Market Overview

The USA Adaptive Headlights market is valued at approximately USD ~ billion in 2024. This market growth is driven by increasing consumer demand for safety features in automobiles, particularly in premium and high-end vehicles. The demand is further supported by advancements in automotive lighting technologies such as LED, matrix LED, and laser headlights. Regulatory mandates for enhanced night-time driving safety and the growing adoption of Advanced Driver Assistance Systems (ADAS) are also key drivers fueling the expansion of the adaptive headlights market.

The United States remains the dominant region in the adaptive headlights market due to its large automotive industry, particularly in cities like Detroit, Michigan, and Silicon Valley, California. Detroit is home to major automotive manufacturers such as General Motors, Ford, and Chrysler, who lead the adoption of advanced headlight technologies. Silicon Valley’s proximity to cutting-edge technology development further accelerates the adoption of adaptive lighting systems, especially as autonomous vehicles and electric vehicles become more prominent in the market.

Market Segmentation

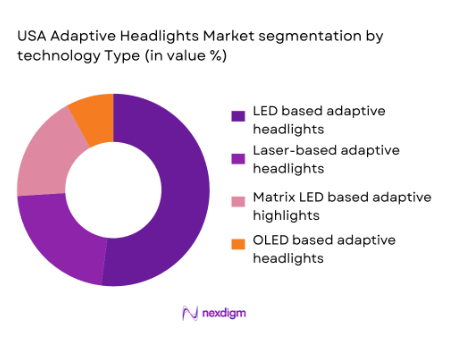

By Technology

The USA Adaptive Headlights market is segmented by technology into LED-based, Laser-based, Matrix LED, and OLED-based adaptive headlights. LED-based adaptive headlights dominate the market due to their efficiency, compact size, and longer lifespan. As more vehicles, including luxury and mid-range models, incorporate LED lighting for both aesthetic and functional purposes, the LED segment remains the leader. These headlights provide improved visibility, energy efficiency, and can be integrated into ADAS systems, thus meeting regulatory and consumer demands for enhanced safety features.

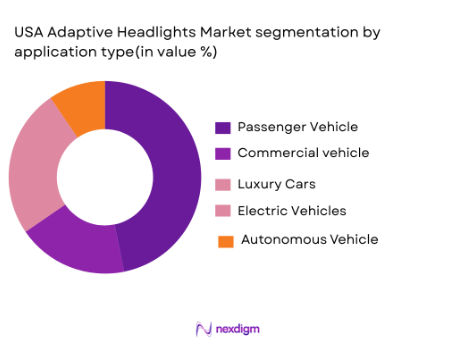

By Application

The market is segmented by application into passenger vehicles, commercial vehicles, luxury cars, electric vehicles (EVs), and autonomous vehicles. The passenger vehicles segment holds the largest share due to the growing adoption of advanced safety features in family and mid-range cars. As consumer awareness increases regarding the benefits of adaptive headlights, including improved driving safety at night and better road visibility, car manufacturers are incorporating these systems into a wider variety of passenger vehicles. Additionally, the integration of adaptive headlights with ADAS further supports the growth of this segment.

Competitive Landscape

The USA Adaptive Headlights market is dominated by a few key players, including global automotive lighting giants such as HELLA, Valeo, OSRAM, and Koito Manufacturing. These companies have a significant market share due to their strong brand presence, technological advancements, and extensive partnerships with automotive manufacturers. The development and integration of adaptive headlights are critical in meeting safety and regulatory standards for modern vehicles, and these players continue to innovate to maintain their leadership positions.

| Company Name | Establishment Year | Headquarters | Technology Offered | Key Markets | Production Capacity |

| HELLA | 1899 | Lippstadt, Germany | ~ | ~ | ~ |

| Valeo | 1923 | Paris, France | ~ | ~ | ~ |

| OSRAM | 1906 | Munich, Germany | ~ | ~ | ~ |

| Koito Manufacturing | 1915 | Tokyo, Japan | ~ | ~ | ~ |

| Magna International | 1957 | Aurora, Canada | ~ | ~ | ~ |

USA Adaptive Headlights Market Analysis

Growth Drivers

Rising Consumer Demand for Enhanced Safety Features in Vehicles

Consumer demand for enhanced safety features in vehicles has been steadily rising, with a focus on technologies that improve visibility and prevent accidents. According to the U.S. Department of Transportation, there were 38,680 motor vehicle fatalities in 2023, emphasizing the need for advanced safety systems like adaptive headlights. Consumers are increasingly opting for vehicles equipped with adaptive headlight systems, which offer improved road visibility and better night-time driving capabilities. This growing awareness and demand are key factors driving the adoption of adaptive headlights

Technological Advancements in LED and Laser-Based Headlighting Systems

Technological advancements in LED and laser-based headlighting systems are accelerating market growth. The global automotive lighting market reached a value of USD 30 billion in 2023, driven by innovations in lighting technologies such as adaptive LEDs and laser headlights. These advancements offer better energy efficiency, improved brightness, and more compact designs compared to traditional halogen lights. As consumers demand higher-quality lighting for their vehicles, these innovations continue to fuel the growth of the adaptive headlights market.

Market Challenges

High Initial Cost of Adaptive Headlight Systems

The high initial cost of adaptive headlight systems remains a significant challenge for widespread adoption. These systems require advanced technology, such as LEDs, laser lights, and sensors, which add to the overall cost of a vehicle. According to the U.S. Bureau of Labor Statistics, the cost of advanced lighting systems can increase the vehicle’s price by up to 15%. This price premium is a barrier for consumers, particularly in the mid-range vehicle segments, where affordability is a priority. The high costs associated with these systems are slowing their adoption across all vehicle categories.

Complexity in Integrating Adaptive Headlights with Existing Vehicle Platforms

Integrating adaptive headlight systems with existing vehicle platforms can be challenging. Many vehicles, especially older models, were not designed to accommodate advanced lighting technologies. The retrofitting process for adaptive headlights involves significant engineering changes, which can increase costs and time. According to the International Energy Agency (IEA), many automotive manufacturers face technical barriers in integrating new lighting systems with older vehicle designs, limiting the growth of the adaptive headlights market in non-premium vehicle segments

Opportunities

Growing Adoption of Autonomous and Self-Driving Cars

The growing adoption of autonomous and self-driving cars presents a significant opportunity for the adaptive headlights market. Autonomous vehicles rely heavily on advanced sensor and lighting systems for navigation and obstacle detection. By 2024, it is projected that the number of autonomous vehicles in the U.S. will increase by over 20%, creating a significant demand for adaptive headlights that can adjust automatically to different driving conditions. These vehicles require high-performance lighting systems to ensure safe operation, particularly in dark or poorly lit areas.

Expansion of Adaptive Lighting Systems in Mid-range Vehicles

The expansion of adaptive lighting systems into mid-range vehicles offers a major growth opportunity for the market. Traditionally, adaptive headlights were a feature of luxury vehicles, but automakers are now including them in more affordable vehicle categories. According to the U.S. Energy Information Administration (EIA), mid-range vehicles are expected to adopt advanced lighting systems as manufacturers seek to differentiate their products. This shift is driven by consumer demand for higher safety standards and better driving experiences in vehicles beyond the premium segments.

Future Outlook

Over the next five years, the USA Adaptive Headlights market is expected to grow significantly due to ongoing advancements in lighting technologies, such as laser and OLED headlights. The increasing adoption of electric and autonomous vehicles will drive further demand for adaptive headlights to improve safety features, such as visibility and night-time driving capabilities. Regulatory pressures will continue to encourage the integration of these technologies in new vehicle models, providing ample growth opportunities for manufacturers of adaptive lighting systems.

Major Players in the Market

- HELLA

- Valeo

- OSRAM

- Koito Manufacturing

- Magna International

- ZKW Group

- Denso Corporation

- Bosch

- Philips Lighting

- Hyundai Mobis

- Toyota Boshoku Corporation

- Stanley Electric

- Lumileds

- General Electric (GE)

- Aptiv

Key Target Audience

- Automotive Manufacturers

- Tier 1 Suppliers

- Electric Vehicle Manufacturers

- Autonomous Vehicle Developers

- Aftermarket Parts Distributors

- Government Regulatory Bodies (U.S. Department of Transportation, NHTSA)

- Investments and Venture Capitalist Firms

- Automotive Safety Consultants

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves identifying critical variables that influence the USA Adaptive Headlights market. These variables include technological innovations, regulatory standards, market trends, and consumer preferences. This phase is underpinned by secondary research from industry reports, regulatory guidelines, and market data from trusted sources.

Step 2: Market Analysis and Construction

In this phase, detailed analysis is conducted on the growth trajectory of the adaptive headlights market. Key data points such as market penetration, technology adoption, and the integration of adaptive lighting systems with ADAS are gathered to understand the market’s size and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the insights gathered and validated through in-depth consultations with industry experts, automotive manufacturers, and technology providers. These consultations help refine assumptions and validate findings.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research findings and insights into a comprehensive report. This involves consolidating data from primary and secondary sources, followed by detailed analysis and forecasts for the USA Adaptive Headlights market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (Adaptive Headlights, Dynamic Lighting Systems, LED, Laser, and Matrix Beam Technology, Abbreviations and Key Terms ADAS, DLS, LIDAR, Matrix LED, Market Sizing Approach Top-Down and Bottom-Up Methodologies, Consolidated Research Approach Secondary and Primary Research Insights, Understanding Market Potential Through In-Depth Industry Interviews Automotive, Manufacturers, Component Suppliers, Tier 1 Suppliers)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Consumer Demand for Enhanced Safety Features in Vehicles

Technological Advancements in LED and Laser-Based Headlighting Systems

Growing Adoption of Autonomous and Electric Vehicles

Stringent Government Regulations on Automotive Safety Standards - Market Challenges

High Initial Cost of Adaptive Headlight Systems

Complexity in Integrating Adaptive Headlights with Existing Vehicle Platforms

Limited Awareness and Acceptance in Non-Luxury Vehicle Segments - Opportunities

Growing Adoption of Autonomous and Self-Driving Cars

Expansion of Adaptive Lighting Systems in Mid-range Vehicles

Demand for Energy-Efficient, Sustainable Lighting Solutions - Trends

Integration of Adaptive Headlights with Advanced Driver Assistance Systems (ADAS)

Shift Toward Laser and OLED Headlights for Improved Performance

Development of Dynamic Lighting Systems for Enhanced Aesthetics - Government Regulation

Headlight Safety Standards (FMVSS, ECE)

Environmental Regulations Promoting Energy-Efficient Lighting - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competitive Ecosystem

- By Value (USD), 2019-2024

- By Volume (Units Deployed), 2019-2024

- By Average Price (Per Unit/Headlight), 2019-2024

- By Technology (In Value %)

LED-based Adaptive Headlights

Laser-based Adaptive Headlights

Matrix LED-based Adaptive Headlights

Halogen-based Adaptive Headlights

OLED-based Adaptive Headlights - By Application (In Value %)

Passenger Vehicles

Commercial Vehicles

Luxury Cars

Electric Vehicles

Autonomous Vehicles - By Vehicle Type (In Value %)

OEM (Original Equipment Manufacturers)

Aftermarket Installations - By Region (In Value %)

Northeast

Midwest

South

West - By Distribution Channel (In Value %)

OEM Direct

Aftermarket Retailers

Online Sales Channels

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Technological Advancements, Recent Developments, Organizational Structure, Distribution Channels, Revenue Streams, Market Reach)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Technology

- Detailed Profiles of Major Companies

HELLA

Bosch

Valeo

Denso

OSRAM

ZKW Group

Stanley Electric

Hyundai Mobis

Lumileds

Koito Manufacturing

Magneti Marelli

General Electric (GE)

Toyota Boshoku Corporation

Philips Lighting

Aptiv

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocations for Adaptive Lighting Systems

- Regulatory and Compliance Requirements for Automotive Lighting

- Needs, Desires, and Pain Point Analysis for Consumers

- Decision-Making Process for OEMs and Aftermarket Consumers

- By Value (USD), 2025-2030

- By Volume (Units Deployed), 2025-2030

- By Average Price (Per Unit/Headlight), 2025-2030