Market Overview

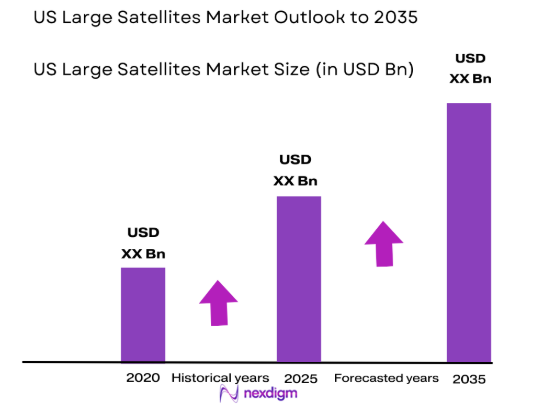

Based on a recent historical assessment, the US Large Satellites Market is valued at approximately USD ~ billion. The market is driven by increasing investments in communication, Earth observation, and defense satellite technologies, with key demand from commercial and government entities. Key technological advancements, including miniaturization and better propulsion systems, further push the market’s growth, while evolving space policies and growing demand for satellite services fuel the expansion. Rising geopolitical tensions also contribute to a surge in defense satellite investments.

The US remains a dominant force in the global large satellites market, largely due to its advanced infrastructure, heavy government involvement, and presence of leading private sector players. Major cities such as Washington D.C., San Francisco, and Los Angeles serve as the central hubs for satellite development and operations. Strong collaborations between government agencies like NASA and private entities, supported by federal funding, cement the US’s position as the leading player in the market. Additionally, the strategic positioning of US-based satellite manufacturers enhances the country’s competitive edge.

Market Segmentation

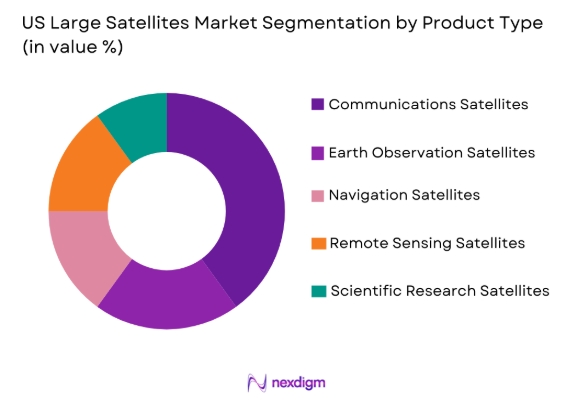

By Product Type

The US Large Satellites Market is segmented by product type into communications satellites, Earth observation satellites, navigation satellites, remote sensing satellites, and scientific research satellites. Recently, communication satellites have a dominant market share due to the ongoing demand for high-capacity internet services, broadband, and military communication systems. The adoption of advanced communication technologies, coupled with increasing internet penetration in remote areas, has further fueled the demand for these systems. Communication satellites offer scalable solutions, with the ability to support both government and commercial networks, making them essential for telecommunications infrastructure.

By Platform Type

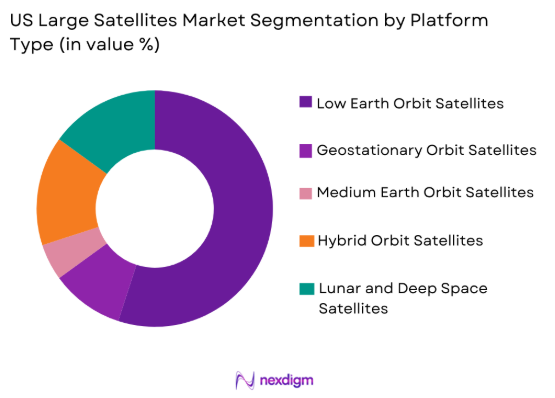

The US Large Satellites Market is segmented by platform type into geostationary orbit satellites, low Earth orbit satellites, medium Earth orbit satellites, hybrid orbit satellites, and lunar and deep space satellites. Low Earth orbit (LEO) satellites have a dominant market share due to the increasing demand for broadband connectivity, Earth monitoring services, and data communication systems. LEO satellites are more cost-effective compared to geostationary counterparts and offer reduced latency, which makes them particularly appealing for commercial applications like Internet of Things (IoT) and high-speed communications. Furthermore, the rise of satellite constellations in LEO enables global coverage, thus reinforcing their market position.

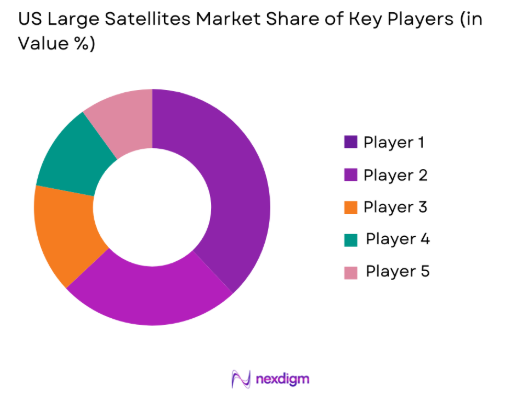

Competitive Landscape

The US Large Satellites Market is characterized by a highly competitive landscape, where both private companies and government agencies play significant roles. Major players continue to consolidate through strategic partnerships and mergers to strengthen their technological capabilities and expand their satellite services. Companies such as SpaceX, Lockheed Martin, and Boeing lead the market with cutting-edge technologies and large-scale manufacturing capacities, while emerging firms focus on innovations like satellite constellations and miniaturized satellites. Government funding and military contracts remain pivotal in maintaining market leadership.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-specific Parameter |

| SpaceX | 2002 | Hawthorne, CA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, IL | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 2000 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

US Large Satellites Market Analysis

Growth Drivers

Increased Demand for Communication Satellites

The demand for communication satellites is growing due to advancements in broadband services, especially in remote and underserved areas. The global shift towards digital services, coupled with increasing satellite internet demand, drives growth in the sector. The rise of satellite constellations like SpaceX’s Starlink has significantly impacted the market, offering low-latency, high-bandwidth services across the globe. Moreover, military communication systems’ reliance on satellites for secure communication further boosts the demand for these systems. With governments focusing on reducing internet disparities and expanding communication capabilities, the market for communication satellites continues to witness rapid growth. The commercial sector’s increasing reliance on satellite data for various applications, including IoT and emergency services, also propels the market forward. The growing need for secure communication for national defense amplifies investments in satellite communication networks. As commercial satellite operators expand their services, the demand for communication satellites will remain robust, contributing to market growth.

Advancements in Earth Observation and Surveillance Technologies

Earth observation satellites are gaining momentum due to their critical role in climate monitoring, agricultural management, and disaster response. Technological improvements in imaging and sensor technologies have enhanced the capabilities of Earth observation satellites, allowing for more accurate data collection and analysis. Governments and private sectors alike use satellite data to track weather patterns, monitor deforestation, and support urban planning. Space agencies’ increasing involvement in monitoring environmental changes fuels demand, as these satellites provide valuable insights that drive policy and decision-making processes. Additionally, the integration of AI and machine learning in satellite data processing is improving the efficiency of monitoring systems. As data availability increases, commercial players are using it to enhance crop yield predictions and improve supply chain management. These advancements are pivotal in driving the adoption of Earth observation satellites, further expanding market demand for sophisticated monitoring technologies.

Market Challenges

High Capital Investment and Operational Costs:

One of the biggest challenges in the US Large Satellites Market is the high capital required for satellite development and launch operations. Building and launching large satellites involves significant investments in research, design, materials, and infrastructure. The complexity and technical requirements of satellite systems, especially those used for communication and Earth observation, add to the financial burden on manufacturers and operators. As satellite operators seek to extend the operational lifespan of their satellites, maintenance and operational costs also become substantial. The cost of launching satellites is another critical factor, with launch vehicles requiring advanced technology and infrastructure. Furthermore, the inability to recover these costs through a single satellite launch necessitates economies of scale to justify the expenses. High investment costs create a barrier for small players looking to enter the market and pose financial risks for firms involved in long-term satellite missions. This financial challenge is particularly difficult for governments and companies with limited funding sources.

Space Debris and Orbital Congestion

With the rise in satellite constellations and the growing number of satellites in orbit, space debris management has become a significant concern. Satellites, once launched, can contribute to space debris if not properly decommissioned, threatening both existing satellites and future missions. The congestion in low Earth orbit (LEO), in particular, increases the risk of satellite collisions, which could result in debris expanding further. This debris poses an ongoing challenge to space operations and is difficult to manage due to the absence of comprehensive global regulations. The lack of effective de-orbiting strategies for old satellites also increases the risk of debris accumulation. The potential for interference with existing satellites, including communication and Earth observation satellites, adds complexity to satellite missions. While the implementation of advanced collision avoidance technologies offers some solutions, the problem of space debris remains a significant barrier to the sustainable growth of the satellite market. Regulations for debris mitigation are still in their early stages, which exacerbates the issue.

Opportunities

Expansion of Satellite-Based Internet Networks

The increasing demand for high-speed internet in underserved areas presents a major opportunity for the US Large Satellites Market. Satellite-based internet networks, especially those using low Earth orbit (LEO) constellations, provide an efficient way to deliver connectivity to remote regions where traditional terrestrial infrastructure is not feasible. This emerging market is poised for growth, as both government and private sectors recognize the benefits of satellite internet in bridging the digital divide. SpaceX’s Starlink and other satellite constellations are at the forefront of this revolution, and their ability to deliver high-speed, low-latency internet services drives interest in satellite communications. The expansion of satellite networks for broadband services, including for education, healthcare, and rural connectivity, will contribute to growing investments in satellite communications infrastructure. Given the evolving technological landscape, satellite internet providers are expected to play a pivotal role in shaping the future of global connectivity.

Rising Demand for Earth Observation and Environmental Monitoring

Earth observation satellites are increasingly being used to monitor environmental changes, including deforestation, climate change, and natural disasters. The growing need for data-driven insights on climate change is driving investments in satellite technology for monitoring environmental health. Governments, research organizations, and environmental agencies are leveraging satellite data to track pollution levels, changes in land use, and the impact of natural disasters. The private sector is also tapping into this market by using satellite data for agricultural forecasting, urban planning, and disaster risk management. The integration of AI and big data analytics with Earth observation systems will enable more accurate predictions and better management of environmental resources. As more countries and organizations adopt satellite technology to combat climate change and safeguard the environment, the demand for Earth observation satellites is expected to increase, creating growth opportunities for satellite manufacturers and service providers.

Future Outlook

The US Large Satellites Market is set for significant growth in the coming years, driven by advancements in satellite technologies, increasing demand for broadband connectivity, and the growing need for environmental monitoring. Innovations such as satellite constellations, miniaturization, and improved propulsion systems will shape the market’s future landscape. Government regulations supporting space exploration and satellite data services will provide favorable conditions for growth, while private-sector involvement, particularly in LEO satellite networks, will drive market expansion. Rising geopolitical tensions and increasing reliance on satellites for communication and defense will further strengthen the market.

Major Players

- SpaceX

- Lockheed Martin

- Boeing

- Northrop Grumman

- Airbus

- SES S.A.

- Maxar Technologies

- Blue Origin

- One Web

- SSL (Space Systems Loral)

- Iridium Communications

- Planet Labs

- Rocket Lab

- Astroscale

- Arianespace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite communication companies

- Aerospace and defense contractors

- Telecom service providers

- Environmental monitoring agencies

- Space technology manufacturers

- Satellite service providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical market variables that influence the growth, trends, and challenges of the market. Key data points and relevant factors are analyzed from multiple sources.

Step 2: Market Analysis and Construction

Market trends and patterns are analyzed using historical data to construct market segmentation, assess competitive landscapes, and understand industry dynamics. This step includes expert consultations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses and assumptions made during the analysis are validated by consulting industry experts and stakeholders. Additional data from primary sources is incorporated for accuracy.

Step 4: Research Synthesis and Final Output

All collected data is synthesized into actionable insights to form a comprehensive report. The final output includes detailed analysis, forecasts, and recommendations based on the research conducted.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investments in Space Programs

Rising Demand for Communication Infrastructure

Technological Advancements in Satellite Manufacturing

Expansion of Earth Observation for Climate Monitoring

Improved Launch Vehicle Capabilities - Market Challenges

High Capital Costs and Initial Investment

Geopolitical Tensions and Export Restrictions

Challenges in Satellite Lifetime and Sustainability

Cybersecurity Threats and Space Debris Management

Regulatory Hurdles and Licensing Issues - Market Opportunities

Growth in Commercial Satellite Networks

Strategic Partnerships Between Government and Private Sector

Emerging Demand for Satellites in IoT and Connectivity - Trends

Miniaturization of Satellite Components

Integration of AI in Satellite Operations

Growth of Mega constellations in Low Earth Orbit

Increased Use of Satellite Data for Climate Solutions

Technological Advances in Space Launch Capabilities - Government Regulations & Defense Policy

International Space Law and Satellite Coordination

Government Funding for National Security Satellites

Export Control Regulations and Licensing Policies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communications Satellites

Earth Observation Satellites

Navigation Satellites

Remote Sensing Satellites

Scientific Research Satellites - By Platform Type (In Value%)

Geostationary Orbit Satellites

Low Earth Orbit Satellites

Medium Earth Orbit Satellites

Hybrid Orbit Satellites

Lunar and Deep Space Satellites - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Modular Solutions

Integrated Solutions

Hybrid Solutions - By End User Segment (In Value%)

Government Agencies

Defense Contractors

Commercial Enterprises

Space Agencies

Satellite Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Third-party Distributors

Online Bidding Platforms - By Material / Technology (In Value%)

Solar Panels

Ion Propulsion Systems

Thermal Control Systems

Advanced Payload Systems

Onboard Computing Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material / Technology, Competitive Positioning, Geographic Coverage, R&D Investments)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

SpaceX

Lockheed Martin

Boeing

Northrop Grumman

Airbus Defence and Space

Thales Alenia Space

SES S.A.

Maxar Technologies

Blue Origin

OneWeb

SSL (Space Systems Loral)

Iridium Communications

Planet Labs

Rocket Lab

Astroscale

- Government Agencies’ Strategic Space Initiatives

- Commercial Enterprises’ Growing Need for Connectivity

- Defense Contractors’ Increasing Investment in Satellite Technology

- Satellite Service Providers’ Expansion into Emerging Markets

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035