Market Overview

The US Geo Satellite market is expected to experience significant growth in the coming years, with its market size estimated at approximately USD ~ billion. Growth is largely driven by increased demand for satellite communication services, advancements in satellite technology, and the expansion of satellite networks to meet the rising need for global connectivity. Government investments in space exploration and national security are also contributing factors to the growth of this market. With continuous technological advancements and infrastructure upgrades, the market is poised for expansion.

Several regions and cities in the US dominate the Geo Satellite market due to their strong technological infrastructure, significant investments, and strategic military and government interests. California, particularly Silicon Valley, stands out as a major hub for satellite technology and aerospace companies. Additionally, Washington D.C. plays a crucial role due to the presence of government agencies that oversee satellite programs. Other states like Florida and Texas are also key players due to the presence of major launch sites and aerospace facilities that support the growing satellite industry.

Market Segmentation

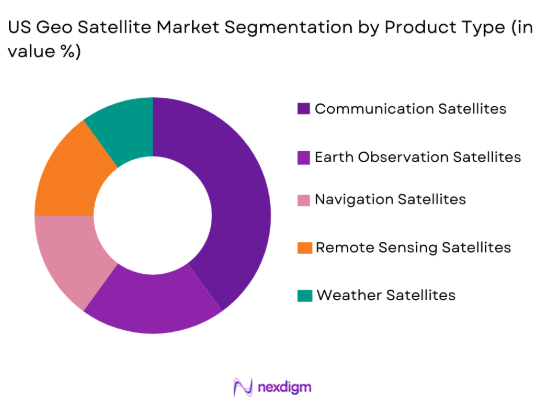

By Product Type

The US Geo Satellite market is segmented by product type into communication satellites, earth observation satellites, navigation satellites, remote sensing satellites, and weather satellites. Recently, communication satellites have a dominant market share due to the growing need for global connectivity and the increasing demand for high-speed internet. The development of next-generation communication satellites capable of providing 5G services, along with the global expansion of satellite networks, has contributed to this dominance.

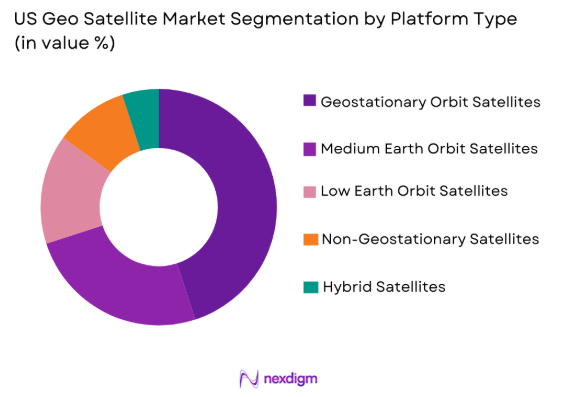

By Platform Type

The US Geo Satellite market is segmented by platform type into geostationary orbit satellites, medium earth orbit satellites, low earth orbit satellites, hybrid satellites, and non-geostationary satellites. Recently, geostationary orbit satellites have a dominant market share due to their ability to provide continuous, stable coverage over a wide geographical area. Their use in communication and broadcasting services makes them essential for numerous industries, including telecommunications and broadcasting.

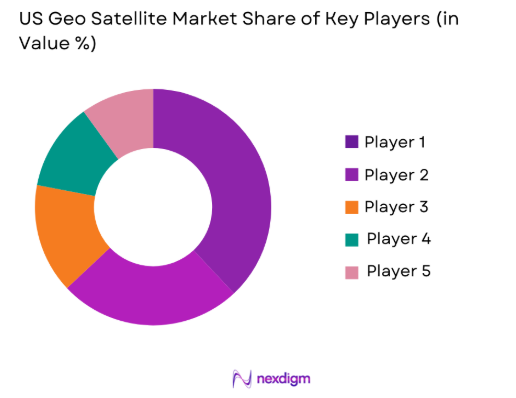

Competitive Landscape

The US Geo Satellite market is highly competitive, with a few dominant players controlling a significant portion of the market. These companies are focusing on advancing satellite technology, increasing the capacity of satellite communication systems, and exploring new launch options. The market has witnessed a wave of consolidation, with mergers and acquisitions strengthening the competitive position of key players. The presence of both established aerospace companies and emerging tech firms provides a diverse competitive landscape.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, IL | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | Hawthorne, CA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| SES S.A. | 1985 | Betzdorf, Luxembourg | ~ | ~ | ~ | ~ | ~ |

US Geo Satellite Market Analysis

Growth Drivers

Technological Advancements in Satellite Technology

Advancements in satellite technology, particularly in the areas of miniaturization, propulsion systems, and energy efficiency, are fueling the growth of the US Geo Satellite market. These innovations have enabled the development of next-generation satellites that are smaller, more efficient, and capable of handling a larger volume of data. The improvement in communication and imaging technologies has further expanded the scope of satellite applications, including telecommunication, earth observation, and national security. Additionally, innovations like multi-orbit satellites and the integration of artificial intelligence into satellite operations are contributing to market expansion. As technology continues to evolve, the deployment of advanced satellites becomes more affordable and accessible, creating new opportunities for growth in the industry. This technological evolution is a key driver in the ongoing transformation of the US Geo Satellite market.

Government Investment in Space Infrastructure

Increased government spending on space exploration, national defense, and satellite infrastructure is another major driver behind the growth of the US Geo Satellite market. The US government is investing heavily in its satellite capabilities to maintain a strategic advantage in national security, communication, and space exploration. Initiatives such as NASA’s Artemis program, the expansion of the U.S. Space Force, and government funding for space-related research and development are contributing to a thriving space ecosystem. Additionally, federal agencies such as the Federal Communications Commission (FCC) and the National Oceanic and Atmospheric Administration (NOAA) are driving investments in satellite technologies. The increasing importance of space-based infrastructure in national defense and economic development further bolsters the government’s role in driving the market’s expansion.

Market Challenges

High Capital Expenditure for Satellite Deployment

One of the significant challenges facing the US Geo Satellite market is the high capital expenditure required for satellite deployment. The costs associated with designing, launching, and maintaining satellites are considerable, and this financial barrier can limit market growth. As satellites are typically expensive to build and launch, only a few companies and government agencies have the financial resources to invest in such projects. Additionally, the cost of upgrading satellite systems to meet the growing demand for high-bandwidth communication further increases capital requirements. This challenge is especially relevant for smaller companies that lack the necessary funding and infrastructure to compete with established players. High capital expenditure can also slow the pace of innovation as companies prioritize cost-effective solutions over cutting-edge technology.

Regulatory Hurdles and Licensing Delays

Regulatory challenges, such as satellite licensing delays and approval processes, present another obstacle for companies in the US Geo Satellite market. Obtaining the necessary regulatory approvals to launch a satellite can be a lengthy and complex process. Agencies like the Federal Aviation Administration (FAA), Federal Communications Commission (FCC), and the National Oceanic and Atmospheric Administration (NOAA) play critical roles in regulating satellite operations. This regulatory environment can cause delays in satellite deployment and result in additional costs for operators. Furthermore, international regulations governing satellite space, spectrum rights, and space debris management complicate the regulatory landscape. The lack of standardized regulations and the need to navigate complex legal frameworks can hinder the development of new satellite technologies.

Opportunities

Expansion of Satellite-Based Internet Services

The growing demand for satellite-based internet services presents a significant opportunity for the US Geo Satellite market. With the rise of remote work, e-learning, and telemedicine, there is an increasing need for reliable internet connectivity in rural and underserved areas. Satellite internet providers are filling this gap by offering high-speed, low-latency internet services through satellite constellations in low-earth and geostationary orbits. Companies such as SpaceX, OneWeb, and Amazon are leading the charge in expanding satellite-based internet services, with a focus on global coverage and affordability. As satellite internet becomes more widely available, the US Geo Satellite market will experience substantial growth, particularly in the commercial sector.

Collaborations and Strategic Partnerships in Satellite Technology

The US Geo Satellite market presents significant opportunities for collaborations and strategic partnerships between aerospace companies, satellite operators, and technology firms. By joining forces, companies can leverage their collective expertise to develop advanced satellite technologies, reduce deployment costs, and improve service delivery. These collaborations allow for the development of new satellite systems that integrate cutting-edge technologies, such as artificial intelligence, quantum communication, and 5G connectivity. Moreover, partnerships between private companies and government agencies enable the sharing of infrastructure, regulatory approvals, and launch services. This collaborative approach is expected to drive innovation and create new market opportunities in the coming years.

Future Outlook

The US Geo Satellite market is expected to continue expanding over the next five years, driven by technological advancements, government investments, and increasing demand for satellite-based services. The development of next-generation satellite constellations, along with innovations in miniaturization and propulsion technologies, will enable the market to cater to evolving communication, earth observation, and defense requirements. Additionally, regulatory support and private sector investments in satellite technologies will further enhance the market’s growth prospects. As global connectivity and data transfer needs continue to rise, the US Geo Satellite market will play a pivotal role in shaping the future of satellite-based services.

Major Players

- Lockheed Martin

- Boeing

- SpaceX

- Northrop Grumman

- SES S.A.

- Thales Alenia Space

- Arianespace

- Iridium Communications

- OneWeb

- Viasat

- L3 Technologies

- Maxar Technologies

- Inmarsat

- Hughes Network Systems

- Globalstar

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Satellite communication companies

- Space exploration agencies

- Defense and military contractors

- Telecommunication service providers

- Satellite data service providers

Research Methodology

Step 1: Identification of Key Variables

Key market variables, such as technological advancements, government policies, and satellite deployment trends, are identified through a combination of primary research and secondary data analysis.

Step 2: Market Analysis and Construction

Market data is analyzed and constructed by segmenting the market based on product type, platform type, and geographical region, using a combination of industry reports and market trends.

Step 3: Hypothesis Validation and Expert Consultation

The developed market model is validated by consulting with industry experts and stakeholders to ensure alignment with real-world trends and developments.

Step 4: Research Synthesis and Final Output

The research findings are synthesized, and a comprehensive market report is prepared, incorporating expert opinions, market data, and future projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of Satellite Communication Networks

Increase in Government Investment in Space Infrastructure

Technological Advancements in Geo Satellite Components

Rising Demand for Earth Observation Data

Advances in Satellite Launch Technologies - Market Challenges

High Initial Capital Costs for Satellite Deployment

Regulatory Barriers in Satellite Licensing

Satellite Lifespan and Maintenance Costs

Risk of Satellite Failures or Malfunctions

Geopolitical Tensions Affecting Space Operations - Market Opportunities

Partnerships with Commercial Satellite Operators

Growth in Demand for Satellite-Based Internet Services

Emerging Opportunities in Space Tourism and Research - Trends

Shift Towards Small and Micro Satellites

Increased Use of AI in Satellite Operations

Rising Demand for Satellite Data in Various Industries

Technological Advancements in Satellite Miniaturization

Growth in Space Debris Management Technologies - Government Regulations & Defense Policy

Space Traffic Management Regulations

Satellite Licensing and Compliance Policies

Government Funding for Satellite Programs

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communications Satellites

Earth Observation Satellites

Navigation Satellites

Remote Sensing Satellites

Weather Satellites - By Platform Type (In Value%)

Geostationary Orbit Satellites

Medium Earth Orbit Satellites

Low Earth Orbit Satellites

Hybrid Satellites

Non-Geostationary Satellites - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Government Agencies

Military Forces

Telecommunication Providers

Aerospace Contractors

Private Space Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

High-Performance Antennas

Satellite Transponders

Power Systems

Solar Panel Technology

Ground Control Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material / Technology, Market Value, Installed Units, System Complexity, Price)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

SpaceX

Lockheed Martin

Boeing

Northrop Grumman

Blue Origin

SES S.A.

Iridium Communications

Intelsat

Eutelsat

Viasat

OneWeb

L3 Technologies

Thales Alenia Space

Rocket Lab

Arianespace

- Government Agencies’ Increasing Dependence on Satellite Data

- Telecommunications Providers Expanding Satellite Connectivity

- Military Forces Advancing Space-Based Communications

- Private Space Firms Seeking Low-Cost Satellite Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035