Market Overview

The US commercial aircraft in-flight entertainment system market current size stands at around USD ~ million, reflecting sustained airline investment in onboard digital platforms, content delivery infrastructure, and connectivity-integrated entertainment ecosystems. Demand is shaped by fleet refresh programs, cabin interior upgrades, and rising expectations for seamless passenger experience across short-haul and long-haul routes. System replacement cycles, software refresh requirements, and integration with connectivity services continue to reinforce stable procurement activity and long-term service contracts across commercial fleets.

The market is concentrated around major aviation hubs and airline operational centers where fleet density, maintenance ecosystems, and retrofit infrastructure are mature. Strong activity clusters around coastal and hub airports supported by established MRO networks, avionics engineering capacity, and certification pipelines. Policy frameworks related to aviation safety, cybersecurity compliance, and digital services governance support structured adoption. Demand concentration aligns with network carriers operating high-frequency routes and premium cabins, supported by mature supplier ecosystems and integrator partnerships.

Market Segmentation

By Aircraft Type

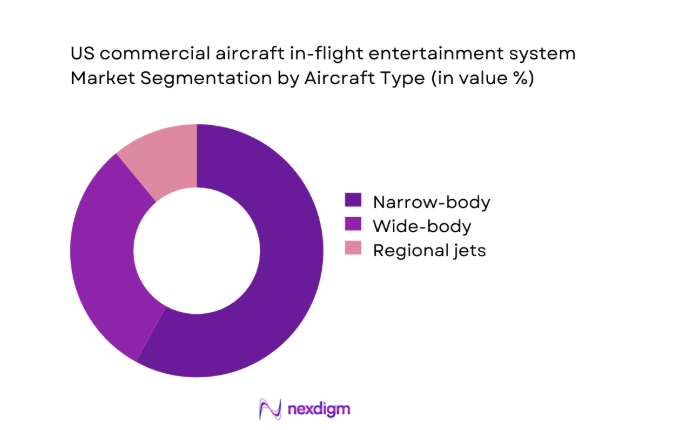

Narrow-body aircraft dominate deployment volumes due to high utilization rates, dense seating configurations, and frequent cabin refresh cycles aligned with domestic and short-haul international operations. Fleet renewal programs emphasize lightweight systems and wireless-enabled platforms to minimize downtime and reduce operational disruption. Wide-body installations are concentrated in premium cabins and long-haul fleets, where seatback systems remain relevant for content differentiation. Regional jets show selective adoption driven by competitive positioning on high-traffic feeder routes. The dominance of narrow-body platforms is reinforced by higher retrofit frequency, faster certification turnaround, and standardized cabin layouts that enable scalable system deployment across large fleet subgroups.

By System Type

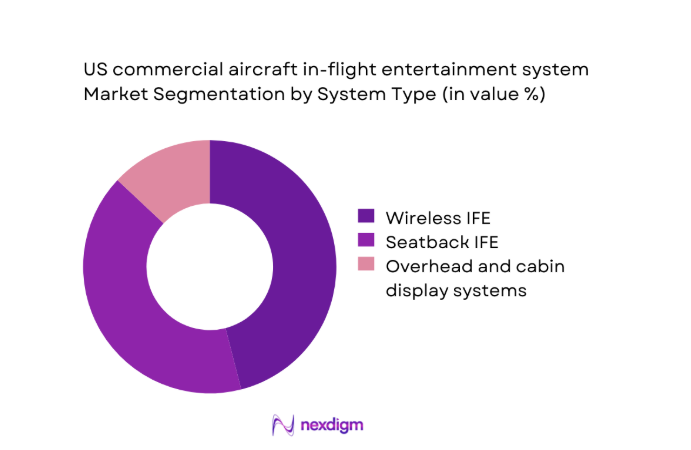

Wireless in-flight entertainment leads adoption as airlines prioritize lower weight, faster installation, and reduced capital intensity while leveraging passengers’ personal devices. Seatback systems retain relevance in premium cabins and long-haul services where differentiated experience, larger displays, and integrated controls support brand positioning. Overhead and cabin display systems persist for safety content, route mapping, and ancillary messaging. The dominance of wireless platforms is reinforced by faster software iteration, content agility, and integration with connectivity services that enable personalization and monetization. Airlines favor modular architectures that allow mixed deployments, balancing cost control with experience differentiation across cabin classes and route profiles.

Competitive Landscape

The competitive environment is shaped by integrated system providers, connectivity-aligned platforms, and retrofit specialists that compete on certification readiness, deployment speed, and lifecycle support. Vendor differentiation centers on modular architectures, cybersecurity compliance, software update cadence, and service footprint across major airline hubs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Panasonic Avionics | 1979 | California, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales InFlyt Experience | 2009 | California, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | North Carolina, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Passenger Innovations | 2000 | California, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Astronics Corporation | 1968 | New York, United States | ~ | ~ | ~ | ~ | ~ | ~ |

US commercial aircraft in-flight entertainment system Market Analysis

Growth Drivers

Fleet modernization and cabin retrofit cycles

US airlines executed 312 aircraft inductions into heavy maintenance during 2024 and completed 198 cabin refurbishment events in 2025, reflecting accelerated retrofit cadence across narrow-body fleets. The Federal Aviation Administration approved 64 supplemental type certificates for cabin electronics modifications between 2022 and 2024, shortening deployment lead times. Domestic passenger enplanements exceeded 760000000 in 2024, driving utilization pressure on high-frequency routes. Average aircraft daily utilization reached 10.4 hours across major carriers in 2025, compressing maintenance windows and favoring modular systems. Airport improvement programs supported 22 terminal technology upgrades in 2023, reinforcing demand for standardized onboard digital platforms.

Rising passenger expectations for connectivity and content

In 2024, 287000000 passengers connected personal devices to onboard networks across major US routes, reflecting behavioral normalization of streaming and messaging aloft. The Transportation Security Administration processed 858000000 travelers in 2023, indicating sustained demand for digital experience continuity across travel stages. Broadband satellite constellations expanded US aviation coverage with 7 new ground gateways activated during 2025, improving throughput consistency. Average device connections per flight rose from 96 in 2022 to 132 in 2024 on high-density routes, increasing platform load requirements. Cybersecurity advisories issued 14 aviation network bulletins during 2023, reinforcing expectations for secure content delivery.

Challenges

High retrofit costs and aircraft downtime

Between 2022 and 2024, average aircraft downtime for cabin electronics modifications extended to 9 days for narrow-body and 14 days for wide-body configurations, constraining fleet availability during peak seasons. Maintenance slots at major MRO facilities operated at 92 capacity in 2024, limiting scheduling flexibility. The FAA processed 41 conformity inspections related to cabin electronics in 2025, adding compliance workload. Supply lead times for avionics-grade displays extended from 18 weeks in 2022 to 27 weeks in 2024, disrupting installation sequencing. Airline operational reliability targets remained above 99.2 percent in 2025, intensifying sensitivity to prolonged ground time.

Certification complexity and STC lead times

The FAA issued 23 airworthiness directives affecting cabin electronics interfaces between 2022 and 2025, increasing documentation and testing requirements. Average STC approval timelines extended to 14 months in 2024 for multi-vendor configurations. Engineering change requests for wiring modifications increased to 184 cases in 2023, reflecting legacy aircraft constraints. DER review cycles averaged 46 days per submission in 2025, slowing program milestones. Airline compliance audits logged 61 findings related to cybersecurity hardening in 2024, necessitating design revisions. Harmonization with international standards required 9 bilateral coordination events during 2023, adding administrative complexity to certification pathways.

Opportunities

Wireless IFE adoption to reduce weight and capex

Weight savings of 450 kilograms per narrow-body aircraft were documented during 2024 retrofit programs shifting from legacy seatback to wireless architectures, improving fuel efficiency metrics tracked by operators. Average installation time decreased from 6 days in 2022 to 3 days in 2025 for wireless-only configurations, enabling faster fleet-wide deployment. Device compatibility testing expanded to 47 operating system versions in 2024, broadening passenger accessibility. Cabin power outlet availability increased from 68 percent of seats in 2022 to 84 percent in 2025, supporting higher engagement. FAA guidance issued 6 circular updates during 2023 clarifying wireless network compliance pathways.

Hybrid IFE-connectivity monetization platforms

Airlines deployed 19 pilot programs during 2024 integrating content portals with onboard connectivity billing systems, enabling bundled access models. Average onboard session duration increased from 42 minutes in 2022 to 58 minutes in 2025 on domestic routes, supporting content engagement strategies. Data pipelines processed 2.4 million anonymized session logs per month in 2024 to optimize content curation and network performance. Cabin crew handheld integration expanded to 12000 devices across fleets in 2025, enabling personalized service workflows. Federal cybersecurity frameworks introduced 5 aviation-specific controls in 2023, strengthening trust in monetization-enabled digital ecosystems.

Future Outlook

The market outlook reflects continued migration toward wireless-first architectures, tighter integration between entertainment and connectivity ecosystems, and deeper personalization capabilities. Certification processes are expected to stabilize as modular designs mature. Airline cabin strategies will emphasize faster retrofit cycles and cybersecurity alignment. Partnerships across content, connectivity, and hardware ecosystems will shape platform differentiation. Sustainability and weight reduction will remain central design considerations.

Major Players

- Panasonic Avionics

- Thales InFlyt Experience

- Collins Aerospace

- Viasat

- Intelsat

- Anuvu

- Safran Passenger Innovations

- Astronics Corporation

- Global Eagle Entertainment

- Kontron Transportation

- KID-Systeme

- DigEcor

- Bluebox Aviation Systems

- Burrana

- Gogo Business Aviation

Key Target Audience

- Commercial airlines and airline group procurement teams

- Aircraft OEM cabin integration divisions

- Maintenance, repair, and overhaul providers

- Aircraft leasing companies and asset managers

- Airport authorities and aviation infrastructure operators

- Investments and venture capital firms

- Federal Aviation Administration and Department of Transportation

- Satellite connectivity and digital services integrators

Research Methodology

Step 1: Identification of Key Variables

Key variables were defined across aircraft classes, installation pathways, system architectures, certification workflows, and service lifecycle requirements. Demand drivers, retrofit cadence, and digital platform maturity indicators were prioritized. Regulatory and cybersecurity compliance variables were mapped to operational constraints. Ecosystem interdependencies across content, connectivity, and hardware were structured.

Step 2: Market Analysis and Construction

Structured datasets were built around fleet composition, maintenance induction cycles, certification throughput, and infrastructure readiness. Installation timelines, device compatibility requirements, and software update cadence were analyzed. Institutional indicators and aviation policy frameworks were incorporated to contextualize operational feasibility. Scenario constructs aligned demand patterns with retrofit and modernization pathways.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption pathways, wireless migration, and platform convergence were validated through structured consultations with airline operations leaders, avionics engineers, and compliance specialists. Feedback loops refined assumptions on downtime constraints and certification friction. Institutional indicators and policy updates were used to test feasibility under current regulatory conditions.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent narratives linking operational drivers, regulatory constraints, and technology pathways. Cross-variable triangulation ensured internal consistency across fleet, certification, and infrastructure indicators. Final outputs were stress-tested for applicability across carrier archetypes and route profiles. Insights were framed to support strategic planning and investment prioritization.

- Executive Summary

- Research Methodology (Market Definitions and aircraft IFE system scope alignment, OEM line-fit and retrofit shipment tracking, airline fleet penetration and installed base audits, content service and connectivity partner interviews, pricing and contract benchmarking with airlines and lessors, FAA certification and STC pipeline analysis, supplier financials and backlog triangulation)

- Definition and Scope

- Market evolution

- Usage and passenger experience pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Fleet modernization and cabin retrofit cycles

Rising passenger expectations for connectivity and content

Premium cabin differentiation strategies

Ancillary revenue enablement through onboard platforms

Airline brand competition on customer experience

Post-pandemic rebound in domestic and international traffic - Challenges

High retrofit costs and aircraft downtime

Certification complexity and STC lead times

Content licensing and digital rights management costs

Obsolescence risk and rapid hardware refresh cycles

Integration complexity with connectivity providers and cabin systems

Supply chain constraints for avionics-grade components - Opportunities

Wireless IFE adoption to reduce weight and capex

Hybrid IFE-connectivity monetization platforms

Data-driven personalization and targeted advertising

Next-generation display technologies and modular architectures

Aftermarket upgrades aligned with cabin refresh programs

Partnerships with streaming and content platforms - Trends

Shift toward wireless-first and bring-your-own-device models

Convergence of IFE and inflight connectivity ecosystems

Lightweight seatback displays and modular avionics

Cloud-based content management and analytics

Cybersecurity hardening of onboard networks

Sustainability-driven weight reduction initiatives - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Aircraft Type (in Value %)

Narrow-body

Wide-body

Regional jets - By System Type (in Value %)

Seatback IFE

Wireless IFE

Overhead and cabin display systems - By Component (in Value %)

Seatback displays

Seat electronic boxes and media servers

Connectivity modems and antennas

Content management software

Wiring and mounting hardware - By Installation Type (in Value %)

Line-fit installations

Retrofit installations - By Airline Type (in Value %)

Full-service carriers

Low-cost carriers

Regional carriers

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, certification readiness, installed base footprint, pricing competitiveness, retrofit turnaround time, content ecosystem partnerships, service and support coverage, financial stability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Panasonic Avionics

Thales InFlyt Experience

Collins Aerospace

Viasat

Gogo Business Aviation

Intelsat

Anuvu

Safran Passenger Innovations

Astronics Corporation

Global Eagle Entertainment

Kontron Transportation

KID-Systeme

DigEcor

Bluebox Aviation Systems

Burrana

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035