Market Overview

The US fighter aircraft market is valued at approximately USD ~ billion, driven by factors such as military modernization programs, technological advancements, and ongoing demand for advanced fighter jets. Increasing defense budgets and the need for superior air combat capabilities have further propelled the market, with demand coming from both domestic and international markets. The US continues to lead fighter aircraft development, producing some of the most advanced and capable fighter jets for national and international defense purposes.

The market is largely dominated by the United States, which has established itself as a global leader in defense spending, innovation, and fighter aircraft production. Additionally, countries like the United Kingdom, France, and Japan contribute to global demand, as they seek to modernize their air forces with advanced fighter jets. The presence of established defense contractors and robust military procurement systems in these regions ensures their continued dominance in the fighter aircraft sector.

Market Segmentation

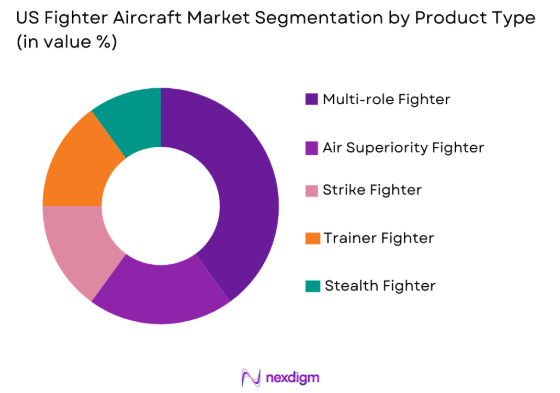

By Product Type

The US fighter aircraft market is segmented by product type into multi-role, air superiority, strike, trainer, and stealth fighter aircraft. Recently, multi-role fighter aircraft have captured the dominant market share, primarily due to their versatile capabilities, which allow for both air-to-air and air-to-ground combat. The versatility of these aircraft allows defense forces to address a broad spectrum of combat needs with a single platform. Multi-role fighters offer flexibility, cost-effectiveness, and advanced technological integration, which have made them the preferred choice for both established and emerging military forces. Their ability to perform multiple missions across a variety of combat scenarios, including offensive, defensive, and surveillance operations, ensures their continued market dominance.

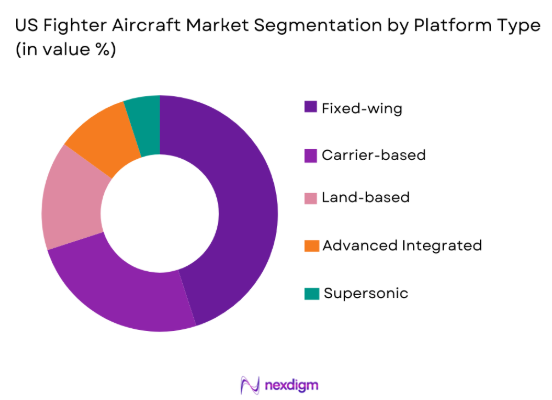

By Platform Type

The US fighter aircraft market is segmented by platform type into fixed-wing, carrier-based, land-based, advanced integrated, and supersonic platforms. Recently, fixed-wing platforms have taken the lead in market share due to their greater operational efficiency, versatility, and cost-effectiveness. These aircraft are designed for a wide range of missions, from air superiority to ground attack, which makes them highly adaptable across various combat situations. Their proven track record in multiple operational theaters and ease of integration into existing defense infrastructures further contributes to their dominance. Fixed-wing fighter jets continue to be a preferred choice for global air forces, offering unparalleled performance in both combat and reconnaissance roles.

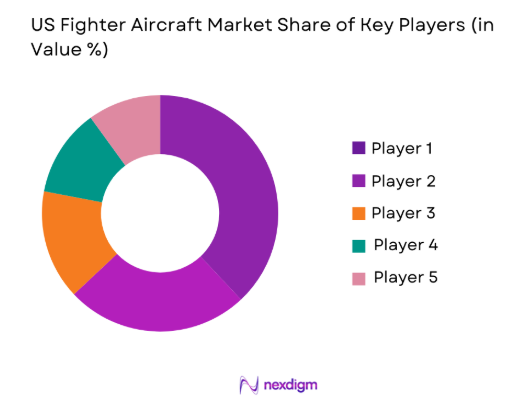

Competitive Landscape

The competitive landscape in the US fighter aircraft market is heavily influenced by major defense contractors and government policies supporting military advancements. The market remains highly consolidated, with key players such as Lockheed Martin, Boeing, and Northrop Grumman dominating the market. These companies benefit from substantial government contracts and extensive technological expertise. Market consolidation and innovation in stealth technology and avionics have enabled these companies to maintain a strong presence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Investment (%) |

| Lockheed Martin | 1912 | Bethesda, Maryland | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, Illinois | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1899 | Reston, Virginia | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, Massachusetts | ~ | ~ | ~ | ~ | ~ |

US Fighter Aircraft Market Analysis

Growth Drivers

Increased military spending

With the growing geopolitical tensions and national security concerns, governments are allocating higher budgets to defense spending, thereby increasing the demand for modern fighter aircraft. This shift in priorities is seen across major defense powers, including the US, as they look to upgrade and maintain their defense capabilities. Increased military budgets have enabled military forces to invest in next-generation fighter jets that offer enhanced versatility, advanced weaponry, and superior air superiority capabilities. The push towards modernization and the need to maintain military readiness in the face of potential threats continue to drive this trend. Additionally, the advancement of new fighter aircraft technologies such as stealth capabilities, integrated avionics, and artificial intelligence is attracting substantial investment from defense contractors and governments alike.

Technological advancements in fighter aircraft systems

The US fighter aircraft market benefits greatly from the continuous technological innovation in fighter aircraft. Technological advancements such as integrated avionics, radar systems, weapon systems, and stealth technology have significantly enhanced the capabilities of modern fighter jets. Innovations like the development of advanced artificial intelligence and machine learning technologies are making fighter aircraft more autonomous, improving their combat effectiveness. The introduction of advanced materials such as composite alloys and next-generation propulsion systems has also allowed for lighter, more fuel-efficient aircraft with greater combat range. These technological developments are not only increasing the effectiveness of fighter aircraft but are also helping reduce operational costs, further driving market growth.

Market Challenges

High capital investment requirements

One of the major challenges facing the US fighter aircraft market is the high cost associated with developing and producing advanced fighter jets. Fighter aircraft require significant capital investment in research, development, and production, making them expensive for both manufacturers and military forces. The costs of developing cutting-edge technologies, maintaining complex supply chains, and meeting rigorous defense specifications further contribute to these high expenses. As a result, many nations, especially smaller defense budgets, find it challenging to invest in the latest models of fighter aircraft. Moreover, the need for extensive pilot training and maintenance infrastructure also increases the overall cost of ownership.

Technological complexity and integration

Another significant challenge for the US fighter aircraft market is the technological complexity involved in integrating various systems within the aircraft. Modern fighter jets are highly sophisticated machines that require the integration of advanced avionics, propulsion systems, stealth features, and weapon systems. Ensuring seamless interoperability between these systems while maintaining optimal performance is a major technical hurdle. Additionally, as new technologies emerge, the integration of these innovations into legacy fighter aircraft systems becomes more challenging, requiring substantial resources. The complexity of upgrading and maintaining these systems may lead to delays and added costs, affecting the overall market growth.

Opportunities

Expansion in stealth fighter aircraft

The increasing demand for stealth technology presents a significant growth opportunity for the US fighter aircraft market. Stealth aircraft, which are designed to avoid radar detection, have become an essential asset for modern air forces. As nations strive for an edge in modern warfare, they are investing heavily in stealth fighters to enhance their defense capabilities. These aircraft offer superior operational effectiveness in contested airspaces and are highly sought after by defense contractors and governments. With the introduction of next-generation stealth technologies, such as improved coatings and integrated avionics, the demand for stealth fighter aircraft is expected to increase substantially.

Growing demand from emerging markets

Another key opportunity in the US fighter aircraft market is the increasing demand from emerging markets. Many developing nations, particularly in Asia and the Middle East, are modernizing their military forces and looking to invest in advanced fighter aircraft. These regions are seeing rapid military growth due to increasing security concerns and geopolitical instability. As a result, these nations are seeking advanced fighter jets to enhance their defense capabilities, creating a lucrative market for US-based manufacturers. Additionally, the availability of financing options and government-backed defense contracts can further drive the demand from these emerging markets.

Future Outlook

Over the next five years, the US fighter aircraft market is expected to continue its growth trajectory, driven by technological innovations and increasing defense budgets. Advancements in stealth technology, artificial intelligence, and autonomous systems will further enhance the capabilities of fighter jets, enabling them to perform a wider range of combat missions. Additionally, as geopolitical tensions persist globally, nations will prioritize modernizing their military assets, including fighter aircraft. The rise of emerging markets investing in defense will provide a significant opportunity for manufacturers to expand their customer base, ensuring continued growth in the sector.

Major Players

- Lockheed Martin

- Boeing

- Northrop Grumman

- General Dynamics

- Raytheon Technologies

- Saab Group

- Leonardo

- BAE Systems

- Dassault Aviation

- Hindustan Aeronautics

- Sukhoi

- Eurofighter GmbH

- Elbit Systems

- L3 Technologies

- Textron Aviation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense forces

- Aerospace contractors

- Fighter aircraft component suppliers

- National air forces

- Commercial defense contractors

- Private sector aerospace firms

Research Methodology

Step 1: Identification of Key Variables

We identify the critical market variables such as technological advancements, geographical demand, defense spending trends, and government regulations.

Step 2: Market Analysis and Construction

Comprehensive data is collected from trusted sources, including government publications, defense reports, and industry leaders to build the market model.

Step 3: Hypothesis Validation and Expert Consultation

We validate the findings by consulting with industry experts and key stakeholders to ensure the accuracy and relevance of the market data.

Step 4: Research Synthesis and Final Output

The collected and verified data is synthesized into a comprehensive report to provide insights, forecasts, and strategic recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Spending

Technological Advancements in Fighter Aircraft Systems

Demand for Modernized Air Forces

Government Defense Contracts and Programs

Geopolitical Tensions and National Security Threats - Market Challenges

High Capital Investment Requirements

Technological Complexity and Integration

Cost of Maintenance and Upkeep

Supply Chain Disruptions

Regulatory and Compliance Barriers - Market Opportunities

Expansion in Stealth Fighter Aircraft

Technological Integration with AI and UAVs

Growing Demand from Emerging Markets - Trends

Development of 6th Generation Fighter Aircraft

Increasing Role of Cybersecurity in Aviation

Modernization of Legacy Aircraft Fleets

Rise of Autonomous Air Combat Systems

Integration of Hypersonic Weapons - Government Regulations & Defense Policy

Export Control and Compliance Policies

Government Funding and Grants for Fighter Aircraft

National Security and Airspace Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Multi-role Fighter Aircraft

Air Superiority Fighter Aircraft

Strike Fighter Aircraft

Trainer Fighter Aircraft

Stealth Fighter Aircraft - By Platform Type (In Value%)

Fixed-Wing Platforms

Carrier-Based Platforms

Land-Based Platforms

Advanced Integrated Platforms

Supersonic Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Integrated Systems

Modular Systems - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Forces

Private Sector / Aerospace Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Composite Materials

Alloys & Metals

Stealth Coatings

Avionics & Electronics

Advanced Propulsion Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Boeing

Northrop Grumman

General Dynamics

Raytheon Technologies

Saab Group

Leonardo

BAE Systems

Dassault Aviation

Hindustan Aeronautics

Sukhoi

Eurofighter GmbH

Elbit Systems

L3 Technologies

Textron Aviation

- Military Forces’ Increasing Demand for Advanced Fighter Aircraft

- Government Agencies’ Role in Procurement and Regulation

- Private Sector’s Role in Technology Development

- Defense Contractors’ Shift Towards High-tech and Multi-role Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035