Market Overview

Based on a recent historical assessment, the US Light Weapons Market size is projected to reach USD ~ billion, driven by growing demand for advanced personal defense and military applications. This market growth is influenced by key factors such as increased defense spending, advancements in lightweight weapon technologies, and heightened security concerns. The expansion of law enforcement and private security sectors further contributes to the overall demand, while consumer preference for compact and versatile weapons continues to rise. Additionally, continued modernization of military forces boosts overall market potential.

The market’s dominance is primarily seen in regions with high defense budgets and advanced technological infrastructure, such as the United States, Europe, and parts of Asia. These regions continue to lead due to factors like technological innovation, government support for defense procurement, and well-established manufacturing ecosystems. The US remains a significant player due to its strong military presence, ongoing defense modernization programs, and continued investment in cutting-edge weapon systems, securing its position as a leader in the global light weapons market.

Market Segmentation

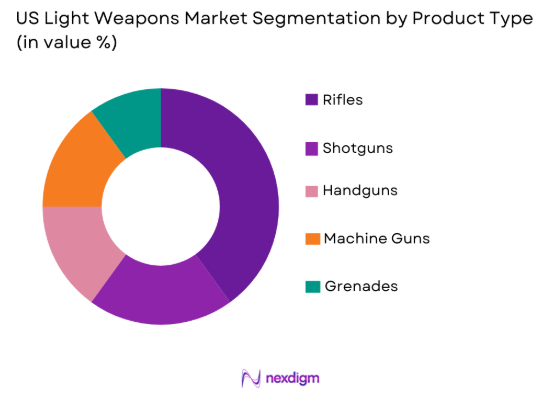

By Product Type

The US Light Weapons market is segmented by product type into rifles, shotguns, handguns, machine guns, and grenades. Recently, rifles had a dominant market share due to their widespread use across military, law enforcement, and civilian sectors. The increasing demand for versatile, reliable, and easy-to-manage weapons has made rifles the go-to choice for many defense contractors and consumers. The wide range of designs, calibers, and configurations available, combined with advancements in manufacturing technologies, further drives the growing preference for rifles in comparison to other light weapon types. As the market expands, the continued focus on improving rifle accuracy and ergonomics further strengthens their dominant position.

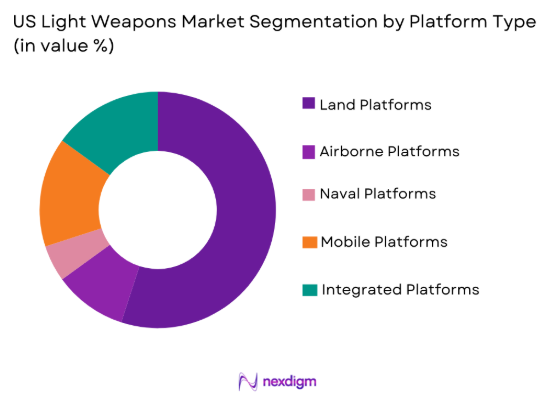

By Platform Type

The US Light Weapons market is segmented by platform type into land platforms, airborne platforms, naval platforms, mobile platforms, and integrated platforms. Recently, land platforms have a dominant market share due to the high demand for personal defense weapons and their extensive application in ground-based military operations and law enforcement. The need for compact, high-performance weapons that can be easily deployed in various environments and combat situations fuels this dominance. Furthermore, advancements in land-based platform technologies, such as armored vehicles and mobile units, continue to enhance the demand for light weapons tailored for ground forces, ensuring land platforms remain at the forefront of the market.

Competitive Landscape

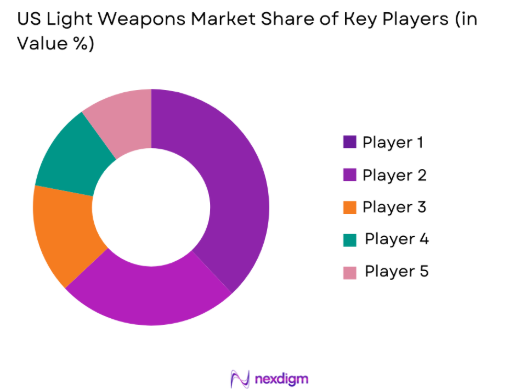

The competitive landscape of the US Light Weapons market is characterized by a mix of well-established manufacturers and a growing number of innovative firms. Industry consolidation is evident as major players continue to acquire smaller companies to expand their technological capabilities and market reach. The influence of these major players is significant, as they set technological trends, influence product innovation, and lead the market in both domestic and international defense procurements. Companies with strong R&D capabilities and diverse product portfolios are expected to maintain dominance in this evolving market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-specific Parameter |

| Smith & Wesson | 1852 | Springfield, MA | ~ | ~ | ~ | ~ | ~ |

| Glock | 1963 | Vienna, Austria | ~ | ~ | ~ | ~ | ~ |

| Sig Sauer | 1853 | Newington, CT | ~ | ~ | ~ | ~ | ~ |

| Colt | 1836 | Hartford, CT | ~ | ~ | ~ | ~ | ~ |

| Heckler & Koch | 1949 | Oberndorf, Germany | ~ | ~ | ~ | ~ | ~ |

US Light Weapons Market Analysis

Growth Drivers

Increased Defense Spending

Increased military budgets, especially in North America, have significantly boosted demand for advanced light weapons. The US government’s commitment to modernizing its armed forces with state-of-the-art technologies is a driving force behind the growth of the light weapons market. The rise in global military expenditures, particularly in defense-focused countries, contributes to market expansion. As the demand for highly advanced, lightweight, and durable weaponry grows, defense contractors are actively focusing on developing systems to meet these needs. The US government also supports domestic manufacturers, which incentivizes the continuous innovation and growth of the market. With heightened geopolitical tensions, there is an ongoing emphasis on enhancing national security, further fueling the demand for cutting-edge light weapons. As defense budgets grow, light weapons are seen as essential for the success of military operations, creating a strong growth trajectory in the market.

Technological Advancements in Weaponry

Technological advancements in light weaponry, including improved accuracy, lightweight materials, and ergonomic designs, have driven demand in both military and law enforcement sectors. The development of smart weapons equipped with advanced sensors and integrated communication systems has further enhanced the capabilities of light weapons, positioning them as indispensable tools in modern military strategies. Additionally, continuous innovation in weapon manufacturing processes has enabled the creation of more efficient and cost-effective products. The integration of modular designs and AI technologies has transformed the usability of these weapons, allowing for increased versatility in various combat scenarios. As countries focus on developing technologically advanced defense systems, light weapons have become a key component in these efforts. The widespread adoption of cutting-edge technologies in weaponry ensures that technological advancements remain a crucial driver of the market’s growth.

Market Challenges

Regulatory Constraints

One of the key challenges facing the US Light Weapons market is the regulatory environment surrounding the production and distribution of firearms and related technologies. Stringent regulations on the sale, use, and export of light weapons, especially in regions with strict gun control laws, can hinder market growth. These regulations often limit the types of firearms that can be legally manufactured or sold, particularly in consumer markets, thereby impacting the revenue potential for manufacturers. Moreover, varying regulations across countries can complicate international sales and create barriers to market entry for companies. Regulatory uncertainties and the frequent changes in legislation regarding gun ownership and sales also contribute to market instability, making it difficult for manufacturers to plan long-term production strategies. As governments continue to impose new laws and guidelines, the regulatory challenge will persist, potentially limiting growth in certain regions.

Economic Pressures

Economic instability and fluctuations in the global economy pose a challenge to the growth of the US Light Weapons market. In times of economic downturn, both governments and private consumers may reduce spending on firearms and defense equipment, limiting demand. Additionally, rising raw material costs, especially for advanced alloys and polymers used in weapon manufacturing, can lead to higher production costs, which are often passed on to consumers. In countries with growing economic pressures, defense budgets may be reduced, directly impacting the procurement of light weapons. Although the demand for security remains high, particularly in volatile regions, economic factors can create challenges for companies seeking to maintain profitability while meeting market needs. These economic pressures, combined with inflationary trends and supply chain disruptions, could negatively affect the growth rate of the market.

Opportunities

Integration of AI in Light Weapons

The integration of Artificial Intelligence (AI) into light weapons is a significant opportunity for manufacturers in this market. AI-powered systems can enhance the precision, targeting, and functionality of firearms, providing tactical advantages in military and law enforcement operations. By embedding AI into light weapons, such as smart rifles, manufacturers can offer solutions that improve decision-making, reduce human error, and enable more effective engagement in combat scenarios. The development of AI-based weaponry is increasingly attractive to defense agencies looking to modernize their forces with advanced technologies. As AI continues to evolve, its applications in light weapons will likely expand, creating significant opportunities for innovation and market growth. The adoption of AI-powered solutions will be especially crucial as the market looks to enhance the capabilities of light weapons while reducing operational risks and improving overall effectiveness.

Rising Demand for Personal Protection

The growing emphasis on personal protection, especially in urban and high-risk areas, presents a significant opportunity for the US Light Weapons market. With increasing concerns over crime and terrorism, civilians and private security firms are increasingly seeking firearms that provide reliable, easy-to-use, and efficient self-defense options. The demand for compact, concealable firearms, such as handguns and concealed-carry rifles, is on the rise. Additionally, law enforcement agencies are also adopting advanced weapons systems to protect public safety, further driving the demand for light weapons. As awareness of personal security increases, the consumer base for these products continues to expand. The personal protection market also includes the burgeoning interest in advanced weaponry technologies, such as smart guns that integrate biometric features. This evolving demand for self-defense solutions creates substantial opportunities for manufacturers to meet the specific needs of individual users and security firms.

Future Outlook

The US Light Weapons market is poised for continued growth over the next five years, driven by technological advancements, increasing defense budgets, and heightened demand for personal protection. As military forces modernize and law enforcement agencies invest in more sophisticated firearms, the demand for advanced light weapons will increase. Technological innovations such as AI integration, smart sensors, and modular weapon systems will shape the future of the market. Regulatory support in certain regions will enable smoother procurement processes, while rising security concerns globally will ensure continued investment in defense and personal safety solutions. The market is expected to witness significant growth, driven by both technological and demand-side factors, offering promising prospects for manufacturers and stakeholders.

Major Players

- Smith & Wesson

- Glock

- Sig Sauer

- Colt

- Heckler & Koch

- Remington Arms

- Beretta

- FN Herstal

- Ruger

- Browning Arms

- Springfield Armory

- LMT Defense

- Kahr Arms

- Sturm, Ruger & Co.

- Magpul Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military forces

- Defense contractors

- Law enforcement agencies

- Private security companies

- Consumer firearms retailers

- Firearms distributors

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the essential variables that drive market trends, such as product types, technologies, regional factors, and consumer preferences.

Step 2: Market Analysis and Construction

We analyze current market trends, historical data, and consumer demand patterns to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, manufacturers, and stakeholders to ensure alignment with current market realities.

Step 4: Research Synthesis and Final Output

All gathered data and insights are synthesized into a comprehensive final report that offers actionable insights and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending in North America

Rising demand for advanced personal defense systems

Growth of private security and law enforcement sectors

Technological advancements in weapon systems

Ongoing military modernization programs - Market Challenges

High manufacturing and maintenance costs

Stringent regulations and compliance requirements

Challenges in weapon system interoperability

Political and social resistance to militarization

Cybersecurity risks in weapon technologies - Market Opportunities

Expansion of private sector security services

Increasing demand for lightweight and portable weapons

Technological integration in weapon systems - Trends

Growth of unmanned and autonomous systems in military applications

Adoption of AI and machine learning in weaponry

Rise in modular, customizable light weapon systems

Integration of IoT in weapon systems

Increased focus on cyber defense for light weapons - Government Regulations & Defense Policy

Tighter control on the export of light weapons

Changing defense procurement policies in the US

Evolving policies surrounding small arms manufacturing

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Rifles

Shotguns

Handguns

Machine Guns

Grenades - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Mobile Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Law Enforcement Agencies

Private Security Firms

Civilian Market

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Aluminum

Polymer

Steel

Titanium

Composite Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material / Technology, Regional Presence, Pricing Strategies, R&D Investments, Product Differentiation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Smith & Wesson

Sig Sauer

Ruger

Remington Arms

Glock

Colt

Heckler & Koch

FN Herstal

Browning Arms

Barrett Firearms

Beretta

Springfield Armory

Magpul Industries

Bushmaster Firearms

Savage Arms

- Military forces’ growing focus on lightweight, versatile weapons

- Law enforcement’s need for effective, compact weaponry

- Private sector’s increasing reliance on security technologies

- Government agencies’ role in regulating weapon systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035