Market Overview

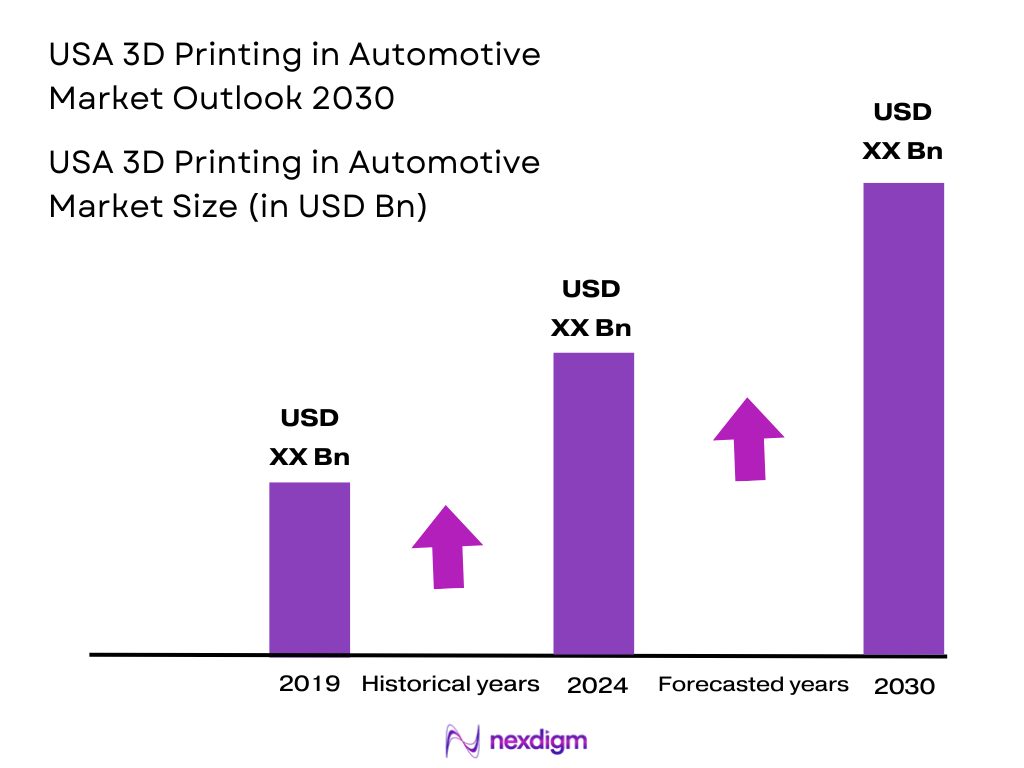

Based on a recent historical assessment, the USA 3D Printing in Automotive market generated USD ~ billion, supported by strong adoption of additive manufacturing across automotive prototyping, tooling, and low-volume component production. Automotive manufacturers increasingly deploy polymer and metal-based printing technologies to accelerate design validation, reduce tooling expenditure, and improve manufacturing flexibility. Growing electric vehicle programs, rising customization demand, and sustained investments in digital manufacturing infrastructure continue to drive adoption across OEMs and Tier-1 suppliers within the national automotive ecosystem.

Market activity is concentrated in industrial hubs including Michigan, California, Ohio, and Texas due to dense automotive manufacturing clusters, advanced supplier networks, and proximity to research institutions. Michigan benefits from legacy automotive engineering capabilities, while California leads in electric vehicle innovation and startup-driven additive manufacturing adoption. Ohio and Texas support scale manufacturing through skilled labor availability and logistics access. Federal manufacturing initiatives, material innovation centers, and strong collaboration between OEMs and technology providers reinforce regional leadership.

Market Segmentation

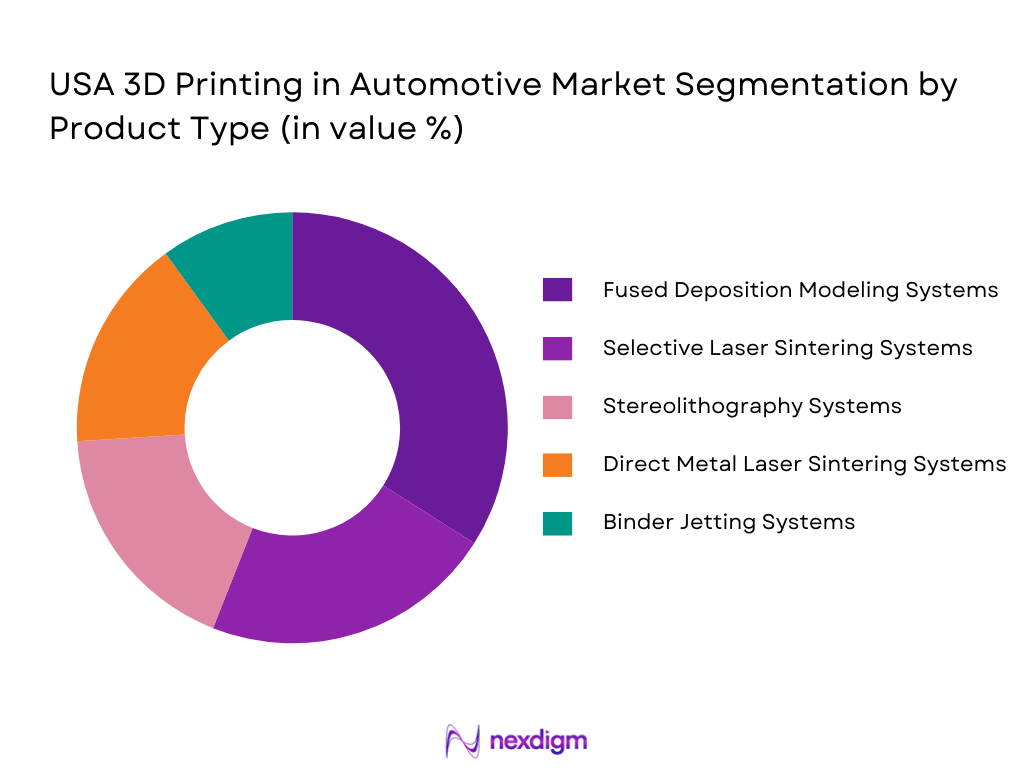

By Product Type

USA 3D Printing in Automotive market is segmented by product type into fused deposition modeling systems, selective laser sintering systems, stereolithography systems, direct metal laser sintering systems, and binder jetting systems. Recently, fused deposition modeling systems have a dominant market share due to extensive use in rapid prototyping, tooling, and functional testing within automotive production environments. These systems offer lower capital costs, broad thermoplastic compatibility, and operational simplicity, making them suitable for widespread deployment across OEM and supplier facilities. Automotive manufacturers rely on fused deposition modeling for faster design iteration, cost-efficient tooling, and interior component validation. Strong material availability, workforce familiarity, and integration with existing CAD workflows further support dominance, enabling scalable deployment across multiple vehicle programs.

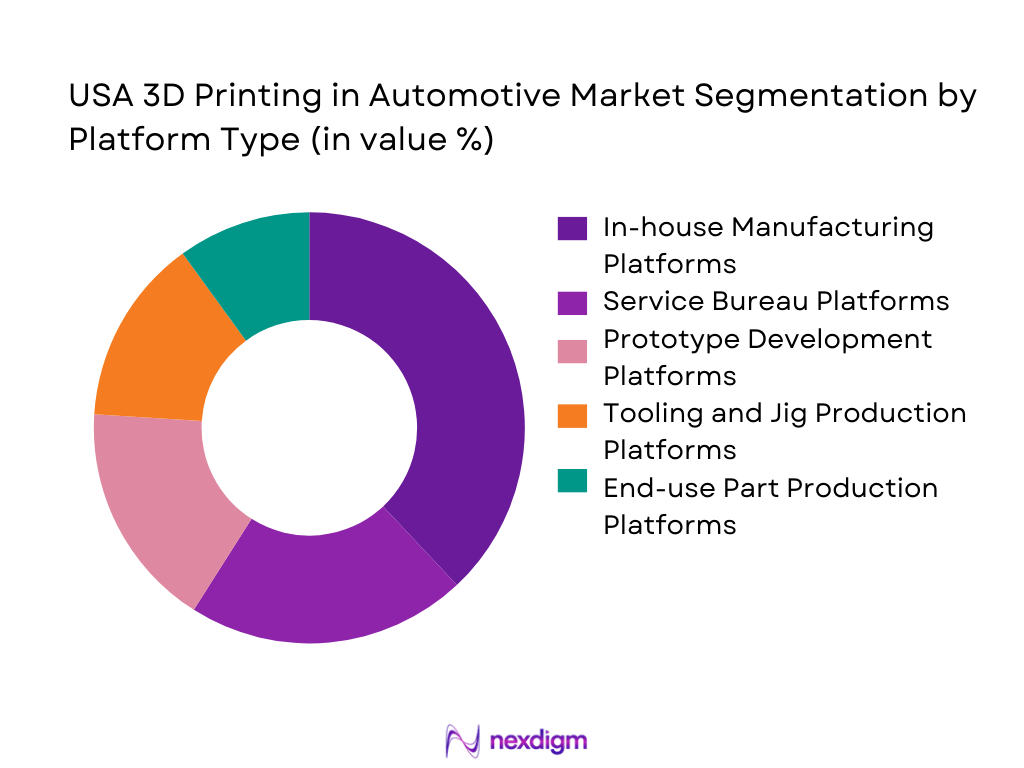

By Platform Type

USA 3D Printing in Automotive market is segmented by platform type into in-house manufacturing platforms, service bureau platforms, prototype development platforms, tooling and jig production platforms, and end-use part production platforms. Recently, in-house manufacturing platforms have a dominant market share as automakers prioritize internal control over design confidentiality, production timelines, and quality management. OEMs increasingly invest in internal additive manufacturing facilities to support rapid prototyping, component testing, and low-volume production without reliance on external vendors. In-house platforms enable faster engineering changes, seamless integration with digital manufacturing systems, and long-term cost efficiencies. Rising electric vehicle development and demand for flexible manufacturing capacity further reinforce this dominance.

Competitive Landscape

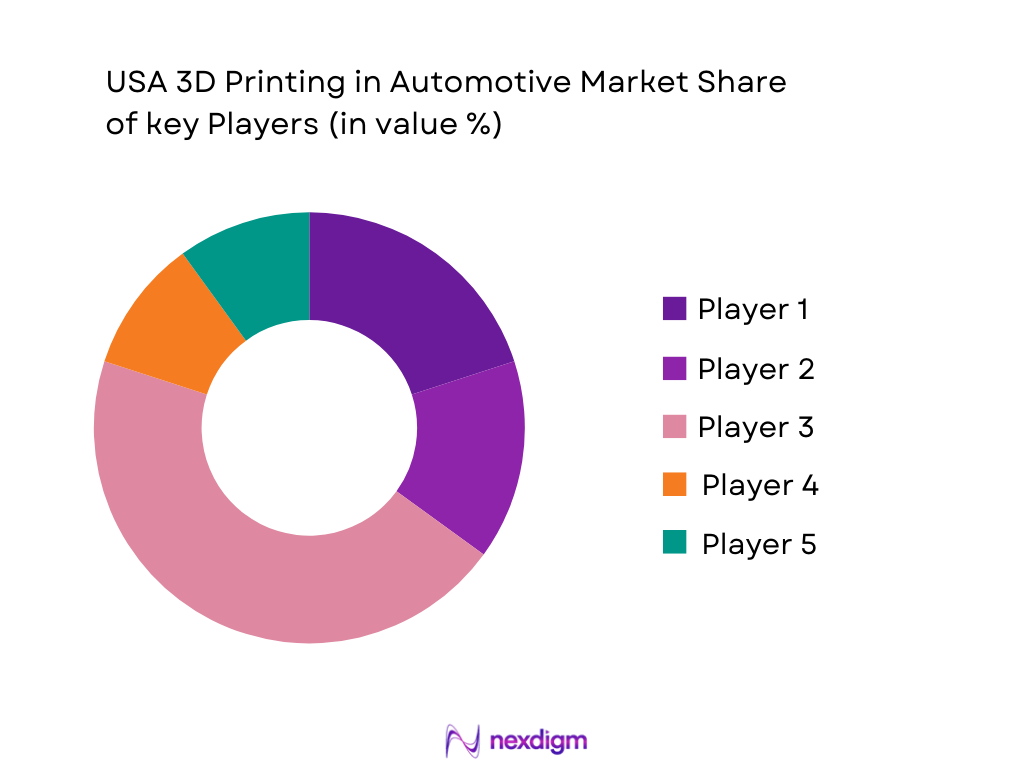

The USA 3D Printing in Automotive market exhibits moderate consolidation, with a mix of established additive manufacturing technology providers and emerging specialists serving automotive OEMs and suppliers. Major players influence technology standards, material innovation, and long-term supply agreements, while strategic partnerships with automakers strengthen market positioning. Competition is driven by technology capability, material breadth, and production scalability.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Automotive Partnerships |

| 3D Systems | 1986 | USA | ~ | ~ | ~ | ~ | ~ |

| Stratasys | 1989 | USA | ~ | ~ | ~ | ~ | ~ |

| HP Inc. | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Desktop Metal | 2015 | USA | ~ | ~ | ~ | ~ | ~ |

| GE Additive | 2016 | USA | ~ | ~ | ~ | ~ | ~ |

USA 3D Printing in Automotive Market Analysis

Growth Drivers

Electric Vehicle Manufacturing Expansion and Lightweighting Demand

Electric Vehicle is accelerating adoption of additive manufacturing as automakers seek to reduce vehicle weight, improve energy efficiency, and shorten development cycles across electric platforms. Additive manufacturing enables complex geometries that traditional methods cannot easily achieve, supporting lightweight structural and thermal components. Electric vehicle programs rely heavily on rapid prototyping to validate battery housings, cooling channels, and power electronics enclosures. Automotive OEMs increasingly integrate 3D printing to reduce tooling dependencies during early-stage development. The ability to consolidate multiple parts into single printed components improves assembly efficiency. Lightweight materials support extended driving range and regulatory compliance. Continuous investment in electric mobility infrastructure reinforces long-term additive manufacturing demand. Supplier ecosystems increasingly align with electric vehicle timelines, strengthening adoption momentum.

Rapid Prototyping and Tooling Optimization Across Automotive OEMs

Rapid drives market growth as manufacturers prioritize speed, flexibility, and cost control across vehicle development programs. Additive manufacturing reduces lead times for prototype parts from weeks to days. Automotive engineers leverage printed tooling, jigs, and fixtures to improve production accuracy and reduce downtime. Custom tooling supports low-volume and specialty vehicle programs. The ability to iterate designs rapidly enhances innovation and time-to-market performance. OEMs increasingly embed additive manufacturing into digital production workflows. Supplier collaboration further accelerates deployment. Cost savings achieved through tooling optimization support sustained investment.

Market Challenges

High Capital Investment and Production Scalability Constraints

High limit broader adoption as industrial-grade printers, materials, and post-processing equipment require significant upfront expenditure. Automotive manufacturers must justify investment against uncertain production volumes. Scaling additive manufacturing for mass production remains challenging due to throughput limitations. Quality consistency across large batches requires advanced monitoring systems. Workforce training increases operational costs. Material qualification processes slow deployment. Smaller suppliers face financial barriers. These factors restrain full-scale integration.

Material Qualification and Automotive Certification Complexity

Present challenges due to stringent safety, durability, and performance standards in automotive applications. Printed components require extensive testing and validation. Certification timelines delay production integration. Limited availability of automotive-grade materials restricts application scope. Regulatory compliance varies by component type. OEM risk aversion slows adoption. Documentation requirements increase development costs. Continuous material innovation is required to overcome these barriers.

Opportunities

Integration of Additive Manufacturing in Series Production Applications

Offers growth potential as technology advances enable higher throughput and improved consistency. Automotive manufacturers increasingly explore additive manufacturing for end-use parts. Improved printer speed supports small-series production. Digital inventory models reduce spare parts storage. On-demand production enhances supply chain resilience. OEMs benefit from localized manufacturing. Advanced quality control systems improve reliability. Long-term cost efficiencies drive opportunity expansion.

Advancement of Metal Additive Manufacturing for Structural Components

Creates opportunity as automakers seek high-strength, lightweight alternatives for powertrain and chassis parts. Metal printing supports complex load-bearing designs. Improved material properties enhance performance. Electric vehicle platforms benefit from thermal and structural optimization. OEM partnerships accelerate development. Certification progress expands use cases. Investment in metal AM ecosystems supports sustained growth.

Future Outlook

The USA 3D Printing in Automotive market is expected to experience steady growth over the next five years, supported by electric vehicle expansion, digital manufacturing adoption, and material innovation. Advancements in metal and polymer printing technologies will improve production scalability. Regulatory support for advanced manufacturing and sustainability initiatives will further encourage adoption. Demand-side focus on customization and rapid development will continue to shape market evolution.

Major Players

- 3D Systems

- Stratasys

- HP Inc.

- Desktop Metal

- GE Additive

- Markforged

- EOS

- Carbon

- Formlabs

- Proto Labs

- Materialise

- SLM Solutions

- Velo3D

- ExOne

- Ricoh USA

Key Target Audience

- Automotive OEMs

- Automotive Tier-1 suppliers

- Electric vehicle manufacturers

- Automotive R&D centers

- Manufacturing technology providers

- Material suppliers

- Investment and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Market variables including technology types, applications, and end users are identified through secondary research and industry databases. Key economic and industrial indicators are analyzed. Market boundaries are clearly defined. Assumptions are validated through expert input.

Step 2: Market Analysis and Construction

Data is structured using bottom-up and top-down approaches. Industry trends and adoption patterns are mapped. Segment-level analysis is conducted. Data consistency is verified.

Step 3: Hypothesis Validation and Expert Consultation

Findings are validated through interviews with industry experts. OEM and supplier perspectives are incorporated. Assumptions are refined. Analytical models are adjusted.

Step 4: Research Synthesis and Final Output

Insights are consolidated into structured outputs. Data accuracy is cross-verified. Conclusions are aligned with market dynamics. Final deliverables are prepared.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for rapid prototyping in automotive design

Increased adoption of lightweight components for fuel efficiency

Customization requirements in electric and luxury vehicles - Market Challenges

High initial investment costs for industrial 3D printers

Material qualification and certification constraints

Limited production scalability for mass manufacturing - Market Opportunities

Expansion of additive manufacturing in electric vehicle platforms

Growing use of metal 3D printing for structural parts

Integration of digital manufacturing workflows - Trends

Shift toward on-demand spare part manufacturing

Increasing use of sustainable and recyclable printing materials

Adoption of hybrid manufacturing processes - Government Regulations

Automotive safety and material compliance standards

Intellectual property protection frameworks

Manufacturing quality and certification regulations - SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2019-2025

- By Installed Units, 2019-2025

- By Average System Price, 2019-2025

- By System Complexity Tier, 2019-2025

- By System Type (In Value%)

Fused Deposition Modeling systems

Selective Laser Sintering systems

Stereolithography systems

Direct Metal Laser Sintering systems

Binder Jetting systems - By Platform Type (In Value%)

In-house automotive manufacturing platforms

Service bureau printing platforms

Prototype development platforms

Tooling and jig production platforms

End-use part production platforms - By Fitment Type (In Value%)

Interior automotive components

Exterior automotive components

Powertrain components

Chassis and structural components

Customized aftermarket components - By EndUser Segment (In Value%)

Passenger vehicle manufacturers

Commercial vehicle manufacturers

Electric vehicle manufacturers

Automotive Tier-1 suppliers

Automotive aftermarket producers - By Procurement Channel (In Value%)

Direct OEM procurement

Tier-1 supplier contracts

Additive manufacturing service providers

Technology licensing agreements

Automotive R&D collaborations

- Market Share Analysis

- Cross Comparison Parameters (Technology capability, Material portfolio, Automotive partnerships, Production scalability, R&D intensity, After-sales support, Digital workflow integration, Customization flexibility, Sustainability initiatives, Supplier network strength)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

3D Systems Corporation

Stratasys Ltd.

HP Inc.

Desktop Metal Inc.

Markforged Holding Corporation

Carbon Inc.

EOS GmbH

GE Additive

Proto Labs Inc.

Materialise NV

SLM Solutions Group AG

ExOne Company

Velo3D Inc.

Formlabs Inc.

Ricoh USA Inc.

- OEM focus on design flexibility and cost reduction

- Tier-1 suppliers leveraging additive manufacturing for tooling

- EV manufacturers using 3D printing for lightweighting

- Aftermarket players adopting customization-driven production

- Forecast Market Value ,2026-2030

- Forecast Installed Units ,2026-2030

- Price Forecast by System Tier ,2026-2030

- Future Demand by Platform ,2026-2030