Market Overview

The USA amphibious aircraft market is witnessing strong growth, driven by increasing demand for specialized aircraft designed to operate in water-based environments. Based on a recent historical assessment, the market size in 2025 is valued at approximately USD ~, reflecting an uptick in demand for both commercial and military applications. The growth is supported by advancements in aircraft technology, increased use of amphibious aircraft for search and rescue missions, and rising interest in tourism sectors, particularly in coastal and island regions. This demand is further fueled by the expansion of infrastructure that accommodates amphibious aircraft, making them a viable choice for remote areas and regions with limited access to traditional transportation options.

The dominant countries driving the USA amphibious aircraft market are the United States and Canada. The United States, with its advanced aviation sector and growing interest in amphibious aircraft for both commercial and military uses, remains at the forefront. The country’s robust defense budget also supports the development of amphibious aircraft for military purposes, including reconnaissance and logistics. Canada, with its vast coastline and numerous lakes, also plays a significant role, using these aircraft for both tourism and rescue operations. The success of this market is largely attributed to the availability of expansive water bodies and government support for aviation infrastructure, which enhances the usability and operational range of amphibious aircraft.

Market Segmentation

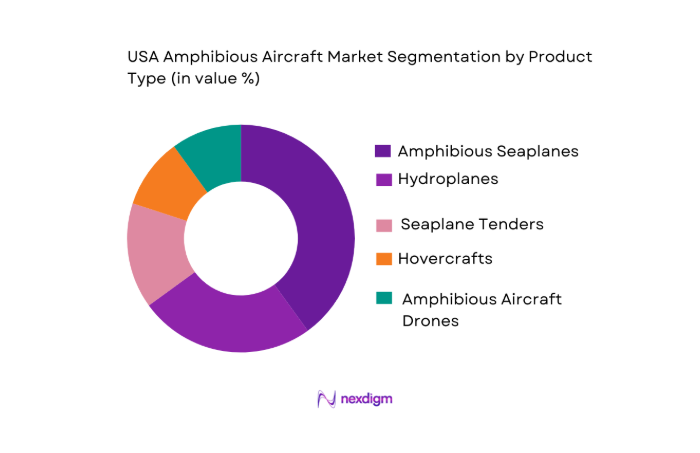

By Product Type:

USA amphibious aircraft market is segmented by product type into amphibious seaplanes, hydroplanes, seaplane tenders, hovercrafts, and amphibious aircraft drones. Recently, amphibious seaplanes have a dominant market share due to their versatility and ability to operate both on land and water. Their widespread use in commercial, military, and rescue operations makes them a preferred choice. These aircraft provide reliable, cost-effective solutions for operating in remote or difficult-to-reach locations, contributing significantly to their growing demand in the market.

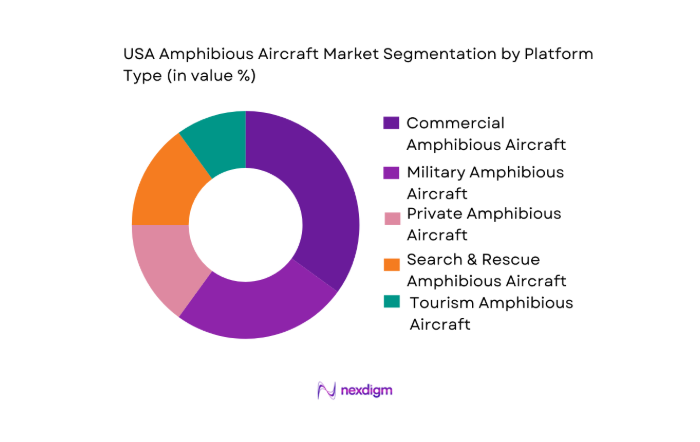

By Platform Type:

USA amphibious aircraft market is segmented by platform type into commercial amphibious aircraft, military amphibious aircraft, private amphibious aircraft, search & rescue amphibious aircraft, and tourism amphibious aircraft. Recently, commercial amphibious aircraft have a dominant market share due to the increasing popularity of these aircraft in the tourism and transport industries. These aircraft provide flexible, cost-effective, and environmentally friendly solutions for operations in regions where conventional airfields are unavailable. Their ability to land and take off from both land and water makes them indispensable for various commercial applications.

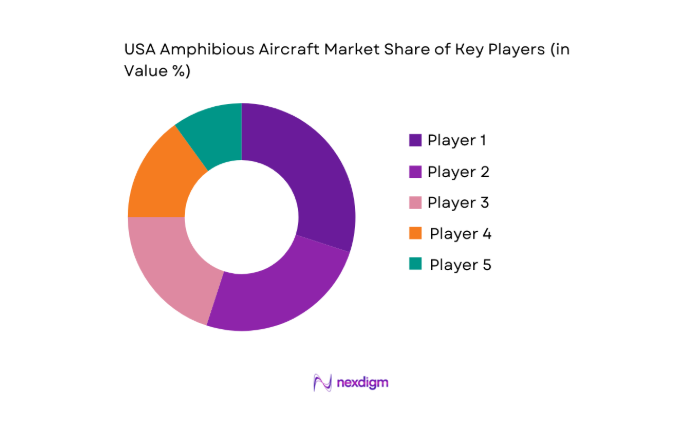

Competitive Landscape

The USA amphibious aircraft market is highly competitive, with numerous players contributing to the growth of the industry. Market consolidation is occurring as major players enhance their technological offerings, focusing on increasing efficiency and sustainability. The influence of established aerospace companies and defense contractors is significant, as they provide both civilian and military amphibious aircraft solutions. The ongoing demand for amphibious aircraft in both commercial and military applications is pushing companies to innovate, with a focus on hybrid and electric models.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-specific Parameter |

| Textron Aviation | 1923 | Wichita, Kansas | ~ | ~ | ~ | ~ | ~ |

| ICON Aircraft | 2008 | Vacaville, California | ~ | ~ | ~ | ~ | ~ |

| Bombardier Aerospace | 1942 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

| Cessna Aircraft Company | 1927 | Wichita, Kansas | ~ | ~ | ~ | ~ | ~ |

| Hawker Pacific | 1974 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

USA Amphibious Aircraft Market Analysis

Growth Drivers

Increasing demand for amphibious aircraft in remote locations

The demand for amphibious aircraft is growing rapidly due to their ability to access remote and isolated locations that are otherwise difficult to reach using conventional aircraft. This is particularly important in areas with limited infrastructure such as islands, coastal regions, and bodies of water, where regular runways are unavailable. Amphibious aircraft can take off and land on both water and land, making them a highly versatile and efficient mode of transport. The growing need for disaster relief and humanitarian aid is also driving the market as amphibious aircraft are increasingly used for rescue missions in inaccessible areas. Furthermore, in remote locations where there is limited transportation infrastructure, these aircraft provide an invaluable service to industries such as tourism, agriculture, and fisheries, allowing for the transportation of goods and passengers to and from hard-to-reach areas. The increasing focus on infrastructure development in these regions is expected to further fuel the demand for amphibious aircraft.

Government investments in search and rescue operations

Governments worldwide are investing heavily in search and rescue (SAR) operations, further propelling the growth of the amphibious aircraft market. These aircraft are essential for SAR operations, as they can access both land and water-based crash sites. As the frequency of natural disasters, maritime accidents, and humanitarian emergencies increases, the demand for efficient and reliable search and rescue solutions is also on the rise. Amphibious aircraft are specifically suited for these operations due to their ability to land on water and navigate through challenging terrain. Governments are increasingly focusing on enhancing their SAR capabilities with the adoption of advanced amphibious aircraft. The integration of cutting-edge technologies, including improved navigation systems, communication tools, and enhanced durability, is further driving the adoption of these aircraft in government fleets. Moreover, the increasing global awareness of disaster preparedness and the growing need for rapid emergency response systems are expected to drive further investment in amphibious aircraft for search and rescue missions.

Market Challenges

High manufacturing and maintenance costs

One of the primary challenges facing the amphibious aircraft market is the high manufacturing and maintenance costs associated with these specialized aircraft. The production of amphibious aircraft requires advanced engineering and the use of high-quality materials to ensure the aircraft can operate safely and efficiently in both water and land environments. This results in significantly higher production costs compared to traditional aircraft. Additionally, maintenance costs are high due to the need for regular inspections and specialized equipment to ensure the aircraft remains in top condition for operation in both harsh environments. The complexity of amphibious aircraft, combined with the need for frequent maintenance and specialized parts, increases operational expenses. For smaller operators, these costs can be prohibitive, limiting market growth. Despite the technological advancements that have reduced some of these costs, amphibious aircraft remain expensive to produce and maintain, which poses a significant challenge for widespread adoption.

Regulatory compliance and certification delays

The amphibious aircraft market faces significant regulatory challenges, as aircraft manufacturers must adhere to stringent safety and environmental regulations before bringing their products to market. The certification process for amphibious aircraft is complex, as they must meet the standards for both aviation and maritime operations. This dual certification requirement creates delays in the approval process and can hinder the timely introduction of new models. Additionally, the environmental regulations surrounding amphibious aircraft, particularly with regard to emissions and fuel consumption, are becoming increasingly stringent. Manufacturers must ensure that their products comply with these evolving regulations, which can require costly modifications and result in delays in the certification process. This regulatory complexity presents a major challenge for manufacturers looking to bring amphibious aircraft to market quickly and efficiently.

Opportunities

Development of environmentally friendly amphibious aircraft

One of the most promising opportunities in the amphibious aircraft market is the development of environmentally friendly aircraft. With growing concerns over climate change and environmental sustainability, there is an increasing demand for hybrid and electric amphibious aircraft that can operate with minimal environmental impact. Electric propulsion technology, in particular, is gaining traction as it offers a significant reduction in emissions and fuel consumption compared to traditional combustion engines. This development aligns with global trends towards reducing carbon footprints in the aviation industry. Companies investing in environmentally friendly amphibious aircraft are well-positioned to capitalize on the growing demand for green technologies. The development of sustainable amphibious aircraft could also attract government incentives and funding, which are increasingly being directed toward environmentally conscious aviation solutions. As technology continues to improve, these environmentally friendly aircraft will become more cost-effective, leading to increased adoption in both commercial and government sectors.

Expansion of military and defense applications

The USA amphibious aircraft market is also experiencing opportunities in the military and defense sectors, particularly with regard to reconnaissance, surveillance, and logistics operations. Amphibious aircraft are increasingly being used by defense organizations for operations in coastal and water-based regions where traditional vehicles cannot operate. These aircraft can quickly access strategic locations, providing valuable support for military missions, disaster response, and humanitarian aid. With the rising need for rapid mobility and logistical capabilities in the defense sector, the demand for amphibious aircraft is expected to grow. Furthermore, the ability to deploy amphibious aircraft for reconnaissance missions in areas with limited infrastructure is becoming an essential capability for modern armed forces. This trend presents significant growth opportunities for manufacturers focusing on the military and defense applications of amphibious aircraft, as governments seek to enhance their maritime and coastal defense capabilities.

Future Outlook

The future of the USA amphibious aircraft market looks promising, with a continued increase in demand driven by technological advancements, governmental support, and the expanding need for versatile aircraft capable of operating in challenging environments. Technological developments in electric and hybrid propulsion systems, as well as advancements in automation and artificial intelligence, are expected to further enhance the capabilities of amphibious aircraft, making them more efficient and environmentally friendly. Additionally, the growing emphasis on infrastructure development in remote and coastal areas will likely increase the demand for amphibious aircraft, opening up new opportunities for commercial and military applications. The market is also poised to benefit from expanding government investments in search and rescue operations and disaster response capabilities.

Major Players

- Textron Aviation

- ICON Aircraft

- Bombardier Aerospace

- Cessna Aircraft Company

- Hawker Pacific

- Airland

- DHC-6 Twin Otter

- Seawings Aircraft

- Airbus

- Gulfstream Aerospace

- Pacific Seaplanes

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- AeroVironment

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial airlines

- Private jet owners

- Military and defense agencies

- Emergency response organizations

- Aviation service providers

- Aircraft manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key market variables, such as product types, platform types, geographical regions, and technological advancements that influence the market.

Step 2: Market Analysis and Construction

Comprehensive analysis is conducted by examining historical data, current trends, and future growth trajectories to construct a detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through consultations with industry experts, including manufacturers, regulators, and end-users, to ensure accurate market assumptions.

Step 4: Research Synthesis and Final Output

The final output is synthesized from the gathered data, with findings and forecasts compiled into a comprehensive market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for amphibious aircraft in remote locations

Government investments in search & rescue operations

Rising demand for tourism-related amphibious aircraft - Market Challenges

High manufacturing and maintenance costs

Regulatory compliance and certification delays

Limited infrastructure for amphibious aircraft operations - Market Opportunities

Development of environmentally friendly amphibious aircraft

Expansion of military and defense applications

Technological advancements in hybrid-powered amphibious aircraft - Trends

Integration of AI in amphibious aircraft operations

Increased interest in amphibious aircraft for emergency services

Rise in private ownership of amphibious aircraft - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Amphibious Seaplanes

Hydroplanes

Seaplane Tenders

Hovercrafts

Amphibious Aircraft Drones - By Platform Type (In Value%)

Commercial Amphibious Aircraft

Military Amphibious Aircraft

Private Amphibious Aircraft

Search & Rescue Amphibious Aircraft

Tourism Amphibious Aircraft - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Aviation Authorities

Commercial Airlines

Military and Defense

Private Owners

Search and Rescue Organizations - By Procurement Channel (In Value%)

Direct Sales

Online Retail

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (Price, Performance, Technology, Operational Efficiency, Market Demand)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Textron Aviation

ICON Aircraft

Bombardier Aerospace

Aviation Industries

Cessna Aircraft

Seawings Aircraft

Gulfstream Aerospace

Pacific Seaplanes

Airbus

Hawker Pacific

DHC-6 Twin Otter

Northrop Grumman

Raytheon Technologies

AeroVironment

Lockheed Martin

- Civil Aviation Operators

- Government & Military Agencies

- Private Aircraft Owners

- Tourism and Leisure Sector

Forecast Market Value, 2026-2035

Forecast Installed Units, 2026-2035

Price Forecast by System Tier, 2026-2035

Future Demand by Platform, 2026-2035