Market Overview

The US freighter aircraft market, valued at approximately USD ~ billion, is primarily driven by increasing demand for air cargo services, fueled by the rise of e-commerce, global trade, and supply chain complexities. Growth is further accelerated by the adoption of larger and more fuel-efficient freighters that cater to evolving logistics needs, including time-sensitive deliveries and cross-border transportation. Freight operators, including express delivery companies, airlines, and third-party logistics providers, are seeking ways to modernize and expand their fleets to meet growing demand in both domestic and international markets.

In terms of geographical dominance, the United States, specifically key hubs such as Los Angeles, Chicago, and Dallas, leads the market due to robust infrastructure, high cargo volumes, and well-established air freight networks. The country benefits from its strategic position as a global logistics center, supported by world-class airports and well-connected rail and road networks. Additionally, demand from e-commerce giants like Amazon, FedEx, and UPS further strengthens the position of the US as the dominant player in the freighter aircraft market.

Market Segmentation

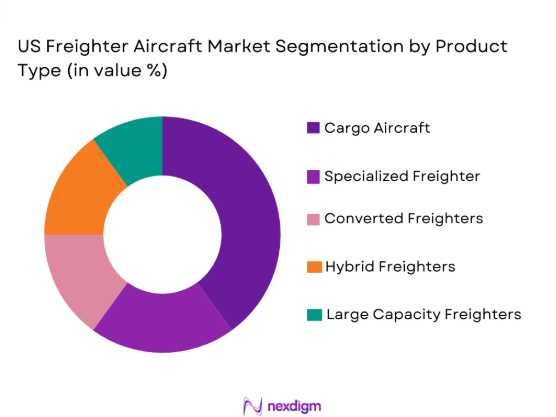

By Product Type

The US freighter aircraft market is segmented by product type into cargo aircraft, specialized freighter aircraft, converted freighters, hybrid freighters, and large capacity freighters. Recently, large capacity freighters have a dominant market share due to factors such as increased demand for faster deliveries, larger shipment volumes, and advancements in fuel efficiency and cargo handling systems. Their ability to transport high volumes of goods across long distances efficiently has made them the preferred choice for major logistics companies, enabling them to meet growing e-commerce demands and international shipping needs. This trend is further driven by increased investments in fleet modernization, and major players such as FedEx and UPS are upgrading their fleets with large capacity freighters to maximize operational efficiency.

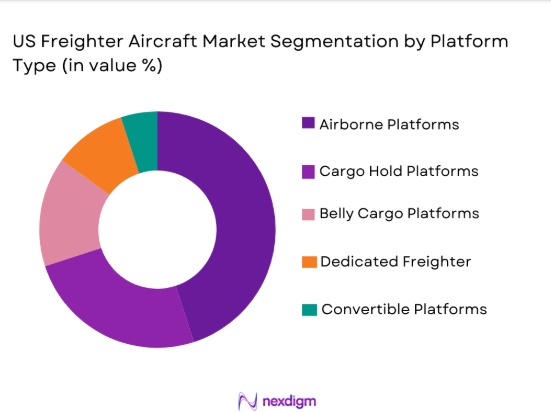

By Platform Type

The US freighter aircraft market is segmented by platform type into airborne platforms, cargo hold platforms, belly cargo platforms, dedicated freighter platforms, and convertible platforms. Recently, dedicated freighter platforms have a dominant market share due to factors such as dedicated infrastructure for cargo, optimized design for large volumes, and the demand for specialized air freight services. Dedicated freighters offer the flexibility and capacity to handle a wide range of cargo, from perishables to large industrial shipments. Additionally, dedicated freighters are increasingly being seen as critical assets for time-sensitive deliveries, offering direct, faster routes for high-value goods. Their operational efficiency, coupled with technological advancements, further drives the preference for these platforms in major logistics networks.

Competitive Landscape

The competitive landscape in the US freighter aircraft market is characterized by consolidation, with major players such as Boeing, Airbus, and Lockheed Martin controlling significant portions of the market. The presence of large logistics companies such as FedEx, UPS, and DHL also plays a vital role in shaping the competitive dynamics by driving demand for specialized aircraft and fleet modernization. Additionally, companies like Amazon Air are becoming increasingly influential in this market, expanding their fleets and supporting the overall demand for freighter aircraft. While large players dominate the space, niche manufacturers and conversion specialists are also emerging, contributing to a more diverse and competitive market environment. This growth is supported by technological advancements, regulatory support, and increasing investment in the aviation sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additonal Parameters |

| Boeing | 1916 | Chicago, IL, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| FedEx Express | 1971 | Memphis, TN, USA | ~ | ~ | ~ | ~ | ~ |

| UPS Airlines | 1982 | Louisville, KY, USA | ~ | ~ | ~ | ~ | ~ |

| Amazon Air | 2016 | Seattle, WA, USA | ~ | ~ | ~ | ~ | ~ |

US Freighter Aircraft Market Analysis

Growth Drivers

Rising E-commerce Demand

The growth of e-commerce is a major driver for the US freighter aircraft market, as logistics companies are under increasing pressure to fulfill online orders swiftly and efficiently. The expansion of e-commerce platforms like Amazon, coupled with the shift toward same-day and next-day delivery services, has led to a surge in demand for air cargo services. Freighter aircraft, particularly large capacity freighters, are integral to fulfilling these needs, offering faster, more reliable transport for goods across long distances. This trend is expected to continue as e-commerce giants expand their global networks to meet the growing consumer demand for quick delivery times, further pushing the need for modernized freighter fleets. The rise of omnichannel retail and the changing consumer purchasing behaviors are creating an even larger opportunity for air cargo to meet the delivery expectations of consumers, especially in peak seasons like the holidays. This driver is expected to lead to continued investment in freighter aircraft, with more airlines and freight operators updating their fleets.

Technological Advancements in Aircraft Design

Another significant growth driver for the US freighter aircraft market is the ongoing advancements in aircraft design and technology, which are focused on improving fuel efficiency, reducing operational costs, and increasing payload capacity. Innovations such as lightweight composite materials, fuel-efficient engines, and enhanced cargo management systems have transformed the freighter aircraft landscape. These advancements not only improve the sustainability of operations but also make freighters more economically viable for logistics companies. Additionally, the development of autonomous systems and digital tools to manage cargo more effectively is expected to further enhance the efficiency of freighter aircraft. These technological improvements are helping to meet the increasing demand for air cargo services while mitigating the environmental impact of the aviation sector, leading to more widespread adoption of modern freighter aircraft by major logistics players.

Market Challenges

High Operational Costs

One of the primary challenges facing the US freighter aircraft market is the high operational and maintenance costs associated with running large cargo fleets. Freighter aircraft require significant capital investment not only for their initial purchase but also for their ongoing maintenance, fuel, and staffing. These costs can be particularly burdensome for smaller freight operators who may struggle to compete with the larger players that benefit from economies of scale. Additionally, the fluctuating cost of aviation fuel and the need for continuous fleet modernization to keep pace with technological advancements further compound these financial challenges. As the market continues to evolve, companies must find ways to mitigate these costs while maintaining high levels of service. This challenge has led to an increased focus on partnerships, leasing options, and the adoption of more fuel-efficient aircraft to help offset these high operational costs.

Stringent Regulatory Environment

The US freighter aircraft market also faces significant challenges in navigating the complex regulatory environment governing aviation. From safety standards set by the Federal Aviation Administration (FAA) to environmental regulations aimed at reducing emissions, freighter aircraft operators must comply with a variety of rules and regulations. These regulations can increase the costs of operations and slow down the pace of fleet modernization as companies must ensure compliance with all applicable laws. In addition to domestic regulations, international regulations, such as the International Civil Aviation Organization (ICAO) standards, add another layer of complexity for companies operating globally. Ensuring compliance with these regulations while maintaining cost efficiency and operational flexibility is a constant challenge for freight operators, potentially impacting their ability to compete in a fast-moving market.

Opportunities

Sustainability in Air Cargo

One of the most promising opportunities in the US freighter aircraft market lies in the growing demand for sustainable solutions. The aviation industry, including freight operators, is under increasing pressure to reduce its carbon footprint and adopt greener technologies. Innovations in hybrid and electric propulsion systems offer a potential breakthrough for reducing fuel consumption and lowering emissions. As government regulations tighten and consumer demand for eco-friendly solutions grows, airlines and freight operators are exploring new, greener technologies for their fleets. This shift towards sustainability provides a significant opportunity for freighter aircraft manufacturers and operators to invest in cleaner technologies, which will not only benefit the environment but also provide a competitive edge in a market increasingly focused on sustainability.

Rise of Automated and Smart Technologies

The rise of automation and smart technologies in cargo operations presents a substantial opportunity for the US freighter aircraft market. The implementation of automated loading and unloading systems, autonomous aircraft operations, and AI-driven logistics solutions are expected to revolutionize the air cargo industry. These technologies can significantly reduce operational costs, improve efficiency, and shorten turnaround times at airports, all of which are crucial in meeting the demands of a rapidly growing global e-commerce market. Additionally, smart technologies that enable real-time tracking, enhanced cargo security, and optimized route planning can further enhance the value proposition of freighter aircraft. This opportunity is already being explored by major players in the industry, with significant investments being made into the development and deployment of automated technologies, signaling a transformation in air freight operations.

Future Outlook

The future of the US freighter aircraft market is expected to be characterized by continued growth, driven by advancements in technology and the increasing demand for air cargo services. Key developments such as sustainable propulsion systems, automation, and digitalization are set to transform the sector. Regulatory support, especially concerning environmental standards, will shape the direction of technological investments, with a strong emphasis on fuel efficiency and emissions reduction. As e-commerce continues to expand, so too will the need for faster and more reliable air freight services, further driving demand for freighter aircraft.

Major Players

- Boeing

- Airbus

- FedEx Express

- UPS Airlines

- Amazon Air

- Atlas Air

- Cargolux

- DHL Aviation

- Emirates SkyCargo

- Lufthansa Cargo

- Qatar Airways Cargo

- AirBridgeCargo Airlines

- Kalitta Air

- Singapore Airlines Cargo

- China Eastern Airlines Cargo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Freight operators

- Aircraft manufacturers

- Logistics service providers

- Airline operators

- Aircraft leasing companies

- Airlines with dedicated air cargo services

Research Methodology

Step 1: Identification of Key Variables

This step involves recognizing the critical factors influencing the market, including technological innovations, demand drivers, regulatory trends, and industry-specific dynamics. Key market variables are identified from a broad spectrum of sources, ensuring a clear focus on the most impactful elements.

Step 2: Market Analysis and Construction

In this phase, a comprehensive market analysis is conducted using both primary data from interviews and surveys and secondary data from reputable sources. The data is structured to create a detailed market model that segments the market into key components for in-depth analysis.

Step 3: Hypothesis Validation and Expert Consultation

The market model hypotheses are validated through consultations with industry experts, executives, and stakeholders to ensure the assumptions are realistic and aligned with current market trends. This step provides real-world insights and a deeper understanding of market challenges and opportunities.

Step 4: Research Synthesis and Final Output

After gathering and validating all the data, it is synthesized into a final comprehensive market report. This output includes insights, forecasts, and actionable recommendations that are presented clearly to assist stakeholders in making informed decisions based on the latest market trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in E-commerce and Online Retail

Increasing Air Cargo Traffic Demand

Need for Modernization in Air Cargo Fleets

Development of Sustainable Aviation Technologies

Expansion of Global Freight Networks - Market Challenges

High Capital Investment Requirements

Stringent Environmental Regulations

Technological Integration Issues

Lack of Standardization in Conversion Services

Limited Availability of Aircraft for Conversion - Market Opportunities

Advancements in Electric and Hybrid Propulsion

Growing Demand for Eco-Friendly Cargo Solutions

Partnerships for Advanced Cargo Handling Solutions - Trends

Digitalization in Freight Operations

Rise of Autonomous Cargo Aircraft

Focus on Reducing Carbon Emissions in Cargo Aviation

Development of New Aircraft Conversion Technologies

Integration of Smart Cargo Systems - Government Regulations & Defense Policy

Aviation Emission Reduction Standards

FAA Regulations for Aircraft Modification

Cargo Security and Inspection Guidelines - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cargo Aircraft

Specialized Freighter Aircraft

Converted Freighters

Hybrid Freighters

Large Capacity Freighters - By Platform Type (In Value%)

Airborne Platforms

Cargo Hold Platforms

Belly Cargo Platforms

Dedicated Freighter Platforms

Convertible Platforms - By Fitment Type (In Value%)

Integrated Solutions

Custom Fitment Solutions

Modification Services

Retrofit Solutions

Conversion Solutions - By EndUser Segment (In Value%)

Freight Operators

E-commerce Giants

Airlines with Cargo Services

Military Logistics

Third-Party Logistics Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Leasing Companies

Freight Operators’ In-House Procurement

Third-Party Distributors - By Material / Technology (in Value%)

Lightweight Composite Materials

Advanced Avionics Systems

Cargo Management Systems

Fuel-Efficient Engines

Automation & Robotics

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Regional Reach, Technological Innovation, Pricing Strategy, Product Portfolio)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Airbus

Lockheed Martin

GE Aviation

Northrop Grumman

DHL Aviation

FedEx Express

Atlas Air

UPS Airlines

Cargolux

Emirates SkyCargo

Amazon Air

Boeing Global Services

Ryanair

IAG Cargo

- Freight Operators Investing in Modern Fleets

- E-commerce Giants Expanding Delivery Networks

- Military Logistics Adoption of Freighter Aircraft

- Third-Party Logistics Providers Focusing on Efficiency

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035