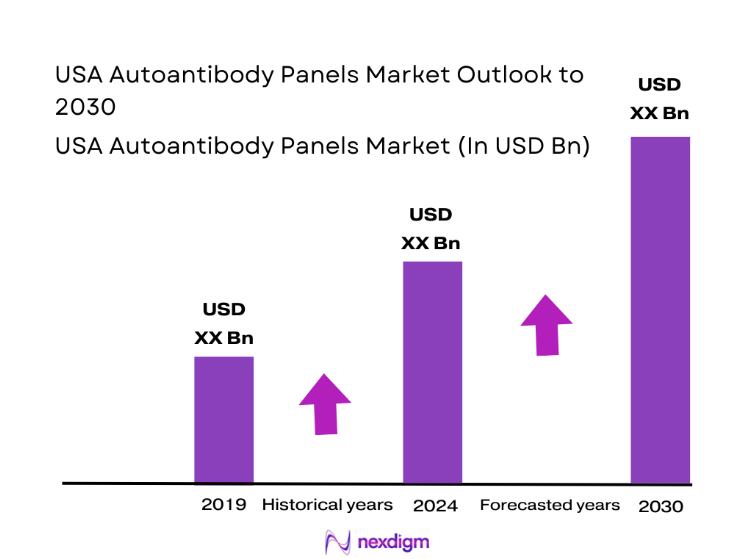

Market Overview

The USA Autoantibody Panels market current size stands at around USD ~ million, reflecting steady diagnostic demand across hospital laboratories and independent testing networks. In the last two assessment cycles, test volumes expanded to nearly ~ million units annually, supported by rising autoimmune case identification and broader physician reliance on panel-based screening. System installations crossed ~ units nationwide, while average revenue per test stabilized near USD ~, driven by multiplex assay adoption and automation-led efficiency gains across high-throughput diagnostic centers.

The market is geographically concentrated in metropolitan healthcare hubs such as New York City, Boston, Chicago, Houston, and Los Angeles, where advanced laboratory infrastructure and specialist density support high diagnostic throughput. These regions benefit from strong payer networks, mature hospital systems, and well-established reference laboratories. Policy alignment toward early disease detection and integrated care pathways further strengthens regional leadership, enabling faster technology uptake and sustained ecosystem development in autoimmune diagnostics.

Market Segmentation

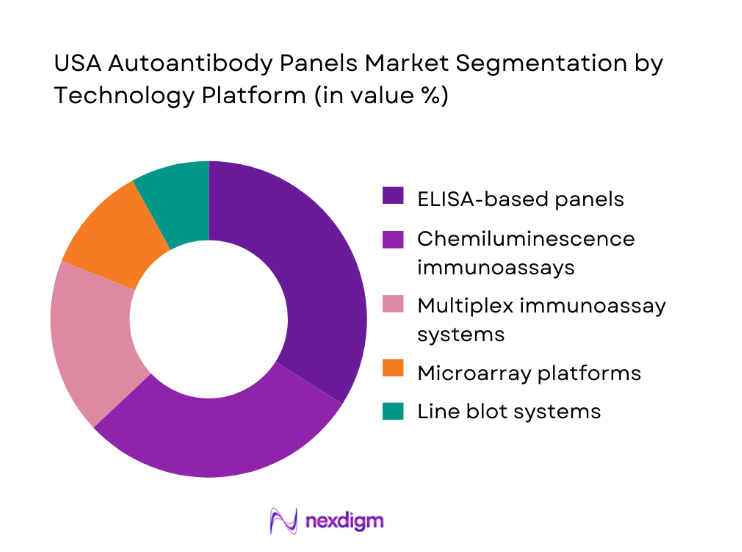

By Technology Platform

ELISA and chemiluminescence systems dominate the USA Autoantibody Panels market due to their balance of cost efficiency, automation compatibility, and clinical familiarity. Multiplex immunoassays and microarray platforms are expanding rapidly in tertiary care and specialty laboratories, driven by demand for broader antibody coverage and reduced turnaround time. High-volume reference labs increasingly favor automated chemiluminescence solutions for consistent throughput, while academic centers adopt microarrays for complex disease profiling. Overall dominance is shaped by scalability, integration with laboratory information systems, and the ability to support expanding autoimmune testing protocols nationwide.

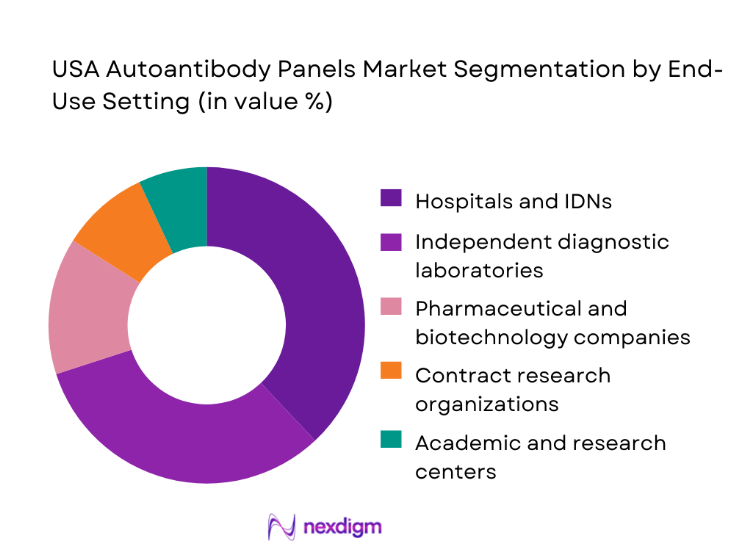

By End-Use Setting

Hospitals and integrated delivery networks represent the largest end-use segment, driven by rising inpatient and outpatient autoimmune testing volumes. Independent diagnostic laboratories follow closely, leveraging centralized operations to manage large sample flows from physician offices and community clinics. Pharmaceutical and biotechnology firms contribute through biomarker discovery and companion diagnostics development, while contract research organizations support clinical trial testing needs. Academic and translational research centers maintain a steady share through grant-funded studies and specialized immunology programs. Segment dominance is closely linked to test throughput capacity, reimbursement structures, and integration within care delivery models.

Competitive Landscape

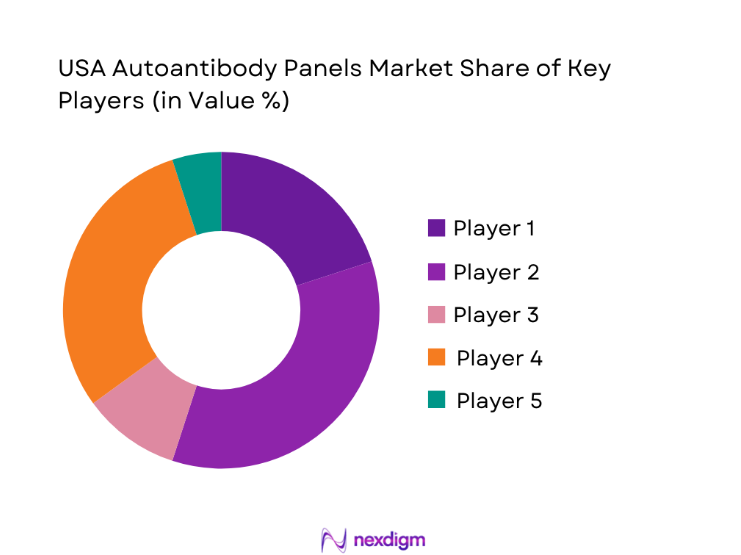

The USA Autoantibody Panels market is moderately concentrated, with a mix of multinational diagnostics manufacturers and specialized immunoassay providers shaping competition. Market structure reflects strong technological differentiation, where assay depth, automation compatibility, and regulatory preparedness define competitive positioning. While large players dominate hospital and reference lab contracts, niche firms retain influence in specialty testing and research-driven applications.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| DiaSorin | 1968 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

USA Autoantibody Panels Market Analysis

Growth Drivers

Rising prevalence of autoimmune diseases in the US population

The growing burden of autoimmune disorders has led to a measurable increase in diagnostic demand, with annual test volumes exceeding ~ million units across major laboratory networks. Clinical registries report patient pools expanding by ~ individuals each year, driving sustained utilization of comprehensive antibody panels. Hospital systems have added ~ diagnostic platforms to manage higher throughput, while outpatient clinics have increased referral rates by ~ cases annually. This expanding patient base continues to reinforce the role of autoantibody panels as a frontline diagnostic tool.

Expansion of early and differential diagnosis protocols in specialty care

Specialty clinics in rheumatology, neurology, and endocrinology have integrated multi-marker testing into routine workflows, resulting in ~ additional panel orders per facility each year. Adoption of standardized diagnostic pathways has increased system utilization by ~ units nationwide. Tertiary hospitals now process ~ samples daily through automated immunoassay lines, improving diagnostic accuracy and reducing follow-up testing volumes by ~ units annually. These shifts underline the central role of panels in early-stage disease identification.

Challenges

High cost of advanced multiplex and microarray platforms

Capital investment requirements for advanced diagnostic systems remain a significant barrier, with average platform deployment exceeding USD ~ million per laboratory. Smaller facilities often delay upgrades, leading to a gap of ~ systems between high-tier and mid-tier providers. Annual maintenance and consumable expenditure approaches USD ~ million across large hospital networks, limiting rapid scalability. These financial constraints restrict uniform access to next-generation diagnostics despite rising clinical demand.

Variability in test standardization and inter-lab reproducibility

Differences in assay calibration and interpretation standards create operational inefficiencies, affecting ~ thousand test results annually across decentralized labs. Quality assurance audits identify ~ instances of result variability per major diagnostic network each year. This inconsistency drives additional confirmatory testing volumes of ~ units annually, increasing turnaround time and operational burden. Lack of harmonized protocols continues to challenge widespread adoption of newer panel technologies.

Opportunities

Expansion of personalized medicine in autoimmune disease management

Precision-based treatment pathways are accelerating demand for detailed autoantibody profiling, with personalized care programs enrolling ~ thousand patients annually. These initiatives generate ~ million incremental panel tests each year across specialty centers. Integrated care models now deploy ~ diagnostic systems dedicated to individualized disease monitoring, supporting long-term treatment optimization. The alignment of diagnostics with targeted therapies strengthens the value proposition of comprehensive panel solutions.

Integration of autoantibody panels into routine preventive screening programs

Preventive care strategies increasingly incorporate autoimmune risk screening, leading to ~ million additional tests annually in primary care settings. Employer-sponsored health programs and community clinics have introduced ~ screening units nationwide to support early detection. These efforts reduce downstream treatment intensity and create steady baseline demand for panel diagnostics, positioning preventive screening as a key growth avenue.

Future Outlook

The USA Autoantibody Panels market is expected to maintain steady expansion through the end of the decade, supported by rising autoimmune disease awareness and integration of diagnostics into preventive and personalized care pathways. Ongoing automation and digital connectivity will enhance laboratory efficiency, while regulatory alignment is likely to accelerate adoption of advanced multiplex platforms. The market will increasingly shift toward value-based diagnostics, emphasizing accuracy, speed, and clinical impact over test volume alone.

Major Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Bio-Rad Laboratories

- DiaSorin

- Thermo Fisher Scientific

- QuidelOrtho

- Grifols

- Inova Diagnostics

- Euroimmun

- Trinity Biotech

- Orgentec Diagnostika

- Zeus Scientific

- Snibe Diagnostic

- Immuno Concepts

Key Target Audience

- Hospital and integrated delivery network procurement teams

- Independent diagnostic laboratory chains

- Specialty clinics in rheumatology, neurology, and endocrinology

- Pharmaceutical and biotechnology companies

- Contract research organizations

- Investments and venture capital firms

- Government and regulatory bodies including the US Food and Drug Administration and Centers for Medicare and Medicaid Services

- Health system purchasing organizations and group procurement alliances

Research Methodology

Step 1: Identification of Key Variables

Key demand indicators, diagnostic utilization metrics, and technology adoption drivers were identified across clinical and laboratory settings. Emphasis was placed on autoimmune disease prevalence, testing frequency, and system deployment patterns. Regulatory frameworks and reimbursement structures were also mapped to establish baseline market parameters.

Step 2: Market Analysis and Construction

Data on testing workflows, laboratory capacity, and platform penetration were consolidated to build a structured market model. Segmentation logic was applied across technology and end-use settings to reflect real-world procurement behavior. Scenario frameworks were developed to capture demand variability.

Step 3: Hypothesis Validation and Expert Consultation

Clinical practitioners, laboratory managers, and regulatory specialists were engaged to validate assumptions on utilization trends and technology adoption. Feedback loops ensured alignment with operational realities in hospital and reference laboratory environments.

Step 4: Research Synthesis and Final Output

All validated inputs were integrated into a unified analytical framework. Market dynamics, competitive positioning, and future outlook were synthesized to deliver a coherent, decision-ready narrative for stakeholders.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, autoantibody panel taxonomy and clinical pathway mapping, market sizing logic by panel utilization and test volume, revenue attribution across assays analyzers reagents and interpretation services, primary interview program with rheumatologists immunologists labs and distributors, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market evolution

- Care and diagnostic pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of autoimmune diseases in the US population

Expansion of early and differential diagnosis protocols in specialty care

Growing adoption of multiplex testing to improve diagnostic efficiency

Increasing awareness among clinicians about comprehensive autoantibody profiling

Technological advances in assay sensitivity and specificity

Supportive reimbursement pathways for specialized autoimmune diagnostics - Challenges

High cost of advanced multiplex and microarray platforms

Variability in test standardization and inter-lab reproducibility

Reimbursement complexity for newer autoimmune panels

Limited trained personnel for advanced immunodiagnostics

Turnaround time pressures in high-volume laboratory environments

Regulatory burden for novel diagnostic panel approvals - Opportunities

Expansion of personalized medicine in autoimmune disease management

Integration of autoantibody panels into routine preventive screening programs

Growth of decentralized and near-patient testing models

Partnerships between diagnostic firms and specialty care networks

Development of AI-driven interpretation tools for complex panel results

Rising demand from clinical research and drug development pipelines - Trends

Shift from single-analyte testing to comprehensive panel-based diagnostics

Growing use of chemiluminescence and automated platforms

Increased adoption of digital pathology and connected diagnostics

Emphasis on standardization and harmonization of autoimmune assays

Expansion of home sample collection linked to centralized testing

Rising role of companion diagnostics in autoimmune therapeutics - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Active Systems, 2019–2024

- By Revenue per Test, 2019–2024

- By Fleet Type (in Value %)

Hospital-based clinical laboratories

Independent diagnostic laboratories

Reference and specialty laboratories

Academic and research institutes

Point-of-care and near-patient testing settings - By Application (in Value %)

Systemic autoimmune disease panels

Organ-specific autoimmune disease panels

Rheumatology diagnostic panels

Neurology autoimmune panels

Endocrine autoimmune panels - By Technology Architecture (in Value %)

ELISA-based panels

Chemiluminescence immunoassay platforms

Multiplex immunoassay systems

Line blot and immunoblot platforms

Microarray-based autoantibody testing - By End-Use Industry (in Value %)

Hospitals and integrated delivery networks

Independent diagnostic service providers

Pharmaceutical and biotechnology companies

Contract research organizations

Academic and translational research centers - By Connectivity Type (in Value %)

Standalone analyzers with local data storage

LIS-integrated laboratory systems

Cloud-enabled diagnostic platforms

EHR-connected enterprise diagnostics

Remote monitoring and telepathology-enabled systems - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (panel breadth, assay sensitivity, automation level, throughput capacity, turnaround time, connectivity features, regulatory approvals, pricing models)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

Roche Diagnostics

Abbott Diagnostics

Siemens Healthineers

Bio-Rad Laboratories

Euroimmun

Inova Diagnostics

QuidelOrtho

Grifols

DiaSorin

Orgentec Diagnostika

Immuno Concepts

Zeus Scientific

Trinity Biotech

Snibe Diagnostic

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Active Systems, 2025–2030

- By Revenue per Test, 2025–2030