Market Overview

The US Paper Packaging Industry is valued at USD 41.5 billion in 2025 with an approximated compound annual growth rate (CAGR) of 4% from 2025-2030, based on a comprehensive analysis of historical data. The growth is largely driven by the increasing demand for sustainable packaging solutions among consumers and businesses alike. This is manifested in the rising adoption of paper packaging in various sectors, particularly in food and beverage, which emphasizes eco-friendliness and recyclability.

The major cities dominating the US Paper Packaging Industry include New York, Los Angeles, and Chicago, supported by their robust economic platforms and large-scale manufacturing facilities. Furthermore, Washington state is critical due to its strong recycling initiatives and efforts in sustainable forestry management. These cities and regions are well-positioned as key players, leveraging their infrastructure, skilled workforce, and proximity to significant consumer markets.

The regulatory environment surrounding environmental legislation is a significant factor shaping the paper packaging industry. The United States’ commitment to waste reduction targets, such as diverting 50% of waste from landfills by 2030, has further emphasized the importance of sustainable materials. With stringent measures governing packaging waste and recycling practices, companies are now transitioning towards compliance through enhanced utilization of paper packaging solutions that align with these regulations.

Market Segmentation

By Product Type

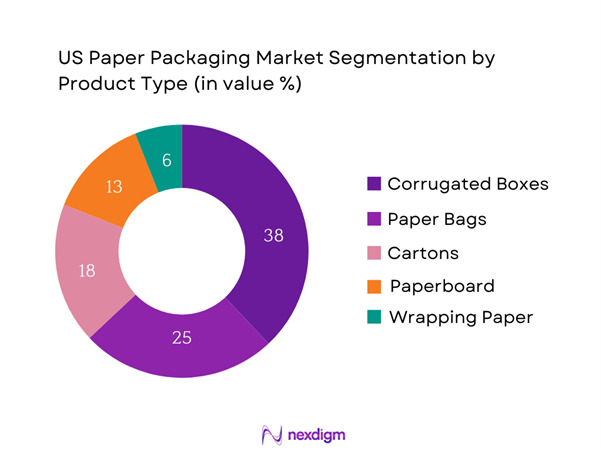

The US Paper Packaging Industry is segmented by product type into corrugated boxes, paper bags, cartons, paperboard, and wrapping paper. Recently, corrugated boxes have emerged as the dominant product type in the market due to their robustness and versatility. They are increasingly favored for shipping and storage solutions across various industries, especially in e-commerce and retail. Major companies such as International Paper and WestRock have invested significantly in innovations, making corrugated packaging more sustainable and user-friendly, which reinforces their market leadership.

By Application

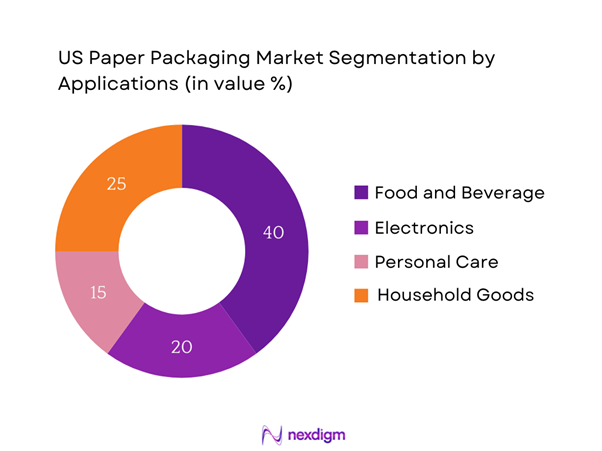

The US Paper Packaging Industry is further segmented by application into food and beverage, electronics, personal care, and household goods. The food and beverage segment currently holds the dominant share in the market, driven by the increasing trend of takeaway and delivery services. As consumers opt for more sustainable and safe packaging for their products, the demand for paper-based solutions is significantly rising across the food sector. This trend is supported by the implementation of strict regulations on plastics, leading businesses to shift towards paper packaging solutions that are both eco-friendly and compliant.

Competitive Landscape

The US Paper Packaging Industry is characterized by several major players who are pivotal in shaping the market’s dynamics. The market is dominated by a few leading companies, including International Paper, WestRock, and Smurfit Kappa. This consolidation highlights the significant influence of these key players in driving innovations and sustainability initiatives, creating barriers for new entrants.

| Major Players | Year Established | Headquarters | Production Capacity | Key Products | Market Focus | Sustainability Initiatives |

| International Paper | 1898 | Memphis, Tennessee | – | – | – | – |

| WestRock | 2015 | Richmond, Virginia | – | – | – | – |

| Smurfit Kappa | 1934 | Dublin, Ireland | – | – | – | – |

| Georgia-Pacific | 1927 | Atlanta, Georgia | – | – | – | – |

| Mondi Group | 1967 | London, UK | – | – | – | – |

US Paper Packaging Industry Analysis

Growth Drivers

Rising Consumer Demand for Eco-friendly Products

The shift towards eco-friendly products is significantly influencing the paper packaging industry. According to the World Bank, the global market for sustainable products is projected to surpass USD 150 billion by end of 2025, driven by a 90% increase in consumer awareness regarding sustainability compared to previous years. In the United States, 65% of consumers report they are more likely to purchase products packaged in environmentally friendly materials, further indicating a substantial demand for paper packaging among conscious consumers. This rising preference for sustainable products is predicted to reinforce the position of paper packaging in the market, as brands pivot to cater to eco-conscious consumers.

Expansion of E-commerce

The exponential growth of e-commerce is a crucial driver for the US paper packaging industry. The rapid proliferation of online shopping platforms necessitates secure and reliable packaging solutions, with paper packaging emerging as a preferred choice due to its lightweight and protective characteristics. Various projections suggest e-commerce growth will continue, with an expected annual compound growth exceeding 14% in the coming years, highlighting the ongoing demand for efficient packaging solutions tailored for e-commerce logistics.

Market Challenges

Competition with Plastic Packaging

Despite the growth trajectory of the paper packaging sector, competition with plastic continues to pose significant challenges. As of 2022, approximately 300 million tons of plastic are produced annually, predominantly for packaging purposes. This extensive utilization of plastic, favored for its cost-effectiveness and durability, creates stiff competition for paper-based alternatives. Many businesses still opt for plastic due to its lower cost and convenience, with plastic packaging often being perceived as more practical. Addressing this challenge, the industry must develop competitive pricing strategies and focus on innovative solutions to capture market share from plastic alternatives effectively.

Fluctuations in Raw Material Costs

Another significant challenge impacting the paper packaging industry is the volatility in raw material costs. In 2022, the price of wood fibers, a primary material for paper production, surged by 25%, largely due to global supply chain disruptions and increased demand from manufacturers. Simultaneously, the costs of recycled paper have seen considerable fluctuations, causing instability within the market. This unpredictability can hinder profit margins for producers and create challenges in inventory management. As manufacturers strive to maintain competitiveness while managing costs, recent trends indicate the need for strategic sourcing and efficient supply chain practices to mitigate these challenges effectively.

Opportunities

Innovations in Sustainable Packaging Solutions

The ongoing innovations in sustainable packaging present significant opportunities for growth in the paper packaging market. Innovations such as water-based inks, compostable materials, and enhanced recycling processes are gaining traction, making paper packaging increasingly attractive to environmentally conscious consumers and businesses. Market leaders are actively researching and developing next-generation materials, driving the transition towards more sustainable practices in packaging solutions. As consumers and businesses alike prioritize sustainability, the opportunities for growth within this segment remain promising.

Growth in the Food Delivery Sector

The expansion of the online food delivery sector is creating vast opportunities for innovation within paper packaging solutions. As consumer demand for takeout and delivery options skyrocketed to an estimated USD 200 billion in 2022, brands are increasingly shifting towards eco-friendly packaging solutions that meet consumer expectations for convenience and sustainability. The demand for paper packaging in this sector is bolstered by regulatory initiatives aimed at reducing plastic use and enhancing food safety standards. A well-aligned emphasis on sustainable packaging in food delivery will accelerate the need for effective paper-based solutions, ensuring continued industry growth in the coming years.

Future Outlook

Over the next five years, the US Paper Packaging Industry is expected to witness significant growth driven by the persistent demand for eco-friendly packaging, innovations in production processes, and a sweeping trend toward sustainability among consumers and businesses. The anticipated green policies and regulatory measures will reinforce this direction, encouraging more companies to adopt paper packaging solutions. Moreover, expansion in the e-commerce sector will continue to fuel the demand for various paper-based packaging products, ensuring a promising landscape for market participants.

Major Players

- International Paper

- WestRock

- Smurfit Kappa

- Georgia-Pacific

- Mondi Group

- Pratt Industries

- Packaging Corporation of America

- Sonoco Products Company

- Huhtamaki

- Klabin S.A.

- Mayr-Melnhof Karton AG

- Nefab Group

- DS Smith

- Stora Enso

- Aleph Group

Key Target Audience

- Manufacturers and Distributors

- Retail Companies

- E-commerce Companies

- Food and Beverage Brands

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Environmental Protection Agency, Food and Drug Administration)

- Packaging Designers and Engineers

- Suppliers of Raw Materials

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves developing an ecosystem map that encompasses all significant stakeholders within the US Paper Packaging Industry. This step relies heavily on extensive desk research, utilizing both secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as trends in consumer behavior and shifting preferences toward sustainable practices.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the US Paper Packaging Industry will be compiled and analyzed. This encompasses evaluating market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, an assessment of service quality statistics will be conducted to enhance the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a wide array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase will include engaging with multiple manufacturers and industry players to obtain detailed insights into product segments, sales performance, consumer preferences, and other critical market factors. This interaction will serve to validate and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the US Paper Packaging Industry.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Evolution

- Key Milestones and Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Consumer Demand for Eco-friendly Products

Expansion of E-commerce

Technological Advancements in Packaging - Market Challenges

Competition with Plastic Packaging

Fluctuations in Raw Material Costs - Opportunities

Innovations in Sustainable Packaging Solutions

Growth in the Food Delivery Sector - Trends

Increased Investment in Recycling Technologies

Customization and Personalization in Packaging - Regulatory Environment

Environmental Legislation Impacting Packaging

Compliance Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Corrugated Boxes

– Single-Wall Boxes

– Double-Wall Boxes

– Triple-Wall Boxes

– Custom Die-Cut Boxes

Paper Bags

– Kraft Paper Bags

– Printed Paper Bags

– Multiwall Paper Bags

– Flat & Satchel Bags

Cartons

– Folding Cartons

– Gable Top Cartons

– Aseptic Cartons

Paperboard

– Coated Unbleached Kraft (CUK)

– Solid Bleached Sulfate (SBS)

– White Lined Chipboard (WLC)

Wrapping Paper

– Industrial Wrapping Paper

– Retail Gift Wrap

– Wax-Coated Wrapping - By Application (In Value %)

Food and Beverage

– Bakery & Confectionery

– Dairy Products

– Frozen & Fast Food

– Beverage Carriers

Electronics

– Consumer Electronics

– Accessory Packaging

– Protective Inner Packaging

Personal Care

– Cosmetics

– Toiletries

– Perfumes & Fragrances

Household Goods

– Cleaning Supplies

– Paper Towels & Tissues

– DIY Tools - By End User (In Value %)

Retail

– Brick-and-Mortar Stores

– Departmental Chains

E-commerce

– Subscription Boxes

– Online Marketplaces (Amazon, Walmart.com, etc.)

– Direct-to-Consumer (D2C) Brands

Food Service

– Quick Service Restaurants (QSRs)

– Cafes & Bakeries

– Catering Services

Industrial Packaging

– Automotive Components

– Machinery Parts

– Chemical Containers - By Region (In Value %)

North

South

East

West - By Sustainability Claims (In Value %)

Recycled Content

– 100% Recycled Paper

– Partially Recycled Materials

Biodegradable/Compostable

– Certified Compostable Packaging

– Naturally Degradable Coatings

FSC Certified

– Forest Stewardship Council (FSC) Mix

– FSC Recycled

– FSC 100% Certified Materials

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Paper Packaging Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths & Weaknesses, Organizational Structure, Revenues, Market Positioning, Product Portfolio, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant Location and Capacity, Sustainability Initiatives, Innovation Capabilities, Unique Value Proposition)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

International Paper

WestRock

Smurfit Kappa

Pratt Industries

Georgia-Pacific

Mondi Group

DS Smith

Packaging Corporation of America

Sonoco Products Company

Stora Enso

Huhtamaki

Nefab Group

Mayr-Melnhof Karton AG

Klabin S.A.

SIG Combibloc

- Market Demand Dynamics

- Purchasing Intention and Trends

- Regulatory Compliance Insights

- Consumer Pain Points and Preferences

- Decision-Making Factors

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030