Market Overview

USA AI Algorithms in Healthcare Market is valued at USD ~ billion, reflecting the rapid institutionalization of algorithmic intelligence as a core layer within the US healthcare delivery and diagnostics ecosystem. Structural demand is driven by the convergence of clinical data explosion, chronic disease burden, and sustained productivity pressure across provider organizations. Hospitals and health systems are increasingly reliant on AI algorithms to interpret imaging volumes, stratify patient risk, automate documentation, and support evidence-based clinical decision-making. Unlike earlier pilot-driven adoption, current demand is enterprise-led and budgeted within long-term digital transformation programs. Algorithm utilization is further reinforced by value-based care models, which require continuous outcome monitoring, predictive intervention, and operational optimization across care pathways. As a result, AI algorithms are no longer treated as experimental technologies but as mission-critical infrastructure embedded within clinical, operational, and financial workflows across the US healthcare system.

Within the United States, demand concentration is highest in healthcare-dense metropolitan regions such as California, the Northeast corridor, Texas, and major Midwest hubs, driven by the presence of large integrated delivery networks, academic medical centers, and advanced diagnostic infrastructure. These regions dominate adoption because they combine high patient volumes, complex case mixes, and capital capacity for enterprise-scale AI deployment. On the supply side, the market is shaped by strong global technology vendors with deep cloud, semiconductor, and data platform capabilities, alongside specialized domestic healthcare AI firms focused on imaging, clinical decision support, and workflow automation. Global vendors influence scalability, interoperability standards, and deployment architectures, while domestic specialists drive clinical specificity, regulatory alignment, and care-pathway optimization. This dual influence structure accelerates commercialization while reinforcing high entry barriers for smaller or less integrated solution providers.

Market Segmentation

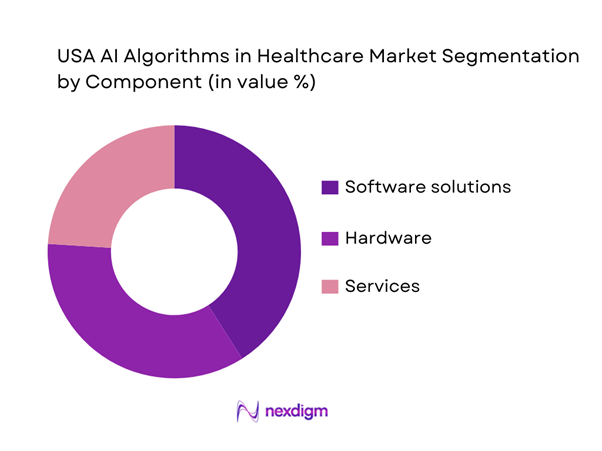

By Component

The market is segmented into software solutions, hardware, and services. Software solutions dominate because hospitals and payers prioritize deployable algorithms that integrate into EHR/PACS workflows, reduce turnaround time, and automate repetitive clinical or administrative steps without requiring extensive new physical infrastructure. Buyers increasingly prefer “workflow-native” software (embedded into existing systems), supported by implementation and monitoring services to manage drift, cybersecurity, and continuous updates—turning software into the core value carrier and the anchor for recurring revenue models.

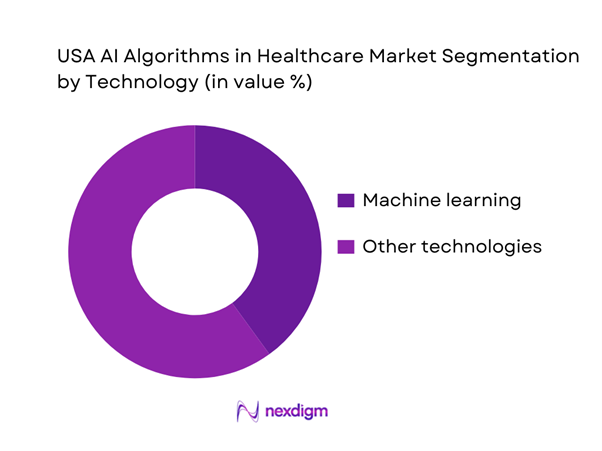

By Technology

The market is segmented into machine learning, natural language processing, context-aware computing, and computer vision. Machine learning dominates because it underpins predictive risk scoring, clinical decision support, and pattern recognition across large structured datasets (EHR, labs, claims), and it generalizes well to operational optimization use-cases (capacity management, no-show prediction, denial prevention). In parallel, ML is frequently combined with imaging-centric pipelines and time-series analytics, making it the default “backbone” technology for multi-department AI portfolios rather than a single-specialty tool.

Competitive Landscape

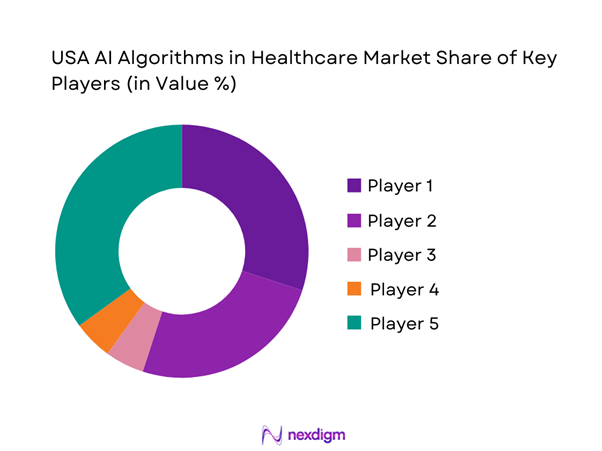

The USA AI Algorithms in Healthcare market is dominated by a few major players, including IBM and global or regional brands like Google Health, Microsoft, and GE HealthCare. This consolidation highlights the significant influence of these key companies.

| Company | Est. year | Headquarters | Primary focus in healthcare AI | Core algorithm modality | Integration footprint | Regulatory posture | Deployment model | Typical buyer | Differentiation |

| Microsoft (Nuance) | 1975 | Redmond, WA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| 1998 | Mountain View, CA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | |

| AWS | 2006 | Seattle, WA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| NVIDIA | 1993 | Santa Clara, CA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | Chicago, IL | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

USA AI Algorithms in Healthcare Market Analysis

Growth Drivers

Rising Diagnostic Complexity and Data Volumes

The accelerating complexity of diagnostic workflows in the US healthcare system is a primary driver of AI algorithm adoption. Providers manage expanding imaging studies, genomic datasets, longitudinal patient histories, and real-time monitoring feeds, creating cognitive and operational overload for clinicians. AI algorithms enable automated pattern recognition, anomaly detection, and prioritization across these data streams, directly improving diagnostic throughput and consistency. As patient acuity rises and multimorbidity becomes more common, clinicians increasingly depend on algorithmic assistance to maintain care quality without extending interpretation times. This cause-and-effect dynamic results in sustained demand for AI models that augment clinical judgment rather than replace it, positioning algorithms as essential productivity enablers across radiology, pathology, cardiology, and population health management workflows.

Clinical Workforce Shortages and Productivity Pressure

Persistent shortages of physicians, nurses, and allied health professionals across the United States have intensified operational stress throughout healthcare organizations. AI algorithms mitigate this pressure by automating documentation, triage, risk scoring, and workflow orchestration tasks that traditionally consume clinician time. The cause lies in structural labor constraints and rising patient demand, while the impact manifests as increased administrative burden and delayed care delivery. Algorithmic augmentation directly improves clinician productivity, enabling providers to manage larger patient volumes without proportional staffing increases. The outcome is a clear economic and operational rationale for algorithm adoption, as healthcare systems use AI to stabilize service capacity, reduce burnout risk, and maintain access levels under constrained workforce conditions.

Challenges

Algorithm Validation and Clinical Trust Barriers

A central challenge in the US AI algorithms in healthcare market is the gap between technical performance and clinical trust. While many algorithms demonstrate high accuracy in controlled environments, providers demand rigorous validation across diverse patient populations and real-world workflows. The cause of resistance stems from concerns around bias, generalizability, and clinical liability. The impact is extended sales cycles and cautious deployment, particularly for high-stakes decision-support use cases. The outcome is a market where vendors must invest heavily in clinical evidence generation, post-deployment monitoring, and explainability frameworks to secure institutional acceptance, slowing time-to-scale despite strong underlying demand.

Data Interoperability and Integration Complexity

Healthcare data fragmentation remains a significant barrier to seamless algorithm deployment. AI performance is highly dependent on data quality, completeness, and interoperability across electronic health records, imaging systems, and ancillary platforms. The root cause lies in heterogeneous IT environments and legacy system architectures. This leads to high integration costs, prolonged implementation timelines, and inconsistent algorithm performance across sites. The resulting outcome is uneven adoption, where only organizations with mature digital infrastructure can fully realize algorithm value, limiting near-term scalability and increasing buyer scrutiny during procurement evaluations.

Opportunities

Enterprise-Wide AI Platform Standardization

Healthcare organizations increasingly seek standardized AI platforms rather than isolated point solutions. This shift creates opportunity for vendors offering modular, interoperable algorithm portfolios that span multiple clinical and operational use cases. The cause is growing CIO-level oversight of digital investments, while the impact is consolidation of AI spend into fewer strategic vendor relationships. The outcome is long-term contracts, deeper workflow integration, and higher switching costs, enabling platform providers to capture sustained enterprise value beyond single-use deployments.

Expansion of Preventive and Population Health Algorithms

AI algorithms applied to preventive care and population health represent a major expansion frontier. Predictive models that identify early risk, care gaps, and intervention opportunities enable providers and payers to shift from reactive to proactive care delivery. The cause is rising chronic disease prevalence and cost containment pressure. The impact is increased demand for longitudinal analytics beyond episodic care. The outcome is a broader algorithm addressable market spanning preventive screening, care coordination, and payer-provider alignment initiatives.

Future Outlook

The USA AI algorithms in healthcare market is expected to evolve toward deeper enterprise integration, with algorithms embedded across the full care continuum rather than deployed as standalone tools. Strategic emphasis will shift toward explainability, lifecycle governance, and system-wide value realization, positioning AI as an essential component of healthcare delivery infrastructure.

Major Players

- IBM

- Google Health

- Microsoft

- GE HealthCare

- Siemens Healthineers

- Philips Healthcare

- Oracle Health

- Epic Systems

- Cerner

- Tempus

- PathAI

- Viz.ai

- Aidoc

Key Target Audience

- Hospitals and integrated delivery networks

- Diagnostic imaging and laboratory providers

- Health insurance and managed care organizations

- Pharmaceutical and life sciences companies

- Digital health platform providers

- Cloud and healthcare IT vendors

- Academic medical centers and research institutions

- Investments and venture capitalist firms

- Government and regulatory bodies (USA)

Research Methodology

Step 1: Identification of Key Variables

Key clinical use cases, algorithm types, buyer segments, deployment models, and regulatory considerations were identified to define the analytical scope.

Step 2: Market Analysis and Construction

Market structure was constructed by mapping algorithm functions to care settings and revenue attribution logic across provider and enterprise buyers.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured consultations with healthcare IT executives, clinicians, and AI solution architects to ensure realism and relevance.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent market narrative emphasizing strategic relevance, competitive positioning, and adoption dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Healthcare AI Algorithm Usage and Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- USA Healthcare Delivery and Digital Infrastructure Architecture

- Growth Drivers

Rising diagnostic complexity and data volumes

Clinical workforce shortages and productivity pressure

Shift toward value-based care and outcomes accountability

Expansion of digital health infrastructure and EHR penetration

Acceleration of precision medicine and genomics programs - Challenges

Algorithm validation and clinical trust barriers

Data interoperability and quality constraints

Regulatory uncertainty for adaptive algorithms

Cybersecurity and patient data protection risks

Integration complexity within legacy IT systems - Opportunities

Enterprise-wide AI platform standardization

Expansion of AI-driven preventive and population health programs

Lifecycle AI deployment across drug development and care delivery

Hospital-at-home and virtual care algorithm adoption

Commercialization of explainable and auditable AI models - Trends

Federated learning adoption

Explainable AI model design

Multimodal data fusion algorithms

Edge AI for point-of-care applications

Algorithm-as-a-service commercial models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Deployment Spend Mix, 2019–2024

- By Buyer Type, 2019–2024

- By Algorithm Function (in Value %)

Diagnostic imaging algorithms

Predictive analytics and risk stratification

Clinical decision support algorithms

Natural language processing algorithms

Workflow optimization and automation algorithms

Personalized treatment and precision medicine algorithms - By Clinical Application Area (in Value %)

Radiology and medical imaging

Pathology and laboratory medicine

Cardiology and chronic disease management

Oncology and genomics-driven care

Emergency and critical care

Population health management - By Technology / Platform Type (in Value %)

Machine learning models

Deep learning and neural networks

Computer vision algorithms

Natural language processing engines

Reinforcement learning systems - By Deployment / Delivery Model (in Value %)

On-premise hospital systems

Private cloud deployments

Public cloud platforms

Hybrid enterprise deployments - By End-Use Customer Type (in Value %)

Hospitals and health systems

Diagnostic imaging centers

Clinical laboratories

Health insurers and payers

Pharmaceutical and life sciences companies

Digital health and telehealth providers - By Region (in Value %)

Northeast

Midwest

South

West

- Competition ecosystem overview

- Cross Comparison Parameters (model accuracy validation depth, clinical evidence maturity, regulatory clearance status, EHR interoperability breadth, algorithm retraining frequency, data privacy architecture, deployment scalability, enterprise integration complexity, pricing transparency)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

IBM

Google Health

Microsoft

GE HealthCare

Siemens Healthineers

Philips Healthcare

Oracle Health

Epic Systems

Cerner

Tempus

PathAI

Viz.ai

Aidoc

Butterfly Network

NVIDIA

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Deployment Spend Mix, 2025–2030

- By Buyer Type, 2025–2030