Market Overview

The USA AI in Clinical Decision Support market is valued at USD ~ billion. The market size reflects enterprise deployments across acute care hospitals, integrated delivery networks, and specialty clinical settings. Growth is driven by increasing diagnostic error mitigation requirements, physician workload intensity exceeding ~ annual patient visits, and rising healthcare IT expenditures exceeding USD ~ trillion. Expansion is further supported by widespread EHR penetration exceeding ~ of hospitals and increasing adoption of AI-enabled clinical risk stratification tools validated through real-world evidence studies.

The market is dominated by California, Massachusetts, New York, Texas, and Illinois, driven by dense concentrations of academic medical centers, digital health innovation clusters, and payer-provider integrated systems. Cities such as Boston, San Francisco, New York City, Houston, and Chicago lead adoption due to proximity to AI research institutions, large hospital networks, and strong venture capital ecosystems. These regions also benefit from early FDA-cleared AI deployments, strong interoperability infrastructure, and large-scale value-based care programs, enabling faster commercialization of AI-driven decision support across diagnostics, therapeutics, and population health management.

Market Segmentation

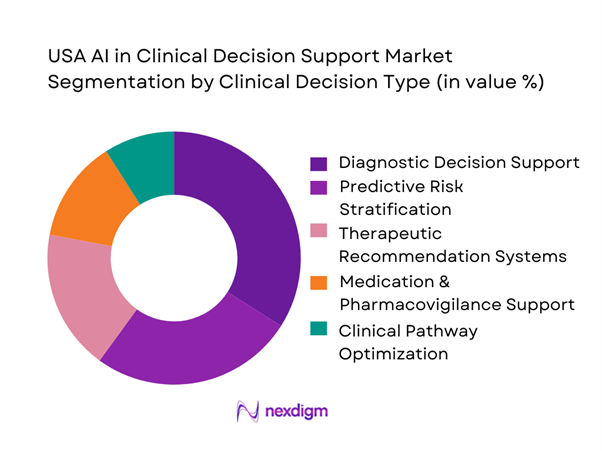

By Clinical Decision Type

The USA AI in Clinical Decision Support market is segmented by clinical decision type into diagnostic decision support, predictive risk stratification, therapeutic recommendation systems, medication safety platforms, and clinical pathway optimization solutions. Diagnostic decision support dominates this segmentation, driven by rising diagnostic error costs exceeding USD ~ annually and increasing reliance on AI-assisted imaging, pathology, and differential diagnosis tools. The dominance is reinforced by FDA-cleared AI solutions in radiology, cardiology, neurology, and oncology, where real-time decision augmentation directly impacts patient outcomes, malpractice exposure, and hospital reimbursement efficiency.

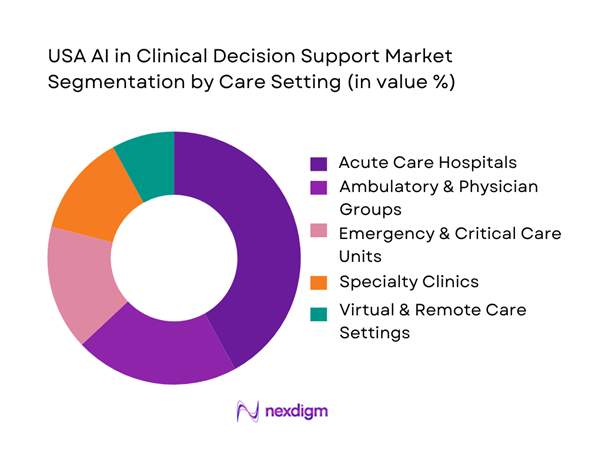

By Care Setting

The market is segmented into acute care hospitals, ambulatory and physician groups, emergency and critical care units, specialty clinics, and virtual care environments. Acute care hospitals dominate market share, driven by high patient acuity, complex diagnostic workflows, and substantial exposure to clinical risk. Large hospitals process millions of diagnostic decisions annually and face increasing pressure to reduce length of stay, prevent adverse events, and comply with value-based reimbursement models. AI-enabled CDS platforms embedded within hospital EHRs deliver measurable improvements in clinical outcomes, making hospitals the primary revenue-generating segment.

Competitive Landscape

The USA AI in Clinical Decision Support market is moderately consolidated, with a mix of large EHR vendors, global technology firms, and specialized AI health companies shaping competition. Market leadership is influenced by FDA clearance depth, EHR integration strength, and clinical validation evidence, rather than sheer product count. Enterprise trust, regulatory readiness, and scalability across care settings are key differentiators among leading vendors.

| Company | Established | Headquarters | Core Clinical Focus | FDA Clearance Status | EHR Integration | Deployment Model | Primary Buyers |

| Epic Systems | 1979 | Wisconsin | ~ | ~ | ~ | ~ | ~ |

| Oracle Health | 1977 | Texas | ~ | ~ | ~ | ~ | ~ |

| Microsoft Nuance | 2000 | Washington | ~ | ~ | ~ | ~ | ~ |

| Google Health | 2018 | California | ~ | ~ | ~ | ~ | ~ |

| IBM Watson Health | 2015 | New York | ~ | ~ | ~ | ~ | ~ |

USA AI in Clinical Decision Support Market Analysis (Market Dynamics)

Growth Drivers

Clinical Workload Intensity

U.S. care delivery volume keeps CDS workloads high because triage, diagnostic ordering, and inpatient decisioning are being executed at scale across EDs and hospitals. National ED utilization alone totals ~ visits, including ~ injury-related visits and ~ visits resulting in hospital admission—a throughput level that increases demand for AI-assisted risk stratification, imaging prioritization, and clinical rule orchestration inside EHR workflows. In inpatient settings, Nationwide Readmissions Database estimates ~ discharges (weighted) from ~ sampled discharges, reflecting the operational density where CDS is embedded in order sets, sepsis pathways, and medication safety. From a macro base, nominal GDP rising from USD ~ billion to USD ~ billion sustains payer and provider investment capacity in analytics modernization, clinical automation, and compute procurement supporting AI-enabled CDS rollouts.

Physician Burnout Levels

Operational strain increases willingness to adopt AI that reduces documentation burden, standardizes decisions, and streamlines care coordination—especially where staffing gaps persist. Job openings in health care and social assistance reached ~, indicating persistent staffing pressure that makes automation and decision support economically and operationally attractive. A survey of ~ U.S. physicians found that ~ reported little to no time or ability to address social determinants of health and ~ wanted greater time and ability—signals of workload mismatch and moral distress that push systems to deploy CDS that improves efficiency and closes care gaps through structured prompts and risk flags. In macro terms, GDP increasing to USD ~ billion supports continued digitization spend even as labor tightness persists, creating a labor-scarcity and investment-capacity environment where AI-enabled CDS adoption accelerates.

Challenges

Algorithm Bias Risk

Bias risk is elevated in CDS because models can amplify inequities when trained on non-representative data or when deployed across heterogeneous sites without monitoring. Structural strain linked to inequities is highlighted by a survey of ~ physicians where ~ reported limited time or ability to address social determinants—conditions that increase reliance on automated scoring and triage, but also increase the chance that models encode access barriers rather than clinical need. Bias risk grows with scale: ~ inpatient discharges represent the magnitude of decision points where biased risk scores can propagate into admission, imaging, and discharge decisions. GDP at USD ~ billion suggests continued investment, but also raises governance expectations, with buyers increasingly demanding bias testing, drift monitoring, and subgroup performance reporting as standard procurement requirements.

Clinical Validation and Evidence Generation Burden

Validation is a core bottleneck because clinical buyers require evidence across populations, sites, and workflows, while regulators and risk teams require documented safety and effectiveness. AI and machine-learning-enabled medical devices authorized number ~, reflecting rapid productization and the expanding need for rigorous post-market performance monitoring and clinical evidence refresh cycles as models encounter new populations and protocol changes. The validation burden is amplified by high utilization contexts: ~ ED visits and ~ admissions from ED create performance pressure where even small workflow friction can cause clinician rejection or safety incidents. Macro conditions with GDP at USD ~ billion sustain R&D and evaluation budgets, but also intensify procurement scrutiny, with buyers increasingly requiring study packages, dataset lineage, model cards, and statistically defensible subgroup analysis before scaling CDS across an enterprise.

Opportunities

Precision Medicine Enablement

Precision medicine expands CDS scope from rules and alerts into therapy selection, genomic interpretation, and longitudinal risk forecasting, provided systems can operationalize complex data at point of care. The total number of authorized AI and machine-learning-enabled devices reaching ~ signals a broadening clinical AI footprint that increasingly intersects with imaging, pathology, and risk stratification components used in precision pathways. High-volume acute entry points—~ ED visits—create opportunity for AI-enabled precision triage that routes patients into the right pathway faster and standardizes downstream care. The macro backdrop with GDP at USD ~ billion supports expansion of data infrastructure required for precision CDS while buyers increasingly demand precision-ready CDS that integrates into enterprise governance and clinical workflow tools without increasing clinician load.

AI-Driven Clinical Pathway Standardization

Standardized pathways are a major near-term opportunity because U.S. providers must deliver consistent quality across large, multi-site networks while managing staffing shortages and utilization pressure. Shared savings programs encompassing ~ organizations and ~ assigned beneficiaries create a large buyer base for pathway-oriented CDS that closes care gaps, standardizes referrals, and improves guideline adherence across populations under shared-savings incentives. Pathway standardization is also driven by sheer operational load: ~ inpatient discharges provide a large denominator where order-set standardization and AI-guided escalation rules can reduce practice variation and improve reliability. With GDP at USD ~ billion, the market has the investment capacity to scale governance-heavy tooling, enabling AI-driven pathway standardization that is deployable, measurable, and acceptable to clinical leadership and compliance stakeholders.

Future Outlook

Over the next five years, the USA AI in Clinical Decision Support market is expected to experience strong expansion, driven by accelerating AI regulatory clarity, deeper EHR-embedded intelligence, and increasing hospital focus on clinical productivity. The transition from rule-based alerts to explainable, predictive, and generative AI models will redefine decision workflows across diagnostics, therapeutics, and population health. Growing adoption of value-based care contracts and real-world evidence learning loops will further position AI-CDS as a core clinical infrastructure component rather than an optional IT add-on.

Major Players

- Epic Systems

- Oracle Health

- IBM Watson Health

- Google Health

- Microsoft Nuance

- Pieces Technologies

- Aidoc

- Viz.ai

- Tempus

- Qventus

- Bayesian Health

- Clew Medical

- LeanTaaS

- DeepMind Health

Key Target Audience

- Hospital Systems and Integrated Delivery Networks

- Academic Medical Centers and Teaching Hospitals

- Health Insurance and Managed Care Organizations

- Pharmaceutical and Life Sciences Companies

- Investments and Venture Capitalist Firms

- Digital Health Platform Operators

- Government and Regulatory Bodies

- Cloud Infrastructure and Healthcare IT Providers

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map was developed covering EHR vendors, AI developers, hospitals, payers, and regulators. Secondary research was conducted using regulatory databases, healthcare IT spending reports, and proprietary clinical AI datasets to identify key demand and supply variables.

Step 2: Market Analysis and Construction

Historical adoption data was analyzed to assess AI-CDS penetration, hospital deployment ratios, and revenue generation patterns. Market construction relied on bottom-up aggregation of enterprise contracts and top-down healthcare IT budget allocation analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through structured interviews with clinicians, CMIOs, hospital CIOs, and AI solution vendors. Insights on deployment barriers, pricing models, and regulatory friction were incorporated to refine estimates.

Step 4: Research Synthesis and Final Output

Final market numbers were triangulated using vendor disclosures, healthcare provider interviews, and regulatory filings to ensure accuracy, consistency, and real-world relevance.

- Executive Summary

- Research Methodology (Market Definitions and Clinical Boundaries, AI Taxonomy and Model Classification, Clinical Decision Support Inclusion–Exclusion Criteria, Clinical Use-Case Mapping Framework, Market Sizing Logic, Bottom-Up Revenue Attribution, Top-Down Budget Mapping, Primary Expert Validation Across Clinicians and Healthcare CIOs, Vendor Revenue Normalization, Limitations and Assumptions)

- Definition and Scope

- Market Genesis and Evolution

- Transition from Rule-Based Clinical Decision Support to AI-Driven Clinical Intelligence

- Position of AI-Enabled CDS within the US Healthcare IT Stack

- Interaction with Electronic Health Records, Health Information Exchanges, Imaging Systems, and Genomics Infrastructure

- Growth Drivers

Clinical Workload Intensity

Physician Burnout Levels

Diagnostic Error Reduction Pressure

Value-Based Care Adoption

AI Compute and Cloud Availability - Challenges

Algorithm Bias Risk

Clinical Validation and Evidence Generation Burden

FDA Clearance and Regulatory Complexity

Physician Trust and Explainability Barriers

Interoperability Limitations - Opportunities

Precision Medicine Enablement

AI-Driven Clinical Pathway Standardization

Hospital Margin Optimization

Population Health Risk Prediction - Trends

Foundation Models in Healthcare

Explainable and Auditable AI

Real-World Evidence Learning Loops

Multimodal Clinical Artificial Intelligence - Regulatory and Compliance Landscape

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Fleet Type (in Value %)

Diagnostic Decision Support

Therapeutic Recommendation Systems

Predictive Risk Stratification

Clinical Pathway Optimization

Medication and Pharmacovigilance Support - By Application (in Value %)

Acute Care Hospitals

Ambulatory Care and Physician Groups

Emergency and Critical Care Units

Specialty Clinics

Virtual and Remote Care Environments - By Technology Architecture (in Value %)

Machine Learning–Based Models

Deep Learning–Based Models

Natural Language Processing Engines

Hybrid Rules and AI Systems

Generative AI–Enabled Clinical Decision Support - By Connectivity Type (in Value %)

Structured Electronic Health Record Data

Medical Imaging Data

Clinical Notes and Unstructured Text

Genomic and Molecular Data

Wearables and Remote Monitoring Data - By End-Use Industry (in Value %)

Physicians

Nurses and Allied Health Professionals

Clinical Administrators

Payers and Care Management Teams

Pharmaceutical and Life Sciences Organizations - By Region (in Value %)

On-Premise Deployment

Cloud-Based Deployment

Hybrid Deployment

EHR-Embedded Solutions

Standalone Clinical Decision Support Platforms

- Market Share Analysis

- Cross Comparison Parameters (clinical use-case breadth, AI model explainability and transparency, FDA clearance and regulatory status, EHR integration depth, deployment flexibility, clinical validation evidence base, revenue model and contract structure, scalability across care settings)

- Competitive Positioning Matrix

- SWOT Analysis of Key Players

- Pricing and Monetization Models

- Detailed Profiles of Major Companies

Epic Systems

Oracle Health

IBM Watson Health

Google Health

Microsoft Nuance

Epic Cognitive Computing

Pieces Technologies

Clew Medical

Aidoc

Tempus

Qventus

Viz.ai

DeepMind Health

Bayesian Health

LeanTaaS

- Diagnostic Accuracy Expectations

- Workflow Friction Points

- Budget Allocation Behavior

- AI Trust Thresholds

- Adoption Decision Framework

- By Value, 2025–2030