Market Overview

The US commercial aircraft market current size stands at around USD ~ million, reflecting sustained fleet replacement cycles and strong domestic route density supported by hub-and-spoke operations. Demand is anchored by narrowbody utilization across high-frequency corridors and cargo fleet expansion for express logistics. Capital deployment remains focused on fuel-efficient platforms, reliability upgrades, and lifecycle serviceability, while procurement strategies emphasize delivery certainty and maintenance support ecosystems aligned with airline operational resilience and network continuity.

Activity concentrates in major aviation hubs such as Seattle, Dallas–Fort Worth, Atlanta, Chicago, Los Angeles, Phoenix, and Miami, where dense route networks, maintenance clusters, and supply-chain depth reinforce ecosystem maturity. Proximity to OEM engineering centers, Tier-1 manufacturing corridors, and MRO bases accelerates deployment and retrofit cycles. Policy alignment around safety certification, sustainability pathways, and airport modernization further supports concentration, while cargo gateways benefit from logistics parks, intermodal connectivity, and dedicated freighter infrastructure.

Market Segmentation

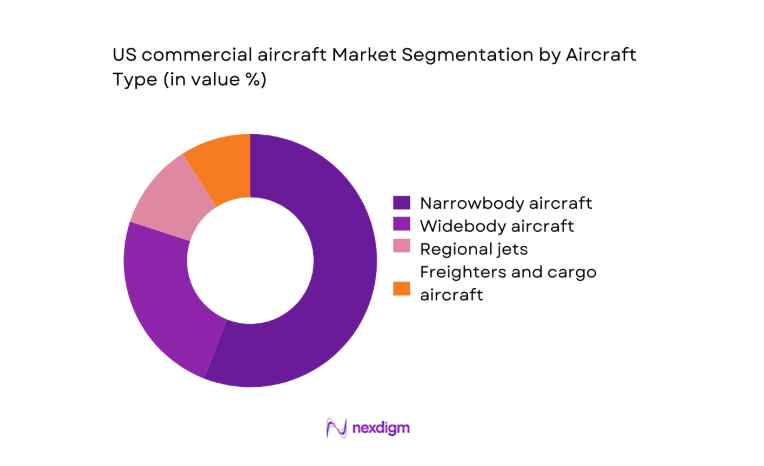

By Aircraft Type

Narrowbody platforms dominate procurement due to high-frequency domestic corridors, dense seating configurations, and rapid turn times across hub-and-spoke networks. Fleet commonality reduces pilot training complexity and spares inventory burden, improving dispatch reliability. Widebody activity concentrates on transcontinental and select international routes supported by premium cabin demand and cargo belly capacity. Regional jets remain relevant for thin routes feeding primary hubs, while dedicated freighters expand with express parcel networks and integrator-led scheduling models. Aircraft type choices reflect route economics, airport slot constraints, and maintenance ecosystem availability across major metropolitan clusters.

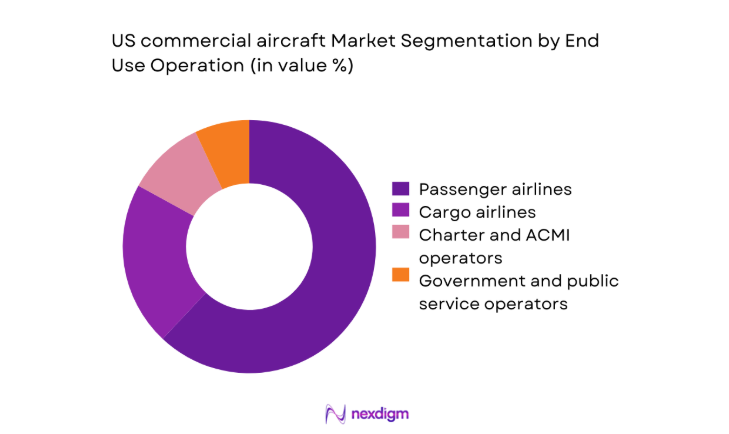

By End Use Operation

Passenger airlines account for the majority of deliveries driven by domestic demand concentration, schedule recovery, and network densification strategies. Cargo airlines continue to scale fleets to support time-definite delivery, hub sorting automation, and cross-border e-commerce lanes. Charter and ACMI operators serve seasonal peaks and capacity smoothing for scheduled carriers, enabling flexible capacity deployment without long-term ownership exposure. Government and public service operators procure specialized configurations for mobility and disaster response, leveraging domestic maintenance networks and regulatory alignment to ensure rapid readiness and lifecycle support.

Competitive Landscape

The competitive environment is shaped by concentrated OEM production, vertically integrated engine and avionics ecosystems, and dense Tier-1 manufacturing corridors. Competitive differentiation centers on delivery reliability, fleet commonality fit, aftermarket depth, and certification readiness, with service networks embedded across major hubs and MRO clusters.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Boeing | 1916 | Arlington, VA | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ | ~ |

| GE Aerospace | 1917 | Evendale, OH | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX | 1930 | Arlington, VA | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

US commercial aircraft Market Analysis

Growth Drivers

Rising domestic and international air passenger demand

US passenger throughput across primary hubs increased steadily during 2024 and 2025 as route frequencies normalized and long-haul schedules reopened. TSA daily checkpoint screenings averaged 2300000 in 2024 and exceeded 2450000 on peak days in 2025, supporting higher aircraft utilization. FAA air traffic operations surpassed 16000000 movements in 2024, reinforcing capacity needs on trunk routes. Airport runway rehabilitation projects across 2024 enabled higher on-time performance, while terminal gate expansions added 420 contact gates nationwide in 2025. These indicators raise fleet deployment intensity, pushing carriers toward higher-frequency narrowbody operations and selective widebody redeployment.

Fleet modernization to improve fuel efficiency and operating economics

US carriers accelerated retirements of older aircraft types during 2024 and 2025 as maintenance checks approached heavy cycles. FAA registry updates show thousands of aircraft transitions between active and storage status annually, tightening operational planning. Engine shop visit volumes increased across 2024, reflecting maintenance cycle convergence and the need for newer propulsion architectures. SAF blending mandates at several hubs advanced in 2025, reinforcing procurement preferences for platforms certified for higher blend rates. Airport noise compliance programs expanded across metropolitan regions in 2024, pressuring fleets toward quieter configurations and newer airframes that reduce operational constraints on night operations.

Challenges

Supply chain constraints for engines, avionics, and structures

Tier-1 delivery schedules faced volatility across 2024 and 2025 as lead times for castings, forgings, and semiconductors extended beyond typical planning cycles. FAA production oversight actions during 2024 increased documentation requirements, slowing throughput at assembly lines. US manufacturing employment in aerospace remained below pre-pandemic levels in 2024, constraining surge capacity. Port congestion metrics during early 2025 reflected extended dwell times for specialized components. These factors compress delivery windows, elevate inventory buffers, and complicate airline fleet induction schedules, forcing interim lease extensions and operational workarounds across high-utilization corridors nationwide.

Production rate instability and delivery delays

OEM rate adjustments during 2024 resulted in uneven monthly delivery profiles, complicating airline capacity planning. FAA conformity inspections expanded in scope during 2024 and 2025, increasing cycle times for completed aircraft acceptance. Airport slot coordination bodies reported schedule re-optimizations across multiple hubs in 2025 as deliveries slipped into later quarters. Airline training pipelines recorded bottlenecks in 2024 as simulator availability lagged induction schedules, delaying crew readiness. These frictions cascade into network planning, forcing temporary wet-lease utilization and route frequency trimming during peak periods, eroding schedule reliability and operational resilience.

Opportunities

Next-generation narrowbody re-fleeting programs

US carriers advanced fleet plans in 2024 and 2025 to replace aging narrowbodies aligned with domestic corridor density. FAA certification pathways for incremental efficiency upgrades progressed in 2024, enabling phased induction without major infrastructure changes. Airport gate compatibility audits in 2025 confirmed readiness for higher-capacity single-aisle configurations across hundreds of gates. SAF availability expanded at major hubs in 2025, supporting operational pilots on newer platforms. Workforce training throughput increased during 2024 as pilot pipelines stabilized, creating conditions for accelerated induction cycles that enhance network frequency while lowering fuel burn per available seat mile.

Growth of dedicated air cargo and freighter conversions

Express integrators expanded hub automation in 2024 and 2025, increasing nightly sort capacity and driving demand for additional lift. Customs modernization pilots at key gateways in 2024 reduced clearance times, improving aircraft turn efficiency for international parcels. Warehouse construction permits across logistics corridors rose in 2025, supporting higher feeder network density. FAA approvals for supplemental type certificates progressed during 2024, enabling faster conversion timelines for mid-life airframes. These conditions support scalable freighter deployment aligned with time-definite delivery growth, strengthening hub-and-spoke cargo connectivity across domestic and transborder lanes.

Future Outlook

Fleet strategies through 2035 will emphasize narrowbody densification, selective widebody redeployment on premium routes, and cargo network scaling aligned with e-commerce flows. Policy momentum on SAF and noise compliance will shape specifications and retrofit pathways. Infrastructure upgrades at major hubs will enable higher utilization, while delivery reliability and maintenance capacity will remain decisive for deployment pacing.

Major Players

- Boeing

- Airbus

- GE Aerospace

- RTX

- Safran

- Spirit AeroSystems

- Honeywell Aerospace

- Parker Hannifin Aerospace

- L3Harris Technologies

- Hexcel

- Triumph Group

- Textron Aviation

- Embraer

- GKN Aerospace

- Leonardo

Key Target Audience

- Commercial passenger airlines

- Cargo and express logistics airlines

- Aircraft leasing companies

- MRO service providers

- Airport authorities and operators

- Original equipment component suppliers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Operational variables included fleet age profiles, utilization intensity across hub corridors, certification timelines, and maintenance cycle clustering. Infrastructure readiness, gate compatibility, SAF availability, and training throughput were mapped to deployment feasibility. Regulatory variables captured certification scope and compliance cadence.

Step 2: Market Analysis and Construction

Route density, airport capacity programs, and MRO coverage were synthesized to construct demand scenarios. Fleet transition pathways were aligned with certification readiness and infrastructure constraints. Scenario construction emphasized operational continuity under delivery volatility.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on induction pacing, maintenance capacity, and training throughput were validated with operators, maintenance planners, and regulatory liaisons. Feedback refined bottleneck identification and mitigation sequencing under current compliance frameworks.

Step 4: Research Synthesis and Final Output

Findings were integrated into deployment pathways, risk registers, and opportunity maps. Outputs aligned infrastructure readiness with fleet strategies, emphasizing operational resilience and compliance-led pacing.

- Executive Summary

- Research Methodology (Market Definitions and commercial aircraft classification by type and mission profile, OEM and Tier-1 production rate tracking and backlog analysis, FAA registry and fleet age profile assessment, airline fleet plan and capacity deployment interviews, airport infrastructure and MRO capacity mapping, leasing and financing transaction benchmarking, defense-civil crossover manufacturing impact assessment)

- Definition and Scope

- Market evolution

- Usage or care pathways

- Ecosystem structure

- Supply chain or channel structure

- Regulatory environment

- Growth Drivers

Rising domestic and international air passenger demand

Fleet modernization to improve fuel efficiency and operating economics

Expansion of e-commerce and express cargo networks

Replacement of aging narrowbody fleets

Recovery of long-haul traffic and international route capacity

Airport hub expansion and slot optimization - Challenges

Supply chain constraints for engines, avionics, and structures

Production rate instability and delivery delays

Labor shortages in manufacturing and MRO

OEM quality control and certification bottlenecks

High capital costs and financing constraints

Geopolitical and trade policy uncertainty affecting suppliers - Opportunities

Next-generation narrowbody re-fleeting programs

Growth of dedicated air cargo and freighter conversions

Sustainable aviation fuel adoption and retrofit opportunities

Digital aircraft health monitoring and predictive maintenance integration

Expansion of regional connectivity with right-sized aircraft

Domestic manufacturing and reshoring of critical components - Trends

Acceleration of fleet commonality strategies among US carriers

Increased adoption of operating leases for balance sheet flexibility

Integration of SAF capability in new aircraft specifications

Rising order intake for narrowbody aircraft with higher seating density

Freighter conversions of mid-life widebody aircraft

Enhanced cabin configurations for premium and hybrid service models - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Aircraft Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Freighters and cargo aircraft - By Propulsion Type (in Value %)

Turbofan

Geared turbofan

Turboprop

Hybrid-electric and alternative propulsion - By Range Class (in Value %)

Short-haul

Medium-haul

Long-haul - By End Use Operation (in Value %)

Passenger airlines

Cargo airlines

Charter and ACMI operators

Government and public service operators - By Ownership Model (in Value %)

Direct airline ownership

Operating lease

Finance lease

Sale and leaseback

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet commonality fit, delivery lead time, total cost of ownership, fuel efficiency performance, cabin configuration flexibility, aftermarket support footprint, financing and leasing support, sustainability readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Boeing

Airbus

GE Aerospace

RTX (Pratt & Whitney, Collins Aerospace)

Safran

Spirit AeroSystems

Honeywell Aerospace

Parker Hannifin Aerospace

L3Harris Technologies

Hexcel

Triumph Group

Textron Aviation

Embraer

GKN Aerospace

Leonardo

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035