Market Overview

The USA attack helicopter market is valued at approximately USD ~ billion based on a recent historical assessment, driven by increased defense spending and advancements in rotorcraft technology. Key drivers include the modernization of military fleets, rising geopolitical tensions, and the demand for advanced, multi-role helicopters capable of conducting complex operations such as reconnaissance, anti-tank warfare, and air support. The market is also supported by the need for helicopters equipped with advanced avionics, precision weapons, and increased operational range, which are crucial in modern warfare scenarios.

The United States leads the market, thanks to its substantial defense budget and global military presence. Major cities, such as Washington, D.C., and defense hubs like Fort Rucker, play a central role in the market’s growth, with U.S. military forces continually investing in technologically advanced helicopters. U.S. manufacturers such as Boeing and Lockheed Martin are key players, supplying cutting-edge platforms like the AH-64 Apache. Other regions, particularly parts of Europe and Asia-Pacific, are investing heavily in attacking helicopters as military modernization continues.

Market Segmentation

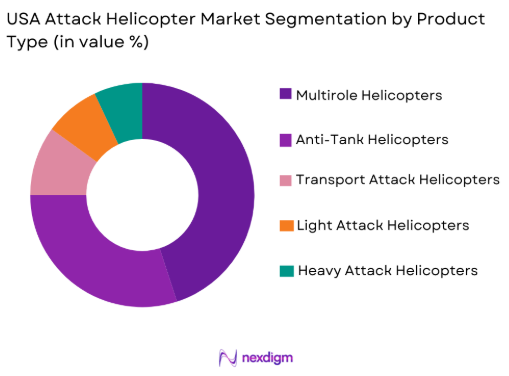

By Product Type

The USA attack helicopter market is segmented by product type into multirole helicopters, anti-tank helicopters, transport attack helicopters, light attack helicopters, and heavy attack helicopters. Recently, multirole helicopters had a dominant market share due to their flexibility and ability to perform various tasks such as reconnaissance, ground attack, and troop support. The adaptability of multirole helicopters has made them the preferred choice for modern military forces, as they reduce the need for multiple specialized aircraft while offering greater operational efficiency. Additionally, technological advancements in avionics and weaponry, such as precision targeting systems and advanced communication networks, have further increased the appeal of multirole helicopters, ensuring their continued dominance in the market.

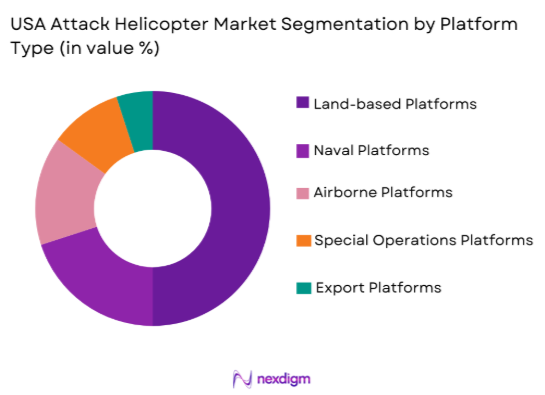

By Platform Type

The USA attack helicopter market is segmented by platform type into land-based platforms, naval platforms, airborne platforms, special operations platforms, and export platforms. Recently, land-based platforms have dominated the market due to their high utilization by military forces worldwide for ground-based combat missions. The ability to operate in various terrains and the high demand for versatile systems capable of providing close air support, anti-tank operations, and reconnaissance have driven the dominance of land-based platforms. These helicopters are critical in supporting infantry operations, ensuring operational success in complex, multi-dimensional warfare environments. Their ability to be rapidly deployed and integrated into a variety of mission scenarios further contributes to their leadership in the market.

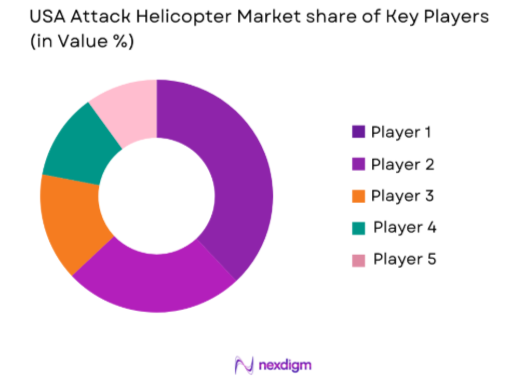

Competitive Landscape

The competitive landscape of the USA attack helicopter market is dominated by a few major players who have established a strong presence in both domestic and international markets. Companies like Boeing, Lockheed Martin, and Airbus Helicopters lead the sector through continuous technological innovation, large-scale production, and strong government contracts. These companies are key in shaping the market’s direction, investing heavily in the development of next-generation attack helicopters and securing high-profile military contracts. With defense budgets increasing globally, the demand for technologically advanced attack helicopters continues to drive competition among these firms. Smaller companies are also emerging, focusing on specialized platforms or niche technological advancements to compete with the larger players. The landscape continues to evolve with consolidation expected through mergers, joint ventures, and strategic collaborations between industry leaders and defense agencies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | Marignane, France | ~ | ~ | ~ | ~ | ~ |

| MD Helicopters | 1947 | Mesa, USA | ~ | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | Fort Worth, USA | ~ | ~ | ~ | ~ | ~ |

USA Attack Helicopter Market Analysis

Growth Drivers

Increased Military Modernization

The modernization of military fleets is one of the primary growth drivers in the USA attack helicopter market. As military forces look to maintain technological superiority and operational readiness, the demand for advanced helicopters has risen significantly. The U.S. military’s ongoing investment in upgrading existing fleets, such as the AH-64 Apache, with the latest avionics, weapons systems, and multi-role capabilities ensures that attack helicopters remain vital to modern warfare strategies. These helicopters are required to perform in increasingly complex combat environments, which necessitates constant innovation and improvement. As part of military modernization efforts, the U.S. government continues to prioritize the procurement of technologically advanced platforms capable of supporting diverse military missions, including reconnaissance, close air support, and anti-tank operations. The focus on interoperability across different military systems, including integration with unmanned aerial vehicles (UAVs) and other advanced technologies, further drives the demand for multi-functional attack helicopters. With global security concerns increasing, the U.S. military’s desire to maintain a technological edge over adversaries continues to fuel the demand for modernized attack helicopters. These modernization efforts not only enhance the effectiveness of existing platforms but also ensure that U.S. military forces have the capability to execute rapid, decisive operations in high-risk environments.

Rising Geopolitical Tensions

Geopolitical tensions and the evolving nature of modern warfare have significantly contributed to the increasing demand for attack helicopters in the USA. As threats from adversaries such as Russia, China, and North Korea grow in both scope and complexity, the need for technologically advanced helicopters capable of rapid deployment and versatile operations becomes even more critical. The U.S. military’s engagement in global operations, peacekeeping missions, and counterinsurgency efforts requires a fleet of attack helicopters that can be quickly mobilized and adapted to a wide range of conflict scenarios. Furthermore, the ongoing conflicts in the Middle East and other regions have demonstrated the need for specialized military platforms that offer air superiority, precision strike capabilities, and battlefield support. As the U.S. military continues to focus on enhancing its strategic and tactical capabilities, particularly in regions with escalating threats, the demand for attack helicopters that can operate in diverse environments and integrate seamlessly with other advanced military systems will continue to rise. This geopolitical landscape is driving the development of attack helicopters with advanced capabilities, including autonomous systems, enhanced stealth features, and increased payload capacity.

Market Challenges

High Operational and Maintenance Costs

One of the most significant challenges facing the USA attack helicopter market is the high operational and maintenance costs associated with these complex platforms. Modern attack helicopters require frequent maintenance to ensure their readiness for combat. This maintenance includes the regular servicing of engines, avionics, weapons systems, and other vital components. The increasing complexity of these helicopters, which now feature advanced avionics, communication systems, and weaponry, has contributed to the rising costs of upkeep. For military forces operating large fleets, these costs can become a significant financial burden, especially as the fleet ages and requires more frequent repairs. The ongoing need for skilled personnel to maintain and operate these sophisticated systems also adds to the cost. As defense budgets come under scrutiny and cost-effectiveness becomes a more significant concern, military planners must find ways to balance the need for advanced systems with the high costs of operation and maintenance. The integration of cutting-edge technologies, while essential for ensuring operational efficiency, also makes these helicopters more costly to operate in the long term. Consequently, the rising operational costs of maintaining and upgrading existing fleets present an ongoing challenge for defense agencies, particularly in times of budget constraints.

Technological Obsolescence and Rapid Advancements

Another significant challenge in the USA attack helicopter market is the rapid pace of technological advancements, which can lead to existing platforms becoming obsolete. As military technologies continue to evolve, older attack helicopter models may struggle to keep up with the latest developments in avionics, weapons systems, and communications. While the U.S. military has made significant investments in modernizing existing fleets, the continuous need for upgrades to maintain technological relevance presents both logistical and financial challenges. The rapid development of new systems, such as advanced unmanned aerial vehicles (UAVs), artificial intelligence (AI), and autonomous capabilities, may outpace the capabilities of current attack helicopter platforms. This requires constant investment in research and development, upgrades, and system integrations to ensure that attack helicopters remain viable in modern warfare environments. The potential for newer platforms to offer superior capabilities, such as enhanced stealth features or greater range and payload capacity, poses a challenge for older helicopters. As a result, the need to continuously innovate and upgrade existing fleets to prevent technological obsolescence is a pressing challenge for military planners, requiring significant financial resources and strategic decision-making.

Opportunities

Technological Advancements in Rotorcraft Systems

One of the most significant opportunities in the USA attack helicopter market is the continued advancement in rotorcraft technologies. Innovations such as hybrid propulsion systems, lightweight composite materials, and noise reduction technologies are transforming the way attack helicopters are designed and operated. The development of hybrid-electric propulsion systems offers the potential to reduce fuel consumption and extend operational range, making helicopters more efficient and cost-effective. Additionally, advancements in stealth technology are enabling helicopters to operate in environments where they can avoid detection by enemy radar, which is especially important in modern warfare where radar evasion is critical for survivability. Furthermore, improvements in rotorcraft design, including more efficient rotor blades and lighter airframes, are helping to reduce the weight of helicopters, improving fuel efficiency and overall maneuverability. As these technologies continue to evolve, they are expected to create new opportunities for the USA attack helicopter market, with manufacturers developing next-generation helicopters that can operate in a broader range of environments with greater efficiency. These advancements will likely open new markets for both military and commercial rotorcraft applications, providing a significant growth opportunity in the attack helicopter segment.

Integration with Unmanned Aerial Vehicles (UAVs)

The integration of unmanned aerial vehicles (UAVs) with manned attack helicopters presents a significant opportunity for enhancing operational capabilities and reducing risks to human operators. The ability to deploy UAVs alongside attack helicopters for surveillance, reconnaissance, and target identification offers military forces a strategic advantage in terms of situational awareness and operational flexibility. UAVs equipped with advanced sensors and communication systems can provide real-time data to the attack helicopter, allowing for more precise targeting and improved mission coordination. Additionally, UAVs can be used for reconnaissance in high-risk areas, enabling attack helicopters to engage targets more effectively while minimizing the risk to personnel. The use of UAVs in tandem with manned helicopters also enables greater operational reach and flexibility, as UAVs can be deployed in GPS-denied environments or other challenging conditions where manned helicopters may struggle. As the integration of UAVs and manned helicopters becomes more prevalent, the USA attack helicopter market will experience increased demand for platforms capable of seamless communication and coordination between these two systems. This technological synergy presents a significant growth opportunity, as defense forces around the world seek more efficient and effective ways to conduct military operations.

Future Outlook

The USA attack helicopter market is expected to experience steady growth over the next few years, driven by continued military modernization and technological advancements. The demand for versatile, multi-role helicopters will remain strong, as military forces prioritize flexibility and operational efficiency. Technological innovations, such as autonomous systems, improved propulsion, and the integration of UAVs, will drive the next generation of attack helicopters. With defense budgets increasing globally and geopolitical tensions rising, the need for advanced rotorcraft systems will remain a key priority for defense agencies. This will create opportunities for both established manufacturers and new players in the market.

Major Players

- Boeing

- Lockheed Martin

- Airbus Helicopters

- MD Helicopters

- Bell Helicopter

- Sikorsky

- Kaman Aerospace

- Leonardo

- AVIC

- Turkish Aerospace Industries

- Russian Helicopters

- Tata Advanced Systems

- Korean Aerospace Industries

- Saab

- Sundstrand Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Aerospace and defense manufacturers

- OEMs and suppliers of helicopter components

- Defense analysts and consultants

- Military research and development units

- International defense ministries

Research Methodology

Step 1: Identification of Key Variables

In this step, key market variables such as technological advancements, geopolitical factors, and defense spending trends are identified and analyzed for their impact on market dynamics.

Step 2: Market Analysis and Construction

Data from secondary and primary sources is analyzed to construct a detailed model of the attack helicopter market, focusing on key drivers, challenges, and trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with industry professionals, military personnel, and technology developers validate the hypotheses formed from the market data, ensuring the accuracy of our analysis.

Step 4: Research Synthesis and Final Output

The final research output synthesizes all findings into a comprehensive market report, providing actionable insights for stakeholders and decision-makers in the USA attack helicopter market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Defense Budgets

Advancement in Attack Helicopter Technologies

Modernization of Military Fleets

Geopolitical Tensions and Defense Needs

Rise in Asymmetric Warfare - Market Challenges

High Procurement Costs

Maintenance and Operational Costs

Technological Obsolescence

Reliability in Harsh Environments

Lack of Skilled Operators - Market Opportunities

Expansion in Export Markets

Rising Demand for Light Attack Helicopters

Partnerships and Collaborations with Private Operators - Trends

Shift Towards Autonomous Capabilities

Integration of UAVs with Helicopter Platforms

Focus on Low-Visibility and Stealth Capabilities

Increased Use of Digital Cockpits

Emerging Hybrid and Electric Propulsion Systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Multirole Helicopters

Anti-Tank Helicopters

Transport Attack Helicopters

Light Attack Helicopters

Heavy Attack Helicopters - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Airborne Platforms

Special Operations Platforms

Export Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Upgrades & Modifications

Military Fitment

Commercial Fitment - By EndUser Segment (In Value%)

Defense Forces

Private Operators

Government Agencies

Security Forces

Specialized Operations Units - By Procurement Channel (In Value%)

Direct Government Procurement

Private Military Contractors

Military Equipment Distributors

International Procurement

OEM-Direct Procurement - By Material / Technology (In Value%)

Composite Materials

Aerospace-Grade Aluminum

Carbon Fiber

Electro-Optical and IR Technologies

Advanced Avionics Systems

- Market share snapshot of major players

- Cross Comparison Parameters (Price, Innovation, Performance, Global Reach, Service Availability, Technology Integration, Compliance, Strategic Alliances, Sustainability, Production Capacity)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Boeing

Airbus Helicopters

Bell Helicopter

Sikorsky

MD Helicopters

Kaman Aerospace

Leonardo

AVIC

Turkish Aerospace Industries

Russian Helicopters

Tata Advanced Systems

Korean Aerospace Industries

Saab

Sundstrand Corporation

- Demand from U.S. Military Forces

- Increasing Use in Special Operations

- Growth in Commercial and Private Sector Applications

- Expansion of Foreign Military Sales

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035