Market Overview

The US homeland security and emergency management market current size stands at around USD ~ million, reflecting sustained demand for integrated public safety platforms, resilient communications, and incident response capabilities across federal, state, and local agencies. Investment patterns emphasize modernization of legacy command systems, interoperable communications, and data-driven situational awareness. Procurement cycles prioritize lifecycle support, cybersecurity hardening, and integration with existing infrastructure, reinforcing multi-year program continuity and vendor qualification requirements.

Deployment intensity is highest across major metropolitan corridors and disaster-prone regions, where infrastructure density, population concentration, and critical asset exposure elevate preparedness needs. Coastal hubs, border regions, and logistics gateways show elevated adoption due to port security, transportation resilience, and cross-jurisdiction coordination demands. Ecosystem maturity is reinforced by established integrator networks, regional fusion centers, and interoperability frameworks, while policy alignment across emergency management agencies accelerates coordinated response planning and technology standardization.

Market Segmentation

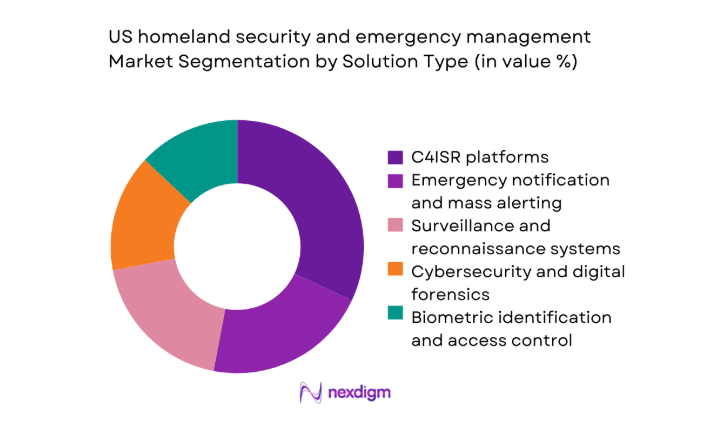

By Solution Type

C4ISR platforms dominate adoption due to their role in unifying incident command, situational awareness, and cross-agency coordination across complex threat environments. Emergency notification systems and surveillance analytics follow closely as agencies prioritize real-time alerts and actionable intelligence for multi-hazard response. Cybersecurity and digital forensics platforms are gaining traction as critical infrastructure digitization expands attack surfaces. Biometric access control adoption remains selective, concentrated in high-security facilities and transportation nodes. Overall dominance reflects procurement favoring interoperable, scalable platforms that integrate data ingestion, command workflows, and field communications within unified operating pictures.

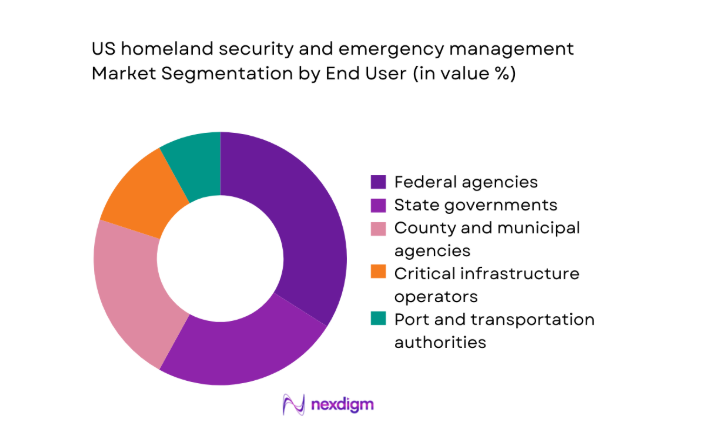

By End User

Federal agencies lead procurement due to centralized mandates for border security, disaster response coordination, and national critical infrastructure protection. State governments represent strong adoption as they bridge federal funding with regional preparedness programs and interoperability mandates. County and municipal agencies drive volume through public safety modernization and NextGen 911 initiatives. Critical infrastructure operators and port authorities adopt selectively, focusing on perimeter security, monitoring, and continuity of operations. Dominance reflects funding alignment, compliance requirements, and operational scale, with federal and state entities shaping standards that cascade across local jurisdictions and sector-specific operators.

Competitive Landscape

The competitive landscape is shaped by prime contractors and systems integrators delivering interoperable platforms, long-term support, and compliance-ready deployments across federal, state, and local agencies.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Motorola Solutions | 1928 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

US homeland security and emergency management Market Analysis

Growth Drivers

Rising frequency and severity of natural disasters and extreme weather events

Across the United States, climate-linked hazards intensified operational demands on emergency management systems during 2024 and 2025. NOAA recorded 28 billion-dollar disaster events in 2023, rising to 31 events in 2024, with 2025 continuing elevated incident counts across coastal and inland regions. FEMA processed over 4 million individual assistance registrations in 2024, stressing coordination platforms and logistics visibility. State emergency operations centers expanded activation days from 110 in 2023 to 147 in 2024, driving requirements for interoperable communications, resource tracking, and field situational awareness. Urban flood mapping updates covered 19 additional metropolitan areas in 2025, expanding digital coordination requirements nationally.

Escalating cyber threats to critical infrastructure and public safety networks

Cyber incidents affecting public safety and critical infrastructure escalated during 2024 and 2025, increasing demand for integrated cyber-physical security coordination. CISA reported 1,200 significant vulnerability advisories in 2024, up from 980 in 2023, with 2025 advisories trending higher. The FBI IC3 logged 880,418 cybercrime complaints in 2023, with public sector incidents rising through 2024 as municipal systems faced ransomware disruptions. DHS sector risk management agencies conducted 460 cyber assessments in 2024 across energy, transportation, and water utilities. Incident response coordination exercises increased to 72 multi-agency drills in 2025, reinforcing the need for unified command visibility.

Challenges

Fragmented procurement across federal, state, and local agencies

Procurement fragmentation across federal, state, and local entities slows deployment coherence and increases integration complexity. In 2024, more than 3,200 active cooperative purchasing vehicles were used across emergency management procurements, creating overlapping standards and contract terms. State procurement codes differ across 50 jurisdictions, while 3,000 counties and over 19,000 municipalities maintain distinct vendor qualification rules. In 2025, GAO identified 146 active federal contract vehicles relevant to public safety technologies, complicating alignment with state schedules. Contract award timelines ranged from 180 to 420 days across agencies, delaying synchronized rollouts and hindering cross-jurisdiction interoperability planning nationwide.

Interoperability gaps among legacy LMR and next-gen broadband networks

Interoperability challenges persist between legacy land mobile radio and broadband systems, constraining unified communications. In 2024, approximately 1,800 distinct radio systems operated across state and local agencies, using multiple frequency bands and proprietary interfaces. FirstNet device activations surpassed 5 million connections by 2024, yet integration with 700 MHz LMR systems remained uneven across 38 states. The FCC authorized 124 waivers in 2025 for spectrum coordination during disaster responses, reflecting ongoing technical mismatches. Training certifications for cross-network operations covered only 62,000 responders nationwide in 2024, limiting consistent field adoption during multi-agency incidents.

Opportunities

AI-driven predictive analytics for disaster preparedness and response

AI-driven predictive analytics can materially improve preparedness by integrating meteorological, geospatial, and infrastructure datasets. NOAA expanded high-resolution forecast grids to 3 km resolution across 2024 deployments, enhancing localized risk modeling. FEMA funded 94 data modernization pilots in 2024, increasing machine-readable incident datasets for model training. State agencies digitized 2.1 million historical incident reports by 2025, enabling supervised learning for evacuation routing and shelter demand forecasting. The National Weather Service increased radar refresh rates to 2 minutes in 2024 for select regions, improving early-warning lead times. These indicators support scalable analytics adoption across emergency operations workflows nationwide.

Cloud-native incident command and resource management platforms

Cloud-native platforms present opportunities to unify command workflows, resource tracking, and interagency coordination with elastic scalability. In 2024, federal cloud authorizations under FedRAMP reached 360 active authorizations, expanding compliant deployment options for public sector platforms. FEMA increased cloud-hosted training enrollments to 84,000 responders in 2024, normalizing remote command simulations. State EOCs expanded virtual coordination rooms from 420 instances in 2023 to 690 in 2024, improving cross-jurisdiction participation. By 2025, 26 states mandated digital resource typing catalogs aligned with NIMS, enabling standardized cloud-based inventory visibility during multi-agency mobilizations across regions.

Future Outlook

The US homeland security and emergency management market outlook through 2035 reflects sustained modernization of interoperable communications, data-driven incident command, and cyber-physical resilience. Federal and state coordination frameworks will continue to mature alongside NextGen 911 and cloud-native platforms. Climate-driven risk profiles will accelerate predictive preparedness and regional mutual-aid integration. Standardization of interoperability protocols and compliance frameworks will shape vendor qualification pathways.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- L3Harris Technologies

- Motorola Solutions

- General Dynamics

- BAE Systems

- Leidos

- CACI International

- SAIC

- Palantir Technologies

- Thales Group

- IBM

- Cisco Systems

- Booz Allen Hamilton

Key Target Audience

- Department of Homeland Security agencies including FEMA, CISA, CBP, TSA

- State emergency management agencies

- County and municipal public safety departments

- Port authorities and transportation security agencies

- Critical infrastructure operators across energy, water, and transportation

- System integrators and managed service providers for public safety platforms

- Procurement and contracting offices within federal and state governments

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Operational use cases, threat domains, interoperability standards, compliance requirements, and deployment models were defined to bound the analytical scope. Data attributes emphasized command workflows, communications resilience, and cyber-physical convergence. Variables were structured to reflect multi-agency coordination complexity and lifecycle support requirements.

Step 2: Market Analysis and Construction

Analytical constructs mapped solution categories to end-user workflows and regulatory pathways. Scenario frameworks aligned disaster response phases with technology enablement layers. Comparative baselines assessed deployment maturity across jurisdictions and operational readiness indicators.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on adoption barriers, interoperability gaps, and digital transformation readiness were validated through structured consultations with emergency management practitioners. Iterative reviews refined operational constraints and procurement realities. Feedback loops stress-tested assumptions against recent incident response patterns.

Step 4: Research Synthesis and Final Output

Findings were synthesized into cohesive narratives linking policy, operations, and technology enablement. Cross-validation ensured internal consistency across segmentation, analysis, and outlook sections. Final outputs emphasize actionable implications for stakeholders and deployment pathways.

- Executive Summary

- Research Methodology (Market Definitions and threat domain coverage, DHS budget and procurement data triangulation, Federal and state RFP and contract award analysis, Primary interviews with emergency management agencies and integrators, Vendor shipment and installed base tracking for public safety systems, Incident response and disaster recovery case study analysis, Regulatory and standards mapping across DHS components)

- Definition and Scope

- Market evolution

- Usage and operational response pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising frequency and severity of natural disasters and extreme weather events

Escalating cyber threats to critical infrastructure and public safety networks

Federal funding growth across DHS, FEMA, and infrastructure resilience programs

Need for interoperable communications and real-time situational awareness

Modernization of legacy public safety and emergency response systems

Expansion of smart city and resilient infrastructure initiatives - Challenges

Fragmented procurement across federal, state, and local agencies

Interoperability gaps among legacy LMR and next-gen broadband networks

Data privacy, civil liberties, and surveillance compliance constraints

Lengthy procurement cycles and complex contracting requirements

Workforce shortages in emergency management and cyber operations

Integration complexity across multi-vendor platforms - Opportunities

AI-driven predictive analytics for disaster preparedness and response

Cloud-native incident command and resource management platforms

Public-private partnerships for critical infrastructure protection

Expansion of FirstNet-enabled applications and device ecosystems

Next-gen 911 modernization and location intelligence deployment

Unmanned systems adoption for search, rescue, and reconnaissance - Trends

Convergence of LMR and broadband communications

Increased use of body-worn cameras with real-time analytics

Shift toward outcome-based and managed service contracts

Adoption of digital twins for infrastructure resilience planning

Growth of cyber-physical security convergence

Standardization of interoperable data platforms across agencies - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Revenue per Unit, 2020–2025

- By Solution Type (in Value %)

Surveillance and reconnaissance systems

Command, control, communications, computers, intelligence, surveillance and reconnaissance platforms

Emergency notification and mass alerting systems

Critical infrastructure protection solutions

Cybersecurity and digital forensics platforms

Biometric identification and access control systems - By Technology (in Value %)

AI and video analytics

IoT sensors and edge devices

Geospatial intelligence and mapping

Cloud-based incident management platforms

Interoperable communications and LMR/LTE

Drones and unmanned systems - By Application (in Value %)

Border and port security

Disaster response and recovery

Public safety and law enforcement operations

Critical infrastructure monitoring

Counterterrorism and threat detection

Cyber incident response - By End User (in Value %)

Federal agencies

State governments

County and municipal emergency management agencies

Public safety and law enforcement departments

Critical infrastructure operators - By Deployment Model (in Value %)

On-premise systems

Cloud-based platforms

Hybrid deployments

Managed services

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (solution breadth, interoperability standards compliance, federal contract footprint, deployment scalability, cybersecurity certifications, service and support coverage, total cost of ownership, partner ecosystem strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Raytheon Technologies

Northrop Grumman

L3Harris Technologies

Booz Allen Hamilton

Leidos

Palantir Technologies

Motorola Solutions

General Dynamics

BAE Systems

CACI International

SAIC

Thales Group

IBM

Cisco Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Revenue per Unit, 2026–2035