrofit momentum aligned with fleet renewal cycles and stricter compliance expectations. Adoption of tunable and smart lighting will deepen as cabin management integration matures. Policy emphasis on safety and sustainability will reinforce replacement demand, while modular designs will compress maintenance windows and support scalable upgrades.

Major Players

- Safran Cabin

- Collins Aerospace

- Diehl Aviation

- STG Aerospace

- Astronics Corporation

- Luminator Technology Group

- Honeywell Aerospace

- Jamco Corporation

- Zodiac Aerospace

- B/E Aerospace

- Precise Flight

- Aircraft Cabin Systems

- Avionic Instruments

- Cobham Aerospace Communications

- Rockwell Collins

Key Target Audience

- Commercial airline fleet operators

- Aircraft original equipment manufacturers

- Maintenance, repair, and overhaul organizations

- Aircraft leasing companies

- Cabin interior integrators and modification centers

- Investments and venture capital firms

- Government and regulatory bodies with agency names such as the Federal Aviation Administration

- Airport authorities and infrastructure operators

Research Methodology

Step 1: Identification of Key Variables

Operational variables across fleet age, utilization cycles, certification pathways, and maintenance intervals are mapped to cabin lighting adoption triggers. Technical variables include photometric compliance thresholds, system integration requirements, and retrofit accessibility across aircraft variants.

Step 2: Market Analysis and Construction

Demand is constructed from fleet induction schedules, maintenance check frequencies, and cabin refurbishment cadences. Supply-side capacity is mapped through certified production throughput, service coverage across maintenance hubs, and installation readiness across aircraft families.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions are validated through structured consultations with fleet planners, maintenance engineers, and certification specialists. Operational constraints, retrofit windows, and compliance timelines are cross-verified against institutional guidance and maintenance planning documentation.

Step 4: Research Synthesis and Final Output

Insights are synthesized into scenario-based outlooks reflecting regulatory evolution, fleet renewal pacing, and technology integration readiness. Findings are stress-tested against operational indicators and consolidated into actionable strategic narratives for decision-makers.

- Executive Summary

- Research Methodology (Market Definitions and cabin lighting system taxonomy, OEM and MRO shipment tracking for lighting systems, Aircraft delivery and retrofit installation analysis, Airline fleet interviews and lighting upgrade surveys, FAA certification and compliance mapping for lighting technologies, Teardown-based BOM and unit cost modeling, Supplier pricing and contract benchmarking)

- Definition and Scope

- Market evolution

- Usage and passenger experience pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising aircraft deliveries and fleet modernization in the US

Airline focus on passenger experience differentiation

Adoption of energy-efficient LED systems to reduce operating costs

Increased retrofit demand from aging narrow-body fleets

Branding-driven cabin mood lighting investments by full-service carriers

Regulatory compliance requirements for emergency and evacuation lighting upgrades - Challenges

High certification and qualification costs for new lighting technologies

Lengthy airline procurement and approval cycles

Price pressure from airline cost optimization initiatives

Integration complexity with legacy cabin management systems

Supply chain disruptions affecting electronic components

Long replacement cycles limiting aftermarket volumes - Opportunities

Fleet retrofit programs for legacy cabin lighting systems

Adoption of smart and sensor-driven lighting for cabin optimization

Customization demand from premium cabin refurbishments

Growth in regional jet cabin refurbishments

Partnerships with cabin interior integrators and MROs

Sustainability-driven upgrades to low-power lighting platforms - Trends

Transition from fluorescent to fully LED-based cabin lighting

Increased use of dynamic mood lighting for circadian rhythm support

Integration of lighting controls with inflight entertainment systems

Modular lighting designs for faster maintenance turnaround

Use of lightweight materials to reduce aircraft weight

Digital twins for cabin lighting lifecycle management - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Lighting Type (in Value %)

LED ambient lighting

Reading and task lighting

Mood and accent lighting

Emergency and evacuation lighting

Lavatory and galley lighting - By Aircraft Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional jets - By Installation Type (in Value %)

Line-fit installations

Retrofit and aftermarket upgrades - By Cabin Zone (in Value %)

Passenger seating areas

Overhead bins and aisles

Galleys and service areas

Lavatories

Crew rest and cockpit-adjacent areas - By Technology and Control System (in Value %)

Static white lighting systems

RGB and tunable color lighting systems

Smart lighting with cabin management system integration

IoT-enabled and sensor-based lighting controls

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, FAA certification coverage, airline OEM approvals, pricing competitiveness, retrofit installation support, CMS integration capability, geographic service footprint, aftermarket support network)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran Cabin

Collins Aerospace

Diehl Aviation

STG Aerospace

Astronics Corporation

Luminator Technology Group

Honeywell Aerospace

Cobham Aerospace Communications

Jamco Corporation

Zodiac Aerospace

Rockwell Collins

B/E Aerospace

Precise Flight

Aircraft Cabin Systems

Avionic Instruments

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035