Market Overview

The US Intelligence Surveillance and Reconnaissance market is valued at approximately USD ~ billion, driven primarily by increasing defense budgets and the demand for advanced intelligence technologies. The growth is also influenced by the rising geopolitical tensions and the need for better surveillance and reconnaissance capabilities to maintain national security. Technological advancements in AI, machine learning, and sensor systems play a significant role in boosting market size. This trend is expected to continue as nations prioritize defense and intelligence solutions.

The dominant players in the market include the US and its allies, where major military powers drive demand for advanced ISR systems. The US continues to lead in both technological innovations and procurement, benefiting from robust government funding and a large defense infrastructure. Additionally, countries like the UK and France are significant contributors, as they emphasize modernizing their military capabilities and investing in high-tech surveillance platforms. These nations continue to shape the landscape of the ISR market.

Market Segmentation

By System Type

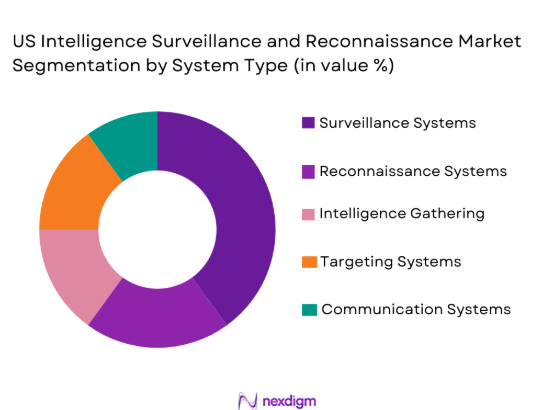

The US Intelligence Surveillance and Reconnaissance market is segmented by system type into surveillance systems, reconnaissance systems, intelligence gathering systems, targeting systems, and communication systems. Recently, surveillance systems have captured the largest market share due to the growing need for continuous monitoring and the ability to collect vast amounts of real-time data. These systems are increasingly being equipped with cutting-edge sensor technologies, enabling enhanced surveillance and faster response times. The demand for such systems is further bolstered by their critical role in national security and military operations.

By Platform Type

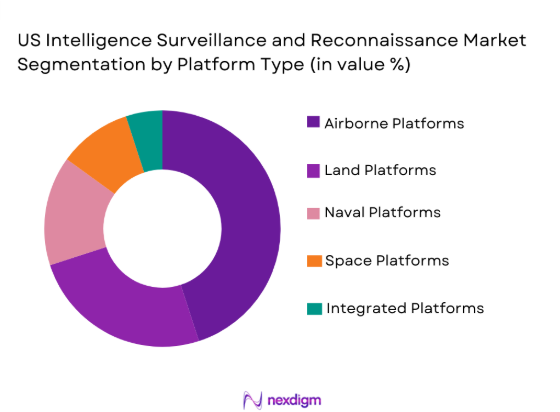

The market is segmented by platform type into airborne platforms, land platforms, naval platforms, space platforms, and integrated platforms. Among these, airborne platforms dominate the market share due to their versatility, ability to cover large areas, and rapid deployment capabilities. They are extensively used in intelligence collection, surveillance, and reconnaissance missions by military forces globally. Airborne platforms also benefit from continuous advancements in unmanned aerial systems (UAS), which offer high efficiency and lower operational costs, further consolidating their leading position in the market.

Competitive Landscape

The competitive landscape of the US Intelligence Surveillance and Reconnaissance market is marked by strong consolidation, with a few key players dominating the market. These players are leveraging technological advancements, large-scale production capabilities, and strategic partnerships to strengthen their market positions. The growing demand for advanced ISR systems, particularly in the defense sector, has encouraged these players to expand their portfolios, focusing on automation, AI integration, and cybersecurity to stay ahead.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, MA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

US Intelligence Surveillance and Reconnaissance Market Analysis

Growth Drivers

Government Funding for National Security

A significant growth driver in the US Intelligence Surveillance and Reconnaissance market is the increasing government expenditure on national security. With rising concerns over cyber-attacks, terrorism, and geopolitical instability, the US government has substantially increased defense spending, particularly for ISR technologies. This includes substantial investments in advanced surveillance systems, reconnaissance satellites, and unmanned aerial vehicles (UAVs). The government’s commitment to securing its borders, critical infrastructure, and military assets has directly propelled demand for ISR systems. The integration of AI and machine learning into these systems also provides a substantial edge in their effectiveness, leading to increased government funding to keep up with evolving threats. This driver will continue to enhance the market’s growth in the long run, as national security remains a priority for defense policies.

Technological Advancements in ISR Systems

Another major growth driver is the continuous technological advancements in ISR systems. As the defense sector embraces innovation, technologies such as AI, machine learning, and enhanced sensor systems are increasingly integrated into ISR systems. These advancements enable more accurate surveillance, quicker data analysis, and real-time actionable intelligence. In particular, innovations in satellite surveillance and UAVs have significantly increased operational efficiency, making them indispensable in modern military operations. With the constant need to stay ahead of emerging threats, the ongoing research and development in ISR technologies are vital in expanding the market’s reach. Newer, more sophisticated systems are also becoming more cost-effective, thereby attracting both large military organizations and smaller defense contractors to invest in these technologies.

Market Challenges

High Capital Costs

One of the major challenges facing the US Intelligence Surveillance and Reconnaissance market is the high capital costs associated with advanced ISR systems. The complexity of these systems, which often involve high-end sensors, AI integration, and specialized platforms like UAVs and satellites, results in significant upfront investments. Furthermore, the cost of maintenance and operational deployment is also high, posing financial challenges to both government agencies and defense contractors. While these systems offer critical advantages, such as enhanced national security and intelligence capabilities, the heavy financial burden often leads to budget constraints and delayed procurement decisions. Smaller defense contractors, in particular, may struggle with the initial cost outlay, which could hinder market expansion.

Cybersecurity Risks

Another challenge to the growth of the US Intelligence Surveillance and Reconnaissance market is the growing cybersecurity risks that accompany advanced ISR systems. These systems collect vast amounts of sensitive data, and as the integration of AI, machine learning, and other digital technologies expands, the risk of cyber-attacks also increases. ISR systems, if compromised, could provide adversaries with critical intelligence, undermining national security efforts. This places immense pressure on defense organizations to not only invest in cutting-edge ISR technology but also in robust cybersecurity measures to protect these systems from cyber threats. As cyber-attacks become more sophisticated, ensuring the security of ISR systems is an ongoing challenge for market players.

Opportunities

Rise of Autonomous Systems in ISR

A prominent opportunity in the US Intelligence Surveillance and Reconnaissance market lies in the rise of autonomous systems. The increasing demand for unmanned aerial vehicles (UAVs), drones, and other autonomous platforms in military operations presents a significant market opportunity. These systems are capable of performing tasks such as surveillance, reconnaissance, and data collection without the need for human intervention. Autonomous ISR systems offer several advantages, including reduced operational costs, increased safety, and the ability to operate in hazardous environments without risking human lives. As defense agencies and contractors continue to adopt autonomous technologies, the market for ISR systems is expected to grow significantly. This trend towards automation is also supported by advancements in artificial intelligence and machine learning, which can enhance the capabilities of autonomous ISR systems.

Emerging Demand for Real-time Intelligence Solutions

Another market opportunity lies in the increasing demand for real-time intelligence solutions. As global security threats become more complex and fast-moving, military forces and intelligence agencies require more immediate access to actionable data. Real-time ISR systems that provide live intelligence on enemy movements, battlefield conditions, and cyber threats are essential for effective decision-making. The rise in geopolitical tensions, particularly in regions such as the Middle East and Eastern Europe, further underscores the need for real-time intelligence. By equipping ISR systems with the ability to gather and analyze data in real-time, defense organizations can enhance their operational response times and improve situational awareness. This need for faster, more efficient intelligence collection creates significant growth opportunities in the market.

Future Outlook

The future outlook for the US Intelligence Surveillance and Reconnaissance market is promising, with substantial growth expected over the next five years. Technological advancements, particularly in AI and autonomous systems, will drive the development of more efficient and cost-effective ISR platforms. Regulatory support and increasing defense budgets, driven by rising geopolitical tensions, will further fuel market expansion. The integration of next-generation technologies, such as AI-enhanced surveillance systems and real-time intelligence solutions, will reshape the market, offering improved operational efficiency and data accuracy.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- General Dynamics

- BAE Systems

- Thales Group

- Leonardo

- Elbit Systems

- L3 Technologies

- Leidos

- Harris Corporation

- Textron Systems

- General Electric

- SAIC

- Rockwell Collins

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense agencies

- Aerospace and defense contractors

- Intelligence agencies

- Cybersecurity firms

- Homeland security agencies

- Technology integrators

Research Methodology

Step 1: Identification of Key Variables

In this step, key market variables influencing the growth of the US Intelligence Surveillance and Reconnaissance market are identified, including defense budgets, technological trends, and geopolitical factors.

Step 2: Market Analysis and Construction

The market analysis is conducted by gathering data from reliable sources, including government publications, industry reports, and primary interviews with experts and stakeholders to understand the market’s current state.

Step 3: Hypothesis Validation and Expert Consultation

The initial hypotheses about market trends and growth drivers are validated through consultations with experts, including defense analysts, technology experts, and industry professionals.

Step 4: Research Synthesis and Final Output

All collected data and insights are synthesized into a comprehensive report, with detailed market segmentation, growth drivers, challenges, opportunities, and future forecasts for the US Intelligence Surveillance and Reconnaissance market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in Defense and National Security

Advancements in Surveillance and Reconnaissance Technologies

Heightened Security Concerns and Geopolitical Tensions

Demand for Real-time Intelligence in Military Operations

Integration of Commercial Technologies into Defense Systems - Market Challenges

High Capital Expenditure in Defense Projects

Technological Integration and Interoperability Issues

Cybersecurity Threats and Vulnerabilities

Complex Regulatory and Compliance Barriers

Political and Social Resistance to Military Expansion - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Battlefield Operations

Surge in Cybersecurity Investments for Defense Systems

Growing Use of Commercial Off-the-Shelf (COTS) Technology

Shift Towards Modular and Scalable Defense Solutions - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveillance Systems

Reconnaissance Systems

Intelligence Gathering Systems

Targeting Systems

Communication Systems - By Platform Type (In Value%)

Airborne Platforms

Land Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Intelligence Agencies

Defense Contractors

Government Agencies

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Surveillance Sensors

Communication Systems

Radar Technologies

AI and Machine Learning Technologies

Advanced Imaging Solutions

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Technology, Material, Regulatory Compliance, Market Reach, Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

General Dynamics

BAE Systems

L3 Technologies

Leidos

Harris Corporation

Thales Group

Elbit Systems

Saab Group

Textron Systems

Aerospace Industries Association

General Electric

Leonardo

- Military Forces’ Increasing Demand for Intelligence Solutions

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Intelligence Agencies’ Use of Advanced Reconnaissance Technologies

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035