Market Overview

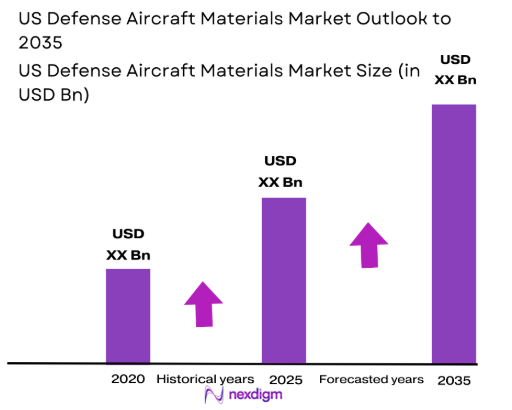

The US Defense Aircraft Materials market is valued at approximately USD ~ billion based on a recent historical assessment. This growth is primarily driven by the ongoing advancements in aerospace technology, increasing defense budgets, and a rising demand for lightweight, durable materials. The market’s expansion is also supported by the evolving need for more efficient and cost-effective defense aircraft solutions. Manufacturers are focusing on materials such as high-performance alloys, composites, and titanium, contributing significantly to the overall market size.

The US market is dominated by key players situated in aerospace hubs such as California, Washington, and Texas. These regions are home to leading manufacturers like Boeing, Lockheed Martin, and Northrop Grumman, which benefit from strong infrastructure, extensive research and development capabilities, and proximity to military and defense operations. Additionally, these regions enjoy government investments and military contracts, driving demand for advanced materials that support defense aircraft production.

Market Segmentation

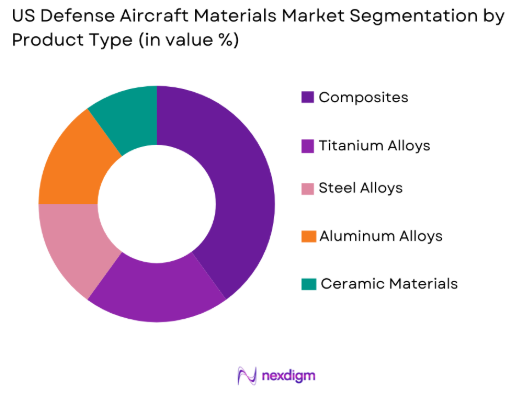

By Product Type

The US Defense Aircraft Materials market is segmented by product type into composites, titanium alloys, steel alloys, aluminum alloys, and ceramic materials. Recently, composite materials have a dominant market share due to their lightweight, durability, and corrosion-resistant properties, making them essential in aerospace applications. The growing demand for fuel-efficient, high-performance aircraft has contributed to the increased use of composite materials. The presence of major aerospace manufacturers and strong investment in research to develop advanced composites have also reinforced this trend.

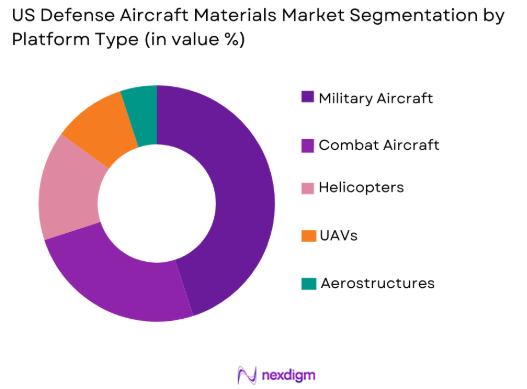

By Platform Type

The US Defense Aircraft Materials market is segmented by platform type into military aircraft, combat aircraft, helicopters, unmanned aerial vehicles (UAVs), and aerostructures. Recently, military aircraft have a dominant market share due to the continuous modernization of air fleets and the rising demand for advanced fighter jets and transport aircraft. As military forces prioritize enhancing their capabilities with next-generation aircraft, manufacturers are focusing on developing high-strength, lightweight materials, bolstering the market demand for these platforms.

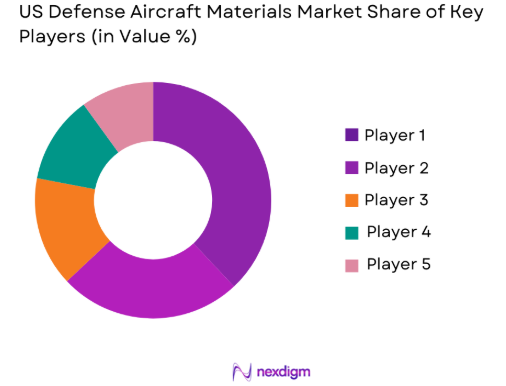

Competitive Landscape

The competitive landscape of the US Defense Aircraft Materials market is characterized by a mix of consolidation and collaboration between major defense contractors and material suppliers. Leading players continue to invest heavily in R&D to create advanced materials that meet the evolving demands of defense aircraft manufacturers. The market is highly influenced by government defense contracts and long-term supply agreements with military agencies, ensuring continued growth and innovation. Partnerships between established companies and emerging material innovators are strengthening their positions in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Reston, USA | ~ | ~ | ~ | ~ | ~ |

US Defense Aircraft Materials Market Analysis

Growth Drivers

Rising Defense Budgets

The increasing defense budgets in the United States are a key growth driver for the US Defense Aircraft Materials market. These expanded budgets support the continuous development and procurement of advanced military aircraft, which require cutting-edge materials for performance, durability, and safety. The demand for sophisticated fighter jets, transport aircraft, and unmanned aerial vehicles has led to a surge in the need for high-performance alloys and composites. As geopolitical tensions rise, the US government is investing in modernizing its air fleets, which in turn stimulates material demand. Additionally, defense contractors are focusing on reducing aircraft weight and enhancing fuel efficiency, further boosting the market for lightweight composite materials. This trend is expected to continue as defense forces prioritize technological advancements and material innovation to maintain operational superiority. Consequently, rising defense budgets are propelling the demand for materials that enhance aircraft capabilities, making this a significant growth driver.

Technological Advancements in Aerospace Materials

Technological advancements in aerospace materials play a crucial role in driving the growth of the US Defense Aircraft Materials market. Continuous research and development in material science have led to the creation of high-performance alloys, lightweight composites, and advanced ceramics, all of which are integral to modern defense aircraft. Innovations such as 3D printing for manufacturing complex aerospace components and the integration of smart materials for improved performance and safety are transforming the industry. These advancements enable the production of materials that are not only lighter and stronger but also more resistant to corrosion, which is critical for military aircraft operating in harsh environments. Furthermore, technologies such as nanotechnology are enhancing the properties of materials, providing greater resistance to heat and pressure, which is crucial for military aircraft in combat scenarios. As the demand for next-generation defense aircraft grows, these technological advancements will continue to drive the market forward.

Market Challenges

High Material Costs

One of the significant challenges faced by the US Defense Aircraft Materials market is the high cost of advanced materials such as composites, titanium alloys, and other high-performance materials. These materials are expensive to produce and require complex manufacturing processes, making them costly for defense contractors and aircraft manufacturers. The price of raw materials like titanium and advanced composites can fluctuate due to supply chain disruptions, impacting the overall cost structure. While these materials offer enhanced performance, such as lighter weight and improved durability, their high costs can limit their widespread adoption, particularly for smaller defense contractors or in budget-constrained programs. Furthermore, the need for constant innovation in aerospace materials to meet evolving military requirements often necessitates substantial investments in R&D, which can further escalate costs. The challenge of managing high material costs remains a key concern for both manufacturers and defense procurement agencies.

Supply Chain Disruptions

Supply chain disruptions have become an increasingly significant challenge for the US Defense Aircraft Materials market. The global nature of aerospace manufacturing means that materials often have to be sourced from various regions, and disruptions in the supply of raw materials can delay production timelines. Trade restrictions, natural disasters, and geopolitical tensions can affect the availability of key materials such as titanium, steel, and high-strength composites, which are crucial for defense aircraft production. Additionally, the complexity of the aerospace supply chain, with multiple tiers of suppliers involved, further exacerbates the risk of delays and cost overruns. As defense manufacturers rely on just-in-time delivery models to manage costs, any interruption in the supply of critical materials can result in production bottlenecks. This challenge underscores the importance of strengthening and diversifying supply chains to ensure that critical materials are available when needed to meet defense aircraft production targets.

Opportunities

Advancements in Additive Manufacturing

Advancements in additive manufacturing, or 3D printing, present significant opportunities for the US Defense Aircraft Materials market. Additive manufacturing allows for the production of complex components with less material waste, shorter lead times, and greater design flexibility compared to traditional manufacturing methods. This technology is particularly useful in the aerospace industry, where the precision of materials and components is critical for aircraft performance. The ability to quickly prototype and produce custom parts for defense aircraft can significantly reduce costs and improve the efficiency of the supply chain. Moreover, 3D printing enables the production of parts with integrated functions, which is not possible with conventional manufacturing techniques. As defense contractors look to reduce production costs and improve aircraft capabilities, the adoption of additive manufacturing technologies for aircraft materials will continue to expand, creating new opportunities for growth in the market.

Sustainability in Aerospace Materials

Sustainability is becoming an increasingly important focus in the US Defense Aircraft Materials market, offering significant opportunities for growth. As governments and defense contractors prioritize environmental sustainability, there is growing demand for eco-friendly materials in aircraft manufacturing. Materials that are recyclable, require fewer resources to produce, or reduce fuel consumption during operation are highly sought after. Additionally, the push toward greener manufacturing processes is driving the development of alternative materials that minimize environmental impact. For instance, lightweight composite materials, which reduce fuel consumption and carbon emissions, are gaining traction in the aerospace industry. As sustainability becomes a more critical factor in defense procurement, manufacturers that can provide environmentally friendly materials that do not compromise on performance will find increasing demand for their products. This focus on sustainability represents a key growth opportunity for companies in the US Defense Aircraft Materials market.

Future Outlook

The US Defense Aircraft Materials market is expected to continue growing in the coming years, driven by advancements in aerospace technology, rising defense budgets, and the increasing demand for lightweight, durable materials. Technological developments in material science, such as the use of composites and advanced alloys, will continue to play a significant role in shaping the market’s trajectory. Additionally, government support for military modernization programs and the growing focus on sustainability will further boost the demand for innovative defense aircraft materials. With increasing geopolitical tensions and the continued modernization of military air fleets, the demand for advanced materials in defense aircraft is projected to remain strong. The market is poised for steady growth, with significant opportunities emerging from advancements in additive manufacturing and sustainable material technologies.

Major Players

- Boeing

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- General Dynamics

- Airbus Group

- Honeywell International

- Safran

- L3Harris Technologies

- Collins Aerospace

- United Technologies Corporation

- Rockwell Collins

- General Electric

- Pratt & Whitney

- GE Aviation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military procurement agencies

- Aerospace manufacturers

- Defense contractors

- Aircraft design and development firms

- Raw material suppliers

- Additive manufacturing companies

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing the US Defense Aircraft Materials market are identified through primary and secondary research, considering factors such as technological advancements, geopolitical dynamics, and demand trends in aerospace.

Step 2: Market Analysis and Construction

Market size, segmentation, and growth forecasts are developed using a combination of quantitative data, historical trends, and expert insights, allowing for comprehensive analysis of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and industry interviews are conducted to validate hypotheses and gather qualitative insights, ensuring a robust understanding of market drivers, challenges, and opportunities.

Step 4: Research Synthesis and Final Output

All data, insights, and analysis are synthesized into a final report, presenting a clear, detailed market overview, segmentation, and future outlook based on the findings from comprehensive research.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Defense Budgets and National Security Investments

Technological Advancements in Aerospace Materials

Increasing Demand for Lightweight and Durable Materials - Market Challenges

High Production and Maintenance Costs

Supply Chain and Material Sourcing Issues

Complex Regulatory and Certification Processes - Market Opportunities

Advancements in Additive Manufacturing for Aircraft Parts

Collaboration with Private Sector for Innovation in Materials

Emerging Demand for Sustainable and Eco-friendly Aircraft Materials - Trends

Growth of Sustainable and Recyclable Aircraft Materials

Increased Integration of Smart Materials in Aircraft Design

Shift towards Hybrid Materials for Enhanced Performance - Government Regulations & Defense Policy

Regulatory Compliance in Aerospace Manufacturing

Government Funding for Innovation in Aircraft Materials

International Export and Import Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Composite Materials

Titanium Alloys

Steel Alloys

Aluminum Alloys

Ceramic Materials - By Platform Type (In Value%)

Military Aircraft

Combat Aircraft

Helicopters

Unmanned Aerial Vehicles (UAVs)

Aerostructures - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM) Solutions

Aftermarket Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Aerospace & Defense OEMs

Private Sector / Aerospace Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value %)

High-Performance Alloys

Lightweight Materials

Smart Materials

Advanced Composites

Thermal Resistance Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Market Value, Installed Units, Price Tier)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Boeing

Lockheed Martin

Northrop Grumman

Raytheon Technologies

General Dynamics

Airbus Group

Honeywell International

Safran

L3Harris Technologies

Collins Aerospace

United Technologies Corporation

Rockwell Collins

General Electric

Pratt & Whitney

GE Aviation

- Military Forces’ Increasing Demand for Advanced Aircraft Materials

- Aerospace and Defense OEMs’ Need for High-Performance Materials

- Defense Contractors’ Role in Aircraft Materials Procurement

- Private Sector’s Growing Interest in Next-Gen Aircraft Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035