Market Overview

The US inflight catering market is valued at approximately USD ~ billion based on a recent historical assessment, driven by rising demand for personalized meal offerings and the growth in passenger traffic. Airlines are increasingly opting for premium catering services, particularly in international long-haul flights, where the need for specialized meals, including dietary-specific options, is growing. The market is also influenced by innovations in technology that enhance food safety, packaging, and operational efficiency, contributing to growth in service quality and customer experience.

Dominant regions in the market include major transportation hubs like New York, Los Angeles, and Chicago. These cities are critical due to their role as international flight gateways, increasing demand for inflight catering services. Furthermore, the prevalence of leading airline hubs and the strategic location of major airports contribute to the dominance of these cities. Other factors, such as the presence of large airline alliances and collaborations with catering companies, play a vital role in maintaining these cities’ positions at the forefront of the inflight catering industry.

Market Segmentation

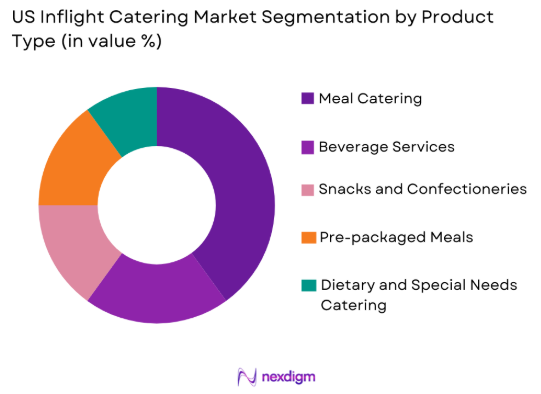

By Product Type

The US inflight catering market is segmented by product type into meal catering, beverage services, snacks and confectioneries, pre-packaged meals, and dietary and special needs catering. Recently, meal catering has dominated the market share due to its critical role in offering customized dining experiences for passengers. Airlines increasingly offer multi-course meals, catering to varied dietary preferences and enhancing the in-flight experience. Moreover, the focus on providing fresh, healthy, and sustainable options aligns with the changing passenger preferences, further fueling the demand for premium meal services.

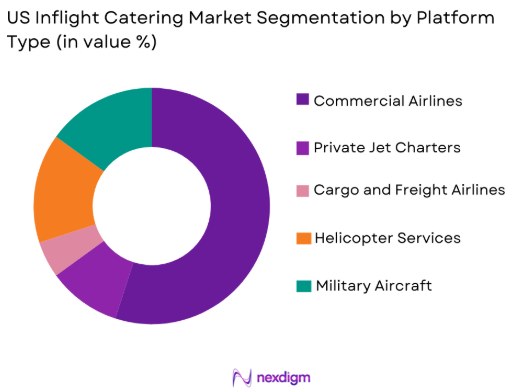

By Platform Type

The US inflight catering market is segmented by platform type into commercial airlines, private jet charters, cargo and freight airlines, helicopter services, and military aircraft. Recently, commercial airlines have captured the largest market share, primarily due to the increasing volume of air travel and the widespread need for in-flight meal services. The growth of low-cost carriers and the demand for enhanced customer service on premium cabins have also significantly contributed to the dominance of this segment.

Competitive Landscape

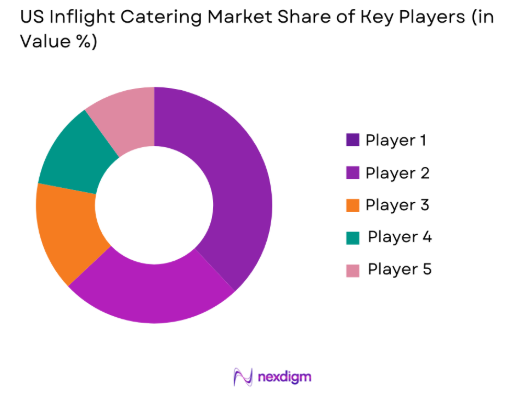

The competitive landscape of the US inflight catering market is marked by consolidation, with a few key players dominating the market. These companies have established a strong foothold by offering a diverse range of catering services to airlines, with a growing focus on high-quality, customizable meals, sustainable packaging, and innovative food safety technologies. The market is also characterized by strategic collaborations between airlines and catering service providers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| LSG Sky Chefs | 1991 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

| Gate Gourmet | 1992 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ |

| SATS Ltd. | 1945 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Flying Food Group | 1983 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Do & Co | 1981 | Vienna, Austria | ~ | ~ | ~ | ~ | ~ |

US Inflight Catering Market Analysis

Growth Drivers

Increased passenger demand for specialized in-flight meals

This driver is fueled by the growing preference among passengers for customized meals that cater to specific dietary requirements, including vegetarian, vegan, gluten-free, and halal options. With airlines offering personalized services to enhance the travel experience, the demand for premium inflight catering services has significantly increased. Airlines are also expanding their meal offerings in response to passenger expectations for healthier and more sustainable dining options, driving market growth. The rise in disposable income across regions has also resulted in greater passenger willingness to pay for premium in-flight meals. This shift towards customization and personalization has made meal offerings a key differentiator for airlines, thereby contributing to the overall market growth.

Expansion of long-haul flights

The increasing number of long-haul international flights has significantly boosted the demand for inflight catering services. These flights often span several hours, leading to greater emphasis on providing high-quality meals and refreshments to enhance passenger comfort. Airlines are focusing on elevating their onboard dining experience by providing multi-course meals, premium beverage offerings, and specialized options that cater to specific passenger needs. Moreover, the growth of international tourism, especially to remote destinations, has driven the expansion of long-haul routes, further increasing the demand for inflight catering services. Airlines are investing in advanced food safety technologies and automated meal preparation to ensure efficient and timely delivery of meals, thereby improving operational efficiency and meeting growing passenger expectations.

Market Challenges

Rising costs of ingredients and operational expenses

The US inflight catering market faces significant challenges due to the rising costs of ingredients, packaging materials, and logistics. Airlines are under pressure to keep costs low while maintaining the quality of their meal offerings. With global inflation and disruptions in the supply chain, catering companies are facing higher food prices, which in turn impact the overall cost of catering services. Additionally, airlines have to balance cost control with customer satisfaction, especially when it comes to premium meal offerings for business and first-class passengers. This cost-pressure is pushing airlines to rethink their catering partnerships, leading to a focus on efficiency and sustainability in their food offerings.

Regulatory compliance and food safety concerns

The market faces ongoing challenges related to strict food safety regulations imposed by aviation authorities and health agencies. Catering services are required to meet stringent hygiene standards to ensure the safety and quality of food served on flights. These regulations often lead to increased operational complexity and higher costs for catering companies. Moreover, compliance with varying regulations across different regions makes it difficult for catering companies to standardize their operations globally. The growing concerns over foodborne illnesses and the need for traceability in food supply chains are putting additional pressure on catering services to maintain the highest standards of food safety.

Opportunities

Growing demand for sustainable packaging solutions

With increasing environmental awareness among consumers, the inflight catering market is presented with a significant opportunity to adopt more sustainable packaging solutions. Passengers are becoming more conscious of the environmental impact of single-use plastics and non-recyclable materials used in catering services. Airlines and catering companies are responding by shifting towards biodegradable and recyclable packaging options, reducing waste and promoting eco-friendly practices. This shift is not only in response to consumer demand but also aligns with global sustainability trends. Catering providers that prioritize sustainable practices are likely to gain a competitive advantage and attract environmentally conscious consumers.

Incorporation of AI and automation in catering services

The integration of artificial intelligence (AI) and automation in inflight catering services presents a significant opportunity for market growth. AI-powered systems can help airlines optimize meal planning, inventory management, and distribution, thereby reducing operational costs and improving efficiency. Additionally, automation in meal preparation and packaging can help caterers meet the increasing demand for personalized meal options while maintaining consistency and speed. This technological advancement can also lead to better tracking and management of food safety and hygiene, further enhancing customer confidence in inflight catering services.

Future Outlook

Over the next five years, the US inflight catering market is expected to witness continued growth driven by increasing passenger demand for personalized meals, technological advancements in catering operations, and a focus on sustainability. Airlines are expected to further refine their catering services with a broader selection of high-quality, eco-friendly meal options. Advances in automation, AI, and food safety technologies will continue to improve operational efficiency, ensuring that airlines can meet rising passenger expectations while managing costs. Regulatory support for sustainable packaging and the growing trend of long-haul flights will further boost the demand for premium inflight catering services.

Major Players

- LSG Sky Chefs

- Gate Gourmet

- SATS Ltd.

- Flying Food Group

- Do & Co

- Air Culinaire Worldwide

- Newrest Group

- Emirates Flight Catering

- American Airlines Catering

- Delta Global Services

- The Emirates Group

- Servair

- JetSet Catering

- Royal Catering Services

- Royal Group International

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airline operators

- Catering service providers

- Food packaging companies

- Technology providers for food safety

- Airport management companies

- Environmental agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market trends, consumer preferences, regulatory policies, and technological advancements were identified. These were based on secondary data sources, market reports, and industry publications.

Step 2: Market Analysis and Construction

In this step, data was analyzed and used to construct market size estimates and segment analysis. Historical data and trends were combined with expert opinions to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations were carried out with industry leaders, manufacturers, and analysts to validate hypotheses and assumptions. This ensured that the findings aligned with real-world market conditions.

Step 4: Research Synthesis and Final Output

The final stage synthesized all collected data and insights into a coherent market report. This involved refining the analysis and ensuring that the report adhered to industry standards and market expectations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Passenger Traffic

Demand for High-Quality In-flight Experience

Technological Advancements in Catering Solutions

Rising Disposable Income and Travel Frequency

Partnerships Between Airlines and Catering Providers - Market Challenges

Cost Pressures from Rising Ingredients and Fuel Costs

Stringent Regulations on Food Safety and Hygiene

Supply Chain Disruptions and Logistics Challenges

Airline Service Standardization Requirements

Environmental Impact of Catering Waste - Market Opportunities

Growth in Demand for Eco-friendly Packaging Solutions

Expanding Premium Service Offerings in Commercial Flights

Adoption of AI and Automation for Catering Operations - Trends

Shift Towards Health-Conscious Meal Options

Increasing Popularity of Special Dietary Meals

Integration of Contactless Service Solutions

Growth of Airline Meal Customization Options

Rising Demand for Localized and Regional Food Choices - Government Regulations & Defense Policy

Regulations on In-flight Food Safety

Airport Security and Catering Supply Chain Compliance

Government Initiatives for Sustainable Aviation

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Meal Catering

Beverage Services

Snacks and Confectioneries

Pre-packaged Meals

Dietary and Special Needs Catering - By Platform Type (In Value%)

Commercial Airlines

Private Jet Charters

Cargo and Freight Airlines

Helicopter Services

Military Aircraft - By Fitment Type (In Value%)

On-board Meal Preparation

Pre-packed Meals

Hybrid Systems

Self-serve Catering

Third-party Catering Services - By End User Segment (In Value%)

Commercial Airlines

Private Jet Operators

Cargo Airlines

Government and Military

Airport Service Providers - By Procurement Channel (In Value%)

Direct Procurement from Catering Services

Airline Catering Partnerships

Online Bidding Platforms

Procurement through Airport Operators

Third-party Distributors - By Material / Technology (in Value %)

Packaging Materials

Cold Chain Technology

Refrigeration Systems

Meal Preparation Equipment

Automated Catering Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Regulatory Landscape, Service Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

LSG Sky Chefs

Gate Gourmet

SATS Ltd.

Dnata Catering

Flying Food Group

Do & Co

Air Culinaire Worldwide

Newrest Group

Emirates Flight Catering

Air India Catering

TFS International

Unifood Catering

Aviator Airport Services

KLM Catering Services

Saudi Arabian Airlines Catering

- Commercial Airlines’ Increasing Demand for Custom Meal Solutions

- Private Jet Charters Offering Premium Catering Options

- Cargo Airlines Incorporating Basic Inflight Catering

- Airport Service Providers Enhancing Passenger Experience

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035