Market Overview

As of 2024, the USA aerospace parts manufacturing market is valued at USD 431.4 billion, with a growing CAGR of 1.7% from 2024 to 2030, supported by increasing air traffic and technological advancements that drive efficiency in production processes. The growth of the aerospace industry is primarily influenced by rising demand for commercial and military aircraft, necessitating innovations and expansions from manufacturers across the sector.

The market is largely dominated by key metropolitan areas like Seattle, Washington, and Dallas, Texas, known for their established aerospace ecosystems. Seattle is home to major players like Boeing, while Dallas serves as a central hub for numerous defence and aerospace firms, both contributing to innovation and supply chain synergies that enhance their competitive edge.

Market Segmentation

By Product Type

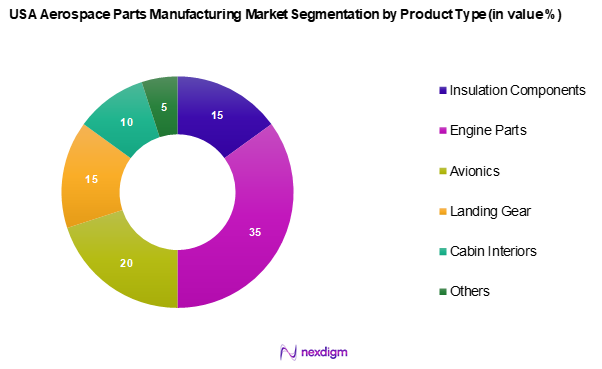

The USA aerospace parts manufacturing market is segmented into insulation components, engine parts, avionics, landing gear, cabin interiors, and others. Engine parts dominate this segment due to their essential role in aircraft performance and safety. The increasing demand for fuel-efficient engines and advancements in engine technology have driven investments towards high-performance engine components, making them critical for manufacturers and airlines focused on operational efficiency.

By Application

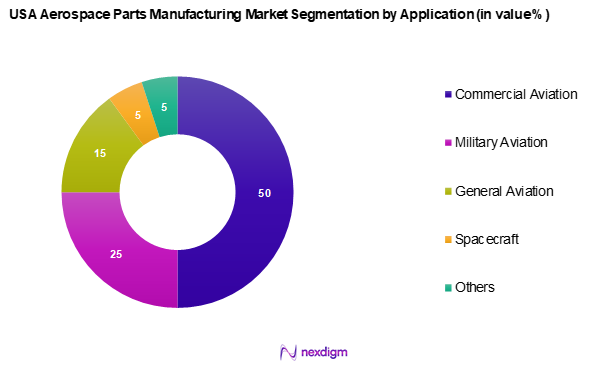

The USA aerospace parts manufacturing market is segmented into commercial aviation, military aviation, general aviation, spacecraft, and others. Commercial aviation is positioned as the leading application segment, fuelled by the consistent rise in global air travel and the demand for new aircraft. The post-pandemic recovery has resulted in airlines renewing or expanding their fleets, creating a substantial need for various aerospace parts, particularly in commercial airliners.

Competitive Landscape

The USA aerospace parts manufacturing market is highly competitive, with a few major players holding a significant influence. The market is characterized by established companies such as Boeing, General Electric, and Raytheon Technologies, which are known for their strong research capabilities and extensive product offerings. These key players not only set market trends but also drive innovation in manufacturing technologies.

| Major Players | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market Share | Product Range |

| Boeing | 1916 | IL, US | – | – | – |

| General Electric Aviation | 1919 | Ohio, US | – | – | – |

| Raytheon Technologies | 1922 | Virginia, US | – | – | – |

| Honeywell International | 1906 | North Carolina,

US |

– | – | – |

| Pratt & Whitney | 1925 | Connecticut, US | – | – | – |

USA Aerospace Parts Manufacturing Market Analysis

Growth Drivers

Increasing Air Travel Demand

A significant growth driver for the USA aerospace parts manufacturing market is the rising demand for air travel, which is expected to exceed pre-pandemic levels. The recovery in global tourism is contributing to this resurgence, creating a pressing need for more aircraft and corresponding parts. As passengers return to the skies, manufacturers in the aerospace sector are likely to experience heightened demand for their products, leading to increased opportunities for growth and innovation across the industry.

Technological Advancements

Technological advancements are crucial in propelling the USA aerospace parts manufacturing market forward. The ongoing investment in state-of-the-art aerospace technologies, including advanced materials and automation, significantly enhances production efficiency. The adoption of next-generation technologies such as artificial intelligence and machine learning is driving improvements in quality and safety in aerospace components. These innovations streamline manufacturing processes and have the potential to boost output, thereby positively impacting overall sales and industry performance.

Market Challenges

Supply Chain Disruptions

Supply chain disruptions continue to present significant challenges for the USA aerospace parts manufacturing market. Ongoing global logistical issues have led to frequent delays and rising costs within the industry. These disruptions have prompted manufacturers to rely more heavily on domestic suppliers to ensure greater stability and resilience in their supply chains. As a result, the necessity for more robust and diversified supply chains has become paramount to mitigate these risks and ensure steady production timelines.

High Manufacturing Costs

High manufacturing costs serve as a critical barrier within the USA aerospace parts manufacturing market. Increased labour costs and rising prices of essential raw materials, such as titanium and aluminum, are straining financial resources. These economic pressures compel manufacturers to seek more cost-effective methods of production, which could limit their investment capacity in research and innovation. Addressing these high costs is vital for ensuring competitiveness and sustainability in the aerospace manufacturing landscape.

Opportunities

Growth in UAV Applications

The expanding applications of Unmanned Aerial Vehicles (UAVs) present a compelling opportunity for the USA aerospace parts manufacturing market. As demand for UAVs in various sectors, including cargo delivery, surveillance, and agriculture grows, there is an increasing need for specialized components designed specifically for these vehicles. This trend allows aerospace manufacturers to diversify their product offerings and explore new revenue channels, capitalizing on a burgeoning segment of the market.

Expansion in Aerospace R&D

The ongoing expansion in aerospace research and development (R&D) is shaping the future of the USA aerospace parts manufacturing market. Strategic investments in R&D emphasize innovation in critical areas such as advanced propulsion and next-generation air mobility. This collaborative environment, involving government entities, universities, and private firms, fosters the development of cutting-edge aerospace technologies. Such an ecosystem creates a demand for new parts and materials, driving growth for manufacturers who can meet these emerging needs.

Future Outlook

Over the next several years, the USA aerospace parts manufacturing market is expected to experience robust growth, driven by the resurgence of air travel post-pandemic, advancements in aerospace technologies, and increased investment in research and development. Furthermore, as manufacturers focus on sustainable practices and efficiency, the demand for innovative aerospace parts is likely to rise, providing significant opportunities for growth across various segments.

Major Players

- General Electric Aviation

- Honeywell International Inc.

- Raytheon Technologies Corporation

- Boeing Company

- Pratt & Whitney (Raytheon Technologies)

- Northrop Grumman Corporation

- Safran S.A.

- BAE Systems

- Rolls-Royce Holdings PLC

- Spirit AeroSystems Holdings, Inc.

- Textron Aviation Inc.

- Collins Aerospace

- Goodrich Corporation

- Magellan Aerospace Corporation

- Moog Inc.

- Airbus

- United Technologies Corporation

- L3 Technologies

- NTN BEARING CORPORATION OF AMERICA

- Amphenol Aerospace

- Berkshire Hathaway Inc.,

- Arconic

- B.C. Bearings Incorporated

- Stanley Black & Decker, Inc.

- Lockheed Martin Corporation

- Triumph Group

- TriMas

Key Target Audience

- Manufacturers and suppliers

- Aerospace and defense companies

- Airlines and commercial operators

- Government and regulatory bodies (e.g., Federal Aviation Administration, Department of Defense)

- Investments and venture capitalist firms

- Aerospace R&D institutions

- OEMs (Original Equipment Manufacturers)

- Maintenance, Repair, and Overhaul (MRO) providers

- Component distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map to identify all major stakeholders within the USA aerospace parts manufacturing market. This step utilizes extensive desk research, employing a range of secondary and proprietary databases to compile thorough industry-level information. The goal is to define the key variables that impact market dynamics and understand the competitive landscape.

Step 2: Market Analysis and Construction

During this phase, historical market data relevant to the USA aerospace parts manufacturing market is compiled and analysed. This includes evaluating parameters such as market penetration, the ratio of manufacturers to service providers, and overall revenue generation. Additionally, an assessment of key statistics regarding service quality is performed to validate the revenue estimates and ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses will be validated through interviews with industry experts, representing a diverse array of companies engaged in aerospace parts manufacturing. These consultations will provide valuable operational and financial insights directly from practitioners in the field, which will refine and corroborate the data gathered.

Step 4: Research Synthesis and Final Output

The final phase consists of actively engaging with multiple aerospace parts manufacturers to gain detailed insights into product segments, sales performance, consumer preferences, and other important factors. These interactions are critical for verifying and complementing the statistics derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the USA aerospace parts manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Air Travel Demand

Technological Advancements - Market Challenges

Supply Chain Disruptions

High Manufacturing Costs - Opportunities

Growth in UAV Applications

Expansion in Aerospace R&D - Trends

Adoption of IoT in Manufacturing

Sustainable Manufacturing Practices - Government Regulation

Safety and Quality Standards

Trade Policies - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Insulation Components

Engine Parts

Avionics

Landing Gear

Cabin Interiors

Others - By Application (In Value %)

Commercial Aviation

Military Aviation

General Aviation

Spacecraft

Others - By Manufacturing Process (In Value %)

Additive Manufacturing

Subtractive Manufacturing

Forming and Shaping

Others - By Distribution Channel (In Value %)

Direct Sales

Distributors - By Region (In Value %)

Northeast

Midwest

South

West

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Segment, Number of Touchpoints, Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

General Electric Aviation

Honeywell International Inc.

Raytheon Technologies Corporation

Boeing Company

Pratt & Whitney (Raytheon Technologies)

Northrop Grumman Corporation

Safran S.A.

BAE Systems

Rolls-Royce Holdings PLC

Spirit AeroSystems Holdings, Inc.

Textron Aviation Inc.

Collins Aerospace

Goodrich Corporation

Magellan Aerospace Corporation

Moog Inc.

Airbus

United Technologies Corporation

L3 Technologies

NTN BEARING CORPORATION OF AMERICA

Amphenol Aerospace

Berkshire Hathaway Inc.,

Arconic

R.B.C. Bearings Incorporated

Stanley Black & Decker, Inc.

Lockheed Martin Corporation

Triumph Group

TriMas

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030