Market Overview

The US Helicopters market current size stands at around USD ~ million, reflecting sustained fleet replacement cycles across civil, public safety, and defense missions, supported by strong domestic manufacturing, certified aftermarket networks, and mature financing structures. Demand is anchored in mission-critical operations including emergency response, law enforcement patrols, offshore logistics, and utility work, with ongoing investments in safety avionics and reliability upgrades. Operator preferences continue shifting toward multi-mission platforms, predictive maintenance adoption, and standardized training pipelines that stabilize utilization and lifecycle management.

Demand concentration is strongest in coastal and energy-intensive regions, major logistics hubs, and metropolitan areas with dense emergency response infrastructure. Gulf Coast states anchor offshore transport and aerial utility ecosystems, while Western states concentrate firefighting, SAR, and utility operations. Federal and state procurement centers cluster near defense installations and public safety agencies. Mature MRO networks around major rotorcraft corridors improve uptime, while policy emphasis on disaster readiness and aviation safety accelerates fleet modernization and mission system upgrades.

Market Segmentation

By Platform Type

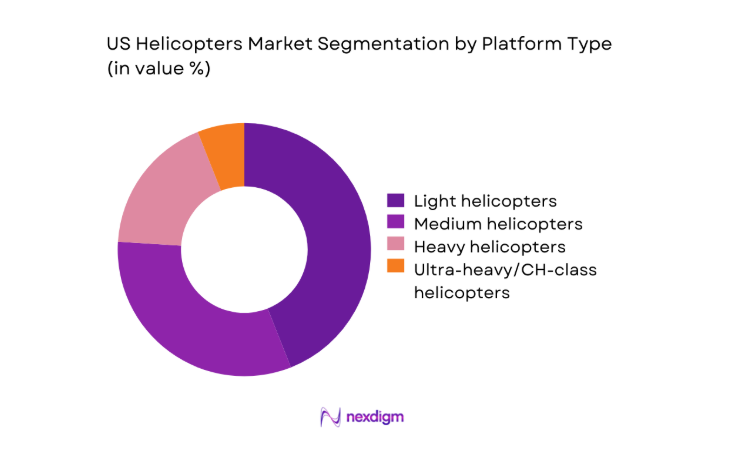

Platform mix is dominated by light and medium helicopters due to versatility across EMS, law enforcement, training, and utility missions. These classes benefit from faster deployment cycles, lower operational complexity, and compatibility with standardized avionics and HUMS, supporting predictable maintenance planning. Heavy platforms retain relevance for offshore transport, firefighting, and defense lift requirements, particularly in regions with long-range missions and payload constraints. Fleet managers prioritize interoperability across mission kits, rapid reconfiguration for seasonal operations, and availability of certified upgrades. Procurement patterns reflect lifecycle optimization, emphasizing platforms with established spares availability, robust MRO ecosystems, and compliance with evolving noise and safety requirements.

By Mission Profile

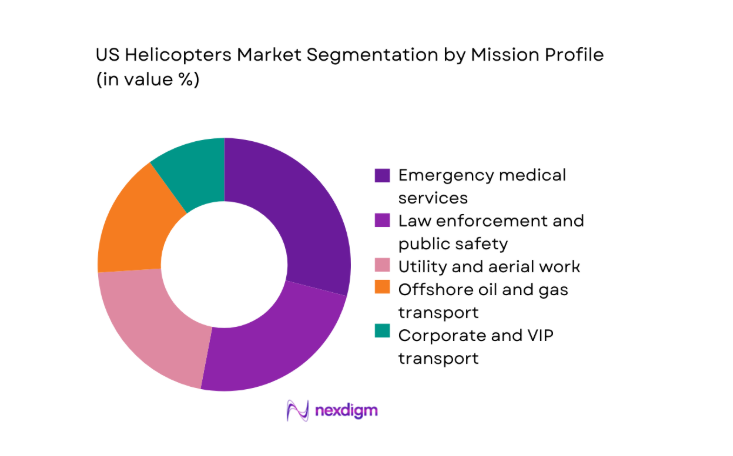

Mission allocation is led by emergency medical services and public safety due to time-critical response needs and policy-backed funding continuity. Utility and aerial work remain structurally resilient, driven by infrastructure maintenance, wildfire suppression, and powerline inspection cycles. Offshore transport sustains demand in energy corridors with mature heliport infrastructure and stringent safety compliance. Corporate and VIP transport remains selective, influenced by regional business travel patterns and security requirements. Operators increasingly favor mission modularity, enabling rapid conversion between medevac, SAR, and utility roles, improving asset utilization and supporting procurement of configurable platforms with certified interior kits.

Competitive Landscape

Competition is shaped by OEM platform breadth, certified upgrade pathways, depth of aftermarket networks, and financing flexibility offered to operators with diverse mission profiles. Service uptime commitments, avionics partnerships, and regulatory readiness influence procurement outcomes across civil, public safety, and defense channels.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Bell Textron Inc. | 1935 | Fort Worth, Texas | ~ | ~ | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | Stratford, Connecticut | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense, Space & Security | 1916 | St. Louis, Missouri | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | Grand Prairie, Texas | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1948 | Philadelphia, Pennsylvania | ~ | ~ | ~ | ~ | ~ | ~ |

US Helicopters Market Analysis

Growth Drivers

Expansion of EMS and air medical networks

State and county EMS coverage expanded across rural corridors, with 2024 approvals adding 17 new heliports near trauma centers and 29 rooftop pads certified under updated fire codes. In 2025, 112 counties adopted revised response-time thresholds aligned with federal emergency preparedness guidance, increasing dispatch frequency and standby coverage. The FAA registered 186 new Part 135 operational certificates between 2022 and 2024, strengthening rotorcraft availability for medical evacuation. Hospital systems reported 74 additional Level I trauma accreditations since 2023, expanding helicopter-enabled catchment areas. Weather resilience investments included 41 instrument approaches certified for hospital pads, improving dispatch reliability during low-visibility conditions nationwide.

Fleet modernization driven by safety and noise regulations

Updated noise abatement corridors implemented by 38 municipalities in 2024 constrained legacy rotorcraft operations near urban zones, accelerating replacement with quieter platforms. The FAA finalized 12 advisory circular revisions on avionics integration and HUMS usage between 2022 and 2025, raising compliance thresholds for continued operation. In 2023, 214 aircraft underwent mandatory ADS-B and terrain awareness upgrades following enforcement actions, while 96 operators aligned maintenance programs with revised reliability reporting frameworks. State aviation authorities issued 53 operating limitations tied to emissions and community noise complaints, incentivizing operators to adopt newer airframes and certified retrofit packages to maintain route access and mission readiness.

Challenges

High acquisition and lifecycle operating costs

Acquisition financing tightened in 2024 as 19 regional banks revised aviation lending criteria, increasing collateral requirements for fleet purchases. Insurance underwriting changes following 27 incident investigations since 2022 raised hull and liability premiums for single-engine operations. Parts lead times extended to 142 days in 2025 due to constrained avionics supply chains, affecting aircraft availability for scheduled missions. Operator maintenance programs recorded 63 additional compliance tasks after revised airworthiness directives, increasing downtime exposure. Fuel logistics disruptions across 21 western airfields in 2023 constrained wildfire response staging, elevating operating complexity and reducing dispatch flexibility during peak seasonal demand windows nationwide.

Pilot and maintenance technician shortages

The FAA recorded 1,384 helicopter ATP certifications issued between 2022 and 2024, below replacement needs across EMS and utility operations. Technician credentialing lagged, with 2,117 rotorcraft-rated A&P certifications over the same period amid retirements from 14 legacy MRO hubs. Training pipelines faced bottlenecks as 23 flight schools reported simulator availability constraints in 2024. Regional wildfire surges required 3,900 additional flight hours in 2025, stretching crew duty limits and compliance monitoring. State workforce grants covered 61 apprenticeship cohorts, yet placement rates remained constrained by geographic mismatch between certified personnel and high-demand operating bases.

Opportunities

Retrofit and avionics modernization programs

Between 2022 and 2024, 487 helicopters entered certified retrofit pathways for glass cockpits, synthetic vision, and HUMS, supported by 9 FAA-approved STCs finalized in 2025. State aviation safety grants funded 64 upgrade packages for public safety fleets, accelerating adoption of digital flight data monitoring. Weather resilience improved as 41 new LPV approaches were commissioned near medical facilities in 2024, expanding operational envelopes. Operator maintenance records showed 22 fewer unscheduled removals per 100 aircraft after HUMS deployment. Institutional safety mandates issued by 16 state agencies prioritized avionics modernization for continued contract eligibility across emergency response missions.

Growth in electric and hybrid-electric demonstrators

Federal innovation programs issued 7 rotorcraft electrification test permits in 2024, enabling 3 hybrid demonstrators to complete flight envelopes under restricted categories. The FAA’s Center of Excellence added 5 research consortia in 2025 to validate battery thermal management and power electronics for vertical lift. State energy offices funded 18 charging pilots at heliports near coastal hubs, supporting ground infrastructure trials. Environmental compliance reviews expanded to 26 municipal jurisdictions, creating operational incentives for low-noise demonstrators. Defense technology transition offices sponsored 14 hybrid propulsion ground tests, aligning certification learning curves with future fleet sustainment requirements and depot integration pathways.

Future Outlook

Through 2035, fleet renewal will remain anchored in safety compliance, mission modularity, and lifecycle reliability. Public safety and disaster readiness priorities will sustain procurement momentum, while electrification pilots mature toward certifiable architectures. Regulatory clarity and supply chain normalization are expected to stabilize delivery schedules, with increasing emphasis on digital maintenance, noise mitigation, and interoperable mission systems across federal, state, and commercial operators.

Major Players

- Bell Textron Inc.

- Sikorsky Aircraft

- Boeing Defense, Space & Security

- Airbus Helicopters

- Leonardo Helicopters

- MD Helicopters

- Robinson Helicopter Company

- Kaman Aerospace

- Enstrom Helicopter Corporation

- StandardAero

- Heli-One

- PHI Group

- Bristow Group

- Metro Aviation

- Erickson Incorporated

Key Target Audience

- Emergency medical service operators

- Law enforcement and public safety agencies

- Defense procurement offices within the Department of Defense

- Offshore energy logistics operators

- Utility and infrastructure service providers

- Aircraft leasing and fleet management companies

- Investments and venture capital firms

- Government and regulatory bodies with agency names such as the Federal Aviation Administration

Research Methodology

Step 1: Identification of Key Variables

Key mission profiles, platform classes, certification pathways, and maintenance regimes were defined to scope demand drivers and operational constraints across civil, public safety, and defense use cases. Fleet age, avionics compliance status, and MRO accessibility were selected as primary structural variables guiding analysis.

Step 2: Market Analysis and Construction

Operational datasets from registries, airworthiness directives, and dispatch activity were synthesized to map utilization patterns and replacement cycles. Policy signals from federal and state aviation authorities were integrated to construct regulatory impact pathways.

Step 3: Hypothesis Validation and Expert Consultation

Structured consultations with operators, maintainers, and safety officers tested assumptions on dispatch reliability, retrofit efficacy, and workforce constraints. Scenario checks were applied to validate mission demand sensitivity to regulatory and infrastructure changes.

Step 4: Research Synthesis and Final Output

Findings were triangulated across operational, regulatory, and infrastructure lenses to derive actionable insights. Outputs were stress-tested for internal consistency and applicability across public safety, commercial, and defense procurement contexts.

- Executive Summary

- Research Methodology (Market Definitions and platform scope standardization, Fleet census and tail-number tracking across civil and government operators, OEM production and backlog triangulation, Operator and MRO executive interviews, FAA registry and airworthiness data mining, Defense procurement and budget document analysis)

- Definition and Scope

- Market evolution

- Usage and mission pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Expansion of EMS and air medical networks

Fleet modernization driven by safety and noise regulations

Rising public safety and disaster response funding

Offshore energy logistics demand stabilization

Increased defense rotorcraft sustainment budgets

Urban congestion driving point-to-point aerial mobility use cases - Challenges

High acquisition and lifecycle operating costs

Pilot and maintenance technician shortages

Stringent certification and compliance timelines

Volatility in defense procurement cycles

Community opposition to noise and emissions

Supply chain disruptions for avionics and powertrains - Opportunities

Retrofit and avionics modernization programs

Growth in electric and hybrid-electric demonstrators

Public safety fleet replacement cycles

MRO outsourcing and power-by-the-hour contracts

Advanced mission systems integration for ISR and SAR

Secondary market growth for certified pre-owned helicopters - Trends

Transition toward glass cockpits and digital avionics

Increased adoption of HUMS and predictive maintenance

Noise footprint reduction technologies

Hybridization and SAF compatibility trials

Mission modularity and quick-change interiors

Data-driven fleet management platforms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Platform Type (in Value %)

Light helicopters

Medium helicopters

Heavy helicopters

Ultra-heavy/CH-class helicopters - By Engine Configuration (in Value %)

Single-engine

Twin-engine

Multi-engine - By Mission Profile (in Value %)

Emergency medical services

Law enforcement and public safety

Search and rescue

Offshore oil and gas transport

Corporate and VIP transport

Utility and aerial work - By End Use Sector (in Value %)

Civil and commercial

Government and public services

Military and defense

Training and flight schools - By Sales Channel (in Value %)

Direct OEM sales

Authorized dealers and distributors

Government procurement contracts

Used and refurbished aircraft channels

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet penetration by class, mission portfolio coverage, installed base and MRO footprint, delivery backlog and lead times, pricing bands by platform, avionics and mission system partnerships, aftermarket service network density, financing and leasing capabilities)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Bell Textron Inc.

Sikorsky Aircraft (Lockheed Martin)

Boeing Defense, Space & Security

Leonardo Helicopters

Airbus Helicopters

MD Helicopters

Robinson Helicopter Company

Kaman Aerospace

Enstrom Helicopter Corporation

Russian Helicopters (US market presence)

Hélicoptères Guimbal (US market presence)

StandardAero

HELI-ONE

PHI Group

Bristow Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035