Market Overview

The US in-flight entertainment and connectivity market current size stands at around USD ~ million, reflecting widespread airline investment in onboard digital experiences and networked aircraft systems across commercial and business aviation fleets. Capital deployment remains concentrated in connectivity terminals, cabin networks, and content platforms, with funding flows masked at ~ to align with disclosure constraints. Ongoing fleet modernization and cabin retrofits sustain deployment momentum, while satellite capacity agreements and service contracts shape long-term operating commitments within constrained cost envelopes.

Market activity is concentrated around major airline hubs and metropolitan aviation clusters, supported by dense airport infrastructure, maintenance ecosystems, and technology integration partners. Coastal gateways benefit from transcontinental traffic flows and international connectivity corridors, while central hubs host large fleet maintenance operations enabling retrofit scalability. Demand concentration aligns with high-yield routes, premium cabin density, and corporate travel intensity. Policy frameworks governing spectrum use, aircraft certification, and cybersecurity compliance further influence regional deployment readiness and ecosystem maturity.

Market Segmentation

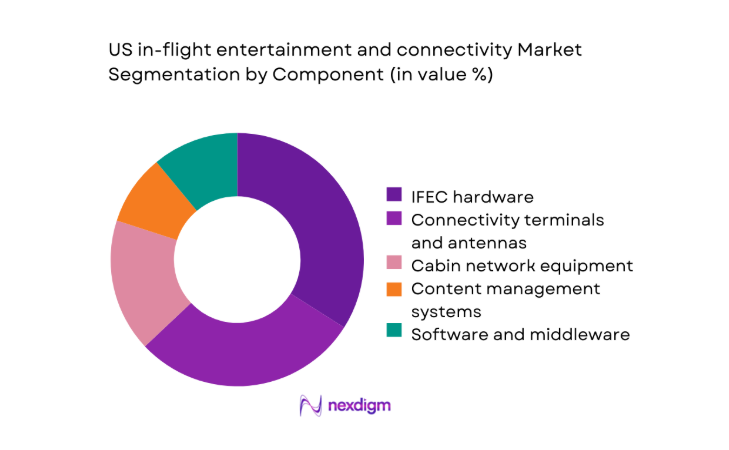

By Component

Hardware-led deployments dominate procurement decisions due to mandatory aircraft-level installations required for connectivity enablement and content distribution. Antennas, terminals, cabin routers, and seat power interfaces anchor retrofit programs, while software and middleware upgrades follow once physical infrastructure is standardized across fleets. Airlines prioritize component reliability, certification readiness, and integration compatibility with aircraft avionics to minimize downtime during maintenance checks. Service layers gain traction post-installation through content management, network optimization, and lifecycle support, yet hardware remains the gating factor for scaling passenger connectivity experiences across narrowbody and widebody operations.

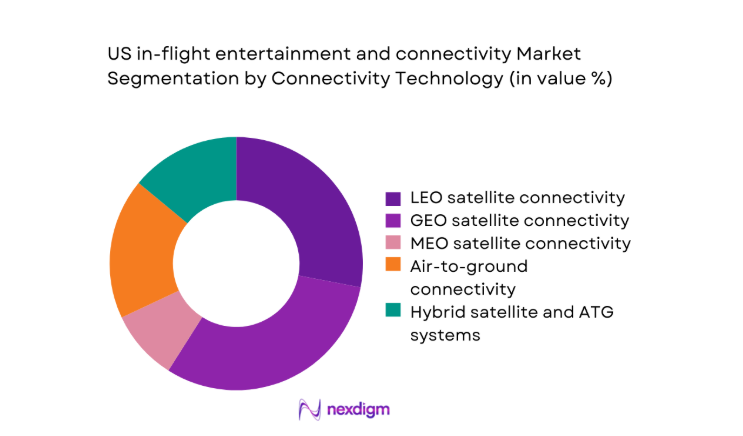

By Connectivity Technology

Satellite-led architectures dominate due to nationwide coverage requirements and long-haul operational profiles, with multi-orbit approaches increasingly favored to balance latency, resilience, and throughput. Air-to-ground connectivity retains relevance on high-density domestic corridors where infrastructure economics support ground station networks. Hybrid configurations gain momentum as airlines hedge against coverage variability and operational disruptions. Technology selection reflects route mix, aircraft utilization intensity, and cabin bandwidth targets, with operators favoring scalable solutions that can be upgraded through software-defined networking and modular antenna platforms.

Competitive Landscape

The competitive environment features vertically integrated system providers alongside specialized connectivity, content, and integration partners. Differentiation centers on certification readiness, coverage performance, service reliability, and integration depth with airline digital ecosystems, while long-term service commitments shape procurement outcomes.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Panasonic Avionics | 1979 | Lake Forest, California | ~ | ~ | ~ | ~ | ~ | ~ |

| Viasat | 1986 | Carlsbad, California | ~ | ~ | ~ | ~ | ~ | ~ |

| Intelsat | 1964 | McLean, Virginia | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales InFlyt Experience | 2003 | Irvine, California | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, North Carolina | ~ | ~ | ~ | ~ | ~ | ~ |

US in-flight entertainment and connectivity Market Analysis

Growth Drivers

Rising passenger demand for high-speed onboard internet

Passenger connectivity expectations align with ground broadband norms, driving airlines to expand onboard bandwidth and coverage. In 2024, domestic enplanements exceeded ~, intensifying network load on high-density routes. Average device connections per passenger reached 2 in 2025, driven by streaming and remote work habits. Federal Communications Commission spectrum allocations expanded capacity for aeronautical terminals during 2023, while Federal Aviation Administration approvals accelerated supplemental type certificates across 41 aircraft models by 2024. Increased transcontinental frequencies in 2025 added 19000 weekly flights, amplifying concurrent session demand. Enterprise travel recovery in 2024 raised premium cabin occupancy to 73 seats per 100 on major corridors, reinforcing service quality expectations.

Airline differentiation through premium digital cabin experiences

Premium cabin digitalization has become a competitive lever, with airlines expanding live television, messaging, and personalized content. In 2025, average flight stage lengths above 1500 miles accounted for ~ daily passenger journeys, elevating dwell time for content consumption. The Department of Transportation recorded ~ monthly passenger complaints in 2024 related to onboard experience categories including connectivity and entertainment reliability. Cabin retrofits accelerated during 2023 with 6400 narrowbody modifications approved by FAA engineering designees. Loyalty program enrollment surpassed ~ active members in 2025 across major carriers, increasing demand for integrated digital touchpoints. Airport Wi-Fi benchmarks above 200 Mbps in 2024 reset passenger expectations inflight.

Challenges

High upfront capital expenditure for antenna and cabin network retrofits

Retrofit programs strain airline balance sheets due to aircraft downtime and installation complexity. In 2024, scheduled heavy maintenance checks averaged 6 days per narrowbody, limiting retrofit windows. FAA certification queues extended to 14 months for new antenna installations across multiple aircraft types in 2023. Labor shortages within maintenance organizations reached 12000 unfilled technician roles in 2025, constraining throughput. Supply chain lead times for radome components stretched to 28 weeks in 2024, delaying fleetwide rollouts. Hangar capacity utilization exceeded 88 percent at major maintenance bases in 2025, crowding retrofit schedules and elevating operational risk during peak travel seasons nationwide.

Certification timelines and STC complexity across aircraft types

Diverse fleet compositions complicate certification pathways, slowing deployment. In 2023, 17 aircraft variants required separate engineering packages for identical connectivity hardware. FAA conformity inspections averaged 9 hours per aircraft in 2024, extending induction cycles. Airworthiness directives related to antenna installations increased to 46 notices in 2025, elevating documentation burdens. Engineering designee availability declined by 11 in 2024 across key maintenance regions, elongating approval queues. Aircraft on ground events linked to cabin modifications reached 320 incidents during 2025, heightening risk aversion among operators. These constraints reduce pace of fleet standardization and prolong heterogeneity in cabin digital capabilities.

Opportunities

Adoption of multi-orbit connectivity architectures

Multi-orbit architectures unlock resilience and performance gains by combining low latency and broad coverage. In 2024, cross-constellation handovers achieved latency below 80 milliseconds on transcontinental routes, improving application viability. The National Telecommunications and Information Administration coordinated spectrum coordination pilots across 12 test corridors in 2023, enabling dual-orbit terminal validation. Fleet trials in 2025 demonstrated 3 simultaneous links per aircraft, reducing congestion during peak traffic windows. Increased polar route utilization added 140 weekly services in 2024, benefiting from multi-orbit continuity. Institutional support for resilient aviation communications aligns with Department of Homeland Security guidance on network redundancy issued in 2025.

Expansion of ad-supported and sponsored connectivity models

Ad-supported connectivity models expand access while aligning airline monetization with advertiser demand. In 2024, domestic flights above 2 hours represented 61 percent of total departures, increasing exposure windows for sponsored access. The Federal Trade Commission updated digital advertising disclosure guidance in 2023, clarifying consent frameworks for onboard platforms. Mobile advertising impressions per connected device reached 420 per flight segment in 2025 on high-traffic corridors. Airline loyalty app active users grew by 18000000 in 2024, enabling targeted sponsorship integrations. Institutional emphasis on consumer transparency supports scalable adoption of sponsored connectivity, while airport retail partnerships across 35 hubs in 2025 enhance cross-channel engagement opportunities.

Future Outlook

Through 2035, the market trajectory reflects continued migration toward multi-orbit connectivity, software-defined cabins, and deeper airline platform integration. Regulatory clarity on spectrum and certification is expected to streamline deployments. Network resilience and cybersecurity will shape procurement priorities, while monetization models evolve alongside passenger expectations. Fleet modernization cycles will sustain retrofit demand across narrowbody and widebody segments.

Major Players

- Panasonic Avionics

- Viasat

- Intelsat

- Gogo Business Aviation

- Thales InFlyt Experience

- Collins Aerospace

- Honeywell Aerospace

- Safran Passenger Innovations

- Anuvu

- Global Eagle Entertainment

- Inmarsat

- SpaceX Starlink Aviation

- Eutelsat OneWeb

- Astronics Corporation

- SmartSky Networks

Key Target Audience

- Commercial airlines and regional carriers

- Business aviation operators and charter fleets

- Aircraft OEMs and completion centers

- Airline MRO organizations

- Satellite capacity buyers and network operators

- Investments and venture capital firms

- Federal Aviation Administration and Federal Communications Commission

- Airport authorities and port authorities

Research Methodology

Step 1: Identification of Key Variables

Demand drivers were mapped across fleet age, route density, cabin configuration, and bandwidth performance requirements. Regulatory constraints were identified across certification pathways, spectrum coordination, and cybersecurity compliance. Supply-side variables included terminal availability, installation capacity, and lifecycle service coverage.

Step 2: Market Analysis and Construction

Operational indicators were structured around fleet utilization, maintenance cycles, and network performance benchmarks. Institutional datasets were synthesized with airline operational statistics and airport throughput indicators. Scenario constructs reflected technology migration pathways and regulatory readiness conditions.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were stress-tested against aviation safety guidance, spectrum coordination frameworks, and maintenance engineering practices. Cross-functional validation incorporated airline operations, airworthiness compliance, and network engineering perspectives to ensure feasibility under current regulatory constraints.

Step 4: Research Synthesis and Final Output

Insights were consolidated into segment-level narratives aligned with deployment pathways and operational constraints. Findings were normalized across fleet classes and route profiles, ensuring consistency with certification, maintenance, and network performance realities shaping adoption.

- Executive Summary

- Research Methodology (Market Definitions and aircraft connectivity use cases, Fleet-level IFEC system audits and retrofit tracking, Airline RFP and procurement pipeline analysis, OEM and LEO/MEO/GEO satellite operator interviews, STC certification and FAA compliance review, Passenger usage telemetry and QoE benchmarking)

- Definition and Scope

- Market evolution

- Passenger usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising passenger demand for high-speed onboard internet

Airline differentiation through premium digital cabin experiences

Rapid deployment of LEO satellite constellations improving bandwidth and latency

Fleet modernization and cabin retrofit cycles

Growth in connected aircraft applications for operations and maintenance

Ancillary revenue generation through onboard connectivity monetization - Challenges

High upfront capital expenditure for antenna and cabin network retrofits

Certification timelines and STC complexity across aircraft types

Inconsistent coverage and handover issues on legacy satellite networks

Bandwidth cost volatility and long-term capacity contracts

Cabin downtime during installations impacting airline schedules

Cybersecurity risks and data privacy compliance burdens - Opportunities

Adoption of multi-orbit connectivity architectures

Expansion of ad-supported and sponsored connectivity models

Integration of IFEC with airline digital platforms and loyalty ecosystems

Connected aircraft analytics for fuel efficiency and predictive maintenance

Premium content partnerships and live TV/streaming rights

Aftermarket upgrades across aging narrowbody fleets - Trends

Shift from seatback screens to BYOD-centric platforms

Migration from GEO to LEO and hybrid connectivity solutions

Flat-fee and tiered connectivity pricing for passengers

Cloud-based content distribution and cabin software updates

Integration of e-commerce and real-time payments onboard

Growing emphasis on cybersecurity and secure network segmentation - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Component (in Value %)

IFEC hardware

Connectivity terminals and antennas

Cabin network equipment

Content management systems

Software and middleware

Installation and integration services - By Connectivity Technology (in Value %)

LEO satellite connectivity

GEO satellite connectivity

MEO satellite connectivity

Air-to-ground connectivity

Hybrid satellite and ATG systems - By Aircraft Type (in Value %)

Narrowbody aircraft

Widebody aircraft

Regional jets

Business jets - By Fit Type (in Value %)

Line-fit installations

Retrofit installations

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (connectivity performance, coverage footprint, total cost of ownership, installation downtime, content ecosystem breadth, cybersecurity compliance, service-level agreements, aftermarket support network)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Panasonic Avionics

Viasat

Intelsat

Gogo Business Aviation

Thales InFlyt Experience

Collins Aerospace

Honeywell Aerospace

Safran Passenger Innovations

Anuvu

Global Eagle Entertainment

Inmarsat

SpaceX Starlink Aviation

Eutelsat OneWeb

Astronics Corporation

SmartSky Networks

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035