Market Overview

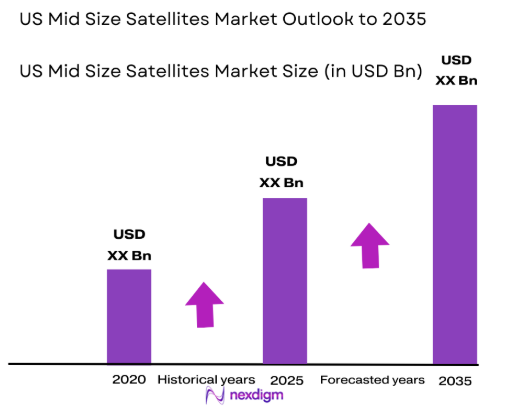

Based on a recent historical assessment, the US Mid Size Satellites Market is expected to reach a total value of USD ~ billion. This growth is primarily driven by the rising demand for high-speed satellite communication systems, especially from telecom companies and defense sectors. In addition, technological advancements in satellite miniaturization and reduced launch costs have significantly contributed to making mid-size satellites more accessible and cost-effective. Several companies are also leveraging satellite constellations to provide low-latency communication globally, boosting market expansion.

In terms of geographic dominance, the United States leads the US Mid Size Satellites Market, due to its strong infrastructure, significant investments in space programs, and high demand for communication and defense applications. The presence of leading companies like SpaceX, Lockheed Martin, and Boeing plays a crucial role in maintaining this dominance. Additionally, the government’s role in funding space exploration, along with a well-established aerospace ecosystem, supports the continued growth of satellite manufacturing and launches.

Market Segmentation

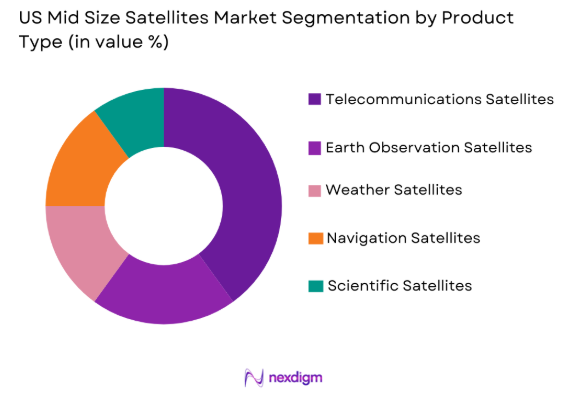

By Product Type

The US Mid-Size Satellites Market is segmented by product type into telecommunications satellites, earth observation satellites, weather satellites, navigation satellites, and scientific satellites. Recently, telecommunications satellites had a dominant market share due to the growing need for global high-speed internet and satellite-based communications for remote areas. This demand has been particularly driven by telecom companies expanding their service offerings to rural and underserved regions. Furthermore, the U.S. government’s focus on military satellite communication and commercial partnerships has further fueled the growth in this segment, making telecommunications satellites the leading sub-segment in the market.

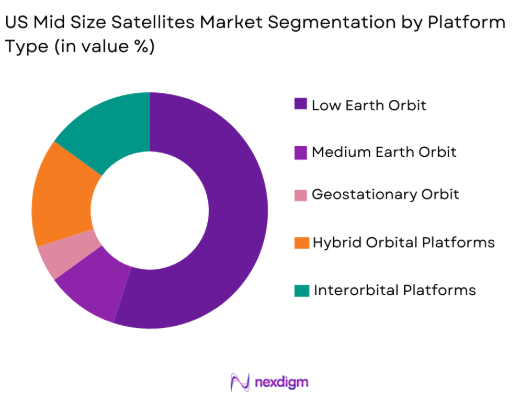

By Platform Type

The US Mid-Size Satellites Market is segmented by platform type into low Earth orbit (LEO), medium Earth orbit (MEO), geostationary orbit (GEO), hybrid orbital platforms, and interorbital platforms. Recently, low Earth orbit satellites have been dominant in the market share due to their ability to provide low-latency communication and high-speed data transfer. This segment has witnessed significant growth driven by satellite constellations such as Starlink, which is addressing global connectivity issues, including in rural and hard-to-reach areas. LEO satellites offer reduced launch costs and quicker deployment times compared to other orbit types, making them the most popular choice in the US mid-size satellite market.

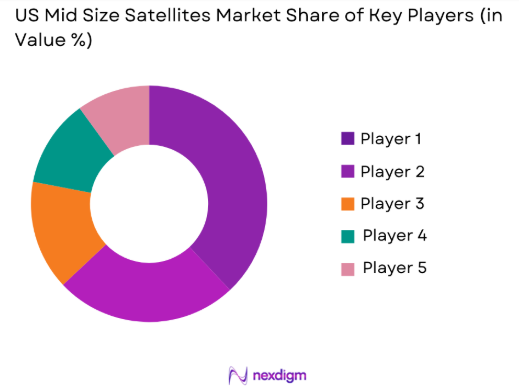

Competitive Landscape

The competitive landscape of the US Mid Size Satellites Market is characterized by major players who dominate through innovation, strategic partnerships, and extensive infrastructure capabilities. Companies like SpaceX, Lockheed Martin, and Boeing continue to lead, investing heavily in satellite technology advancements. The industry is seeing a consolidation trend, with new entrants focusing on satellite constellations and innovative satellite technologies. Major players are also expanding their portfolios by offering satellite launch services and forming joint ventures with government agencies and private enterprises to strengthen their market presence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Key Differentiator |

| SpaceX | 2002 | Hawthorne, CA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, IL | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Blue Origin | 2000 | Kent, WA | ~ | ~ | ~ | ~ | ~ |

US Mid Size Satellites Market Analysis

Growth Drivers

Technological Advancements in Satellite Miniaturization

Miniaturization has played a crucial role in the growth of the US Mid Size Satellites Market. The demand for smaller, lighter satellites has increased as it lowers production and launch costs, enabling more frequent and affordable satellite launches. The development of advanced materials and innovative designs has enabled manufacturers to reduce satellite size while maintaining or improving performance. This evolution makes mid-size satellites highly attractive for commercial, scientific, and defense applications. The ability to produce multiple satellites at lower costs is driving large-scale deployments, especially by companies like SpaceX and OneWeb, aiming to deploy vast satellite constellations to provide global internet coverage. These advancements are expected to continue fueling market growth.

Demand for Global Connectivity and Communication

The increasing demand for global high-speed internet, especially in remote and underserved areas, has been a major driver for the US Mid Size Satellites Market. As 5G networks continue to expand, the need for efficient satellite-based communication systems has grown. Many telecom providers are looking to satellites as a solution to deliver seamless connectivity to rural regions. The U.S. government has also been heavily involved in funding satellite communications for national defense and security purposes, thus boosting market development. Additionally, satellite companies like SpaceX’s Starlink have received high attention for their innovative approaches to internet delivery, particularly in rural areas, helping drive the growth of mid-size satellites in the U.S.

Market Challenges

High Launch and Infrastructure Costs

Despite advancements in satellite technology, the cost of launching satellites remains one of the most significant challenges facing the US Mid Size Satellites Market. Although miniaturization has reduced manufacturing costs, the complexity and expense of launching and maintaining satellites are still considerable. Launch vehicles such as SpaceX’s Falcon 9 reduce these costs but still represent a barrier for smaller players in the industry. Many companies rely on government funding or partnerships to cover these costs, but the capital-intensive nature of satellite operations remains a significant challenge. Until launch costs decrease further, the industry may experience slower growth in satellite deployment.

Regulatory and Compliance Barriers

Another major challenge in the US Mid Size Satellites Market is the regulatory and compliance framework governing satellite operations. The U.S. Federal Communications Commission (FCC) and other regulatory bodies impose strict rules on satellite licensing, frequency allocations, and environmental considerations, which can delay market entry and operations. The market also faces challenges in terms of international coordination for satellite space traffic management. The need to meet international regulations, such as the Outer Space Treaty, further complicates the regulatory environment. These complexities can slow down innovation and market penetration for new entrants while giving established players a competitive advantage.

Opportunities

Satellite-as-a-Service (SaaS) Model

The increasing trend of offering satellite capabilities as a service is opening up new opportunities in the US Mid Size Satellites Market. Companies are now providing satellite-based services for communication, Earth observation, and navigation without customers having to own the infrastructure. This model allows for lower upfront costs and easier scalability for users. SaaS models enable companies to access satellite data and services on-demand, making it more accessible to smaller enterprises, government agencies, and research institutions. With more affordable entry points, businesses are now able to integrate satellite services into their operations to improve decision-making, logistics, and communication.

Private Sector Partnerships for Satellite Launches

There is significant opportunity for growth in the US Mid Size Satellites Market through private sector partnerships. Commercial companies like SpaceX, Boeing, and Blue Origin have already made strides in reducing satellite launch costs. These companies are expected to expand their collaboration with government agencies and private firms, making satellite launches more affordable and accessible. Partnerships will help leverage the expertise and resources of both public and private entities, which can reduce costs and expedite satellite deployment. As the market evolves, private sector players will have an increasingly important role in shaping the future of the satellite ecosystem.

Future Outlook

The future outlook for the US Mid Size Satellites Market over the next five years is positive, with rapid technological advancements driving growth. The market is expected to see increased satellite deployments, driven by demand for global connectivity and government defense initiatives. Technological innovations in satellite miniaturization, propulsion systems, and launch vehicles are expected to reduce costs further and enable more widespread use. Additionally, regulatory support for satellite constellations and partnerships with private companies will help expand coverage and infrastructure. As demand for broadband access and Earth observation data continues to grow, mid-size satellites are poised to become a key component of the global satellite ecosystem.

Major Players

- SpaceX

- Lockheed Martin

- Boeing

- Northrop Grumman

- Blue Origin

- SES S.A.

- OneWeb

- Thales Alenia Space

- Raytheon Technologies

- L3 Technologies

- Airbus Defence and Space

- Viasat Inc.

- SSL (Space Systems Loral)

- Rocket Lab

- Planet Labs

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Telecommunications companies

- Defense contractors

- Satellite operators

- Launch service providers

- Satellite data analytics firms

Research Methodology

Step 1: Identification of Key Variables

This step involves recognizing and understanding the key variables that affect the market. The identified variables are essential in building an effective market model.

Step 2: Market Analysis and Construction

The market analysis involves gathering data from various primary and secondary sources, constructing a framework to understand the market trends. This helps identify growth and demand drivers.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through expert interviews and consulting with industry professionals to refine insights and correct any misinterpretations of the data.

Step 4: Research Synthesis and Final Output

In the final step, all research findings are synthesized into a cohesive report, ensuring the validity of conclusions, which are then presented to the client for decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for High-Speed Communication

Government Initiatives in Satellite Connectivity

Technological Advancements in Satellite Miniaturization

Rising Demand for Earth Observation Data

Integration of AI and IoT with Satellite Operations - Market Challenges

High Capital Costs in Satellite Manufacturing

Regulatory and Compliance Barriers

Launch Vehicle Availability and Costs

Orbital Debris and Space Traffic Management

Complexity in Satellite Maintenance and Operations - Market Opportunities

Expansion of 5G Networks via Satellite Connectivity

Collaborations with Private Sector for Cost-Effective Solutions

Growing Demand for Remote Sensing Data - Trends

Increase in Satellite Constellations for Global Coverage

Shift Toward Smaller, More Efficient Satellite Designs

Growth in Satellite-as-a-Service Models

Rise of Private Players in the Satellite Market

Advances in Satellite Data Security - Government Regulations & Defense Policy

Satellite Data Protection Laws

Launch and Export Control Regulations

Government Funding for Satellite Research and Development

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Telecommunications Satellites

Earth Observation Satellites

Weather Satellites

Navigation Satellites

Scientific Satellites - By Platform Type (In Value%)

Low Earth Orbit (LEO)

Medium Earth Orbit (MEO)

Geostationary Orbit (GEO)

Hybrid Orbital Platforms

Interorbital Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Telecommunication Providers

Government Agencies

Defense Contractors

Research Institutions

Commercial Enterprises - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Solar Panels

Propulsion Systems

Communication Equipment

Advanced Imaging Sensors

Launch Vehicles

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Regulatory Compliance, Market Share, Pricing, Market Growth Rate)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

SpaceX

Northrop Grumman

Blue Origin

SES S.A.

OneWeb

Thales Alenia Space

Raytheon Technologies

Boeing

L3 Technologies

Airbus Defence and Space

Viasat Inc.

SSL (Space Systems Loral)

Rocket Lab

Planet Labs

- Government and Defense Use of Satellite Technology

- Commercial Sector Growth in Satellite Usage

- Telecom Providers’ Interest in Satellite Networks

- Scientific and Research Communities’ Satellite Deployment

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035