Market Overview

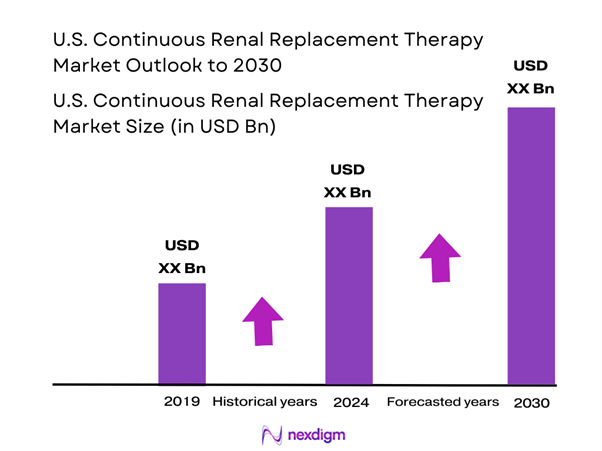

The U.S. Continuous Renal Replacement Therapy market is estimated to reach USD 1.5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8% from 2024-2030, based on a robust five-year historical analysis. This growth is driven by the increasing prevalence of acute kidney injury (AKI), advancements in medical technology, and an expanding geriatric population. According to the National Kidney Foundation, the incidence of kidney disease in the U.S. is rising, demanding effective dialysis solutions, particularly continuous renal replacement therapy (CRRT), to manage patients in critical conditions.

Dominant regions within the market include major metropolitan areas such as New York, Los Angeles, and Chicago, primarily due to their extensive healthcare infrastructures and prominent medical research institutions. These cities possess high patient density with critical care facilities and nephrology departments, enabling them to offer advanced CRRT solutions. Moreover, the presence of leading healthcare providers and dialysis centers further reinforces their dominance.

Technological innovations in medical devices have significantly advanced CRRT procedures. For example, the introduction of highly efficient filtration systems and automated monitoring devices has improved patient outcomes. The advancement in remote monitoring capabilities allows healthcare practitioners to supervise dialysis treatments from afar, a trend that has gained momentum, particularly during public health crises like the COVID-19 pandemic.

Market Segmentation

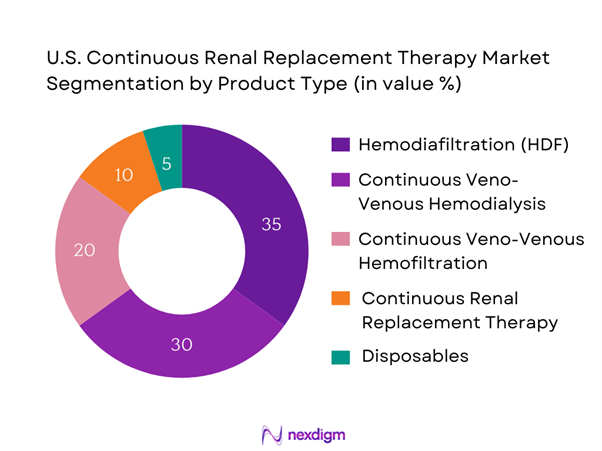

By Product Type

The U.S. Continuous Renal Replacement Therapy market is segmented by product type into Hemodiafiltration (HDF), Continuous Veno-Venous Hemodialysis (CVVHD), Continuous Veno-Venous Hemofiltration (CVVH), Continuous Renal Replacement Therapy Systems, and Disposables. Among these, the Hemodiafiltration segment has a dominant market share due to its enhanced efficiency in solute removal and fluid management. HDF combines both diffusion and convection, facilitating better clearance of middle-molecule toxins, which makes it a preferred choice in hospitals treating severely ill patients needing effective renal support.

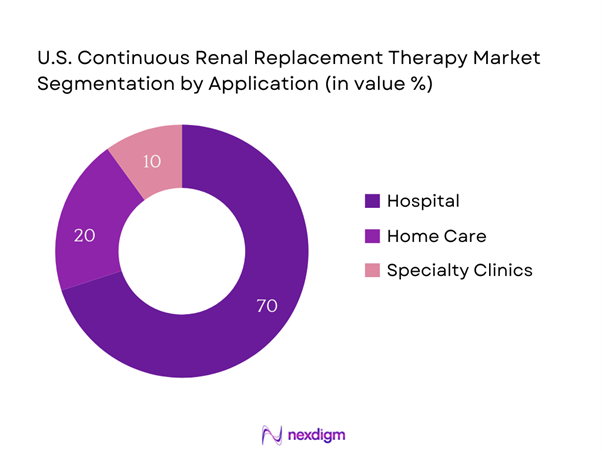

By Application

The market is also segmented by application into Hospital, Home Care, and Specialty Clinics. The Hospital segment leads the market due to the high demand for continuous renal replacement therapy in critical care settings, where patients often experience acute kidney injury. With the increasing complexity of patient cases and the need for round-the-clock monitoring, hospitals require reliable and effective CRRT systems. Furthermore, hospitals benefit from advanced technological integration, which enhances patient outcomes significantly.

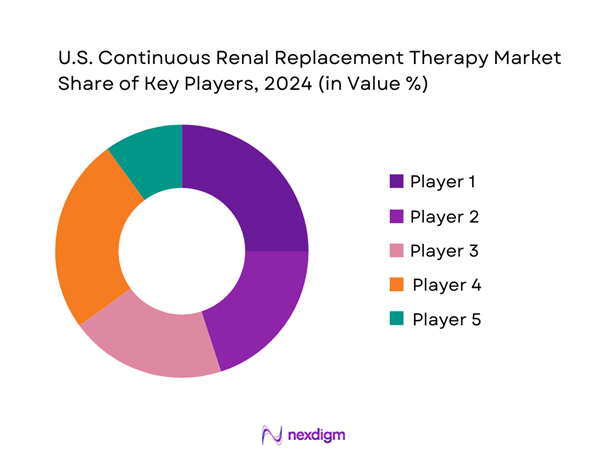

Competitive Landscape

The U.S. Continuous Renal Replacement Therapy market is dominated by a few major players, including Baxter International, Fresenius Medical Care, B. Braun Melsungen AG, Nipro Corporation, and Medtronic. This consolidation highlights the significant influence of these key companies as they continually innovate and improve product offerings to meet the increasing demand for renal therapies.

| Company | Establishment Year | Headquarters | Product Portfolio | Market Strategy | Key Partnerships |

| Baxter International | 1931 | Deerfield, Illinois | – | – | – |

| Fresenius Medical Care | 1996 | Bad Homburg, Germany | – | – | – |

| B. Braun Melsungen AG | 1839 | Melsungen, Germany | – | – | – |

| Nipro Corporation | 1954 | Osaka, Japan | – | – | – |

| Medtronic | 1949 | Dublin, Ireland | – | – | – |

U.S. Continuous Renal Replacement Therapy Market Analysis

Growth Drivers

Increasing Incidence of Acute Renal Failure

The U.S. is experiencing a rising incidence of acute renal failure (ARF), with about 1 in 5 patients in intensive care units (ICUs) developing this condition. The National Institute of Diabetes and Digestive and Kidney Diseases reported that in 2023 alone, over 500,000 hospitalizations were attributed to ARF in the United States. Due to underlying health issues such as diabetes and hypertension—conditions affecting over 34 million people and 47% of U.S. adults, respectively—the need for Continuous Renal Replacement Therapy (CRRT) has become crucial in healthcare settings.

Rising Geriatric Population

As of 2023, there are approximately 56 million individuals aged 65 and older in the U.S., a demographic that is projected to reach 80 million by 2040. The increasing elderly population correlates with higher incidences of chronic diseases, including kidney-related ailments. According to the U.S. Census Bureau, around 73% of older adults have two or more chronic diseases. This demographic shift not only increases the demand for renal therapies but also necessitates advanced treatment options such as CRRT, highlighting the importance of specialized renal care for aging patients.

Market Challenges

High Cost of Equipment

The cost of advanced CRRT equipment remains a significant barrier to widespread adoption. The estimated expenditure on renal replacement therapy equipment in the U.S. is around USD 1.5 billion annually, encompassing machines, disposables, and services. Many hospitals cite budget constraints, as healthcare spending reached approximately USD 4.1 trillion in 2023. As a result, the high costs associated with the initial investments and ongoing operational expenses deter some healthcare facilities from implementing CRRT systems, thus limiting patient access to vital renal therapies.

Complexity of Procedures

The complexity associated with CRRT procedures poses a challenge for healthcare providers, especially in emergency and intensive care settings. CRRT requires well-trained medical personnel for operation and monitoring, a factor that can strain resources in healthcare facilities with staff shortages. According to the Staffing Report from the American Association of Critical-Care Nurses, about 60% of facilities indicate difficulty in maintaining adequate staff levels. This situation must be addressed to ensure that patients receive timely and effective renal treatments when needed.

Opportunities

Growth of Home-Based Therapies

The trend towards home-based therapy is gaining traction, driven by the need for more personalized and convenient care options. As of 2023, approximately 20% of patients requiring dialysis are engaging in home therapies, a number that has been steadily increasing year-on-year due to advancements in technology and patient education. The rising awareness for chronic kidney disease management empowers patients to control their healthcare regimen from home, which is expected to boost the demand for CRRT solutions tailored for home use, enhancing overall patient outcomes and quality of life.

Rising Awareness among Patients

With increasing access to information through digital platforms and social media, patients’ awareness of kidney health and treatment options is at an all-time high. In recent surveys, around 67% of patients diagnosed with chronic kidney disease expressed their need for understanding available treatment options, including CRRT. This increased awareness facilitates better communication between patients and providers, encouraging more patients to seek timely treatment. Given the rapid advancements in medical technology, this growing patient involvement offers substantial opportunities for educating the public and enhancing market accessibility.

Future Outlook

The U.S. Continuous Renal Replacement Therapy market is anticipated to witness significant growth, driven by an increase in the incidence of acute kidney injuries, ongoing advancements in CRRT technology, and an aging population with a rising prevalence of chronic kidney diseases. The integration of advanced monitoring systems and patient-centric solutions will further drive market expansions, providing improved outcomes and fostering confidence among healthcare providers and patients alike.

Major Players

- Baxter International

- Fresenius Medical Care

- Braun Melsungen AG

- Nipro Corporation

- Medtronic

- Asahi Kasei Medical

- Terumo Corporation

- Gallant Pharmaceuticals

- Dialysis Clinic, Inc.

- Cardinal Health

- NephroPlus

- RenalTech

- DaVita Inc.

- Sorin Group

- Rockwell Medical

Key Target Audience

- Healthcare Providers

- Hospitals and Clinics

- Dialysis Centers

- Medical Device Manufacturers

- Government and Regulatory Bodies (e.g., Centers for Medicare & Medicaid Services)

- Health Insurance Companies

- Investments and Venture Capitalist Firms

- Pharmaceutical Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. Continuous Renal Replacement Therapy market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. Continuous Renal Replacement Therapy market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple continuous renal replacement therapy manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. Continuous Renal Replacement Therapy market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Incidence of Acute Renal Failure

Rising Geriatric Population

Advancements in Medical Technology - Market Challenges

High Cost of Equipment

Complexity of Procedures - Opportunities

Growth of Home-Based Therapies

Rising Awareness among Patients - Trends

Increasing Adoption of Telemedicine

Development of Patient-Centric Solutions - Government Regulation

FDA Guidelines

Reimbursement Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Number of Units Sold, 2019–2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Hemodiafiltration (HDF)

– High-Flux HDF

– Low-Flux HDF

– Online HDF

Continuous Veno-Venous Hemodialysis (CVVHD)

– Pre-Dilution CVVHD

– Post-Dilution CVVHD

Continuous Veno-Venous Hemofiltration (CVVH)

– High-Volume CVVH

– Standard CVVH

Continuous Renal Replacement Therapy Systems

– Integrated CRRT Machines

– Modular CRRT Devices

– Portable CRRT Units

Disposables

– CRRT Bloodlines

– Dialyzers and Filters

– Tubing Sets

– Catheters and Connectors

– Substitution Fluids and Dialysates - By Application (In Value %)

Hospital

– Tertiary Care Hospitals

– Public Hospitals

– Private Multi-Specialty Hospitals

Home Care

– Remote Monitoring-Enabled CRRT

– Portable Device Installations

– Tele-nephrology Supervision

Specialty Clinics

– Kidney Specialty Clinics

– Post-ICU Care Clinics

– Transplant Follow-up Clinics - By End-User (In Value %)

Nephrologists

– Adult Nephrology Practices

– Pediatric Nephrologists

– Renal Consultants in Critical Care

Intensive Care Units (ICUs)

– Surgical ICUs

– Medical ICUs

– Cardiac ICUs

Dialysis Centers

– Independent Dialysis Chains

– Hospital-Affiliated Dialysis Units

– Mobile Dialysis Services - By Region (In Value %)

Northeast

Midwest

South

West - By Equipment Type (In Value %)

Dialysis Machines

– CRRT-Specific Machines

– Multi-Mode Machines (Acute + Chronic)

Bloodlines

– Pre-connected Bloodline Sets

– Dual-Lumen Bloodlines

– Pediatric-Specific Bloodlines

Filters and Dialyzers

– High Cut-Off Filters

– Standard Hemofilters

– Biocompatible Dialyzers

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Product Portfolio, Technological Innovations, Regulatory Compliance, Clinical Outcomes and Efficacy, Regional Presence, Customer Support and Training Programs, Sustainability Initiatives, Unique Value Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKU for Major Players

- Detailed Profiles of Major Companies

Baxter International

Fresenius Medical Care

B. Braun Melsungen AG

Nipro Corporation

Asahi Kasei Medical

Medtronic

Terumo Corporation

Gallant Pharmaceuticals

Dialysis Clinic, Inc.

Cardinal Health

NephroPlus

RenalTech

DaVita Inc.

Sorin Group

Rockwell Medical

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Number of Units Sold, 2025-2030

- By Average Price, 2025-2030