Market Overview

The market size of the aviation industry in India has experienced significant growth due to factors such as increased disposable income, a rapidly expanding middle class, and government initiatives to boost aviation infrastructure. As of a recent historical assessment, the market value for this industry is projected to surpass USD ~ billion. Driven by growing demand for both domestic and international air travel, coupled with technological advancements in aircraft, the sector continues to witness rising investments. Furthermore, the increasing trend of privatization in airport management has contributed to the expansion of airport capacities, enabling better connectivity across regions. Infrastructure development and regulatory support have been essential in ensuring the market’s steady growth trajectory, positioning India as a key player in the global aviation market.

India remains a dominant force in the global aviation market, with key cities such as Delhi, Mumbai, and Bengaluru serving as major hubs for both domestic and international flights. The country benefits from its strategic location between East and West, making it a gateway for international travelers. Several factors contribute to India’s dominance, including the expansion of regional air services, government initiatives like the UDAN scheme, and increased air cargo demand. Moreover, the country has witnessed a boom in aviation tourism, further fueling market growth. With government policies aimed at reducing infrastructure bottlenecks and enhancing connectivity, India’s aviation market is set to thrive in the coming years.

Market Segmentation

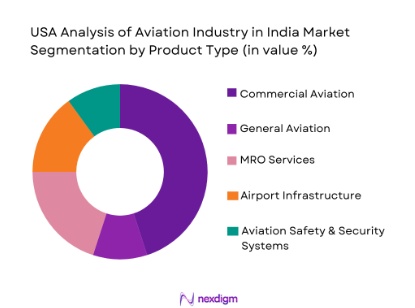

By Product Type

The aviation industry market is segmented by product type into commercial aviation, general aviation, MRO services, airport infrastructure, and aviation safety & security systems. Recently, commercial aviation has a dominant market share due to factors such as increasing air travel demand, large-scale fleet expansions by airlines, and government subsidies. Furthermore, the large consumer base of middle-class travelers has pushed airlines to offer competitive prices, further driving demand. With major airports undergoing modernization and upgrades, commercial aviation continues to capture a major share of the market, supported by increasing numbers of air carriers and frequent flyers.

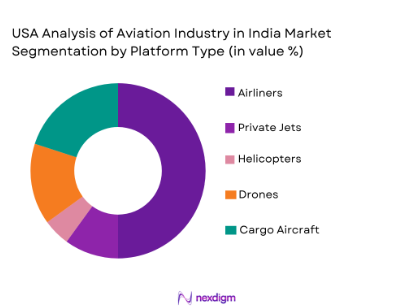

By Platform Type

The aviation industry market is segmented by platform type into airliners, private jets, helicopters, drones, and cargo aircraft. Airliners hold a dominant market share, driven by the robust demand for both domestic and international flights, especially in emerging markets. The rise in the middle-class population, increased affordability of air travel, and the government’s focus on expanding the regional connectivity network are pivotal factors contributing to the growth of airliner services. Additionally, the rising trend of low-cost carriers offering budget-friendly travel options further bolsters the position of airliners in the aviation market.

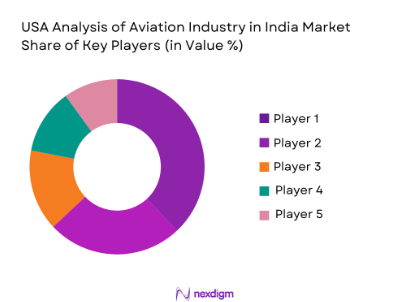

Competitive Landscape

The aviation industry in India is highly competitive, characterized by several large domestic and international players. Major players in the market, such as Air India, IndiGo, and SpiceJet, continue to consolidate their positions through strategic mergers, acquisitions, and expansion initiatives. The influence of these key players shapes market dynamics and trends. The government’s focus on modernizing airports and providing subsidies to airlines has further intensified competition. International players have also been expanding their footprint in India, making it a highly lucrative market for aviation companies worldwide.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Air India | 1932 | New Delhi, India | ~ | ~ | ~ | ~ | ~ |

| IndiGo | 2006 | Gurgaon, India | ~ | ~ | ~ | ~ | ~ |

| SpiceJet | 2005 | Gurgaon, India | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

USA Analysis of Aviation Industry in India Market Analysis

Growth Drivers

Expanding Middle-Class Population

The growing middle-class population in India is one of the key drivers of the aviation industry. With a significant portion of the population having rising disposable income, air travel is becoming more accessible to a broader segment of society. This demographic shift has led to increased demand for both domestic and international flights, with a notable rise in regional connectivity as well. The expanding middle class drives the need for more affordable and accessible air travel options, which has encouraged the growth of low-cost carriers. As a result, commercial aviation has flourished, and airlines have been able to cater to a growing consumer base. Furthermore, the government has been facilitating the growth of regional air routes through various policies, such as the UDAN scheme, which aims to make air travel more affordable and accessible to smaller cities. This has contributed significantly to the market’s overall growth. Additionally, the rise of budget airlines and affordable ticket pricing strategies has made air travel more cost-effective, ensuring that middle-class consumers continue to increase demand for air travel services. As air travel becomes more accessible, the aviation industry continues to expand its reach, supporting the development of infrastructure such as regional airports and the need for more aircraft. This growing consumer base fuels the development of commercial aviation, thereby contributing to a flourishing market.

Technological Advancements in Aircraft Design

Technological advancements in aircraft design are another key driver of the aviation industry’s growth. The increasing demand for more fuel-efficient and environmentally friendly aircraft has prompted innovations in materials and propulsion systems. These technological advancements allow airlines to reduce operational costs while offering more comfortable and efficient travel experiences to passengers. Aircraft manufacturers are investing heavily in developing lightweight composite materials and advanced aerodynamics to enhance fuel efficiency and reduce carbon emissions. Furthermore, the introduction of more advanced avionics systems and digital cockpit technologies has led to improved safety, navigation, and operational efficiency. These innovations have made air travel more cost-effective and sustainable, attracting both airlines and passengers. The aviation industry’s focus on adopting green technologies, including sustainable aviation fuel (SAF) and electric propulsion systems, further strengthens the market’s growth trajectory. Additionally, advancements in artificial intelligence and data analytics are enhancing the operational capabilities of airlines, improving the customer experience, and streamlining fleet management. The cumulative effect of these technological advancements is a market that continues to evolve and expand in response to the growing demand for efficient, sustainable, and safe air travel solutions.

Market Challenges

High Operational Costs

One of the significant challenges facing the aviation industry in India is the high operational costs associated with running airlines and managing airports. Airlines are burdened with substantial expenses related to fuel, aircraft maintenance, staff wages, and airport fees. Rising fuel prices, in particular, have a direct impact on the cost structure of airlines, as fuel costs account for a significant portion of an airline’s operating expenses. This challenge is exacerbated by the limited availability of cost-efficient fuel alternatives, further increasing operational costs. Additionally, the infrastructure required to maintain and modernize airports and support air traffic control systems adds further costs to the market. While the government has been focusing on expanding and modernizing infrastructure, including regional airports, the high capital expenditures involved in these projects contribute to the overall cost burden. Furthermore, the competitive nature of the market, with many low-cost carriers vying for consumer attention, has led to pressure on airlines to keep ticket prices low, which may reduce profitability. As a result, airlines are seeking ways to optimize their operations and reduce costs while maintaining safety and customer satisfaction standards. This challenge is likely to persist, especially as competition intensifies in the rapidly growing aviation market.

Regulatory Compliance and Bureaucratic Hurdles

Regulatory compliance and bureaucratic hurdles pose a significant challenge to the aviation industry in India. Despite ongoing efforts to streamline the regulatory process, the aviation sector continues to face delays and inefficiencies in obtaining necessary approvals for new routes, aircraft acquisitions, and airport development projects. These regulatory challenges often lead to bottlenecks in the growth of aviation infrastructure and the expansion of airline operations. Furthermore, the complexity of navigating India’s aviation laws and regulations can discourage foreign investment in the market. In particular, restrictions on foreign ownership of airlines and aviation-related entities limit the potential for international collaboration and investment. Regulatory requirements related to air safety, environmental standards, and security can also increase operational costs for airlines. While the government has made efforts to reform the aviation regulatory framework, including the introduction of new policies to promote competition and ease access to financing, bureaucratic inefficiencies remain a persistent challenge. Addressing these regulatory issues will be crucial for unlocking the full potential of the aviation market in India, as smoother processes will enable faster growth and better service delivery in the sector.

Opportunities

Growth in Regional Air Travel

The growth of regional air travel represents a significant opportunity for the aviation industry in India. The government’s push for expanding regional connectivity through the UDAN scheme has helped democratize air travel, making it more affordable and accessible to smaller cities. With a large population spread across diverse regions, India presents a vast market for regional air services that can bridge the gap between major metropolitan cities and smaller towns. This is especially relevant given India’s growing urbanization and the increasing demand for faster and more efficient transportation options. Airlines have begun to expand their fleets to cater to this rising demand for regional air travel, introducing smaller aircraft that are better suited to shorter routes. Regional connectivity is also expected to improve business opportunities, facilitate tourism, and enhance trade and logistics within the country. Additionally, the increasing focus on improving regional airports and airport infrastructure will support this growth trend. This shift towards regional air travel will create significant demand for new aircraft and will foster greater competition among airlines operating in smaller markets, ensuring that passengers have more travel options at affordable prices. As regional air travel continues to grow, it will contribute to the overall expansion of the Indian aviation market.

Government Initiatives to Boost Aviation Infrastructure

Government initiatives to boost aviation infrastructure offer a unique opportunity for growth within the Indian aviation market. The Indian government has prioritized the development of new airports, runway expansions, and upgrades to air traffic control systems, particularly in underdeveloped regions. These infrastructure projects, backed by both public and private investments, are aimed at improving connectivity, reducing congestion at major airports, and providing better services to passengers. By modernizing airports and increasing the number of functional terminals, India aims to support the increasing demand for air travel and improve the overall travel experience for passengers. Additionally, the government has been providing financial support and incentives to airlines to encourage the expansion of their fleets and routes. Furthermore, the privatization of select airports has opened the door for greater private sector involvement, ensuring more efficient management of facilities. With these continued efforts to improve aviation infrastructure, the market is expected to experience long-term growth, attracting both domestic and international airlines to increase their presence in India. The combination of improved infrastructure, government support, and strategic policies will drive the development of the Indian aviation sector.

Future Outlook

The future outlook for the aviation industry in India is highly positive, with expected growth in air travel, increased infrastructure investment, and ongoing regulatory support. The sector is poised for expansion, driven by rising middle-class incomes and a robust demand for both domestic and international flights. Technological advancements and improved airport capacities will continue to enhance operational efficiency, while government-backed initiatives will ensure regional connectivity and the growth of smaller airports. Additionally, growing interest in sustainable aviation practices and the adoption of greener technologies will influence the future of the industry. Over the next five years, the market is set to witness continued investments in infrastructure and fleet expansion, ensuring the aviation sector’s critical role in India’s economic development.

Major Players

- Air India

- IndiGo

- SpiceJet

- Boeing

- Airbus

- GE Aviation

- Honeywell Aerospace

- Rolls-Royce

- Raytheon Technologies

- Lockheed Martin

- Collins Aerospace

- Safran

- Pratt & Whitney

- Rockwell Collins

- Bombardier

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and fleet operators

- Airport authorities and infrastructure developers

- Aircraft manufacturers

- Aerospace equipment suppliers

- Aircraft leasing companies

- Airline service providers

Research Methodology

Step 1: Identification of Key Variables

Identifying critical factors influencing the aviation market, such as demand drivers, technological advancements, regulatory frameworks, and economic conditions.

Step 2: Market Analysis and Construction

Analyzing historical data and constructing models to forecast market trends, considering all major influencing variables.

Step 3: Hypothesis Validation and Expert Consultation

Validating assumptions and market predictions through consultations with industry experts, stakeholders, and secondary data sources.

Step 4: Research Synthesis and Final Output

Synthesizing the collected data into a comprehensive report, ensuring all insights are actionable and align with market expectations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expanding Middle-Class Population in India

Increasing Air Travel Demand

Government Investment in Aviation Infrastructure

Technological Advancements in Aircraft Design

Rising Demand for Regional Air Connectivity - Market Challenges

High Operational Costs

Stringent Regulatory Compliance

Infrastructure Limitations at Airports

Environmental Concerns

Limited Skilled Workforce in Aviation Maintenance - Market Opportunities

Growth in Regional Air Travel

Government Incentives for Aviation Development

Emerging Demand for Green Aviation Technologies - Trends

Rise in Air Cargo Services

Adoption of Autonomous Aircraft Technology

Increasing Public-Private Partnerships in Aviation

Shift Towards Sustainable Aviation Fuel

Digitization and Automation in Aviation Operations - Government Regulations & Defense Policy

Stricter Environmental Regulations for Aircraft Emissions

Favorable Government Policies for Aviation Expansion

Regulations for Drone Operations in Commercial Use

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial Aviation

General Aviation

MRO Services

Airport Infrastructure

Aviation Safety & Security Systems - By Platform Type (In Value%)

Airliners

Private Jets

Helicopters

Drones

Cargo Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment Upgraded Systems

Component Replacement - By End User Segment (In Value%)

Commercial Airlines

Private Operators

Cargo Companies

Government & Defense

Airport Authorities - By Procurement Channel (In Value%)

Direct Purchase

Leasing & Financing

Government Procurement

Third-Party Distributors

Online Marketplaces - By Material / Technology (in Value%)

Lightweight Composite Materials

Advanced Aerodynamics Technology

Next-Gen Avionics Systems

Electric Propulsion Systems

3D Printing Technology

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Adoption, Market Presence, Product Offering, Customer Service, Supply Chain Integration, Pricing Strategy, R&D Investment, Regulatory Compliance, Market Growth, Profit Margins)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Airbus

GE Aviation

Honeywell Aerospace

Rolls-Royce

Raytheon Technologies

Lockheed Martin

Collins Aerospace

Safran

Pratt & Whitney

Rockwell Collins

Bombardier

Embraer

Textron Aviation

Tata Advanced Systems

- Increasing Air Traffic from Regional Airports

- Rising Demand for Domestic and International Connectivity

- Focus on Airport Modernization Projects

- Adoption of Technology in Passenger Services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035