Market Overview

The USA anti-inflammatory topical creams market is part of the broader U.S. topical pain relief market, which is valued at USD ~ billion in 2024. This growth is driven by rising prevalence of musculoskeletal disorders (arthritis, joint pain), an expanding geriatric population, and increasing consumer preference for non-systemic topical therapies. The topical cream format is especially preferred for localized inflammation and pain due to easier application and fewer systemic side-effects.

Within the U.S., metropolitan markets such as New York, Los Angeles, Chicago and the broader states of California and Florida dominate consumption of anti-inflammatory topical creams. These regions lead due to higher healthcare expenditure, dense distribution and retail pharmacy networks, high prevalence of active lifestyle and sports injury cases, and strong direct-to-consumer channels including e-commerce. Also, leading pharmaceutical manufacturers and contract cream-formulation facilities are concentrated in these regions, further supporting product availability and innovation.

Market Segmentation

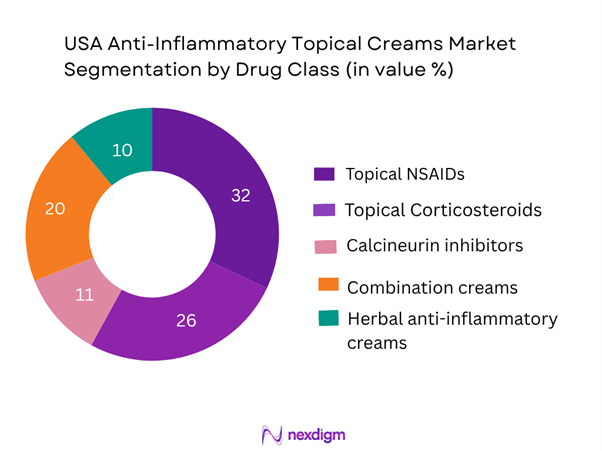

By Drug Class

The market is segmented by drug class into: Topical NSAIDs (e.g., diclofenac, ketoprofen), Topical corticosteroids (e.g., hydrocortisone, betamethasone), Calcineurin inhibitors (e.g., tacrolimus, pimecrolimus), Combination creams (analgesic + anti-inflammatory + cooling agents) and Herbal/Botanical anti-inflammatory creams (CBD, plant extracts). The topical NSAIDs sub-segment dominates with an estimated share of 32% in 2024. This is due to their strong positioning for musculoskeletal inflammation, regulatory approvals for OTC use (e.g., diclofenac gel) and high consumer acceptance for non-systemic relief. They offer the right balance of efficacy, convenience and safety compared to systemic NSAIDs or stronger corticosteroids, thus capturing leading share.

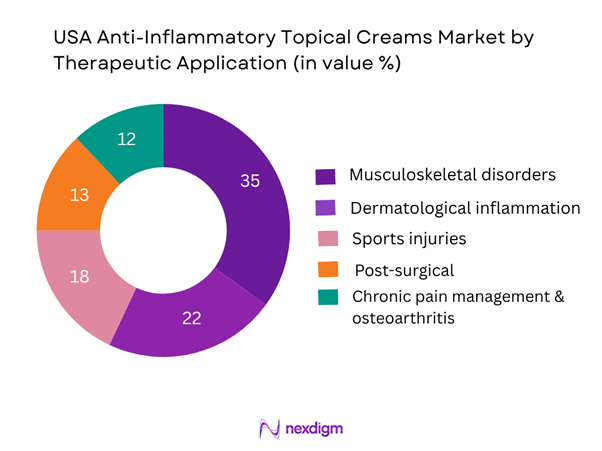

By Therapeutic Market Application

The market is segmented by therapeutic application into: Musculoskeletal disorders (arthritis, tendonitis, bursitis), Dermatological inflammation (eczema, psoriasis, contact dermatitis), Sports injuries & pain management, Post-surgical / local inflammation, Chronic pain management & osteoarthritis. Among these, the musculoskeletal disorders segment dominates with an estimated share of 35% in 2024. This dominance stems from the large prevalence of arthritis and joint pain among U.S. adults (≈ 60 million adults report chronic pain), and the suitability of topical anti-inflammatory creams to provide localized relief in joints and muscles without systemic side-effects. Retail and OTC availability of topical creams for arthritis, and rising sports injury incidence in older adults, also reinforce this sub-segment’s leading position.

Competitive Landscape

The U.S. anti-inflammatory topical creams market is dominated by a combination of major global pharmaceutical companies and specialist topical formulation firms. A few large players hold significant scale in manufacturing, regulatory approvals (OTC and Rx), and distribution (retail pharmacies, e-commerce). At the same time, niche brands focusing on natural/botanical topicals are gaining ground, increasing competitive intensity.

| Company | Founded | Headquarters | OTC vs Rx Mix | Manufacturing Footprint (US) | Topical Cream Portfolio Strongholds | R&D Capabilities in Topical Formulation | Recent Strategic Move |

| Pfizer Inc. | 1849 | New York, NY, USA | – | – | – | – | – |

| Johnson & Johnson | 1886 | New Brunswick, NJ, USA | – | – | – | – | – |

| GlaxoSmithKline plc (GSK) | 2000* | Brentford, UK / PA, USA | – | – | – | – | – |

| Bayer AG | 1863 | Leverkusen, Germany / NJ, USA | – | – | – | – | – |

| Dr. Reddy’s Laboratories Ltd. | 1984 | Hyderabad, India / NJ, USA | – | – | – | – | – |

USA Anti-Inflammatory Topical Creams Market Analysis

Key Growth Drivers

Rise in Arthritis and Chronic Inflammatory Disorders

In the United States, approximately 21.3 % of adults aged 18 and older have been diagnosed with arthritis, equivalent to tens of millions of people. Within this group, an estimated 33 million adults have osteoarthritis alone. The large affected population drives demand for non-systemic, locally applied therapies, making topical anti-inflammatory creams a key option for joint and muscle pain relief without systemic drug exposure. As the burden of musculoskeletal conditions remains high, the need for effective topical solutions grows.

Increasing Preference for Topical Over Systemic Therapy

The trend toward topical formulations is supported by patient and clinician preference for treatments that limit systemic exposure, especially among older adults with multiple comorbidities. With one in five U.S. adults reporting arthritis and the condition rising in populations aged 65+ (over half of adults age 75+ have arthritis) topical creams offer a safer alternative to oral anti-inflammatory agents with fewer systemic side-effects. This shift in therapeutic strategy supports growth in the topical anti-inflammatory cream segment.

Key Market Challenges

Adverse Effects of Long-Term Topical Steroid Use

While topical corticosteroids are widely used for inflammatory skin conditions, long-term or high-potency use carries risks such as skin thinning, dermal atrophy, systemic absorption and adrenal suppression. These safety concerns reduce physician and patient willingness to use steroids long-term for musculoskeletal inflammation, limiting the addressable market for steroid-based topical creams and creating pressure for safer non-steroidal formats.

Price Competition and Generic Erosion

The topical anti-inflammatory space faces intense competition from generic manufacturers and OTC brands, which exerts downward pressure on pricing and margins. When patented formulations go off-patent or face generic entrants, branded players must defend market share and invest in innovation to avoid erosion. Lower-cost generics may commoditise the segment, thereby reducing profit potential for premium formulations.

Emerging Opportunities

CBD and Botanical Topical Creams Gaining Legitimacy

Growing consumer interest in botanical actives and cannabidiol (CBD)-infused topicals presents a strong opportunity in the anti-inflammatory cream market. While still regulated differently than traditional pharmaceuticals, these products are gaining acceptance and retail shelf presence. As consumer awareness and regulatory clarity around botanical anti-inflammatories increase, formulators can leverage this to introduce differentiated topical creams.

Advanced Penetration Enhancers and Drug Delivery Systems

Developments in advanced delivery technologies—such as micro-needling assisted delivery, nano-vesicles, iontophoresis-enhanced creams—enable deeper skin penetration of anti-inflammatory actives and open potential for higher-efficacy topical treatments. These technological enhancements allow manufacturers to position new formulations as premium or clinically superior, offering differentiation and growth potential in the topical anti-inflammatory market.

Future Outlook

Over the next several years, the U.S. anti-inflammatory topical creams market is expected to grow steadily as consumer demand for non-systemic, localized therapies increases and formulation technologies evolve for improved dermal penetration and efficacy. The rise of e-commerce, tele-dermatology prescribing, and OTC self-care models will accelerate market expansion. Furthermore, innovations in botanical and CBD-infused topicals, as well as enhanced delivery systems (nano-emulsions, liposomes), will open new avenues for product differentiation. Market entrants and established brands alike will need to invest in product innovation, direct-to-consumer channels and regulatory positioning to capture white-space opportunities in this evolving segment.

Major Players

- Pfizer Inc.

- Johnson & Johnson

- GlaxoSmithKline plc (GSK)

- Bayer AG

- Reddy’s Laboratories Ltd.

- Novartis AG

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Amneal Pharmaceuticals Inc.

- Reckitt Benckiser Group plc

- Haleon plc

- Perrigo Company plc

- Bausch Health Companies Inc.

- Aenova Group

Key Target Audience

- Pharmaceutical & Generic Drug Manufacturers

- CDMOs / Contract Manufacturing Organisations (Topical Creams)

- Investments & Venture Capitalist Firms

- Retail Pharmacy Chains & Distributors

- Sports Medicine Product Developers

- Government & Regulatory Bodies (e.g., U.S. Food & Drug Administration – Center for Drug Evaluation and Research)

- Healthcare Insurers & Pharmacy Benefit Managers (PBMs)

- Dermatology Clinics & Hospital Pharmacy Procurement Departments

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem of manufacturers, topical cream formulations, distribution channels (retail, e-commerce), end users (musculoskeletal, dermatological), and regulatory pathways (OTC vs Rx) for the U.S. anti-inflammatory topical creams market. Extensive desk research was undertaken across pharmaceutical and OTC topical markets to identify relevant drivers and constraints.

Step 2: Market Analysis and Construction

In this phase, historical market values and volume proxies (from broader topical pain relief reports) were compiled and analysed. Sub-segment splits (by drug class, therapeutic application) were derived using available public data and expert triangulation. The average price levels, manufacturing footprint and distribution channel trends were assessed to build a bottom-up market sizing model for the U.S. market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on growth drivers (e.g., ageing population, shift to topical formats), segment dominance and distribution evolution were validated through interviews with dermatologists, OTC brand managers, and formulation scientists in topical anti-inflammatory creams. Their insights refined assumptions for pricing, formulation innovations and channel shifts.

Step 4: Research Synthesis and Final Output

The final phase synthesised desk research, expert interviews, and modelling into the comprehensive market report. All findings were validated, triangulated and cross-checked across sources to ensure accuracy and usability for business professionals, strategy teams and investors in the U.S. anti-inflammatory topical creams market.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Market Sourcing Approach, Data Triangulation, Primary Interviews with Dermatologists and Pharma Executives, Secondary Research Databases (Drugs@FDA, IQVIA Rx Sales, PubMed Clinical Trials), Limitations and Future Scope)

- Definition and Scope of Topical Anti-Inflammatory Preparations

- Evolution of Topical NSAIDs and Corticosteroid Products in the US Market

- Therapeutic Landscape

- Regulatory Timeline of Major Approvals

- Supply Chain & Value Chain Analysis

- Reimbursement & Insurance Coverage Landscape

- Key Growth Drivers

Rise in Arthritis and Chronic Inflammatory Disorders

Increasing Preference for Topical Over Systemic Therapy

Expansion of OTC and E-Commerce Channels

Technological Advancements in Cream Formulation (Nano-Emulsions, Liposomes)

R&D Investment in Novel Topical Biologics - Market Challenges

Adverse Effects of Long-Term Topical Steroid Use

Price Competition and Generic Erosion

Stringent FDA Labeling and Reformulation Compliance

Supply Chain Vulnerability for API and Excipients - Emerging Opportunities

CBD and Botanical Topical Creams Gaining Legitimacy

Advanced Penetration Enhancers and Drug Delivery Systems

Integration of Tele-Dermatology in Product Distribution

Rising Adoption in Sports and Rehabilitation Medicine - Key Market Trends

Shift Toward Non-Steroidal and Natural Formulations

Combination Therapies for Dual Relief

Customized Formulations for Skin Type & Condition

Sustainability in Packaging and Formulation Base - Government Regulation

FDA Monograph for OTC Topical NSAIDs

FDA Guidelines for Topical Corticosteroids

Pharmacovigilance and Adverse Event Reporting Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value (USD Million), 2019-2024

- By Volume (Tons / Units Sold), 2019-2024

- By Average Price (USD per gram / pack), 2019-2024

- By Drug Class (in Value %)

Topical NSAIDs

Topical Corticosteroids

Calcineurin Inhibitors

Combination Creams

Biologic or Herbal Topical Formulations - By Therapeutic Application (in Value %)

Musculoskeletal Disorders

Dermatological Inflammation

Sports Injuries and Pain Management

Post-Surgical or Local Inflammation

Chronic Pain Management and Osteoarthritis - By Distribution Channel (in Value %)

Retail Pharmacies

Hospital Pharmacies & Outpatient Clinics

Online Pharmacies (E-commerce Platforms)

Supermarkets / Mass Merchandisers

Specialty Dermatology Stores / Dispensaries - By End-User (in Value %)

Adults (18–64 Years)

Geriatric Population (65 Years and Above)

Athletes and Sports Professionals

Pediatric Population

Post-Operative Care Patients - By Region (in Value %)

Northeast (High Healthcare Access, Dense Dermatology Network)

Midwest (High Prevalence of Arthritis Cases)

South (Largest Pharmaceutical Distribution Base)

West (California CBD and OTC Product Dominance)

- Market Share of Major Players (Value/Volume)

Market Share by Therapeutic Class (NSAID, Steroid, Herbal) - Cross-Comparison Parameters for Major Players (Company Overview, Business Strategy, Recent Developments, R&D Pipeline, Distribution Strength, OTC vs Rx Revenue Mix, Manufacturing Footprint, Brand Equity Index)

- Detailed Profiles of Major Companies

Pfizer Inc.

Johnson & Johnson (Neutrogena, Aveeno)

GSK Consumer Health (Voltaren Topical)

Novartis AG

Bayer AG

Sanofi S.A.

Teva Pharmaceuticals USA

Dr. Reddy’s Laboratories Ltd.

Sun Pharmaceutical Industries Ltd.

Mylan Viatris Inc.

Reckitt Benckiser Group plc

Haleon plc

Perrigo Company plc

Bausch Health Companies Inc.

Amneal Pharmaceuticals Inc.

- Patient Demographics & Utilization Patterns

- Prescription vs OTC Usage Trends

- Consumer Perception and Purchase Drivers

- Adherence Behavior and Price Elasticity

- Decision-Making Influencers

- By Value (USD Million), 2025-2030

- By Volume (Unit Sales), 2025-2030

- By Average Price (USD per gram), 2025-2030