Market Overview

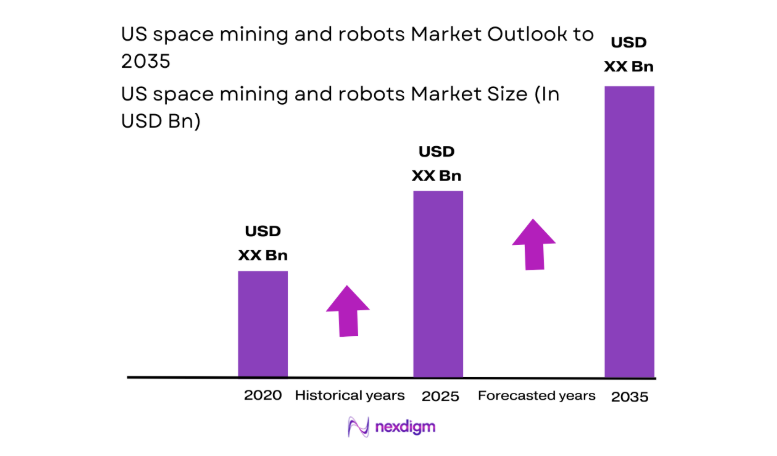

The US space mining and robots market current size stands at around USD ~ million, reflecting early-stage commercialization across robotic prospecting, surface mobility, and in-situ resource utilization systems. Demand is shaped by mission-readiness requirements, qualification cycles, and platform integration with launch and surface operations. Capital intensity remains high due to extreme-environment engineering, redundancy standards, and verification regimes. The market is characterized by long development timelines, iterative mission demonstrations, and tight coupling with orbital logistics and surface power architectures.

Activity concentrates around launch corridors, cislunar mission operations hubs, and advanced robotics manufacturing clusters. Infrastructure density near coastal launch sites and test ranges supports integration and qualification workflows. Demand clusters where mission planning, autonomy software, and space systems engineering talent co-locate with deep-space communications assets. Ecosystem maturity is reinforced by policy alignment with lunar exploration programs, permitting pathways for mission licensing, and coordinated safety frameworks governing in-space operations, spectrum access, and planetary protection.

Market Segmentation

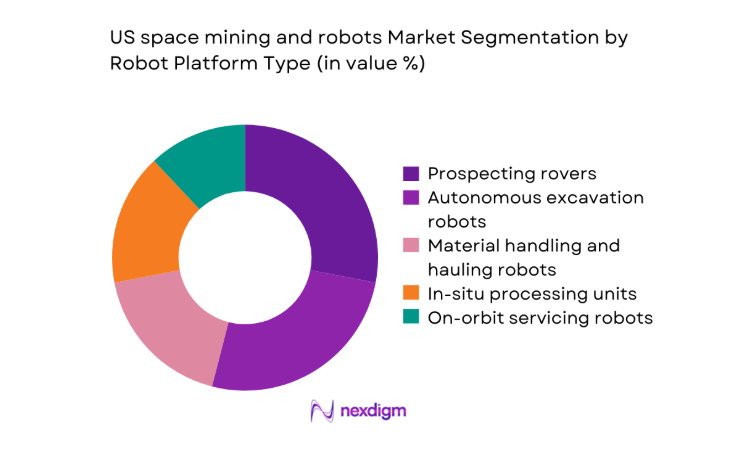

By Robot Platform Type

Autonomous prospecting rovers and excavation robots dominate due to mission-critical roles in terrain mapping, regolith handling, and payload delivery under constrained power and thermal envelopes. Material handling units and in-situ processing systems gain traction where surface operations extend beyond single sorties into multi-mission campaigns. On-orbit servicing robots complement surface platforms by enabling assembly, inspection, and transfer tasks that reduce mission risk and increase utilization of deployed assets. Platform modularity supports rapid reconfiguration across prospecting, extraction, and logistics functions, while software-defined autonomy allows capability upgrades without hardware refits, improving lifecycle efficiency and mission adaptability across heterogeneous environments.

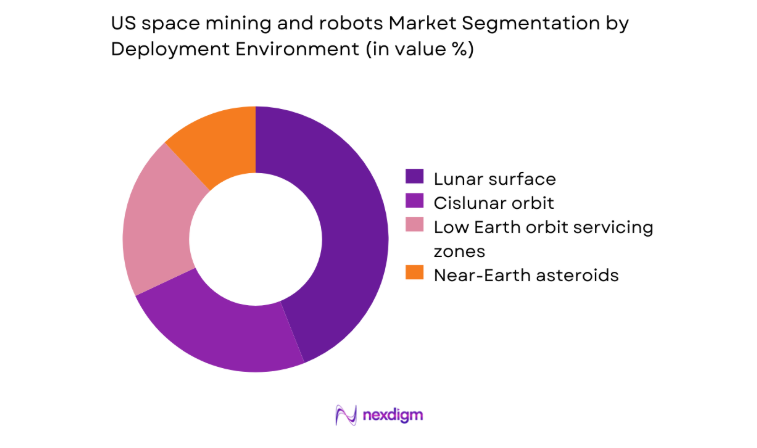

By Deployment Environment

Lunar surface deployments lead adoption because of mission cadence, surface-accessibility, and established communications relays. Cislunar orbit operations support assembly and logistics, creating demand for dexterous robotic systems with rendezvous and docking capabilities. Near-Earth asteroid missions remain selective, driven by technology readiness thresholds and navigation complexity. Low Earth orbit zones emphasize servicing and inspection use cases that derisk deeper-space operations through incremental validation. Environmental constraints such as radiation exposure, abrasive regolith, and thermal cycling shape platform selection, driving ruggedization, redundancy, and autonomy upgrades that favor deployment environments with predictable mission windows and established support infrastructure.

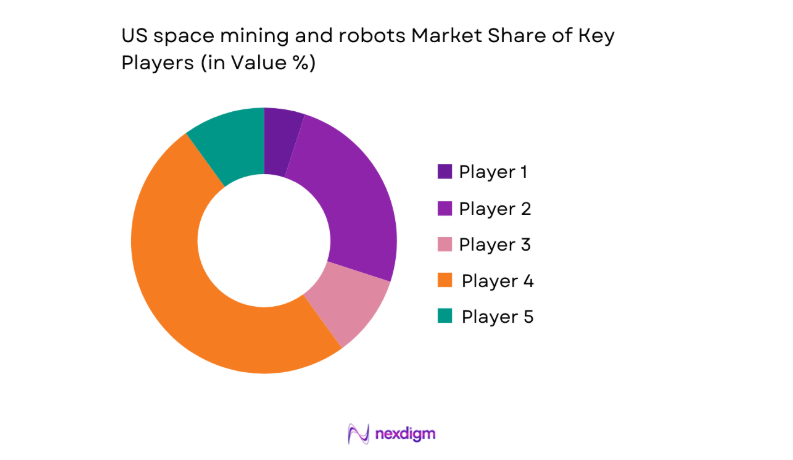

Competitive Landscape

The competitive environment features vertically integrated system developers alongside specialized autonomy, robotics hardware, and mission-operations providers. Partnerships across launch integration, surface power, and communications enable differentiated mission performance. Competitive positioning hinges on technology readiness, mission heritage, and regulatory preparedness, while commercial models increasingly emphasize modular platforms and service-based delivery to shorten procurement cycles and de-risk deployment.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Astrobotic Technology | 2007 | Pittsburgh, PA | ~ | ~ | ~ | ~ | ~ | ~ |

| Intuitive Machines | 2013 | Houston, TX | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeybee Robotics | 1983 | Pasadena, CA | ~ | ~ | ~ | ~ | ~ | ~ |

| Maxar Technologies | 1957 | Westminster, CO | ~ | ~ | ~ | ~ | ~ | ~ |

| Redwire Space | 2020 | Jacksonville, FL | ~ | ~ | ~ | ~ | ~ | ~ |

US space mining and robots Market Analysis

Growth Drivers

Rising US investment in lunar and cislunar infrastructure

Federal appropriations supported 2024 mission allocations exceeding ~across exploration, surface systems, and cislunar logistics, with 2025 programmatic increases aligned to sustained lunar presence. Launch cadence expanded to 9 deep-space missions in 2024 and 11 planned for 2025, increasing demand for surface robotics integration and operations support. Regulatory approvals processed through licensing offices rose by 17 cases in 2024, accelerating mission readiness. Expansion of deep-space communications added 6 relay upgrades during 2023–2024, improving operational uptime. These institutional commitments anchor long-horizon deployment pipelines, reducing uncertainty for robotics suppliers and integrators.

Demand for in-situ resource utilization to reduce launch mass

ISRU demonstrations advanced from laboratory validation to surface analog trials, with 14 field tests conducted during 2023–2025 across desert and polar simulants. Propellant production prototypes achieved continuous operation exceeding 72 hours in 2024 test campaigns, validating thermal and power management. Payload mass constraints remain binding, with launch performance envelopes limiting single-mission delivered mass to 3,500 kilograms for typical lunar transfer profiles in 2025. Mission architectures targeting refueling nodes logged 4 integrated system rehearsals in 2024. These constraints incentivize robotic extraction and processing to localize consumables, directly expanding demand for autonomous excavation and beneficiation systems.

Challenges

High technology development and qualification costs

Qualification cycles require environmental testing across vacuum, radiation, and thermal extremes, with 18 standardized test protocols mandated across 2023–2025 for flight readiness. Component-level failure rates observed in thermal vacuum chambers averaged 2 failures per 100 cycles in 2024, extending redesign timelines. Radiation hardening thresholds increased by 30 krad requirements for surface electronics in 2025 mission profiles. Reliability assurance necessitates redundant actuation channels, adding 4 additional subsystems per mobility platform. Integration with power and comms stacks requires 5 interface certifications before flight acceptance. These cumulative requirements slow iteration velocity and constrain deployment schedules for new robotic platforms.

Uncertain commercial viability and ROI timelines

Commercial mission backlogs reached 7 contracted payloads awaiting surface windows during 2024–2025, reflecting scheduling bottlenecks and financing gaps. Insurance underwriting for deep-space robotics added 2 new risk exclusions in 2024, complicating coverage structures. Demonstration-to-commercial transition timelines extend beyond 36 months for surface extraction workflows validated in 2023. Contract milestones depend on 3 sequential mission successes before multi-mission commitments activate. Institutional procurement cycles average 18 months, delaying scale deployment. These factors elongate payback horizons, tempering near-term adoption despite validated technical performance and increasing institutional interest.

Opportunities

Public–private partnerships for lunar ISRU demonstrations

Co-funded demonstration frameworks expanded to 6 collaborative mission slots in 2024–2025, enabling shared risk across surface robotics, power, and comms stacks. Test campaigns increased field readiness through 9 integrated rehearsals in analog sites during 2024. Data-sharing agreements unlocked access to 4 mission telemetry repositories, accelerating algorithm tuning for autonomy and navigation. Contract vehicles now permit milestone-based releases after 2 successful surface operations, improving cashflow predictability for suppliers. Standardized payload interfaces adopted across 5 mission profiles reduce integration friction. These structures lower barriers for emerging robotics platforms to achieve flight heritage and scale deployment pathways.

Integration of robotics with in-space manufacturing

Additive manufacturing payloads completed 8 microgravity fabrication trials in 2023–2024, validating feedstock handling and quality control. Surface manufacturing pilots demonstrated continuous tool-path operation exceeding 48 hours in 2025 analog trials. Robotics-manufacturing integration enables localized part replacement, reducing resupply dependencies constrained by launch windows capped at 12 viable lunar transfer periods annually. Autonomous inspection systems logged 1,200 defect detections across 2024 trials, improving maintenance outcomes. Standard tool changers adopted across 3 platform families enable cross-compatibility. These capabilities create new service models around on-site fabrication, spares logistics, and adaptive mission reconfiguration for sustained surface operations.

Future Outlook

The market is set to mature as sustained lunar operations transition from demonstration to repeatable mission architectures. Policy continuity and mission cadence will deepen ecosystem readiness, while autonomy and modular platforms compress deployment cycles. Integration with surface power and in-space manufacturing will broaden use cases, supporting durable operational footprints through the late decade.

Major Players

- Astrobotic Technology

- Intuitive Machines

- Moon Express

- ispace U.S.

- OffWorld

- Honeybee Robotics

- Maxar Technologies

- Northrop Grumman

- Lockheed Martin

- Blue Origin

- SpaceX

- Redwire Space

- Sierra Space

- Axiom Space

- Made In Space

Key Target Audience

- Investments and venture capital firms

- NASA

- Federal Aviation Administration Office of Commercial Space Transportation

- Federal Communications Commission

- US Department of Defense

- Commercial lunar mission operators

- Satellite operators and in-orbit service providers

- Space systems integrators

Research Methodology

Step 1: Identification of Key Variables

Program milestones, mission cadence, autonomy maturity, power architectures, and surface-operability constraints are scoped to define demand drivers and adoption thresholds. Regulatory pathways and licensing workflows are mapped to deployment feasibility. Supply-side capability variables capture platform modularity, interface standards, and qualification readiness.

Step 2: Market Analysis and Construction

Mission pipelines, launch manifests, and infrastructure readiness are synthesized to construct adoption pathways. Technology readiness levels are aligned to operational use cases. Value-chain linkages across robotics hardware, autonomy software, power, and comms are integrated to reflect system-level dependencies.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions are stress-tested against mission analog data and regulatory requirements. Engineering feasibility is validated through field-test outcomes and integration benchmarks. Institutional procurement dynamics are examined to refine deployment timelines and partnership structures.

Step 4: Research Synthesis and Final Output

Findings are consolidated into scenario-based outlooks linking policy continuity, mission cadence, and platform maturity. Cross-segment implications are harmonized to ensure internal consistency. Outputs are structured to inform strategic planning, partnerships, and deployment sequencing.

- Executive Summary

- Research Methodology (Market Definitions and mission-phase boundaries, Primary interviews with space mining startups and robotics integrators, Expert consultations with NASA and DoD space systems officials)

- Definition and Scope

- Market evolution

- Usage and mission pathways

- Ecosystem structure

- Supply chain and launch-to-orbit channel structure

- Growth Drivers

Rising US investment in lunar and cislunar infrastructure

Demand for in-situ resource utilization to reduce launch mass

Growth of commercial lunar missions and CLPS programs - Challenges

High technology development and qualification costs

Uncertain commercial viability and ROI timelines

Harsh lunar and asteroid operating environments - Opportunities

Public–private partnerships for lunar ISRU demonstrations

Integration of robotics with in-space manufacturing

Long-term contracts for propellant production and supply - Trends

Shift toward modular and reconfigurable robotic systems

Increased use of AI-driven autonomy and edge computing - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Unit Economics, 2020–2025

- By Robot Platform Type (in Value %)

Prospecting rovers

Autonomous excavation robots

Material handling and hauling robots

In-situ processing and beneficiation units

On-orbit servicing and assembly robots - By Mission Phase (in Value %)

Prospecting and surveying

Sample collection and return

Pilot-scale extraction

Resource processing and storage

On-orbit transfer and utilization - By Resource Target (in Value %)

Water ice

Rare earth elements and platinum group metals

Regolith for construction and shielding

Volatiles for propellant production

Silicates for manufacturing feedstock - By Deployment Environment (in Value %)

Lunar surface

Near-Earth asteroids

Cislunar orbit and Lagrange points

Low Earth orbit in-orbit servicing zones - By Autonomy Level (in Value %)

Teleoperated systems

Supervised autonomy

Fully autonomous robotic systems

- Market share of major players

- Cross Comparison Parameters (Technology readiness level, Autonomy and AI maturity, Mission heritage and flight validation, ISRU process integration capability, Robotics payload mass efficiency, Power and thermal management capability, Partnerships with launch providers, Compliance with US regulatory frameworks)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Astrobotic Technology

Intuitive Machines

Moon Express

ispace U.S.

OffWorld

Honeybee Robotics

Maxar Technologies

Northrop Grumman

Lockheed Martin

Blue Origin

SpaceX

Redwire Space

Sierra Space

Axiom Space

Made In Space

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Unit Economics, 2026–2035