Market Overview

The US MEO Satellite market is valued at approximately USD ~ billion in recent historical assessments, driven by increasing demand for reliable and fast communication systems. The growth is mainly attributed to the advancements in satellite technology, the rise in commercial satellite launches, and the increasing reliance on satellite-based services in remote and underserved areas. The military and defense sectors also contribute significantly to this expansion, as MEO satellites provide enhanced communications, surveillance, and navigation capabilities. These factors combined are expected to lead to continued growth in the MEO satellite market, especially as new players enter the market and technological advancements lower costs.

The United States, particularly cities like Washington D.C. and Silicon Valley, dominates the MEO satellite market due to robust government support, the presence of leading satellite manufacturers, and strong defense infrastructure. The U.S. government, along with private companies such as SpaceX and Amazon, is heavily investing in satellite technology, positioning the country as a key player in the market. Moreover, regions with established aerospace sectors like California and Florida also lead in MEO satellite development and deployment. The increasing demand for broadband connectivity and remote monitoring solutions is further propelling the growth in these areas.

Market Segmentation

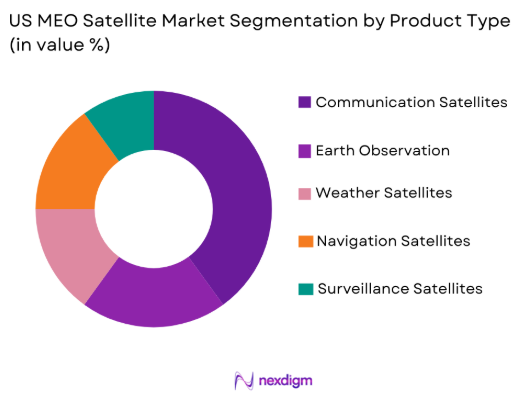

By Product Type

The US MEO Satellite market is segmented by product type into communication satellites, earth observation satellites, weather satellites, navigation satellites, and surveillance satellites. Recently, communication satellites have the dominant market share due to factors such as their critical role in providing broadband services, supporting government and military operations, and the rapid adoption of satellite-based internet solutions across rural and remote areas. Increased demand for high-speed internet and mobile communications is further driving this segment’s growth, with companies like SpaceX and OneWeb contributing to infrastructure development.

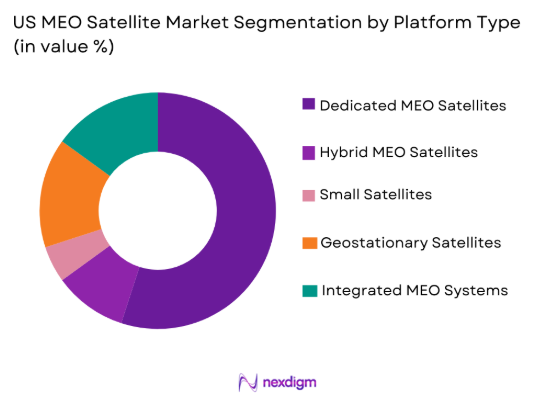

By Platform Type

The US MEO Satellite market is segmented by platform type into dedicated MEO satellites, hybrid MEO satellites, small satellites, geostationary satellite interconnections, and integrated MEO systems. Recently, dedicated MEO satellites have the dominant market share, primarily due to the increasing demand for high-performance and purpose-built communication platforms. The U.S. government and private firms are increasingly opting for dedicated MEO platforms to ensure robust, low-latency connectivity for both commercial and defense applications. These systems are also more adaptable and cost-effective, offering better scalability and frequency reuse compared to other platforms.

Competitive Landscape

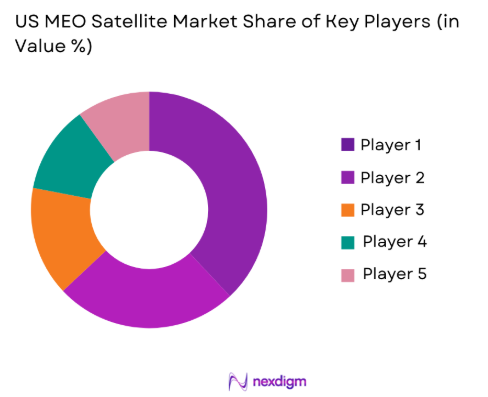

The competitive landscape of the US MEO Satellite market is characterized by consolidation, with key players investing heavily in satellite technology and infrastructure to maintain market leadership. Major players such as SpaceX, OneWeb, and Boeing are pushing innovation and expanding their satellite constellations to provide faster and more reliable communication networks globally. There is significant collaboration between government agencies and private companies, especially in defense and communication satellite deployments. This increasing collaboration has led to substantial market growth, with the dominant players consolidating their positions through technological advancements and strategic partnerships.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| SpaceX | 2002 | Hawthorne, CA | ~ | ~ | ~ | ~ | ~ |

| OneWeb | 2012 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, IL | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

US MEO Satellite Market Analysis

Growth Drivers

Government Investment in Space Infrastructure

One of the main growth drivers of the US MEO Satellite market is substantial government investment in space infrastructure, especially in the defense and communication sectors. The U.S. government has prioritized space as a critical national security domain, ensuring significant funding for satellite constellations and systems. Agencies such as NASA, the Department of Defense (DoD), and the Federal Communications Commission (FCC) are allocating increasing amounts of capital to satellite projects. This public sector investment stimulates private sector involvement, attracting startups and established companies alike to enter the market. Such funding supports the development of new satellite technologies and the expansion of existing satellite constellations. This in turn increases demand for MEO satellites that are essential for communication, surveillance, and navigation. The U.S. government’s defense, telecommunications, and broadband initiatives fuel ongoing market expansion, with the military’s need for advanced reconnaissance systems and commercial demand for connectivity driving growth.

Advancements in Satellite Technology

Technological advancements in satellite technology have significantly boosted the US MEO Satellite market. New innovations such as miniaturized satellite components, propulsion systems, and improved solar arrays have lowered the cost of deploying and maintaining MEO satellites. The use of cutting-edge materials like lightweight composites enhances the satellite’s efficiency and lifespan, making them more commercially viable. Additionally, advancements in satellite communication technologies such as inter-satellite links, onboard processing, and high-throughput payloads have led to enhanced performance and capabilities. The increased focus on autonomous satellite operations and the integration of artificial intelligence (AI) and machine learning in satellite systems also plays a crucial role in this growth. These technological advancements make MEO satellites an attractive option for both government and commercial sectors, especially those seeking reliable, low-latency solutions for data transfer, communication, and environmental monitoring.

Market Challenges

High Operational and Launch Costs

One of the significant challenges faced by the US MEO Satellite market is the high operational and launch costs associated with deploying MEO satellites. The capital-intensive nature of launching satellites into medium Earth orbit requires large investments in rocket launch vehicles, satellite manufacturing, and ground infrastructure. Additionally, satellite operators must account for recurring operational expenses, such as maintenance, control station management, and bandwidth costs. These high costs present a barrier to entry for smaller players and limit the scalability of certain satellite systems. Despite advances in technology, such as reusable launch vehicles, the costs of space operations remain a significant challenge for new satellite constellations, especially as competition within the market increases. This issue is compounded by the need for regulatory approvals, licensing fees, and insurance, further adding to the overall financial burden.

Space Debris and Collision Risks

Space debris poses another significant challenge to the US MEO Satellite market. The increasing number of satellites launched into space has raised concerns about the potential for collisions and the generation of more debris in orbit. The risk of satellite collisions can lead to damage or complete destruction of satellites, creating more space debris and impacting other operational spacecraft. In response, regulatory bodies such as the Federal Aviation Administration (FAA) and the U.S. Space Surveillance Network (SSN) have developed guidelines for satellite operators to minimize debris and avoid potential risks. However, managing space debris remains a persistent challenge, as the sheer volume of operational satellites in medium Earth orbit continues to grow. Companies are now investing in technologies to address these risks, such as collision avoidance systems and de-orbiting mechanisms, but effective debris mitigation strategies are still evolving.

Opportunities

Expansion of Global Communication Networks

The expansion of global communication networks presents a significant opportunity for the US MEO Satellite market. As demand for broadband services continues to increase, particularly in underserved and rural regions, MEO satellites offer an efficient solution for providing reliable internet connectivity. Companies like SpaceX with their Starlink program and OneWeb are already deploying large-scale satellite constellations aimed at delivering high-speed internet to areas lacking terrestrial infrastructure. The ability to provide seamless, high-bandwidth communication across continents and remote areas creates a growing demand for MEO satellite services. Additionally, the expansion of mobile networks and the Internet of Things (IoT) further drives the need for reliable satellite-based communication systems. The ongoing rollout of 5G networks will also create additional demand for satellite services, as MEO satellites are positioned to support the integration of 5G systems by providing connectivity in hard-to-reach regions.

Technological Partnerships for Satellite Manufacturing

Another opportunity for growth in the US MEO Satellite market lies in technological partnerships for satellite manufacturing. Collaborations between private companies and government agencies have proven to be highly beneficial in reducing costs, improving technology, and increasing the speed of satellite deployment. Public-private partnerships, especially those in defense-related projects, allow for the pooling of resources and expertise, enabling faster development of new satellite systems. Furthermore, companies like Boeing, Lockheed Martin, and Northrop Grumman are actively working with the government to create next-generation satellites for communication, surveillance, and defense. The integration of commercial technologies into military satellite systems presents significant growth potential. Additionally, advancements in satellite propulsion and autonomous operational systems, when developed through joint partnerships, can enhance the overall efficiency and performance of satellite systems, ensuring market competitiveness and innovation.

Future Outlook

The future of the US MEO Satellite market looks promising with expected continued growth over the next five years. The market will be driven by ongoing advancements in satellite technology, particularly in miniaturization, autonomous operations, and enhanced communication systems. Government investment in space infrastructure, including national defense and satellite communication, will continue to fuel market growth. The demand for global connectivity, especially in underserved areas, will further stimulate the market as new satellite constellations are launched. Additionally, innovations such as reusable launch vehicles, space debris mitigation technologies, and AI-driven satellite systems will improve cost-efficiency and reduce operational risks. Increased regulatory support and the growing commercial space sector will further bolster market expansion.

Major Players

- SpaceX

- OneWeb

- Boeing

- Lockheed Martin

- Northrop Grumman

- SES

- Telesat

- Iridium Communications

- Hughes Network Systems

- Viasat

- Arianespace

- Airbus Defence and Space

- Rocket Lab

- L3Harris Technologies

- Thales Alenia Space

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Satellite operators

- Satellite communications service providers

- Mobile network providers

- Defense and intelligence agencies

- Telecommunications companies

Research Methodology

Step 1: Identification of Key Variables

Key variables, including market trends, growth drivers, challenges, and technological developments, are identified through secondary research, expert consultation, and industry analysis.

Step 2: Market Analysis and Construction

The market is analyzed based on key parameters such as product types, platform types, and technological trends. Data is collected from reliable sources, including market reports, industry publications, and government reports.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, satellite manufacturers, and government agencies are consulted to validate hypotheses and provide insights into emerging trends, growth drivers, and challenges.

Step 4: Research Synthesis and Final Output

The final market report synthesizes collected data, validated insights, and expert input into a comprehensive, actionable market analysis, providing clear recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of global communication networks

Increased demand for satellite-based internet connectivity

Technological advancements in satellite manufacturing

Growing geopolitical emphasis on space infrastructure

Rising demand for real-time data from MEO satellites - Market Challenges

High launch and operational costs of MEO satellites

Space debris management and collision avoidance issues

Technological integration and system interoperability concerns

Regulatory and licensing constraints in the space sector

Limited availability of dedicated MEO satellite frequencies - Market Opportunities

Increased commercial applications for MEO satellites

Partnerships between private and public sector organizations

Development of innovative satellite propulsion systems - Trends

Shift towards small and modular satellite designs

Increase in partnerships for satellite manufacturing and launches

Development of hybrid MEO-GEO satellite systems

Rise in the deployment of advanced communication networks

Growing focus on satellite-based environmental monitoring - Government Regulations & Defense Policy

U.S. government regulations on satellite frequency allocation

International treaties affecting satellite operations

Defense initiatives for secure satellite communication systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication Satellites

Navigation Satellites

Earth Observation Satellites

Weather Satellites

Surveillance Satellites - By Platform Type (In Value%)

Dedicated MEO Satellites

Hybrid MEO Satellites

Small Satellites

Geostationary Satellite Interconnections

Integrated MEO Systems - By Fitment Type (In Value%)

On-orbit Deployment

Ground Station Integration

Satellite-to-Satellite Communication Systems

Modular Systems

Cloud-Based Connectivity Solutions - By End User Segment (In Value%)

Government and Military

Telecommunications Operators

Aerospace and Defense Contractors

Commercial Enterprises

Space Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Private Sector Deals

Third-Party Distributors

Online Bidding Platforms - By Material / Technology (In Value%)

Lightweight Composite Materials

Solar Power Systems

Onboard Processing Systems

Adaptive Antenna Technologies

Miniaturized Satellite Components

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Market Value, Installed Units, Price Forecast, System Complexity Tier)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

SpaceX

OneWeb

SES S.A.

Iridium Communications

Telesat

Amazon Kuiper

Lockheed Martin

Boeing

Northrop Grumman

Thales Alenia Space

Airbus Defence and Space

Viasat

Arianespace

Rocket Lab

Hughes Network Systems

- Government entities increasing reliance on MEO satellites for defense

- Telecom operators investing in MEO for wider coverage

- Commercial enterprises leveraging satellites for IoT and logistics

- Aerospace firms incorporating MEO solutions for navigation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035