Market Overview

The US Medium and Large Caliber Ammunition market size is based on recent assessments, with a market value of USD ~ billion. The market is driven by increased defense budgets and technological advancements, particularly in smart ammunition and precision-guided munitions (PGM). The growing demand for modernized weaponry and ammunition solutions within both military and defense sectors contributes significantly to this growth. As of the latest data, the market is expected to maintain a steady upward trajectory with continuous investments in defense systems.

The dominance of the United States in this market stems from its military spending and global defense presence. Countries such as the US lead in technological advancements, R&D investments, and strategic military partnerships. Additionally, a highly developed defense infrastructure and a robust supply chain for ammunition manufacturing enable the country to maintain its leadership. The US defense policies, strategic initiatives, and its role in global security contribute to its dominant market position.

Market Segmentation

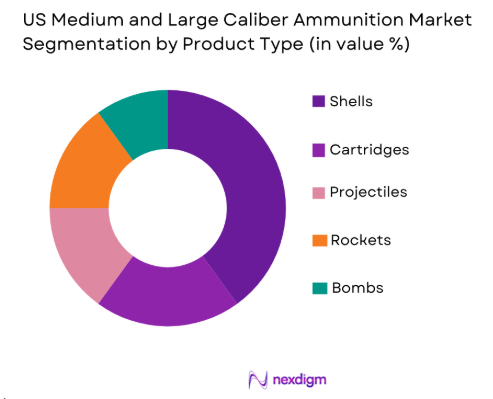

By Product Type

The US Medium and Large Caliber Ammunition market is segmented by product type into shells, cartridges, projectiles, rockets, and bombs. Recently, the dominant sub-segment is projectiles, driven by the increased adoption of precision-guided munitions (PGMs) which are seen as highly effective in modern warfare. The demand for PGMs is particularly high in land, air, and naval defense applications due to their accuracy and long-range capabilities. Furthermore, PGMs are increasingly integrated into various platforms, making them the preferred choice for military forces worldwide. Advancements in technology and the focus on improving ammunition’s efficiency further propel the growth of this sub-segment, increasing its market share. The integration of these munitions with AI and machine learning technologies for target acquisition has enhanced their popularity and is expected to continue driving their demand.

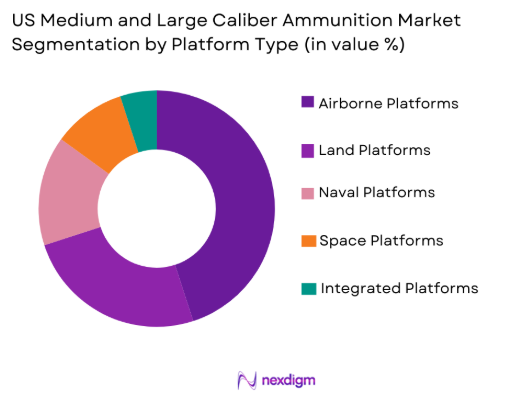

By Platform Type

The US Medium and Large Caliber Ammunition market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Recently, the dominant sub-segment is airborne platforms, driven by the increasing deployment of high-tech ammunition systems in fighter jets, bombers, and surveillance aircraft. Airborne platforms have seen substantial investments in the development of lightweight yet powerful ammunition, designed to complement advanced aerospace technologies. The growing demand for air superiority and precision strike capabilities has spurred this sub-segment’s growth. Furthermore, military forces focus on expanding their aerial fleet to address modern threats, which is expected to fuel the demand for medium and large caliber ammunition for airborne platforms in the coming years.

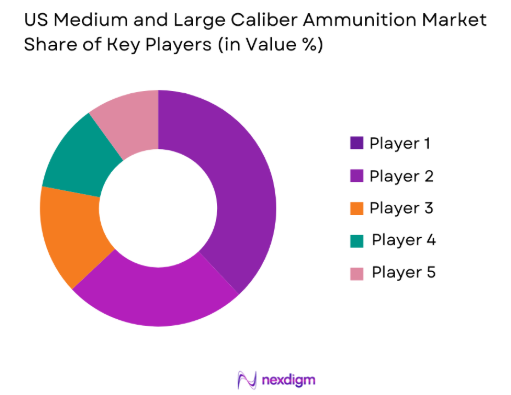

Competitive Landscape

The competitive landscape of the US Medium and Large Caliber Ammunition market reflects a high degree of consolidation, with major defense contractors dominating the market. These players maintain their positions through continuous technological innovations and strategic acquisitions. The influence of large firms such as General Dynamics and BAE Systems ensures that the market is characterized by significant R&D investments and global reach. Furthermore, the market experiences a competitive edge due to the increasing demand for advanced munitions systems, creating opportunities for collaborations between private and government sectors. Additionally, these major players are focused on expanding their market presence by meeting evolving defense and security needs, ensuring a stable and expanding market share.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | |

| General Dynamics | 1899 | Reston, Virginia | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~

|

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~

|

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~

|

| Raytheon Technologies | 1997 | Waltham, MA | ~ | ~ | ~ | ~ | ~

|

US Medium and Large Caliber Ammunition Market Analysis

Growth Drivers

Increased Government Investment in Defense

Government spending in the defense sector, especially for the modernization of military forces, plays a significant role in driving the market growth of medium and large caliber ammunition. This is reflected in the growing number of defense contracts aimed at upgrading weapons and ammunition systems across the US military. The US government allocates substantial budgets annually to enhance its defense capabilities, including the procurement of ammunition that can support modern warfare needs. A significant driver in this investment is the focus on improving national security and keeping pace with technological advancements in ammunition. As threats evolve, defense budgets are expected to grow, further pushing the demand for advanced ammunition solutions. Additionally, programs that focus on the development of smart munitions have seen increased investment, thus boosting the ammunition market. The US government’s commitment to ensuring its armed forces are equipped with cutting-edge ammunition technology supports the long-term growth of the market.

Technological Advancements in Ammunition Manufacturing

Advances in ammunition manufacturing technologies are creating a major growth driver in the US Medium and Large Caliber Ammunition market. Recent innovations, particularly in smart ammunition, precision-guided munitions (PGMs), and enhanced projectile capabilities, are reshaping the ammunition sector. These technological advancements have contributed to the growing demand for high-performance ammunition that offers greater accuracy, longer ranges, and reduced collateral damage. Furthermore, the integration of AI and machine learning in ammunition systems is improving their operational effectiveness. As militaries demand increasingly sophisticated ammunition systems to meet modern warfare requirements, technological advancements are likely to be at the core of future market growth. Ammunition manufacturers are investing heavily in R&D to develop new materials and improve the reliability of ammunition systems. This drive for technological innovation is expected to continue influencing the demand and supply dynamics of the ammunition market, ensuring sustained growth.

Market Challenges

High Production Costs and Material Availability

The rising costs of raw materials, coupled with the complexity of manufacturing advanced munitions, presents a significant challenge for the US Medium and Large Caliber Ammunition market. Ammunition manufacturers are dealing with rising expenses for essential materials such as steel, alloys, and other specialized compounds used in the production of ammunition. Moreover, the production of precision-guided munitions (PGMs) and other advanced ammunition systems requires high investment in sophisticated manufacturing techniques and equipment. These high production costs make it difficult for smaller manufacturers to compete in the market, limiting market entry. Additionally, fluctuations in material costs and supply chain disruptions can impact production timelines and pricing, thereby affecting overall market dynamics. Consequently, ammunition manufacturers are focusing on optimizing production efficiency and reducing costs through technological advancements. The market must address these challenges to remain sustainable in the long run.

Regulatory Constraints and Certification Delays

The US Medium and Large Caliber Ammunition market faces challenges due to stringent regulatory requirements and certification delays, especially concerning the development and deployment of new ammunition systems. Military and defense organizations must ensure that all ammunition products meet strict safety, quality, and environmental standards, which can often lead to delays in product availability. The certification process for advanced ammunition systems, such as PGMs and smart munitions, involves extensive testing, which can slow down the development timeline. Regulatory frameworks also vary across countries, adding another layer of complexity when selling ammunition internationally. Compliance with these regulations requires manufacturers to invest considerable time and resources in research, testing, and obtaining necessary approvals. As the demand for advanced ammunition systems grows, the regulatory landscape will continue to present challenges, and manufacturers will need to adapt to these evolving requirements.

Opportunities

Development of Smart Ammunition Technologies

The growing focus on precision-guided munitions and smart ammunition presents a major opportunity for the US Medium and Large Caliber Ammunition market. Smart ammunition is designed to increase targeting accuracy, minimize collateral damage, and improve operational efficiency, making it highly desirable for modern military forces. This technological shift is transforming the ammunition sector, as militaries seek smarter, more effective ways to engage targets. The increasing incorporation of artificial intelligence and machine learning into ammunition systems is enhancing their functionality, making them more adaptable to complex combat scenarios. The US defense industry is actively pursuing the development of advanced munitions to stay ahead of global military forces, and manufacturers are collaborating with technology firms to innovate in this area. The growing demand for these systems, particularly in precision strikes and intelligence-driven operations, creates significant opportunities for companies operating in this market to expand their portfolios.

Emerging Markets in Defense Procurement

Emerging markets are a major opportunity for the US Medium and Large Caliber Ammunition market. As military spending increases in countries across the globe, there is a growing demand for ammunition to support the modernization of armed forces. Nations in Asia, the Middle East, and Latin America are increasing their defense budgets, particularly for the acquisition of advanced ammunition and weapons systems. This growing procurement demand in emerging markets is creating opportunities for US-based ammunition manufacturers to expand their global reach. These regions are heavily investing in upgrading their military arsenals to meet contemporary threats, providing a significant avenue for US companies to supply ammunition. Furthermore, government partnerships and defense trade agreements between the US and these countries facilitate easier market entry, providing ammunition suppliers with new growth prospects. As these markets continue to develop, the demand for medium and large caliber ammunition is likely to increase.

Future Outlook

The US Medium and Large Caliber Ammunition market is expected to see substantial growth over the next five years, driven by increased investments in defense modernization, technological advancements in ammunition, and a heightened focus on precision-guided munitions. The future growth of this market will be supported by expanding demand for smarter, more effective ammunition solutions across military and defense applications. Advances in AI, machine learning, and smart munitions will continue to drive product innovation. Additionally, international defense agreements and emerging markets are expected to play a critical role in expanding global demand. Regulatory developments and environmental considerations will also shape the market’s trajectory, as the industry adapts to stricter standards. Overall, the US Medium and Large Caliber Ammunition market’s future looks poised for sustained growth with a focus on precision, efficiency, and technological innovation.

Major Players

- General Dynamics

- BAE Systems

- Northrop Grumman

- Lockheed Martin

- Raytheon Technologies

- Textron Systems

- Rheinmetall

- Leonardo

- L3 Technologies

- Harris Corporation

- Thales Group

- Honeywell Aerospace

- Saab Group

- Elbit Systems

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Aerospace and defense manufacturers

- International defense organizations

- Large-scale ammunition procurement agencies

- National security agencies

- Private defense technology developers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying key market variables, including demand drivers, technological trends, and key challenges, that influence the market’s structure and growth potential.

Step 2: Market Analysis and Construction

After identifying key variables, data is collected and analyzed to construct an accurate market model that reflects historical data, growth trends, and future predictions.

Step 3: Hypothesis Validation and Expert Consultation

A thorough validation process is undertaken through expert consultations, interviews with industry leaders, and feedback loops to ensure that the research findings are accurate and aligned with industry realities.

Step 4: Research Synthesis and Final Output

The final output is synthesized, consolidating research insights, analyses, and forecasts, which are then presented as the completed market report for industry stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Defense

Technological Advancements in Ammunition Manufacturing

Growing Geopolitical Tensions and Defense Budgets

Expansion of Military Modernization Programs

Advances in Precision-guided Munitions (PGM) Technologies - Market Challenges

High Production Costs and Material Availability

Complexity of Ammunition Standards and Compliance

Geopolitical and Trade Barriers

Environmental Impact Concerns

Regulatory Constraints and Certification Delays - Market Opportunities

Development of Advanced Smart Ammunition Technologies

Emerging Markets in Defense Procurement

Collaborations between Defense Contractors and Tech Firms - Trends

Shift Towards Autonomous Ammunition Systems

Integration of AI and Machine Learning for Ammunition Design

Focus on Green and Environmentally Friendly Ammunition Solutions

Expansion of Tactical and Strategic Missile Systems

Increased Use of Laser and Directed Energy Weapons - Government Regulations & Defense Policy

Export Control Regulations

Weapon Safety and Compliance Standards

Government Funding for Ammunition Innovation

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Shells

Cartridges

Projectiles

Rockets

Bombs - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Steel

Alloys

Ceramics

Composites

Smart Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Production Cost, Technological Innovation, Geopolitical Influence, Safety Standards)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

General Dynamics

Northrop Grumman

BAE Systems

Lockheed Martin

Raytheon Technologies

Rheinmetall

Saab Group

Elbit Systems

Harris Corporation

Thales Group

Leonardo

L3 Technologies

Honeywell Aerospace

Boeing

Textron Systems

- Military Forces’ Increasing Demand for Advanced Ammunition

- Security Agencies Focusing on Modernizing Ammunition Systems

- Private Sector Engagement in Advanced Ammunition Technologies

- Government Procurement Strategies and Budget Allocations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035