Market Overview

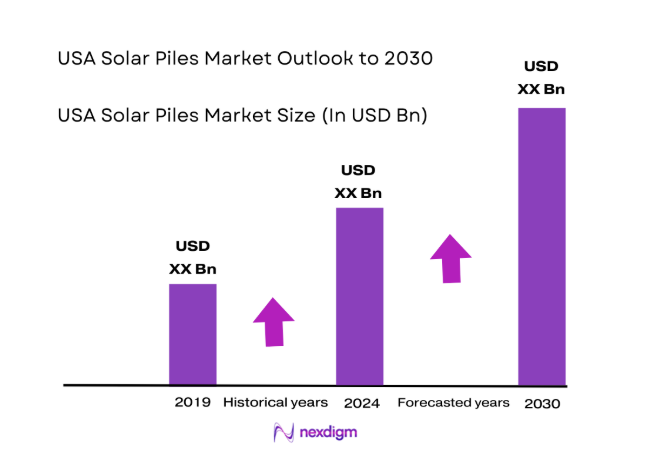

The USA Solar Piles market current size stands at around USD ~ million, reflecting sustained deployment of ground-mounted solar foundations across utility-scale and distributed projects nationwide. Demand is supported by ongoing capacity additions, standardized tracker architectures, and site-specific geotechnical requirements that favor steel and helical pile solutions. Procurement cycles are aligned with project pipelines, and domestic fabrication capacity continues to expand to meet delivery schedules. Supply resilience, coating availability, and installation productivity shape near-term procurement planning and contractor utilization.

Activity is concentrated in the Southwest and Midwest due to land availability, grid interconnection corridors, and utility-scale project clustering, while the Southeast is accelerating with expanding corporate offtake pipelines. Western states benefit from mature EPC ecosystems and standardized permitting processes. Northeastern deployment is shaped by community solar programs and brownfield redevelopment. Regional demand patterns reflect soil class distribution, corrosion zones, logistics access to fabrication hubs, and proximity to interconnection queues and transmission upgrades.

Market Segmentation

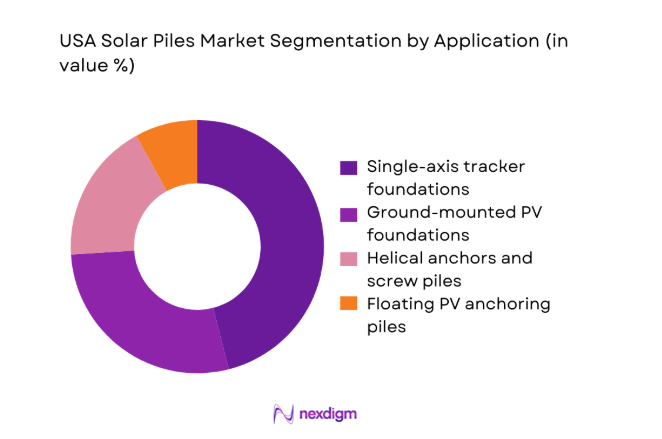

By Application

Single-axis tracker foundations dominate due to their prevalence in utility-scale deployments, where standardized profiles simplify engineering, accelerate installation cycles, and improve mechanical compatibility with larger module formats. Ground-mounted PV foundations follow, driven by fixed-tilt projects in constrained sites and community solar. Helical anchoring applications expand in rocky or environmentally sensitive locations, while floating PV anchoring remains niche but growing in water-stressed regions. The dominance of tracker-linked applications is reinforced by EPC preferences for integrated foundation packages, predictable tolerances, and repeatable installation methods across multi-site portfolios, supporting scale efficiencies and schedule certainty.

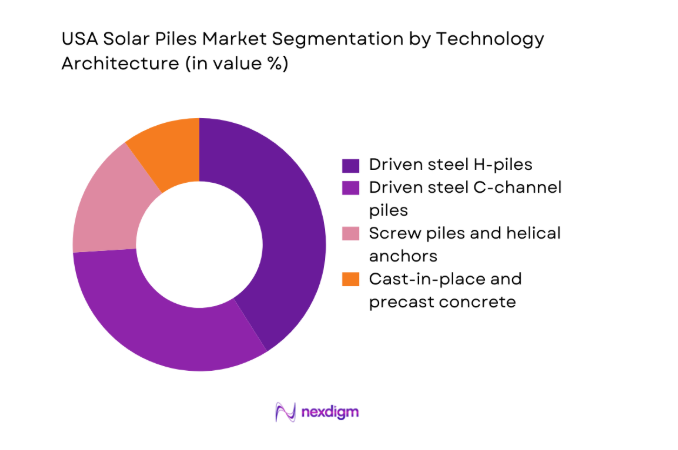

By Technology Architecture

Driven steel H-piles and C-channel piles lead due to proven load-bearing performance, rapid installation, and broad tracker compatibility across varied soil classes. Screw piles and helical anchors gain traction in restrictive permitting environments and rocky terrains where driven piles face refusal risks. Cast-in-place and precast concrete solutions are used selectively for high corrosion zones and specialized load cases. Technology choice is influenced by soil resistivity, frost depth, corrosion exposure, and access constraints. Standardization by tracker suppliers further consolidates demand toward steel profiles that enable predictable procurement, logistics, and installation productivity across utility-scale portfolios.

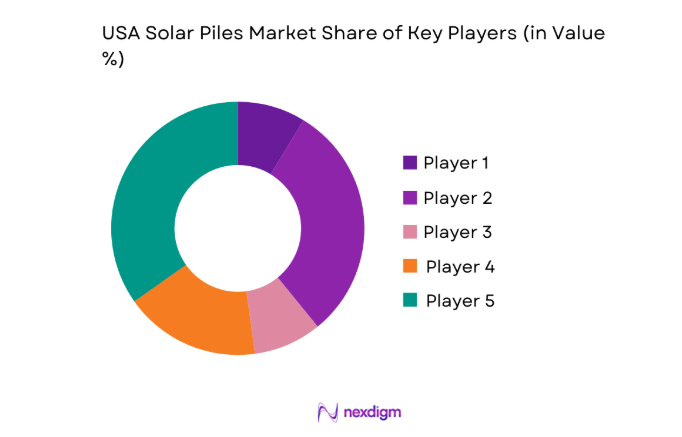

Competitive Landscape

The competitive landscape is characterized by vertically coordinated suppliers spanning steel fabrication, coating services, and on-site installation partnerships. Differentiation centers on lead-time reliability, corrosion protection, tracker compatibility, and logistics coverage across high-growth regions. Procurement decisions emphasize delivery certainty and execution risk management across multi-site portfolios.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Nucor Corporation | 1968 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Valmont Industries | 1946 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| MasTec | 1929 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Quanta Services | 1997 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Black & Veatch | 1915 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA Solar Piles Market Analysis

Growth Drivers

Utility-scale solar capacity additions driven by state RPS mandates

State renewable portfolio standards enacted across multiple jurisdictions accelerated utility procurement in 2023 and 2024, driving new ground-mounted installations requiring pile foundations. In 2023, more than 30 states maintained binding clean energy mandates, while 2024 updates expanded compliance timelines for utilities serving over 1000000 customers. Interconnection queues processed over 7000 applications nationwide in 2024, with transmission upgrades initiated across 1200 miles of corridors. Federal permitting streamlining in 2024 reduced average environmental review timelines by 90 days. These institutional actions sustain multi-site project pipelines, increasing standardized foundation deployment and repeatable pile specifications.

Declining LCOE of solar PV increasing ground-mounted installations

Utility-scale project approvals accelerated during 2023 and 2024 as declining levelized cost of energy expanded bankability for large ground-mounted sites. In 2024, over 60 gigawatts of utility-scale solar projects advanced through late-stage permitting nationwide, supported by 140 regional grid upgrade approvals. Domestic module manufacturing capacity exceeded 40 gigawatts in 2024, improving supply reliability for EPC schedules. Logistics corridors handled over 20000 truck movements to solar sites across the Southwest in 2023. Lower balance-of-system complexity favored standardized tracker systems, reinforcing demand for uniform pile profiles across expanding project footprints.

Challenges

Geotechnical variability increasing design and installation complexity

Project sites across the Southwest, Midwest, and Southeast exhibit heterogeneous soil classes, with refusal rates exceeding 15 events per 100 driven piles in rocky terrains documented during 2023 construction seasons. Frost depth variability across northern states exceeds 36 inches, necessitating deeper embedment lengths and revised load calculations. In 2024, over 800 site investigations required redesign iterations following initial geotechnical reports. Environmental permitting imposed setbacks in wetlands across 27 counties, constraining pile spacing and alignment. These factors extend installation cycles, increase equipment mobilizations, and elevate execution risk for multi-site utility portfolios.

Volatility in steel prices impacting pile procurement costs

Steel input volatility disrupted procurement planning during 2023 and 2024, with monthly mill lead times fluctuating between 6 and 14 weeks. Import constraints affected over 120 shipments at coastal ports in 2023, delaying fabrication schedules for coated profiles. Domestic furnace restarts in 2024 stabilized output volumes across 18 facilities, yet regional allocation quotas constrained rapid scale-up for peak construction windows. Freight bottlenecks across 9 rail corridors in 2024 added transit uncertainty for long-haul deliveries. These dynamics complicate fixed-schedule EPC commitments and increase inventory buffering requirements for foundation suppliers.

Opportunities

Repowering of aging utility-scale solar plants with upgraded foundation

Repowering programs accelerated in 2023 and 2024 as early utility-scale projects reached structural refurbishment cycles. Over 400 operating sites commissioned before 2015 entered assessment phases for tracker upgrades and foundation reinforcement. Asset managers approved refurbishment plans across 26 states in 2024, driven by module upsizing and wind-load compliance updates. Interconnection capacity retained at 95 percent of original allocations for repowered sites, improving redevelopment economics. Repowering creates repeatable demand for replacement piles, corrosion upgrades, and deeper embedment designs, favoring suppliers with standardized profiles and rapid mobilization capabilities.

Expansion of community solar projects in Northeast and Midwest

Community solar permitting expanded during 2023 and 2024 across northeastern and midwestern states, with more than 900 new project approvals issued by state agencies in 2024. Municipal zoning updates enabled dual-use land across 1400 acres of brownfield sites, favoring shallow foundation solutions compatible with environmental remediation constraints. Grid hosting capacity maps published in 2024 opened additional feeder capacity across 320 substations, accelerating project clustering. Community solar developers favor modular installation schedules and smaller crew footprints, creating opportunities for helical and driven pile suppliers offering rapid deployment across fragmented sites.

Future Outlook

Through 2030, project pipelines will favor standardized foundation architectures aligned with tracker system evolution and domestic manufacturing expansion. Regional growth will track transmission buildouts and interconnection reforms, with repowering cycles adding recurring demand. Policy stability and permitting streamlining will support execution certainty, while technology selection will increasingly reflect site-specific geotechnical optimization.

Major Players

- Nucor Corporation

- Valmont Industries

- MasTec

- Quanta Services

- Black & Veatch

- Kiewit Corporation

- Fluor Corporation

- Mortenson

- McCarthy Building Companies

- Vulcan Materials Company

- Solar Steel USA

- Gaylor Electric

- Terracon Consultants

- Prysmian Group

- ArcelorMittal

Key Target Audience

- Utility-scale solar developers

- EPC contractors for renewable energy

- Solar tracker manufacturers

- Geotechnical engineering firms

- Steel fabrication and coating providers

- Investments and venture capital firms

- U.S. Department of Energy and Federal Energy Regulatory Commission

- State energy offices and public utility commissions

Research Methodology

Step 1: Identification of Key Variables

Project pipeline indicators, tracker adoption patterns, soil class distribution, corrosion exposure zones, and domestic fabrication capacity were mapped across priority regions. Installation methods, embedment requirements, and logistics access were defined as primary technical variables shaping deployment feasibility.

Step 2: Market Analysis and Construction

Project approvals, interconnection queues, and transmission upgrades were synthesized to construct deployment pathways by region. Technology architecture adoption and application mix were modeled against geotechnical constraints and EPC standardization practices.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on installation productivity, refusal risk, and coating demand were validated through structured consultations with EPC site managers, geotechnical specialists, and fabrication operations leaders across high-growth corridors.

Step 4: Research Synthesis and Final Output

Findings were reconciled across regulatory developments, infrastructure pipelines, and technology trends to produce coherent scenario narratives. Sensitivity checks aligned regional drivers with operational constraints to ensure implementation realism.

- Executive Summary

- Research Methodology (Market Definitions and scope for utility-scale and distributed solar pile foundations, Project pipeline tracking and installation capacity mapping by state and developer, Bottom-up market sizing using MW installed and piles-per-MW conversion factors, Revenue attribution by pile type, coating, and installation method, Primary interviews with EPCs, geotechnical contractors, and pile manufacturers, Triangulation of import-export data, permitting records, and interconnection queues, Assumptions on soil class distribution, corrosion zones, and installation productivity rates)

- Definition and Scope

- Market evolution

- Usage pathways in utility-scale and distributed PV projects

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Utility-scale solar capacity additions driven by state RPS mandates

Declining LCOE of solar PV increasing ground-mounted installations

Acceleration of single-axis tracker deployments requiring higher pile volumes

Federal tax incentives and domestic content provisions stimulating project pipelines

Grid interconnection backlogs pushing developers toward larger, centralized sites

Land availability in Southwest and Midwest favoring pile-based foundations - Challenges

Geotechnical variability increasing design and installation complexity

Volatility in steel prices impacting pile procurement costs

Supply chain disruptions and lead times for coated and galvanized piles

Permitting delays and local zoning constraints for ground-mounted PV

Labor shortages for specialized pile driving crews

Environmental restrictions in wetlands and sensitive habitats - Opportunities

Repowering of aging utility-scale solar plants with upgraded foundations

Expansion of community solar projects in Northeast and Midwest

Adoption of corrosion-resistant coatings in coastal and high-salinity soils

Growth in agrivoltaics requiring customized pile heights and spacing

Integration of digital geotechnical surveying to optimize pile design

Domestic manufacturing expansion under onshoring incentives - Trends

Shift toward screw piles and helical anchors in rocky and constrained sites

Increased use of automated pile driving and GPS-guided installation

Standardization of pile profiles by tracker OEMs

Rising demand for higher load-bearing piles for larger module formats

Pre-construction geotechnical modeling using LiDAR and soil mapping

Bundling of piles with tracker systems by integrated suppliers - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Fleet Type (in Value %)

Utility-scale solar farms

Community solar projects

Commercial and industrial rooftop systems

Residential ground-mounted systems

- By Application (in Value %)

Ground-mounted PV foundations

Single-axis tracker foundations

Dual-axis tracker foundations

Floating PV anchoring piles

- By Technology Architecture (in Value %)

Driven steel H-piles

Driven steel C-channel piles

Screw piles and helical anchors

Concrete cast-in-place piles

Precast concrete piles

- By End-Use Industry (in Value %)

Utility-scale power generation

Commercial facilities

Industrial facilities

Residential energy systems

Public sector and municipal solar

- By Connectivity Type (in Value %)

Fixed-tilt mounting structures

Single-axis tracker-connected piles

Dual-axis tracker-connected piles

Hybrid mounting system connections

- By Region (in Value %)

West

Southwest

Midwest

Northeast

Southeast

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Manufacturing capacity, Coating and corrosion protection capabilities, Tracker system compatibility, Installation service footprint, Project delivery lead times, Cost per pile installed, Compliance with Buy American provisions, Warranty and aftersales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Bench marketing

- Detailed Profiles of Major Companies

Nucor Corporation

ArcelorMittal

Valmont Industries

Prysmian Group

Vulcan Materials Company

Quanta Services

McCarthy Building Companies

Mortenson

Solar Steel USA

Gaylor Electric

Terracon Consultants

MasTec

Fluor Corporation

Kiewit Corporation

Black & Veatch

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030