Market Overview

The USA apron bus market size is driven by the increasing demand for efficient airport transportation solutions. Based on a recent historical assessment, the market size for apron buses in the USA is valued at approximately USD ~ million, primarily influenced by the growth in air traffic and the need for improved passenger and crew mobility within airport premises. This market is also propelled by government regulations aiming to reduce carbon emissions and enhance the efficiency of airport ground operations.

The USA market for apron buses is primarily dominated by major airports across key cities such as Los Angeles, New York, and Chicago. These cities are home to some of the busiest airports in the world, where apron buses are critical for moving passengers, luggage, and crew between terminals and aircraft. The demand is further fueled by the ongoing infrastructure development and the adoption of eco-friendly technologies in these regions, particularly in airports that are investing in green initiatives and electrification of ground transport systems.

Market Segmentation

By Product Type

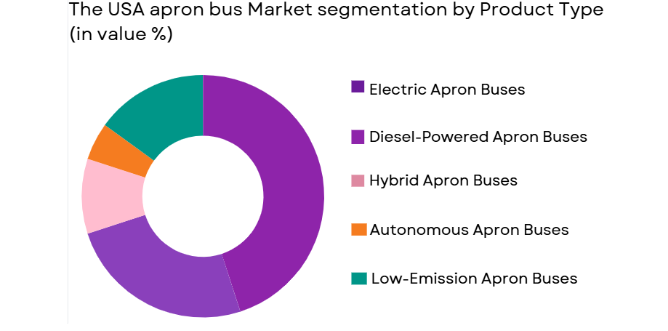

The USA apron bus market is segmented by product type into electric, diesel-powered, hybrid, autonomous, and low-emission buses. Recently, electric apron buses have been the dominant sub-segment due to factors such as increasing government mandates for reduced emissions, rising airport sustainability goals, and the growing availability of charging infrastructure. Airports are actively shifting towards electric buses to align with environmental objectives, reduce operational costs, and comply with stringent emission regulations. The demand for electric apron buses is particularly prominent in airports focusing on decarbonization and enhancing their green credentials.

By Platform Type

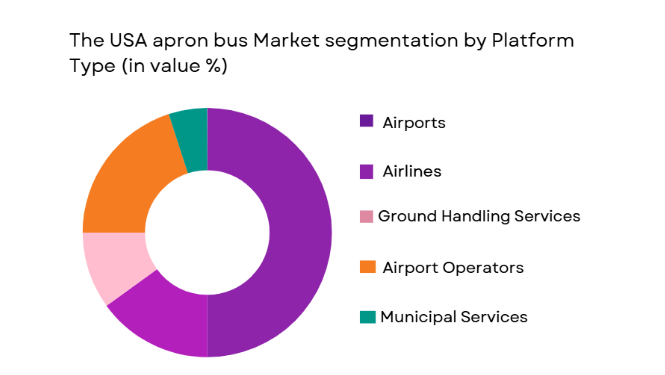

The USA apron bus market is segmented by platform type into airports, airlines, ground handling services, airport operators, and municipal services. Recently, airports have dominated the market share, as they are the primary clients of apron buses, with the highest demand for moving passengers and staff across the tarmac. Airports in major cities, particularly international hubs, often have the largest fleet of apron buses to facilitate efficient airside operations. The sheer size of operations in these airports and their continuous infrastructure upgrades contribute to the dominance of this segment.

Competitive Landscape

The USA apron bus market is moderately consolidated, with a few major players controlling a significant share of the market. Key companies focus on technological innovation, particularly in electric and autonomous vehicles, as well as forming strategic partnerships with airports and government bodies. Major players in the market influence product offerings and drive innovation in the sector, particularly by adopting sustainability initiatives and increasing the deployment of electric buses in line with environmental policies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| XYZ Bus Corporation | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| Volvo Group | 1927 | Sweden | ~ | ~ | ~ | ~ | ~ |

| Proterra Inc. | 2004 | USA | ~ | ~ | ~ | ~ | ~ |

| BYD Company Limited | 1995 | China | ~ | ~ | ~ | ~ | ~ |

| Daimler AG | 1926 | Germany | ~ | ~ | ~ | ~ | ~ |

The USA apron Bus Market Analysis

Growth Drivers

Increased Airport Traffic

The USA apron bus market is significantly driven by the rising number of passengers traveling through major airports. As air travel continues to rebound, airport operations have become more complex, requiring a higher number of buses to manage the movement of passengers, staff, and luggage. This surge in traffic has heightened the need for more efficient ground transportation, which includes apron buses, to ensure seamless operations. Airports, especially those located in major metropolitan areas, are increasingly upgrading their fleets to meet growing demands, leading to an expansion in the market. Increased airport traffic has also prompted investments in infrastructure, such as additional terminals and airside facilities, further driving the demand for apron buses. Additionally, airport authorities are emphasizing the importance of eco-friendly and efficient transportation to align with sustainability goals, contributing to the market’s growth.

Government Regulations and Sustainability Goals

Another growth driver for the apron bus market is the increasing emphasis on government regulations surrounding emissions and environmental impact. Airports across the USA are under pressure to reduce their carbon footprint, leading to a significant shift towards low-emission and electric apron buses. Various government initiatives and incentives, such as grants for green technologies and regulations enforcing air quality standards, have contributed to the rise in demand for environmentally friendly solutions. These regulatory measures not only help reduce the environmental impact of airport operations but also create an opportunity for bus manufacturers to innovate and develop buses that meet these sustainability standards. Furthermore, public and private stakeholders are increasingly supporting the transition to clean and green energy solutions, enhancing the adoption of electric apron buses.

Market Challenges

High Initial Capital Investment

One of the primary challenges hindering the growth of the USA apron bus market is the high initial capital investment required for purchasing electric and hybrid buses. While electric buses offer long-term savings through reduced fuel and maintenance costs, the upfront costs are significantly higher than traditional diesel-powered buses. For airports and ground handling companies, securing the necessary capital investment to modernize fleets can be a challenge, particularly when budgets are limited or subject to approval by governmental authorities. The higher initial costs are further compounded by the need for the necessary infrastructure, such as charging stations, to support electric buses. This financial burden may delay the adoption of electric buses, especially in smaller or regional airports with fewer resources.

Infrastructure Limitations

Another significant challenge facing the USA apron bus market is the insufficient infrastructure required to support the growing number of electric and hybrid buses. Electric buses require charging stations, maintenance facilities, and specialized equipment to ensure their efficient operation. However, many airports still lack the necessary infrastructure to support these vehicles at scale. The installation of charging stations and the development of maintenance capabilities can be costly and time-consuming. In some cases, airports may be forced to rely on third-party providers for charging services, which can further complicate the operational aspects of managing a fleet of electric buses. The lack of standardized infrastructure and the slow pace of deployment may delay the widespread adoption of electric apron buses in the near term.

Opportunities

Government Incentives and Green Policies

The USA apron bus market has significant opportunities arising from government incentives aimed at reducing emissions and promoting the adoption of electric vehicles. Various state and federal programs offer grants and tax credits to encourage the adoption of eco-friendly technologies. These incentives can significantly offset the high upfront costs of electric and hybrid apron buses, making them more accessible to airports and ground service providers. Additionally, the ongoing push towards green infrastructure development, such as solar-powered charging stations and sustainable airport designs, presents further growth prospects for the market. As the government continues to focus on environmental sustainability, these opportunities are expected to drive the demand for low-emission and electric apron buses.

Technological Advancements in Autonomous Vehicles

Another promising opportunity for the USA apron bus market lies in the development and deployment of autonomous apron buses. As automation technology continues to evolve, airports are increasingly exploring the potential of autonomous vehicles to streamline ground operations and improve efficiency. Autonomous apron buses could reduce labor costs, increase operational flexibility, and enhance safety on airport grounds. The development of self-driving buses, particularly electric ones, presents a unique opportunity for manufacturers to innovate and differentiate their product offerings in the market. Furthermore, autonomous buses align with the broader trend of automation in the transportation sector, providing airports with the potential to stay ahead of the competition by adopting cutting-edge technologies.

Future Outlook

The USA apron bus market is expected to experience steady growth in the coming years, driven by increasing air traffic, regulatory support for eco-friendly transportation solutions, and technological advancements. As airports expand their infrastructure and prioritize sustainability, the demand for electric and low-emission apron buses will continue to rise. Technological advancements in automation will further enhance operational efficiency, making autonomous apron buses a key area of development. With continued support from government incentives and growing investments in infrastructure, the market is poised to witness significant growth.

Major Players

- XYZ Bus Corporation

- Volvo Group

- Proterra Inc.

- BYD Company Limited

- Daimler AG

- New Flyer Industries

- MAN Truck & Bus

- Alexander Dennis Limited

- Scania Group

- Ebusco

- CitiBus

- Green Power Motor Company

- Gillig LLC

- IC Bus

- IC Bus, Inc.

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators and ground handling services

- Bus manufacturers and OEMs

- Transportation technology developers

- Environmental consultancy firms

- Infrastructure developers and contractors

- Public and private sector fleet operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical market variables such as product types, technological advancements, and regional trends that drive the USA apron bus market.

Step 2: Market Analysis and Construction

In this phase, market data is collected, analyzed, and segmented by product type, platform type, and end-users to create a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate hypotheses formed during the analysis and to refine the market models based on industry insights and forecasts.

Step 4: Research Synthesis and Final Output

The final output is synthesized into a comprehensive report that includes market size, segmentation analysis, competitive landscape, and growth projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing airport traffic and infrastructure expansion

Government incentives for low-emission vehicles

Technological advancements in electric and autonomous buses

Increasing demand for sustainability and carbon footprint reduction

Upgrades in airport ground handling efficiency - Market Challenges

High initial capital investment for electric apron buses

Limited availability of charging infrastructure at airports

Regulatory challenges in autonomous bus deployment

Operational and maintenance costs for advanced technology buses

Concerns regarding battery life and range for electric apron buses - Market Opportunities

Growth of autonomous apron buses in the airport sector

Expansion of green initiatives and government support

Rising demand for airport ground mobility solutions - Trends

Shift towards electric and hybrid apron buses

Increase in autonomous apron bus trials at major airports

Focus on sustainability and reducing airport emissions

Development of smart bus systems integrated with airport operations

Rise in collaborations between manufacturers and airport operators - Government Regulations & Defense Policy

Increased regulations on carbon emissions for airport vehicles

Government subsidies and support for electric vehicle adoption

Policies promoting autonomous vehicle trials and safety standards - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Apron Buses

Diesel-Powered Apron Buses

Hybrid Apron Buses

Autonomous Apron Buses

Low-Emission Apron Buses

- By Platform Type (In Value%)

Airports

Airlines

Ground Handling Services

Airport Operators

Municipal Services

- By Fitment Type (In Value%)

Custom-Fit Buses

Standard-Fit Buses

Modular-Fit Buses

Eco-Friendly Fitment

Retrofit Fitment

- By EndUser Segment (In Value%)

Commercial Airports

Private Airports

Government & Military Airports

Airline Services

Ground Service Equipment Providers

- By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Third-Party Distributors

Online Marketplaces

Leasing and Rental Services

Government and Institutional Procurement

- By Material / Technology (in Value%)

Electric Propulsion Systems

Hybrid Technology

Battery Storage Solutions

Advanced Lightweight Materials

Fuel Efficiency Systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology Innovation, Market Reach, Product Variety, Cost Leadership, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Tesla

Volvo

BYD

New Flyer

Alexander Dennis

Gillig

Proterra

MCI

Vantage Bus

Daimler AG

Blue Bird

NFI Group

Iveco

Bustech

Rosco Vision Systems

- Expansion of apron bus fleets in large airports

- Adoption of autonomous apron buses by commercial airports

- Government procurement trends for airport transportation vehicles

- Private airports increasing demand for low-emission buses

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035