Market Overview

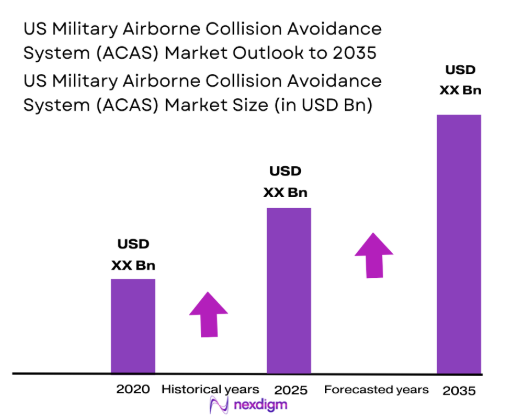

The US Military Airborne Collision Avoidance System (ACAS) market is expected to reach a market size of USD ~ billion, based on a recent historical assessment. This growth is driven by increasing investments in aviation safety and military modernization. Enhanced system performance and demand for autonomous operations are also contributing factors. With defense budgets on the rise, particularly for upgrading and maintaining military aviation infrastructure, ACAS solutions play a pivotal role in enhancing safety standards. A growing emphasis on preventing mid-air collisions in defense systems further supports this market expansion.

The market for US Military Airborne Collision Avoidance Systems is primarily dominated by defense-focused regions such as the United States, particularly in areas with major military bases and aerospace research centers. The country’s dominance in technological advancements and defense spending, coupled with a significant military presence, has made it a leader in the ACAS market. The government’s focus on air safety and defense modernization, including integration with unmanned aerial vehicles (UAVs) and AI-driven solutions, ensures that the US remains at the forefront.

Market Segmentation

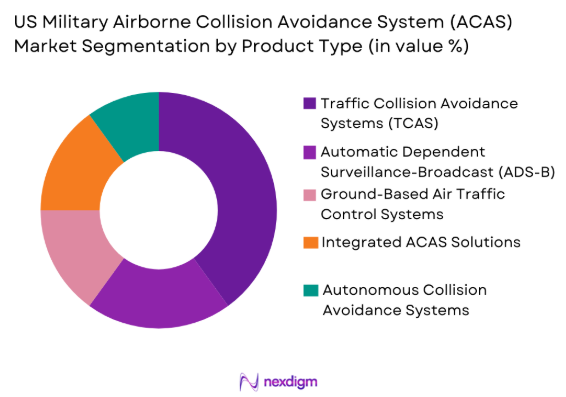

By Product Type

The US Military Airborne Collision Avoidance System (ACAS) market is segmented by product type into various sub-segments, including Traffic Collision Avoidance Systems (TCAS), Automatic Dependent Surveillance-Broadcast (ADS-B) systems, ground-based air traffic control solutions, and integrated ACAS solutions. Recently, TCAS has captured a dominant market share. The system’s long-established presence in aviation, along with its proven reliability in mid-air collision prevention, has positioned it as the leading technology. Additionally, TCAS is widely adopted by both military and commercial aircraft, and its robust performance under various operational conditions makes it a preferred choice for defense contractors.

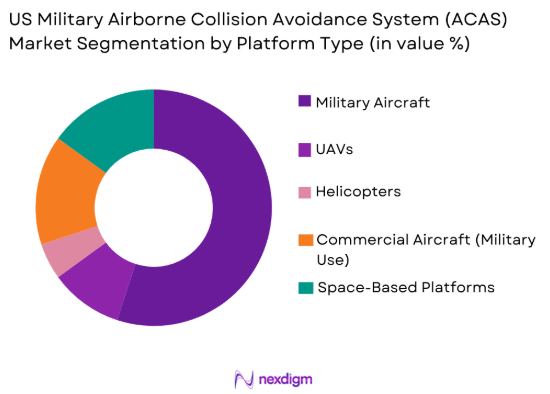

By Platform Type

The US Military Airborne Collision Avoidance System market is segmented by platform type into military aircraft, UAVs, helicopters, commercial aircraft (military use), and space-based platforms. Recently, military aircraft dominate the market due to the constant need for collision avoidance systems in various air operations. The integration of advanced ACAS technology in military aviation enhances safety and operational efficiency, especially in complex combat and surveillance missions. Moreover, the increasing deployment of UAVs in military applications has boosted the demand for advanced collision avoidance systems that can operate autonomously, ensuring further dominance of military platforms in the market.

Competitive Landscape

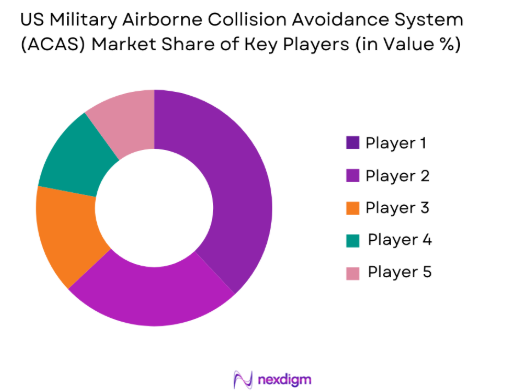

The US Military Airborne Collision Avoidance System (ACAS) market is characterized by a highly competitive landscape, with numerous key players operating in the space. Major defense contractors and aerospace companies lead the market, with investments focused on advanced technologies, including AI-based solutions and radar systems for collision avoidance. Consolidation is evident, as companies are forming partnerships and strategic alliances to innovate and enhance product offerings. The increasing reliance on autonomous systems in both military and commercial aviation will likely fuel further competition in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, MA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, NC | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

US Military Airborne Collision Avoidance System ACAS Market Analysis

Growth Drivers

Increased Investment in Military Aviation Safety

The growing focus on enhancing the safety of military aviation is a significant driver of market growth. Governments worldwide, particularly in defense-centric nations like the United States, are allocating substantial resources to upgrading aviation safety technologies. These advancements include the integration of collision avoidance systems, which are critical in reducing mid-air collisions. The focus on modernizing aging fleets of military aircraft and increasing the use of unmanned aerial vehicles (UAVs) also drives demand for these systems. This shift towards next-generation safety solutions is further backed by the rising need for advanced operational technologies that can ensure safety in complex airspace environments. As military forces deploy more complex and diverse air platforms, the demand for cutting-edge airborne collision avoidance systems grows exponentially. This investment trend is expected to continue, creating a robust market for ACAS technologies.

Technological Advancements in Autonomous Flight Systems

The rise of autonomous flight systems in both military and civilian applications significantly contributes to the market’s growth. Autonomous systems require advanced collision avoidance technologies to function safely in busy airspaces. As military forces adopt more UAVs and autonomous aircraft for surveillance, reconnaissance, and combat operations, the demand for integrated and automated collision avoidance solutions has surged. This technology not only enhances operational safety but also ensures that unmanned aircraft can perform missions without constant human intervention. The integration of AI, machine learning, and real-time data analytics into these systems ensures that potential collisions are detected and avoided in real-time. Autonomous flight systems are seen as essential for future military operations, and the increasing reliance on these systems is one of the primary drivers for the market’s growth.

Market Challenges

High Cost of Advanced ACAS Technologies:

A key challenge in the market is the high cost associated with developing and implementing advanced Airborne Collision Avoidance Systems. These systems require significant research and development investments to ensure they meet stringent defense standards. Furthermore, the integration of cutting-edge technologies such as AI, radar, and machine learning into ACAS solutions adds to the overall costs. Military organizations often face budgetary constraints, which can delay or limit the deployment of these systems. As a result, many defense contractors struggle to balance the need for advanced safety technologies with budgetary restrictions. The cost of upgrading existing aircraft with the latest ACAS technology is also a significant financial burden for many organizations. This challenge may slow down the widespread adoption of advanced collision avoidance solutions, limiting market growth.

Technological Integration and Interoperability Issues

Another challenge the market faces is the difficulty of integrating ACAS solutions into existing military platforms. Many legacy systems in use across military fleets are not compatible with newer, more advanced collision avoidance technologies. Upgrading these systems to ensure seamless operation across various air platforms presents significant technical hurdles. Furthermore, the integration of ACAS solutions into diverse military environments, including joint operations between different defense forces, can lead to interoperability issues. Ensuring that new technologies can effectively communicate with older systems, while maintaining operational efficiency, is a significant challenge. This technological gap can delay the deployment of new solutions and lead to increased operational costs. The inability to seamlessly integrate new systems into existing infrastructures remains a key obstacle for the market.

Opportunities

Partnerships with Private Tech Firms for Enhanced Cybersecurity

One significant opportunity for the ACAS market is the collaboration between defense contractors and private technology firms, particularly in the field of cybersecurity. As the military sector increasingly adopts digital and autonomous technologies, the need for robust cybersecurity measures to protect these systems from threats grows. Cybersecurity risks, especially in airborne collision avoidance systems, can have serious consequences on safety and operational efficiency. By partnering with leading tech companies that specialize in cybersecurity, defense contractors can enhance the security of their ACAS solutions, making them more reliable and resilient. This collaboration will also help mitigate the risks of cyberattacks on defense systems, making them more attractive to military clients. The increasing complexity of modern warfare and the need for secure operational technologies presents a lucrative opportunity for ACAS providers to expand their market reach.

Emerging Demand for Autonomous Systems and Robotics

The increasing demand for autonomous systems in both military and commercial applications represents a significant growth opportunity for the ACAS market. As UAVs, drones, and autonomous aircraft become more prevalent in military operations, the demand for advanced collision avoidance technologies specifically designed for these platforms rises. Autonomous systems require robust, fail-safe mechanisms to ensure they can navigate complex airspaces without human intervention. This presents an opportunity for ACAS technology providers to tailor their solutions to meet the specific needs of autonomous platforms. As autonomous systems are integrated into more defense and surveillance applications, the market for specialized ACAS solutions is expected to expand rapidly. The growing interest in autonomous systems presents an exciting opportunity for innovation in the ACAS market, as manufacturers develop more advanced and adaptable solutions.

Future Outlook

The future of the US Military Airborne Collision Avoidance System (ACAS) market looks promising over the next five years. The market is expected to experience significant growth due to continued advancements in autonomous systems, AI, and military aviation safety technologies. Key technological developments will focus on improving system integration, reducing costs, and enhancing the interoperability of ACAS solutions with a wide range of platforms, including UAVs and helicopters. Regulatory support and increasing demand for unmanned aerial systems will further drive market expansion, as defense contractors work to meet evolving safety standards. The increasing reliance on AI and machine learning to predict and avoid mid-air collisions will be crucial to shaping the future trajectory of the ACAS market.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Collins Aerospace

- Thales Group

- BAE Systems

- Honeywell

- General Electric

- Leonardo

- Saab Group

- Elbit Systems

- Rockwell Collins

- L3 Technologies

- Boeing

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Aerospace and aviation safety regulators

- Civilian aerospace companies

- UAV manufacturers

- Air traffic control agencies

- Airlines and aviation safety organizations

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical variables that influence the market, including product types, platform types, and technological trends.

Step 2: Market Analysis and Construction

In this phase, detailed analysis of market trends, growth patterns, and competitive landscapes is conducted to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses are validated through consultations with industry experts and key stakeholders to ensure accuracy and reliability in the findings.

Step 4: Research Synthesis and Final Output

The final step synthesizes the research findings, consolidating data and insights into a coherent report that provides actionable market intelligence.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Investment in Military Aviation Safety

Technological Advancements in Air Traffic Control Systems

Rising Demand for Autonomous Flight Systems

Military Modernization and Aircraft Upgrades

Government Regulations on Aviation Safety - Market Challenges

High Cost of Advanced ACAS Technologies

Technological Integration with Existing Platforms

Cybersecurity Risks in Collision Avoidance Systems

Compliance with Evolving Military Standards

Limited Awareness in Non-military Aviation Sectors - Market Opportunities

Integration with AI for Predictive Safety Measures

Collaborations with Civil Aviation for Technology Exchange

Advancements in Lightweight Collision Avoidance Sensors - Trends

Rise of Autonomous Aircraft and UAVs

Shift Towards Cloud-Based Aviation Safety Systems

Increased Focus on Real-time Data Sharing and Analytics

Automation and Autonomy in Military Aviation Operations

Growing Investment in Cybersecurity for Aviation Systems - Government Regulations & Defense Policy

FAA Regulations Impacting Military Aviation Systems

DOD Funding and Policy Support for ACAS Development

Global Aviation Safety Standards Compliance

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automatic Dependent Surveillance-Broadcast (ADS-B)

Traffic Collision Avoidance Systems (TCAS)

Ground-Based Air Traffic Control Systems

Integrated ACAS Solutions

Autonomous Collision Avoidance Systems - By Platform Type (In Value%)

Military Aircraft

UAVs

Helicopters

Commercial Aircraft (Military Use)

Space-based Platforms - By Fitment Type (In Value%)

Onboard Systems

Ground-Based Systems

Integrated Airborne and Ground Systems

Cloud-Based Solutions

Modular and Scalable Solutions - By End User Segment (In Value%)

US Air Force

US Navy

US Army Aviation

Private Defense Contractors

Aerospace and Defense Research Institutes - By Procurement Channel (In Value%)

Direct Military Procurement

Government Tenders

Defense Contractors

Third-party Distributors

Public-private Partnerships - By Material / Technology (in Value %)

Radar and Radio Frequency Systems

Infrared and Optical Sensors

AI and Machine Learning Algorithms

Data Fusion Technologies

Communication and Navigation Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material / Technology, Market Value, Installed Units, System Complexity Tier)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Boeing

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Honeywell

General Electric

Collins Aerospace

L3 Technologies

Saab Group

Elbit Systems

Rockwell Collins

Thales Group

Harris Corporation

Leonardo

Mitre Corporation

- US Air Force’s Focus on Enhancing Aircraft Safety

- Government Agencies’ Role in Standardization and Certification

- Private Contractors’ Investment in ACAS Development

- Growth in Defense Technology Exports

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035