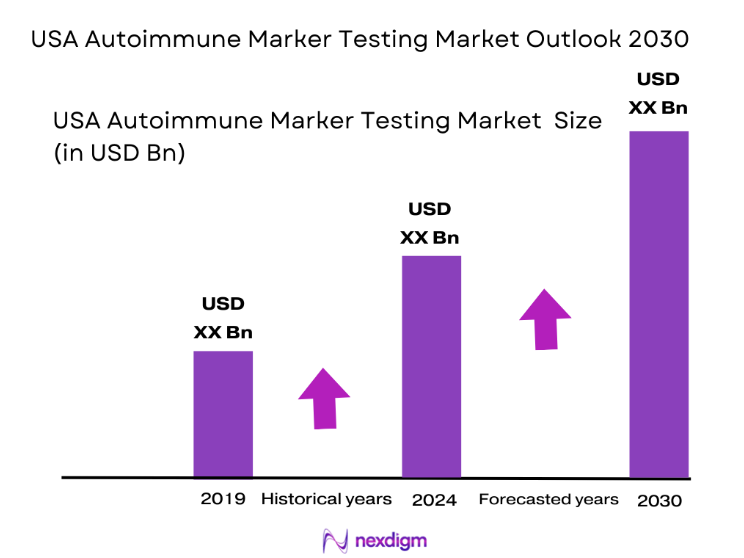

Market Overview

The USA autoimmune marker testing market is valued at approximately USD ~, with its growth primarily driven by the increasing prevalence of autoimmune diseases, including rheumatoid arthritis, lupus, and multiple sclerosis. The demand for these diagnostic tests has grown as more patients seek early diagnosis and accurate monitoring of these chronic conditions. Additionally, advancements in testing technologies, such as multiplex panels and next-generation sequencing, have increased the demand for more precise and personalized autoimmune testing. The market is expected to experience steady growth as more healthcare providers adopt these tests to enhance patient care.

The USA is the dominant market for autoimmune marker testing due to its advanced healthcare infrastructure, widespread availability of diagnostic technologies, and a well-established network of clinical laboratories and hospitals. Cities like New York, Los Angeles, and Chicago lead the market because of their large patient populations, the presence of leading diagnostic firms, and access to cutting-edge medical research. The high number of healthcare facilities equipped with the latest diagnostic tools, coupled with strong government healthcare policies, propels the demand for autoimmune testing services in these areas.

Market Segmentation

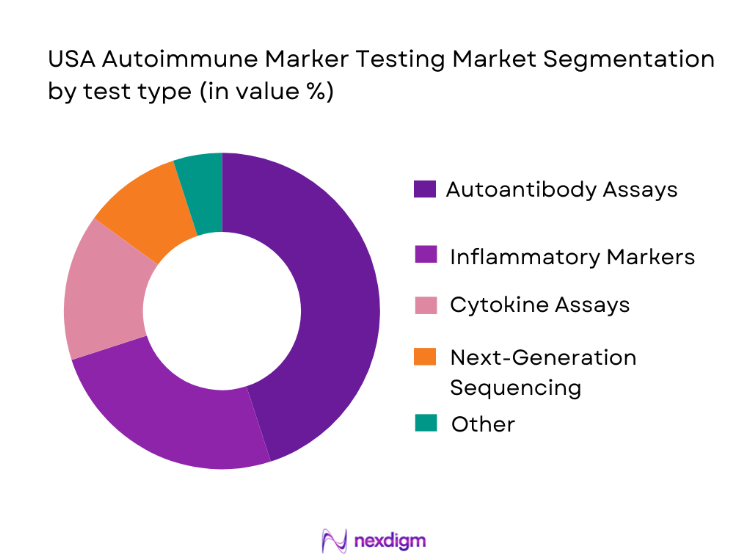

By Test Type

The USA autoimmune marker testing market is segmented into various test types, including autoantibody assays (such as ANA, RF, dsDNA), inflammatory markers (like CRP and ESR), cytokine assays, and next-generation sequencing panels. Among these, autoantibody assays dominate the market, particularly due to their broad application in diagnosing systemic autoimmune diseases such as lupus and rheumatoid arthritis. These tests are highly valued for their ability to detect specific antibodies that indicate autoimmune activity, which is crucial for early diagnosis and monitoring of disease progression. The increasing adoption of multiplex panels that test for multiple autoantibodies simultaneously has further boosted the dominance of this segment.

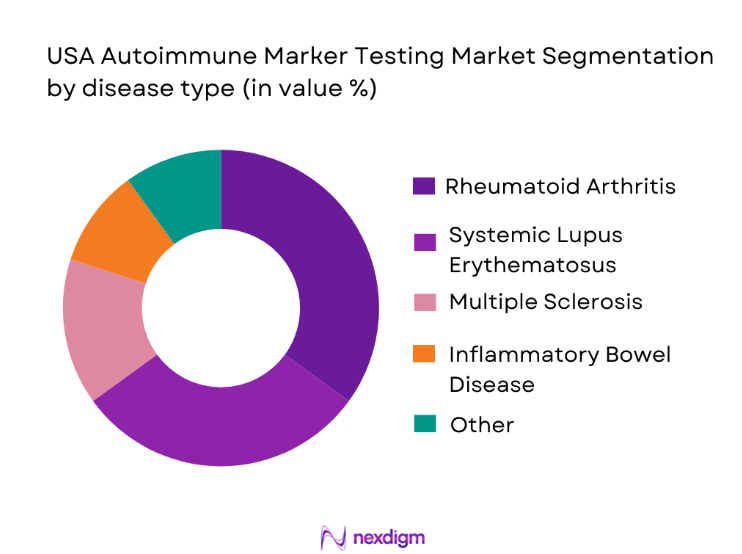

By Disease Type

The market is also segmented by disease type, with rheumatoid arthritis and systemic lupus erythematosus (SLE) holding the largest market share. Rheumatoid arthritis is the most common autoimmune disease diagnosed in the USA, requiring regular monitoring of autoimmune markers such as rheumatoid factor and anti-citrullinated protein antibodies (ACPA). Lupus testing, particularly for antinuclear antibodies (ANA), is also a key driver of the market, given the need for early detection to manage this potentially fatal disease. These conditions drive consistent demand for autoimmune testing services as they require continuous monitoring and management.

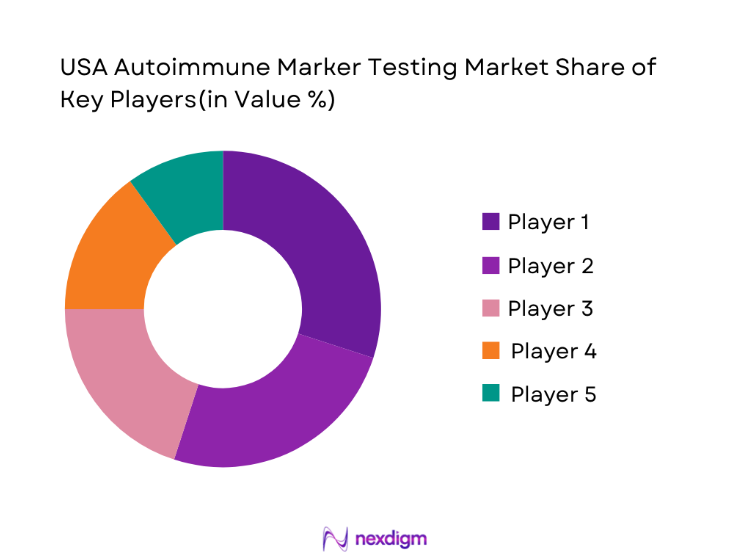

Competitive Landscape

The USA autoimmune marker testing market is highly competitive, with major players including both established global diagnostic firms and emerging specialized companies. The key players dominate by offering comprehensive test panels, leveraging advanced technologies such as immunoassays and next-generation sequencing. These companies also benefit from strong distribution networks and partnerships with hospitals and laboratories. Leading players like Thermo Fisher Scientific, Abbott Laboratories, and Roche Diagnostics continue to strengthen their positions through innovations in testing platforms and increased R&D investment. Smaller players are also making strides by introducing novel markers and focusing on niche disease areas.

| Company | Establishment Year | Headquarters | Technologies Offered | Key Products | Market Strategy |

| Thermo Fisher Scientific | 1956 | Waltham, MA | ~ | ~ | ~ |

| Abbott Laboratories | 1888 | Abbott Park, IL | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Basel, Switzerland | ~ | ~ | ~ |

| Quest Diagnostics | 1967 | Secaucus, NJ | ~ | ~ | ~ |

| Labcorp | 1978 | Burlington, NC | ~ | ~ | ~ |

USA Autoimmune Marker Testing Market Analysis

Growth Drivers

Increased Prevalence of Autoimmune Diseases

The prevalence of autoimmune diseases in the U.S. has been steadily rising due to factors such as an aging population and improved diagnostic capabilities. According to the CDC, autoimmune diseases affect an estimated ~ Americans, with rheumatoid arthritis and lupus being among the most prevalent. The aging population is a key factor, as autoimmune conditions are more common among older adults. Furthermore, environmental factors like pollution and lifestyle changes also contribute to the increasing incidence of autoimmune diseases. These trends drive the need for more accurate and timely autoimmune marker testing to manage and monitor these conditions.

Rising Demand for Early Diagnosis and Monitoring of Chronic Autoimmune Disorders

Early diagnosis and continuous monitoring are crucial for managing chronic autoimmune disorders. The increasing demand for these services is linked to the growing awareness about autoimmune conditions and the need for personalized treatment. According to a 2024 study published by the World Health Organization (WHO), there has been a global shift towards proactive healthcare, with early diagnosis now being emphasized to reduce long-term complications. This rise in demand is further supported by the increasing patient burden of chronic conditions, leading to higher healthcare expenditures and a focus on preventing long-term disability. Monitoring tools such as autoimmune marker testing are crucial for these patients.

Market Challenges

High Test Costs and Limited Reimbursement for Some Marker Tests

One of the significant challenges in the autoimmune marker testing market is the high cost associated with certain tests. Many advanced autoimmune assays, especially those used for rare conditions, are not covered by insurance, making them prohibitively expensive for some patients. For instance, the cost of advanced molecular tests can range from ~ to ~ per test, depending on the complexity. Additionally, reimbursement rates for autoimmune tests are often insufficient, as reported by the Centers for Medicare and Medicaid Services (CMS), limiting patient access to essential diagnostic services.

Regulatory Barriers and Approval Timeframes for New Testing Platforms

The regulatory approval process for new autoimmune marker tests can be lengthy and complex, hindering innovation and market entry. For example, new diagnostic tests for autoimmune diseases must undergo rigorous clinical trials, which can take years. In 2024, the FDA’s approval of a new autoimmune test for rheumatoid arthritis took approximately 3 years, highlighting the delays in bringing new products to market. These regulatory barriers contribute to slow market penetration for novel diagnostics, particularly in autoimmune marker testing, where innovative solutions are needed to address the growing healthcare demand.

Opportunities

Growth in Home-Based and Point-of-Care Testing Kits

There is a significant shift towards home-based and point-of-care (POC) testing kits, driven by consumer demand for convenience and immediate results. According to the U.S. Department of Health and Human Services (HHS), home-based diagnostics are increasingly popular, with more people opting for over-the-counter testing options for conditions like diabetes and autoimmune diseases. The ease of use and reduced costs are factors driving the adoption of home testing kits, and the market for such products is expected to grow significantly. Point-of-care tests for autoimmune diseases are becoming more accurate and affordable, making them an attractive option for patients seeking quick diagnoses.

Expanding Market for Companion Diagnostics and Biomarker Discovery

The growing focus on personalized medicine is creating significant opportunities for autoimmune marker testing, particularly in the development of companion diagnostics. These tests, which help match patients with the most effective treatment options, are increasingly being integrated into clinical practice. The National Institutes of Health (NIH) has reported that the market for companion diagnostics is expanding rapidly, with increased investment in biomarker discovery to better understand autoimmune diseases. As personalized treatments become more prevalent, the demand for these specialized tests will continue to rise, presenting a strong growth opportunity for the autoimmune marker testing market.

Future Outlook

Over the next 5 years, the USA autoimmune marker testing market is expected to exhibit steady growth, driven by technological innovations in diagnostics and the rising prevalence of autoimmune diseases. Advances in multiplex testing and next-generation sequencing technologies are expected to enhance the accuracy and speed of tests, leading to greater adoption in clinical settings. Furthermore, increasing demand for personalized medicine and precision diagnostics will continue to drive the market. The expansion of testing services in outpatient and point-of-care settings, coupled with ongoing improvements in insurance coverage for autoimmune testing, will further contribute to market growth.

Major Players

- Thermo Fisher Scientific

- Abbott Laboratories

- Roche Diagnostics

- Quest Diagnostics

- Labcorp

- Bio‑Rad Laboratories

- PerkinElmer

- Aesku Diagnostics

- Trinity Biotech

- Inova Diagnostics

- SQI Diagnostics

- Crescendo Bioscience

- Beckman Coulter

- bioMérieux

- Siemens Healthineers

Key Target Audience

- Healthcare Providers

- Diagnostic Testing Service Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Healthcare Insurers and Payers

- R&D and Biotech Companies

- Pharmaceutical Companies

- Private Healthcare Facilities

Research Methodology

Step 1: Identification of Key Variables

This step focuses on gathering and identifying key market variables such as the types of autoimmune diseases being tested, the most commonly used test methods, and geographic and demographic trends. Data is sourced from secondary databases and industry reports to form a base for further analysis.

Step 2: Market Analysis and Construction

Data on the market size, growth rates, and historical trends is analyzed. This includes assessing the adoption rate of new technologies, the market share of different testing platforms, and the distribution of testing across various disease types and regions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on initial findings and validated through consultations with industry experts, including laboratory directors, diagnostic companies, and healthcare providers. These interviews provide insights into market dynamics, adoption rates, and customer needs.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from market analysis and expert consultations to create a comprehensive, validated report. This includes the evaluation of future market opportunities, technological advancements, and the strategic positioning of key players in the autoimmune marker testing industry.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations and Terminology Specific to Autoimmune Marker Testing, Market Sizing Approach, Primary and Secondary Research Methodology, Data Consolidation and Validation Techniques, Limitations, Assumptions, and Areas of Further Research)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Increased Prevalence of Autoimmune Diseases

Rising Demand for Early Diagnosis and Monitoring of Chronic Autoimmune Disorders

Advancements in Diagnostic Technologies and Point-of-Care Testing - Market Challenges

High Test Costs and Limited Reimbursement for Some Marker Tests

Regulatory Barriers and Approval Timeframes for New Testing Platforms

Complexities in Autoimmune Disease Diagnosis (Overlapping Symptoms) - Trends

Shift Toward Multiplex Testing and Personalized Medicine

Digital Health Integration with Autoimmune Testing - Opportunities

Growth in Home-Based and Point-of-Care Testing Kits

Expanding Market for Companion Diagnostics and Biomarker Discovery

Increased Focus on Early Intervention and Preventive Healthcare - Government Regulations

FDA and Regulatory Body Guidelines on Diagnostic Testing

Policies Governing Lab Operations, Approval, and Reimbursement for Autoimmune Testing - SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Sub-Category, 2019-2025

- By Test Type (In value %)

Autoantibody Assays

Inflammatory Markers

Multiplex and Next‑Generation Sequencing Tests

Point-of-Care Diagnostic Kits - By Disease Type (In value %)

Systemic Autoimmune Diseases

Organ-Specific Autoimmune Conditions

Rare Autoimmune Diseases and Diagnostic Gaps - By Technology Platform (In value %)

Immunoassay Technologies

Mass Spectrometry and PCR-Based Diagnostics

Next-Generation Sequencing and High-Throughput Technologies - By End-User (In value %)

Hospitals and Integrated Delivery Networks (IDNs)

Clinical Diagnostic Laboratories

Research Institutions and Academic Medical Centers

Specialty Immunology and Rheumatology Clinics - By Payer Type (In value %)

Medicare and Medicaid

Private Commercial Payers

Self-Pay and Out-of-Pocket Testing

- Cross-Comparison Parameters (Company Profile,Testing Platforms, Pricing Models, Regulatory Compliance, Test Availability)

- SWOT Analysis of Key Players

Strengths: Product Portfolio, Innovation

Weaknesses: Market Reach, Regulatory Hurdles

Opportunities: Expansion, Emerging Markets

Threats: Price Sensitivity, Intense Competition - Pricing Analysis of Major Players

Test Pricing Comparison Among Leading Brands

ASP and Volume Discount Structure - Major Players

Thermo Fisher Scientific

Abbott Laboratories

Roche Diagnostics

Quest Diagnostics

Labcorp

Siemens Healthineers

Bio‑Rad Laboratories

PerkinElmer

Aesku Diagnostics

Trinity Biotech

Inova Diagnostics

SQI Diagnostics

Crescendo Bioscience

Beckman Coulter

bioMérieux

- Factors Influencing Test Adoption

- Cost Sensitivity and Reimbursement

- Test Accuracy and Reliability in Disease Monitoring

- Physician Recommendations and Prescriptions

- Patient Preferences for Testing Modalities (Home Kits vs. Lab Tests)

- Regulatory Compliance for End-Users

- By Revenue (USD), 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030