Market Overview

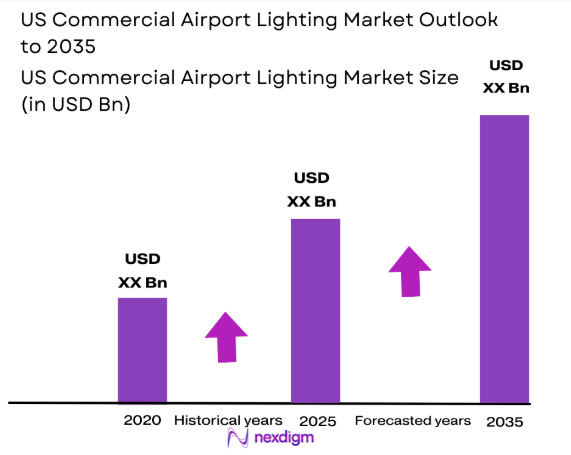

Based on a recent historical assessment, the US commercial airport lighting market has reached an estimated size of USD ~ billion. This growth is driven by the continuous expansion of airport infrastructures, particularly in major hubs across the country. Technological advancements, including LED lighting systems and solar-powered solutions, are further driving demand. The focus on energy efficiency and safety regulations is also contributing to the market’s ongoing development, with investments aimed at replacing outdated systems and meeting sustainability goals.

The market is dominated by cities such as New York, Los Angeles, and Chicago, where major airports are continually expanding and modernizing their infrastructure. The dominance of these cities is due to high traffic volumes, government investment in upgrading airport facilities, and their strategic importance in global air travel. Additionally, these locations benefit from proximity to key stakeholders and a highly developed technological and logistics ecosystem, making them attractive for advancements in airport lighting technologies.

Market Segmentation

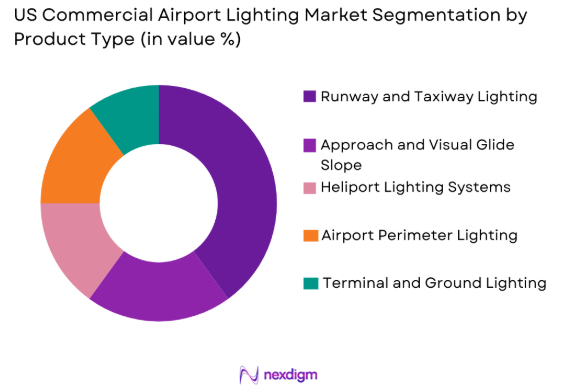

By Product Type

The US commercial airport lighting market is segmented by product type into runway and taxiway lighting, approach and visual glide slope systems, heliport lighting systems, airport perimeter lighting, and terminal and ground lighting systems. Recently, runway and taxiway lighting systems have dominated the market due to their critical role in aviation safety and increased demand for compliance with updated regulations. These systems require high visibility, durability, and low maintenance, driving continued investment and innovation in this segment. Technological advancements in LED and solar-powered lighting solutions have also made runway and taxiway lighting more energy-efficient and cost-effective, increasing their adoption in major airports.

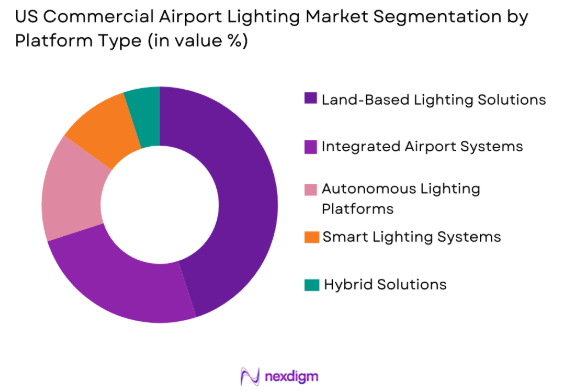

By Platform Type

The US commercial airport lighting market is segmented by platform type into land-based lighting solutions, integrated airport systems, autonomous lighting platforms, smart lighting systems, and hybrid solutions. Recently, land-based lighting solutions have dominated the market due to their widespread use in both small and large airports. These systems offer reliability and ease of installation, making them the preferred choice for most commercial airports. In addition, advancements in smart lighting solutions and integration with airport management systems have increased the functionality of these land-based systems, further boosting their market share.

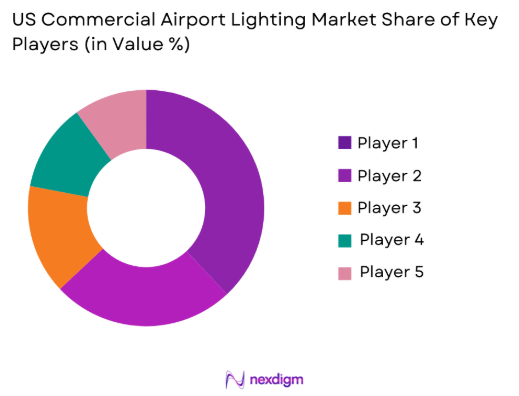

Competitive Landscape

The US commercial airport lighting market is marked by a competitive landscape with consolidation among several key players. Major companies are competing through product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. Large players in the market are focusing on the integration of advanced technologies like IoT and AI in airport lighting systems to cater to growing demand for energy efficiency and sustainability. With rising investments in infrastructure and airport modernization, these companies are capitalizing on opportunities to expand their market reach and cater to the increasing need for advanced lighting solutions in commercial airports.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameters |

| Honeywell | 1906 | Morris Plains, NJ | ~ | ~ | ~ | ~ | ~ |

| Signify | 1909 | Eindhoven, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Astronics | 1968 | East Aurora, NY | ~ | ~ | ~ | ~ | ~ |

| Eaton | 1911 | Dublin, Ireland | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | Cincinnati, OH | ~ | ~ | ~ | ~ | ~ |

US Commercial Airport Lighting Market Analysis

Growth Drivers

Government Regulations and Safety Standards

One of the key drivers of the US commercial airport lighting market is the stringent safety regulations and standards imposed by government authorities. These regulations mandate the use of lighting systems that meet high visibility and safety standards, especially for runway and taxiway lighting. Airports are increasingly investing in modern lighting solutions to ensure compliance with the Federal Aviation Administration (FAA) regulations. These safety-driven investments are pushing airports to upgrade their lighting systems to meet the growing demands of air traffic control and flight operations. Furthermore, airports are increasingly adopting energy-efficient lighting solutions, such as LED technology, to comply with environmental regulations aimed at reducing carbon emissions. The government’s role in ensuring aviation safety through regulations continues to significantly drive market growth. Additionally, the push for sustainability and energy-efficient solutions in airports is further contributing to the adoption of modern lighting technologies.

Technological Advancements in LED and Smart Lighting

Another key driver for the market is the advancement of LED technology and the rise of smart lighting systems. LED lighting is known for its energy efficiency, long lifespan, and reduced maintenance costs, making it an attractive choice for airports looking to modernize their lighting infrastructure. With airports increasingly focusing on reducing energy consumption and costs, LED systems have become a staple in commercial airports across the country. Furthermore, the integration of smart lighting systems, which can be controlled remotely and adjusted based on weather or operational conditions, is enhancing the functionality of airport lighting. These advancements in lighting technologies have driven substantial investments from both government agencies and private airport operators. Smart lighting systems also offer added benefits such as improved visibility, enhanced safety, and better integration with airport management systems, making them highly sought after in the market.

Market Challenges

High Initial Capital Expenditure

One of the major challenges faced by the US commercial airport lighting market is the high initial capital expenditure required for upgrading existing lighting systems. Modern lighting solutions, particularly LED and smart lighting systems, require significant upfront investments in infrastructure and technology. These costs can be prohibitive for smaller airports or regional airports with limited budgets. Despite the long-term savings in energy costs and maintenance, the high upfront costs of these advanced systems can deter airports from adopting them. Additionally, the complexity of integrating new systems with existing airport infrastructure adds to the financial burden, making it a significant challenge for the industry. As airports continue to expand and modernize, finding cost-effective solutions for upgrading lighting systems remains a critical challenge in the market.

Maintenance and Operational Costs

Another challenge that hinders the growth of the commercial airport lighting market is the maintenance and operational costs associated with advanced lighting systems. While technologies like LED and solar-powered systems reduce energy consumption and maintenance requirements over the long term, these systems still require periodic maintenance to ensure optimal performance. Airports must invest in trained personnel, monitoring systems, and replacement parts, which can be costly. In addition, certain lighting systems, such as smart lighting platforms, require ongoing software updates and system calibration, which adds to the operational costs. The need for continuous investment in maintenance and operational efficiency can strain the budgets of airport operators, especially in smaller airports with fewer resources.

Opportunities

Adoption of Solar-Powered Lighting Solutions

The increasing demand for sustainable and energy-efficient solutions presents a significant opportunity for the US commercial airport lighting market, particularly for solar-powered lighting systems. Solar-powered lighting solutions are becoming increasingly popular in airports due to their ability to reduce energy consumption and lower long-term operational costs. The US government’s push for sustainability in infrastructure projects, including airports, is accelerating the adoption of solar-powered solutions. Many airports are now investing in renewable energy sources, including solar lighting, to meet environmental goals and comply with energy efficiency mandates. These lighting systems not only help reduce carbon emissions but also improve the energy independence of airports. As airports continue to focus on sustainability, solar-powered lighting will play a key role in shaping the future of commercial airport lighting.

Expansion of Smart Airports and IoT Integration

The growing trend of smart airports presents an exciting opportunity for the US commercial airport lighting market. The integration of Internet of Things (IoT) technology in lighting systems enables airports to optimize energy use, improve maintenance schedules, and enhance safety. By implementing smart lighting systems, airports can remotely control lighting based on real-time operational needs, such as adjusting runway lighting during adverse weather conditions or peak flight times. This level of automation not only enhances the efficiency of lighting systems but also improves overall airport operations. As the smart airport market continues to grow, there will be increasing demand for advanced lighting solutions that can integrate with other airport management systems. The IoT revolution in airports opens up new possibilities for innovation and expansion in the lighting market.

Future Outlook

The future outlook of the US commercial airport lighting market appears promising as airports continue to focus on modernization and sustainability. Over the next five years, technological advancements in lighting, particularly the adoption of smart and LED lighting systems, will play a central role in driving market growth. Regulatory support, especially regarding energy efficiency and sustainability, will encourage further investment in advanced lighting solutions. The increasing demand for smart airports and the integration of IoT will lead to greater adoption of smart lighting systems that enhance airport operations, improve safety, and reduce energy consumption. With infrastructure expansion and the need to meet stricter regulations, the market is expected to witness significant growth in the coming years.

Major Players

- Honeywell International

- Signify

- Astronics

- Eaton

- GE Aviation

- ADB SAFEGATE

- OSRAM Licht

- Hella Automotive

- Thales Group

- L-3 Communications

- Cree, Inc.

- Whelan Security

- Philips Lighting

- Luminii Lighting

- Schneider Electric

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities and operators

- Infrastructure development firms

- Commercial airport contractors

- Airport security services

- Airlines

- Technology firms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables and factors that influence the US commercial airport lighting market, such as government regulations, technological trends, and infrastructure investments.

Step 2: Market Analysis and Construction

In this step, a thorough analysis is conducted to assess the current market size, growth drivers, challenges, and segmentation, using data from reliable industry sources and government reports.

Step 3: Hypothesis Validation and Expert Consultation

The market hypothesis is validated through consultation with industry experts, including representatives from leading airport operators, lighting manufacturers, and regulatory bodies.

Step 4: Research Synthesis and Final Output

The final output synthesizes the gathered data and insights into a comprehensive report, providing a detailed market analysis, forecasts, and actionable recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Air Traffic and Airport Expansion Projects

Technological Advancements in Energy-Efficient Lighting

Government Regulations Promoting Sustainable Airport Infrastructure

Rise in Smart Airports and Digital Transformation

Focus on Safety and Precision in Airport Operations - Market Challenges

High Capital Investment Required for Advanced Systems

Regulatory Compliance and Certification Challenges

Interoperability with Existing Airport Infrastructure

Limited Awareness of Smart and Energy-Efficient Solutions

Maintenance and Repair of Advanced Lighting Systems - Market Opportunities

Growing Demand for Solar-Powered and Sustainable Lighting

Integration of Smart Airport Technologies

Expansion of Airport Infrastructure in Emerging Economies - Trends

Adoption of LED and Energy-Efficient Lighting Solutions

Increasing Use of Autonomous Lighting Platforms

Integration of IoT for Real-Time System Management

Adoption of AI-Driven Solutions for Predictive Maintenance

Focus on Safety Standards and Compliance - Government Regulations & Defense Policy

Energy Efficiency Standards for Airport Lighting

Safety and Visibility Regulations for Runways and Taxiways

Funding Programs for Sustainable Infrastructure Projects

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Runway and Taxiway Lighting

Approach and Visual Glide Slope Systems

Heliport Lighting Systems

Airport Perimeter Lighting

Terminal and Ground Lighting Systems - By Platform Type (In Value%)

Land-Based Lighting Solutions

Integrated Airport Systems

Autonomous Lighting Platforms

Smart Lighting Systems

Hybrid Solutions - By Fitment Type (In Value%)

Fixed Lighting Solutions

Modular Systems

Smart and Adaptive Lighting

Solar-Powered Systems

Energy-Efficient Solutions - By End User Segment (In Value%)

Commercial Airports

Private and Small Airports

Government Airport Authorities

Airport Contractors and Operators

Airlines and Aviation Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

LED Lighting Technology

Smart Sensors and IoT Integration

Solar-Powered Lighting Systems

Fiber Optic Lighting Systems

Sustainable Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Market Value, Installed Units, System Complexity, Future Demand)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell International

Schneider Electric

Signify

Aviation Lighting Systems

Oberon Inc.

Astronics Corporation

Eaton Corporation

Hella Automotive

SAE International

Sensus

GE Aviation

L-3 Communications

Whelan Security

Cree, Inc.

O’Rourke Engineering

- Increased Investment by Commercial Airports in Modern Lighting

- Role of Government Agencies in Enforcing Standards

- Private Airports Focused on Sustainability and Innovation

- Airport Contractors Prioritizing Cost-Effective Lighting Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035